Hey there, fellow investors! Welcome back to ‘The Dividend Uncle’, where we break down the latest in REITs and steady-income investments.

Today, we’re revisiting one of my largest holdings, CapitaLand China Trust or CLCT for short. For a while now, I’ve shared with you that my personal analysis showed that CLCT was undervalued, especially after it plunged 50% this year.

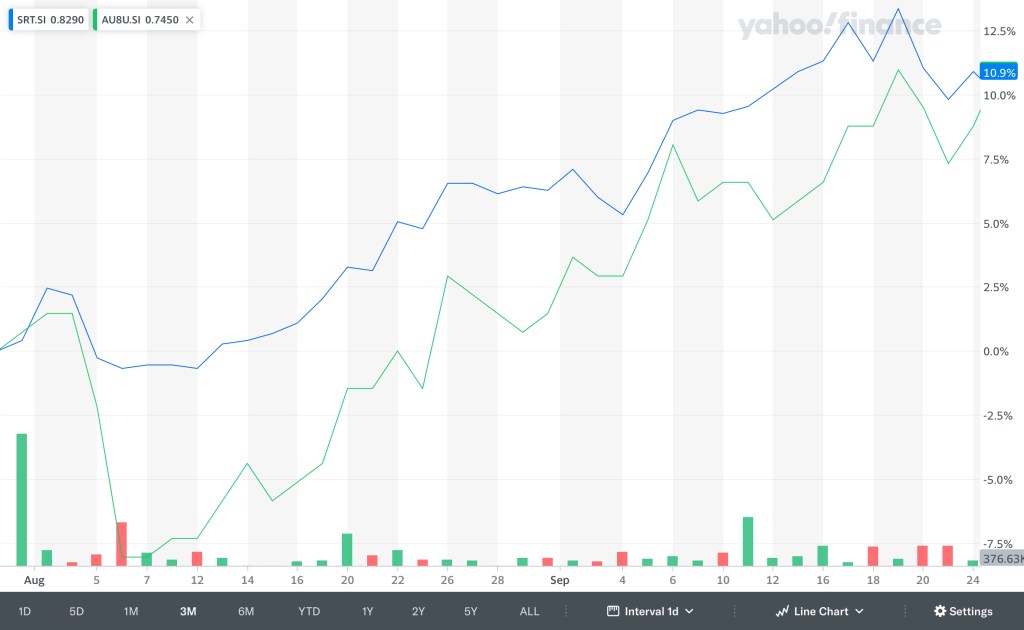

Since early August, sentiments have improved alongside the rally in the wider REITs sector. Up till the week ended 20 September, CLCT’s share price jumped 20%. And if there were any doubts about its recovery, they were cast aside last week when CLCT rallied another 10% on 27th September itself, bringing the total rally to around 35%. The initial rally was in line with the broader resurgence of the REIT sector, driven by expectations of US Fed rate cuts, and the sharp rise last week was likely fueled by China’s stimulus measures.

In today’s post, I’ll share with you why I held on to CLCT, even when the market overlooked it, and whether I think this rally has more legs to run. As always, this is based on my real portfolio, where CLCT plays a key role, and I’ll share what I’m planning to do with my holdings in CLCT moving forward.

Before we dive in, I must let you know that this content is for informational and educational purposes only and does not constitute financial advice. The opinions expressed are based on publicly available information and personal analysis, and they are not tailored to your specific financial situation. The REITs and institutions mentioned are cited purely as examples. While I have no affiliations, sponsorships, or financial relationships with any of them, I may personally hold positions in some of the investments discussed. Before making any investment decisions, you are strongly encouraged to consult a licensed financial adviser.

Okay, let’s dive in!

Why I Believed CLCT Was Undervalued When Market Was Giving Up

Let’s start by revisiting why I’ve held on to CLCT, even when it was one of the worst performers among blue-chip REITs like Mapletree Logistics Trust and Mapletree Pan Asia Commercial Trust. I’ll summarize my analysis from a previous post, but updating the property performance metrics with the latest Q2 2024 numbers. If you’d like a deeper dive, the link to that video is at the top right corner, so feel free to check it out later for more details.

From a fundamentals perspective, CLCT had been delivering steady performance in its key segments, retail, business parks, and logistics. The retail segment, which makes up 70% of its portfolio, showed resilience with occupancy of 97.8%, and positive rental reversions of 1.2%. Shopper traffic grew by 14.1%, and tenant sales increased by 6.6% year-on-year, indicating strong consumer activity despite the broader economic slowdown in China. Business parks, which account for 23% of the portfolio, remained stable with an occupancy rate of 90.5%.

The logistics segment, which only represents 7% of the portfolio, was the weak link with some properties having occupancy rates as low as 60% last year and negative rental reversions. However, given its small contribution to the overall portfolio, I felt the market was overreacting to this weakness while ignoring the strengths in the retail and business park segments.

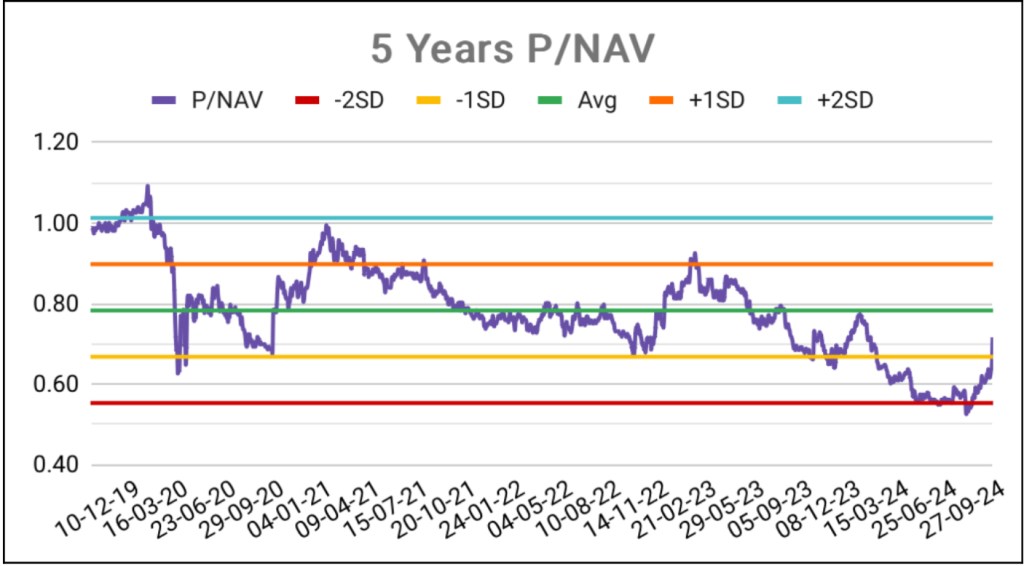

What’s most striking is that CLCT was trading at a significant discount to its historical price-to-book value, before the recent rally started. Even if we take a conservative approach and assume that the logistics properties contribute nothing to the REIT, the price-to-NAV ratio, was around 0.65, still well below the five-year average of 0.8. Similarly, even assuming the logistics properties don’t contribute to distributable income, the dividend yield remained an attractive 8.8%, which is far above the five-year average of 6.9%.

For me, this was a clear sign that the market was being too pessimistic, and I believed CLCT was worth holding onto for a potential recovery.

The 35% Rally Since Early August: What’s Driving It?

So, let’s zoom out and look at what’s been driving CLCT’s impressive 35% rally since early August.

The first 20% of the rally was aligned with the broader resurgence in the REIT sector. As the US Federal Reserve began cutting interest rates, the entire REIT market benefitted from improved investor sentiment, and CLCT joined the upward trend. Expectations of lower interest rates made REITs more attractive across the board. Specifically for CLCT, which has debt mostly denominated in SGD, the US rate cuts help alleviate financing cost pressures by reducing the interest expense loans. This in turn improves the REIT’s overall profitability and boosts its distributable income.

SRT.SI: CSOP iEdge S-REIT Leaders Index ETF

AU8U.SI: CapitaLand China Trust

However, the more recent 10% rally last week can be attributed to China’s latest stimulus measures. The Chinese government’s efforts to support the economy have had a strong impact, with the C.S.I. 300 index of Shanghai- and Shenzhen-listed companies up 15.7%. This shows the extent of market optimism driven by the government’s economic support. The ongoing interest rate cuts by the Chinese government have further eased financing costs for the REIT, providing additional support.

For CLCT, this is particularly important. With the stimulus improving both consumer and business sentiment, the wealth effect from a rising stock market is likely to boost consumer spending, which can positively impact retail properties. At the same time, better economic performance is expected to drive demand for business parks and logistics spaces. So, while CLCT was previously weighed down by negative sentiment around China, last week it benefitted from the opposite—a positive “China effect.”

Does CLCT’s Rally Have More Room to Grow?

Now, the big question: is there more to come?

In my opinion, yes, but with some caution. CLCT’s fundamentals remain solid, and the recent rally reflects a growing recognition of its long-term value.

However, it’s crucial to acknowledge a significant challenge: the ongoing downturn in China’s property sector. This situation is impacting both corporate profits and consumer wealth. Property is one of the most significant purchases individuals make, and a drop in property values can lead to a negative wealth effect. If you recently bought a property that has lost value, it’s natural to feel less financially secure, which could dampen consumer spending.

While the government’s stimulus measures aim to bolster the economy, they don’t directly address the issues plaguing the property market. Lower interest rates may enhance housing affordability, but without a recovery in the property sector, overall sentiment in the Chinese economy might remain fragile.

Despite these headwinds, CLCT continues to trade at a discount to its historical price-to-book ratio. While the price-to-book ratio has surged alongside the price rally, it remained below the 1-year high. If we were to zoom out to a 5-year view, we can see that it is still below the 5-year average of 0.8. Its dividend yield also remains appealing, at 7%. If consumer confidence improves and the property market stabilizes, CLCT stands to benefit significantly from the resurgence of retail activity and business parks.

Chart from https://www.reit-tirement.com/

The Dividend Uncle’s Take: My Investment Decisions on CLCT

Now, let’s talk about how CapitaLand China Trust fits into my portfolio.

First off, CLCT has been a solid source of dividends for me, which is why I’ve been holding onto it through the ups and downs. In fact, I just received more than $1,400 in dividends a few days back, enough to cover my kopi breaks for the rest of the year! That’s a nice reminder of why I stick with quality REITs. Despite the volatility we’ve seen in China-related investments, the dividend payouts have been consistent, and that’s a big part of why I remain confident in my position.

I’ve held CLCT across the COVID crisis and watched it recover from the lows of 2020. Although the current share price hasn’t hit the highs we saw before the pandemic, it’s still comfortably above those COVID-era lows.

A lot of that confidence comes from my belief in CapitaLand’s ability to manage retail malls effectively. Many of CLCT’s malls are strategically located in prime catchment areas, places where people go to buy daily necessities, catch up with friends, or enjoy a meal out. These are not unlike Singapore’s suburban malls, which continue to perform well due to their accessibility and relevance to daily life. I expect CLCT’s retail properties to benefit from this same resilience as China’s consumer confidence slowly returns.

I won’t go into too much detail on the broader economic outlook, as I covered that in the earlier section. But I will say that while I’m aware of the risks, particularly in China’s property sector, I believe CLCT’s retail-focused portfolio and CapitaLand’s management give it a strong foundation to weather the challenges ahead.

For now, I’m happy holding onto my position.

As always, this post reflects my personal analysis and what I’m doing in my own portfolio. Let me know in the comments if you’re holding CLCT or considering adding it to your investments. And if you found this post helpful, don’t forget to hit that like button and subscribe for more updates on my investing journey.

Thanks for joining me today, and I’ll see you in the next one!

Leave a comment