Greetings to all my fellow investors! Welcome to a very special and delightful episode of ‘The Dividend Uncle.’ Today, I’m sharing something close to my heart – my actual investment portfolio. Ever since the setting up of my YouTube channel more than one year ago, I have always touted its mission to be “based on my real portfolio, always”. I am sure this is “broken” Singlish, but this signifies that I will only recommend investments that I will buy myself, it’s not just empty talk. Here it is, the ultimate reveal of my investment portfolio. It’s a journey filled with decisions that are not always smart, and exciting opportunities, and I’m thrilled to take you along with me.

Before we dive in, I must let you know that this content is for informational and educational purposes only and does not constitute financial advice. The opinions expressed are based on publicly available information and personal analysis, and they are not tailored to your specific financial situation. The REITs and institutions mentioned are cited purely as examples. While I have no affiliations, sponsorships, or financial relationships with any of them, I may personally hold positions in some of the investments discussed. Before making any investment decisions, you are strongly encouraged to consult a licensed financial adviser.

Perfectly Balanced Portfolio?

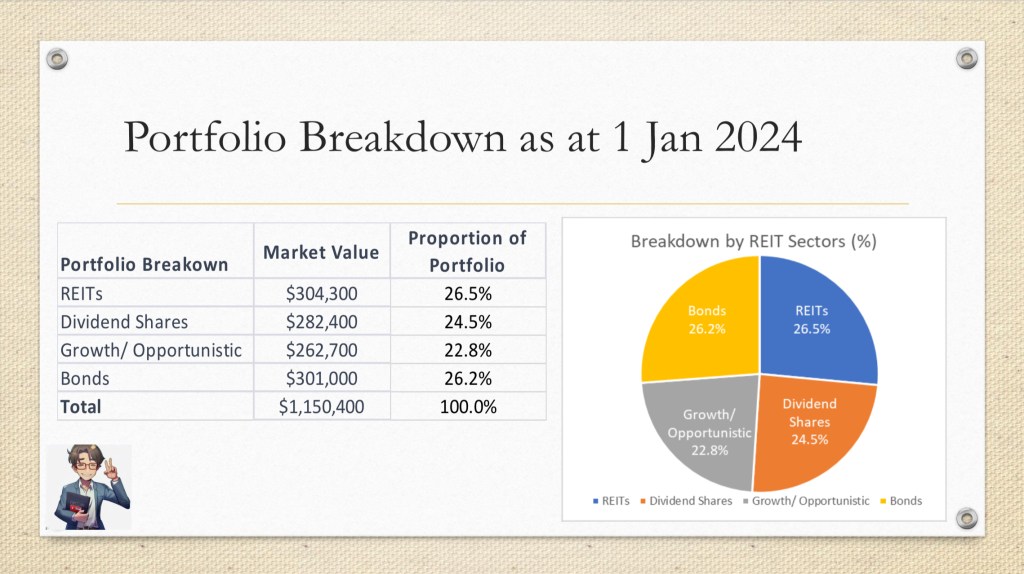

Let’s start with an overview of my portfolio. As you can see from the perfectly balanced pie chart, it’s a balanced blend of REITs and dividend stocks, spiced up with growth and opportunistic shares and more than a hint of bonds.

While this almost perfect quarters might seem like it was all planned from the start. But truth be told, it’s been a journey. I began with a heavy lean on REITs and gradually branched out into the other areas, shaping the portfolio you see today.

You might notice the tilt towards dividends and fixed income. That’s the cornerstone of my strategy and why I named my channel ‘The Dividend Uncle.’ Some might say it leans towards the conservative side, especially with growth and opportunistic investments forming just a quarter of the portfolio. But remember, this is my retirement plan. I’m counting on those dividends and bond coupons to fund my golden years. There’s nothing quite like the reassurance of regular cash flowing into the bank account.

Let’s dive in for more details of my portfolio!

The World of REITs

In the realm of REITs, diversity is key. From the solid foundation of office REITs to the bustling world of retail, and the welcoming aura of hospitality REITs – each has its unique flavor. Let’s explore these categories and understand their role in the portfolio.

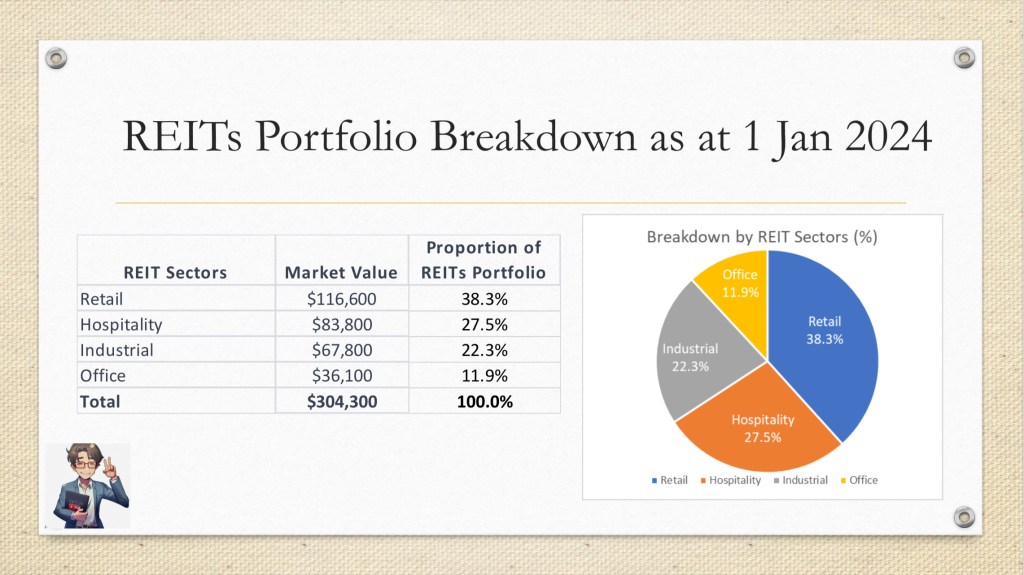

In the realm of REITs, diversity is key. Let’s break it down. What I did to classify each REIT into a sector was based on the largest sector of the assets in a REIT.

1. Retail REITs bring in regular foot traffic and diverse revenue streams from various retailers, making them a dynamic part of the portfolio. They account for 38.3% of my REITs portfolio, with market value of $117,000.

2. Hospitality REITs, based on hotels, resorts, and student accommodation, offer unique opportunities, especially with tourism trends. They account for 27.5%, with market value of $84,000.

3. Industrial REITs, consisting of high-tech office parks, factories, logistics, and data centre provides stability through economic cycles. They account for 22.3% of my portfolio, with market value of $68,000.

4. Finally, Office REITs are the backbone, offering stability and solid income from long-term tenants in commercial spaces. With a market value of $36,000, they account for 11.9% of my REITs portfolio.

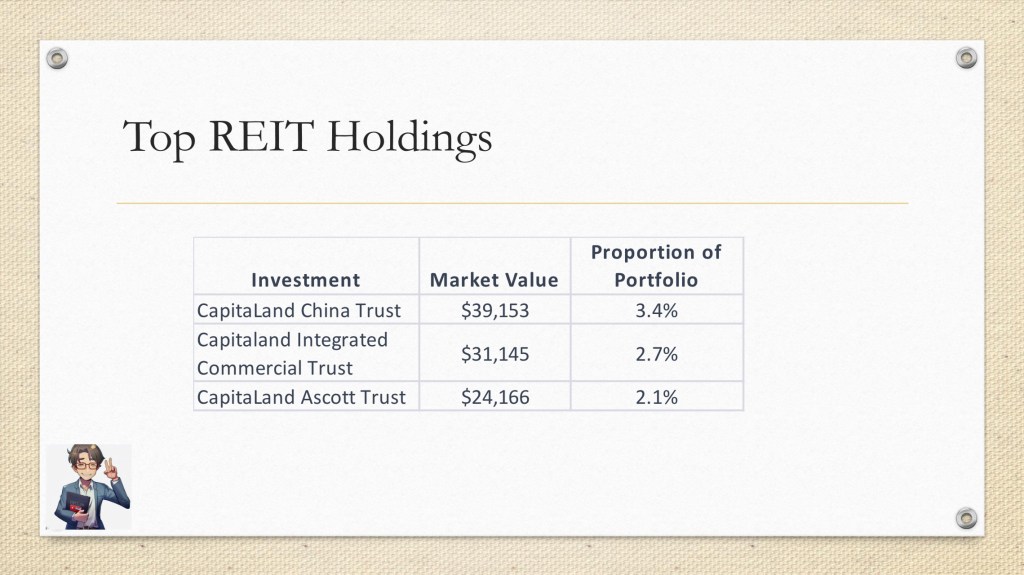

Here are my top 3 REIT Holdings:

1. CapitaLand China Trust or CLCT has a diverse portfolio of retail, business park, and logistics properties across major cities in China, with a focus on new economy sectors like biomedical and e-commerce. It is my biggest REIT holding with market value of $39,000 and 3.4% of my total portfolio.

2. CapitaLand Integrated Commercial Trust or CICT, is the first and largest REIT listed on the Singapore Exchange. It invests in both retail and office spaces, predominantly located in Singapore, with additional assets in Frankfurt, Germany, and Sydney, Australia. It is my second largest REIT holding with market value of $31,000, and 2.7%.

3. CapitaLand Ascott Trust or CLAS is the largest lodging trust in the Asia-Pacific region, boasts an extensive portfolio of hospitality-focused properties. It accounts for 2.1% of my portfolio and market value of $24,000.

The Appeal of Dividend Stocks

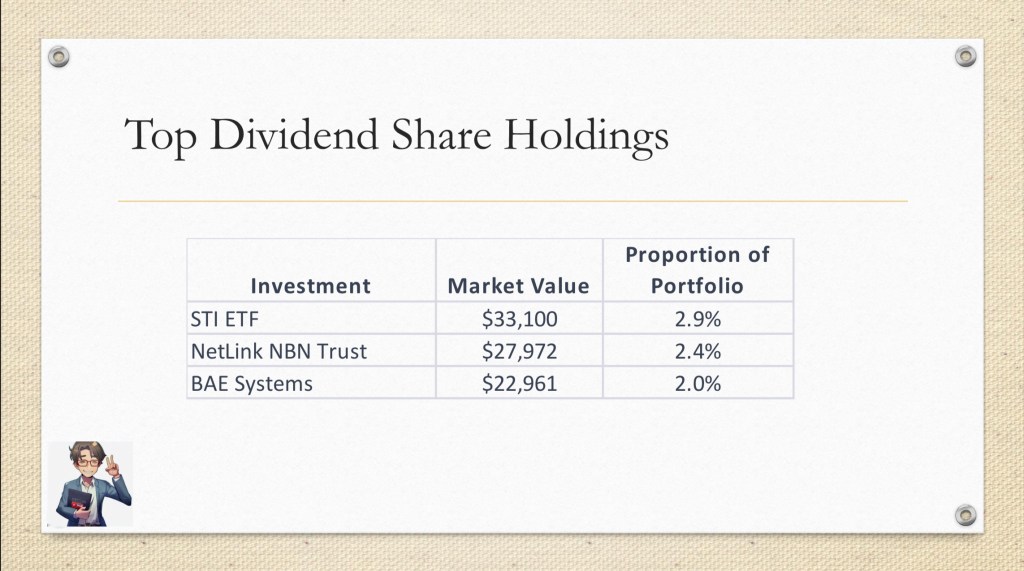

Now, let’s talk about dividend stocks. These are the steady performers, offering regular returns and stability. I’ll share with you some of my top picks and why they’re an essential part of any investment feast.

1. The SPDR Straits Times Index ETF, launched in 2002, tracks the STI, providing investors diversified exposure to the top 30 largest and most liquid companies in Singapore. I have accumulated $33,100, accounting for 2.9% of my total portfolio.

2. NetLink NBN Trust owns the only nationwide fiber network in Singapore, supporting the Nationwide Broadband Network, and is essential for delivering ultra-high-speed internet access across mainland Singapore and its connected islands. The market value of my holdings is $28,000, accounting for 2.4% of my total portfolio.

3. BAE Systems, listed in the UK, is a leading British multinational corporation specializing in defense, security, and aerospace. It’s Europe’s largest defense contractor and ranks among the top defense companies globally. A large part of the market value of $23,000 consist of capital gains, which accounts for 2.0% of my portfolio.

Growth and Opportunistic Shares – Potential for Tomorrow

Growth shares are like the seeds of tomorrow’s giants. They may be small now, but they hold the potential for significant growth. Here’s a look at the top players in my growth shares portfolio.

1. The biggest holding is actually Endowus Dimensional Funds, which I buy using my SRS or supplementary retirement scheme money. I have selected a global fund, an emerging markets fund and a value focused fund within this holding. Although the market value is huge, at $62,900, the money is well diversified into thousands of shares.

2. The second largest holding is the SPDR US Dividends Aristocrats ETF, listed in the UK. It consists of 120 companies listed in the US, which have raised their dividends consistently over the past 25 years. I hold about $20,000 in this ETF, accounting for 1.7% of my portfolio.

3.The Vanguard Emerging Markets ETF, listed in the UK consists more than 2000 shares in the emerging market economies of the world. The market value of $17,200 has been dragged down by declines in Chinese equities, which is the largest country of exposure in the ETF.

Bonds – Backbone of Stability

Bonds are the anchors of my portfolio, providing stability and a steady stream of income. They’re like the dependable kopi tiam uncle – always there, always reliable. My bond investments are relatively simple.

Most of my holdings here are in Singapore Savings Bonds or SSBs. Over the past year, with the high interest rates offered by these SSB, I have allocated more cash to them. However, as their rates have tapered off recently, I am shifting more of my target bond allocation to the next part of my bond portfolio.

The more exciting part of my bonds portfolio consist of Endowus Fixed Income – Stable Income portfolio. It is a collection of 7 unit trusts from renowned fund managers such as PIMCO and JP Morgan. Hence, I am benefiting from diversification across different types of issuers and duration, and also from the expertise of different fund managers. This yields about 5 to 6% per annum, good enough for me!

Integrating Key Investment Lessons

As we’ve explored my portfolio, a few key lessons stand out, shaping the way I invest. Let’s quickly touch on these before we wrap up.

Firstly, diversification – it’s not just a buzzword; it’s a crucial strategy. You’ve seen how I’ve spread my investments across REITs, dividend stocks, growth shares, and bonds. This mix helps balance risk and reward, ensuring that my portfolio can withstand market ups and downs.

Secondly, aligning investments with personal goals. My portfolio is tailored to support my retirement, focusing on assets that provide regular income and stability. It’s essential to reflect on what you’re investing for – be it retirement, education, or another goal – and choose investments that align with these objectives.

The power of dividend investing is another critical lesson. The regular income from dividends and REIT distributions forms a significant part of my strategy, providing a reliable income stream. This approach demonstrates how investing for dividends can be a solid foundation for a long-term financial plan, especially for retirement.

Lastly, the role of bonds. They might not be as flashy as stocks, but bonds are the backbone of stability in my portfolio. They provide a steady income stream and act as a safety net during market volatility.

And that’s a wrap on my investment portfolio! It’s been a joy sharing this with you. Remember, investing is a personal journey, and what works for me may not be your cup of tea. Always do your own research and consider your own financial goals. Until next time, keep exploring, keep learning, and keep investing. Happy investing, everyone!

Leave a comment