Hey savvy investors! I know I just posted an update yesterday, and normally, I don’t post so frequently. But today, there’s special news that I couldn’t wait to share; news that could mark a turning point for the very long-suffering investors in US office REITs.

Here’s the big announcement: On his inauguration, President Trump mandated that all government office workers return to the office five days a week! Yes, you heard that right, no more hybrid or work-from-home arrangements. This is something I’ve been discussing in my videos for a while now, and today, it’s finally official. Elon Musk previously hinted at this mandate when speaking about government efficiencies, but today’s confirmation has sent ripples through the market.

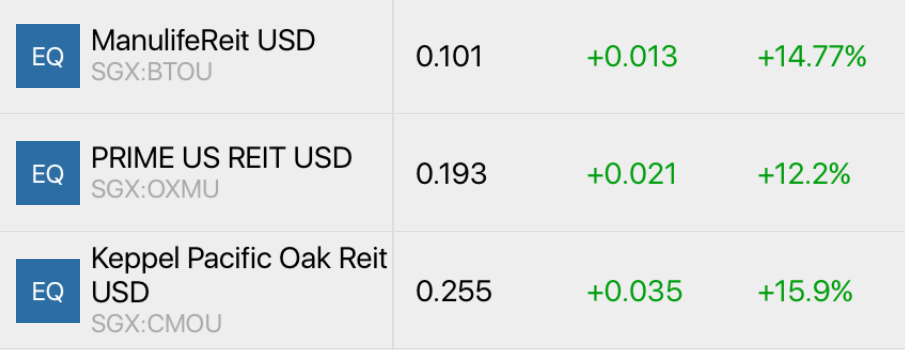

And what a reaction it was! All three major US office REITs surged by about 15% today. For those who held Keppel Pacific Oak US REIT, Manulife US REIT, and Prime US REIT, today’s rally may feel like a welcome relief, bringing some long-awaited boost to dampened spirits!

Before we dive in, let me remind you that this video is for informational and educational purposes only. It is not financial advice or a recommendation to buy or sell any investments. Always consult a licensed financial adviser to understand what is suitable for your specific financial situation.

Why This Is Big News for US Office REITs

So, why does this matter for US office REITs like Manulife US REIT? Let me break it down for you:

1. Accelerate the Back-to-office Trends: This trend isn’t limited to government tenants either. We’ve already seen several major companies mandating a return to the office. This includes Amazon, JP Morgan, AT&T and Tesla. With Trump’s move setting a strong precedent, this could accelerate the shift across industries. Even REITs with low exposure to government tenants could benefit from the broader recovery in office demand as more companies follow suit. This signals a potential turning point for the office market as a whole, beyond just government-occupied buildings.

2. Higher Physical Occupancy: A full return-to-office mandate for government workers could mean greater physical occupancy in offices. And when offices are physically occupied, tenants are far more likely to renew leases upon expiry, barring other unforeseen circumstances. That will provide much needed stability for these REITs.

3. Boost to Property Valuations: With higher expected occupancies, the valuation of office properties is likely to improve as well. For REITs like Manulife US REIT, which has been looking to divest some properties, this gives them stronger negotiating power for better prices.

4. Better Sentiment for the Sector: Let’s face it. US office REITs have been hammered over the past couple of years, as work-from-home trends reduced demand for office spaces. This mandate could signal a long-overdue revival.

Potential Risks: It’s Not All Positive

Now, before we get too excited, let’s also look at the potential negatives here.

Some reports suggest that this mandate may not be as positive as it seems. Musk, in particular, has hinted that this push to bring workers back to the office is part of a broader plan to drive some resignations and improve efficiencies in the government sector. Essentially, forcing people to return to the office could result in many unhappy workers choosing to quit and move to other industries.

If that happens, demand for office space might actually decline over time, as government agencies downsize their workforce. And personally, I can relate: if my employer forced me to return to the office five days a week, I wouldn’t be too thrilled either!

The Dividend Uncle’s Take

So, what’s my take on all of this? Well, it’s certainly great news for the short-term sentiment around US office REITs. While the 15% jump is noteworthy, it’s important to approach such rallies with caution, as short-term market reactions don’t always translate to sustained recovery. The long-term impact will depend on how this mandate plays out: the overall performance of US office REITs will depend on a variety of factors, including broader economic conditions and tenant demand trends.

As someone holding Keppel Pacific Oak US REIT and Manulife US REIT, this rally feels like a long-awaited boost. But I’m cautious—this could be just a reaction, and the next quarters will show whether the recovery is sustainable. Now, while I hold these REITs, this does not mean they are suitable for everyone. Please evaluate your own investment goals and risk tolerance.

Alright folks, what do you think about this mandate? Are you holding onto US office REITs, or do you think this is just a temporary rally? Let me know in the comments below! And if you found this video helpful, don’t forget to give it a like and subscribe for more insights.

Until next time, happy investing!

Leave a comment