Hey savvy investors! Today’s post is about an ETF that, in theory, sounded perfect for my investment style: MOAT ETF, the VanEck Morningstar Wide Moat ETF. Given that it focuses on high-quality companies with durable competitive advantages, follows a disciplined approach to valuations, and adjusts its portfolio to avoid overhyped stocks, I went into my research thinking this was the one ETF I could hold forever.

But after digging deeper into its actual performance, I have to say that honestly, I was disappointed. While I was expecting a more defensive, Buffett-style ETF that could outperform in different market conditions, what I found instead was an ETF that lacks real downside protection, struggles to beat the S&P 500 over the long term, and behaves too similarly to broad market ETFs despite its higher expense ratio.

So, in today’s post, I’d like to share what I’ve found so you don’t have to do it for yourself. I’ll first go through why I initially found MOAT ETF attractive, before explaining why I’ve ultimately decided not to invest in it. And if you’ve been looking around for smart beta ETFs to avoid the Big Tech concentration in the S&P 500, or even considering adding MOAT ETF to your portfolio, stick around, because the reasons I found might change your mind too!

But first, as always, let me remind you that this post is for informational and educational purposes only. It’s not financial advice or a recommendation to buy or sell any specific investment. I’ve done my own research, and I encourage you to do yours as well before making any investment decisions.

Alright, let’s get into it!

The Good: Why I Initially Liked MOAT

Before I tell you why I’m not investing in MOAT, let’s be fair, there are things I liked about this ETF.

At first glance, MOAT looks like the perfect ETF for a long-term investor like me. It follows a Buffett-style approach, focusing on high-quality companies with strong competitive advantages. Specifically, MOAT selects companies that have an economic “moat” as determined by Morningstar’s equity research team. These companies must demonstrate durable competitive advantages, things like strong brand recognition, cost advantages, network effects, or high switching costs, that allow them to maintain profitability over the long run. This is exactly the kind of quality-focused investing that aligns with my philosophy. An example is Alphabet Inc., the parent company of Google. Alphabet’s dominance in the search engine market, along with its extensive data collection and analysis capabilities, provides it with a significant competitive edge that is difficult for competitors to replicate.

But what’s even more important than owning great companies is ensuring that we don’t overpay for them. This is where MOAT’s second selection criterion comes in, it only includes stocks that are undervalued relative to Morningstar’s assessment of fair value. In theory, this means MOAT avoids the mistake of buying overhyped stocks at stretched valuations, something that’s particularly important in today’s market where many high-growth stocks trade at excessive multiples. This valuation discipline is a key reason I initially thought MOAT would provide a better long-term return compared to market-cap-weighted ETFs.

Beyond just picking good companies at fair prices, MOAT also actively rebalances its portfolio every quarter to maintain its focus on undervalued, high-quality companies. Unlike passive ETFs that let overvalued stocks keep growing in size, MOAT systematically removes stocks that have become too expensive and replaces them with new companies that meet its strict quality and valuation criteria. This ensures that investors aren’t stuck holding overhyped stocks indefinitely—a feature that sounded like a great way to manage risks and improve long-term returns.

So at the start, I was really excited about MOAT. It seemed to combine everything I look for in an investment: quality, valuation discipline, and active risk management. But as I dug deeper, I found that MOAT’s actual performance doesn’t live up to its promise. And that’s where my disappointment began.

Why I’m NOT Buying MOAT

1. No Real Downside Protection

One of the key reasons I originally considered MOAT was because I thought it would perform better during market downturns. The idea was that since it focuses on undervalued, high-quality stocks, it would be less volatile and provide a cushion during market crashes.

But here’s what I found: in times of market drawdowns, MOAT falls just as much as the broader market.

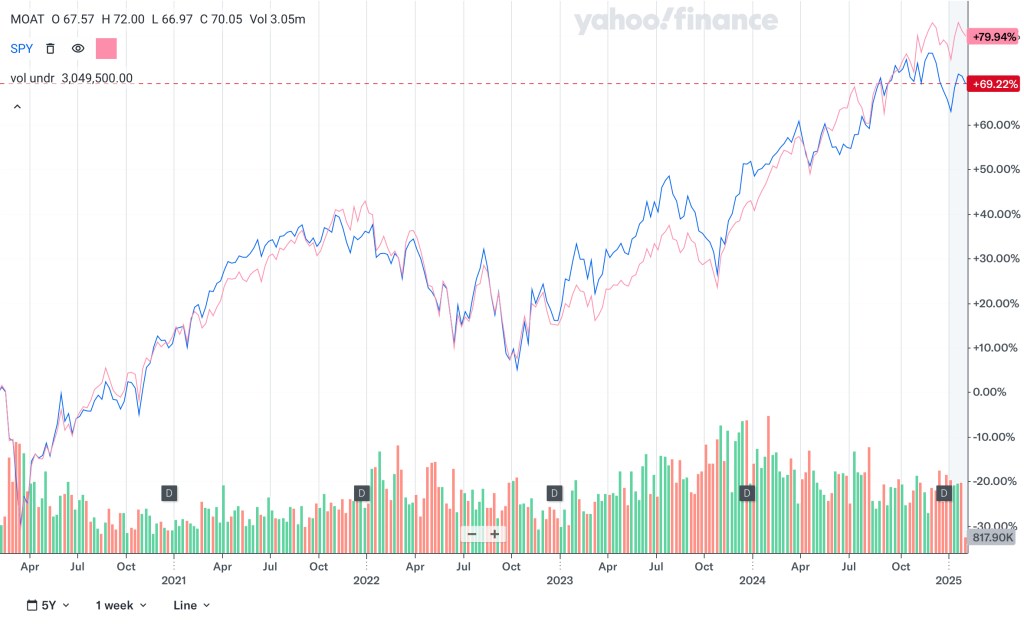

Take the most recent market drop due to President Trump imposing tariffs on Canada, Mexico and China. Looking at the chart, the SPY ETF based on S&P 500, in red, was down about the same extent as MOAT ETF, in blue. There was no real downside protection, despite its so-called focus on quality and valuation discipline.

Now, this isn’t just a one-off case. Looking at the price performance in 2024, we can see that MOAT has almost never beaten the SPY ETF on a down cycle. In June 2024, MOAT dropped more than SPY; in August 2024, they declined by similar extent, despite its supposed ability to avoid overvalued stocks and cushion losses. Given its similar downside performance to SPY, I question whether it adds meaningful defensive qualities.

Before we move on, if you’ve enjoyed the content so far, please hit the ‘like’ and ‘subscribe’ buttons, just to give some cheers to your friendly dividend uncle! Okay, let’s move on.

2. No Long-Term Outperformance vs. the S&P 500

Now, I know what you might be thinking: maybe MOAT still outperforms the S&P 500 over the long term, even if it doesn’t hold up better during downturns.

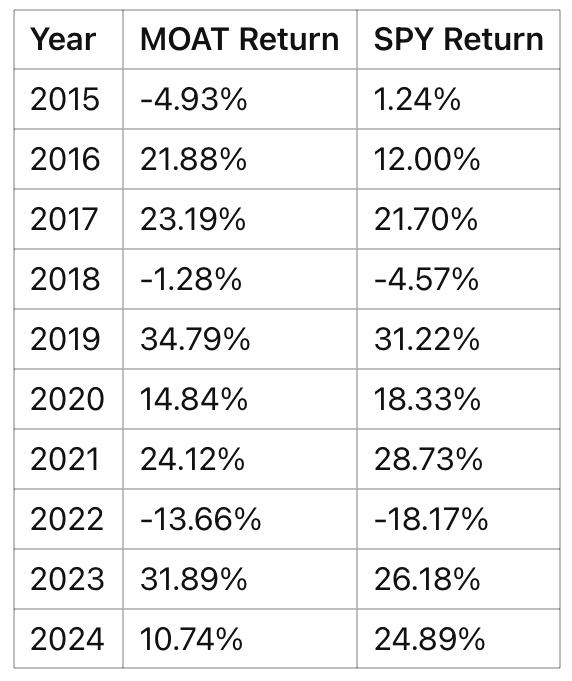

So I looked at its annual returns over the past 10 years, and here’s the problem: excluding the years when their performances are similar, MOAT has only outperformed SPY in two years in 2016 and 2023.

This underperformance actually reflects a bigger issue with smart beta ETFs like MOAT. It’s incredibly difficult to predict which sectors will do well in the future, and which sectors are overvalued, and especially when they will start to decline. Expensive stocks can stay expensive for a very long time, and underperforming sectors don’t necessarily recover just because they’re undervalued.

If MOAT was truly effective at picking the best undervalued companies with strong competitive advantages, we should have seen more consistent outperformance over time. But instead, we see a mixed track record, with MOAT often lagging the S&P 500.

3. High Correlation with SPY – So Why Not Just Buy SPY?

Another major issue I found with MOAT is that its performance closely mirrors the S&P 500.

Looking at the data, the correlation between MOAT and SPY is 0.88. That’s a very high correlation, meaning that MOAT’s price movements closely track the broader market.

And without going into mathematics like how to calculate correlations, you can just look at their price trends over time. It’s clear that MOAT isn’t really doing anything drastically different: it’s just moving in sync with the SPY ETF most of the time.

So here’s the problem: if MOAT is going to behave similarly to SPY, why not just invest in SPY instead? SPY ETF has lower fees: MOAT’s expense ratio is 0.46% vs. SPY’s 0.09%, and it doesn’t require us to worry about rebalancing decisions. In a long-term portfolio, expense ratios matter, so if two ETFs are going to deliver similar results, it makes sense to go with the cheaper option.

MOAT’s active adjustments might sound good in theory, but if it’s not meaningfully outperforming and is still highly correlated with the S&P 500, then why should I pay higher fees for it?

The Dividend Uncle’s Take

At the start of my research, I really thought MOAT would be a great long-term investment. It follows Buffett’s philosophy, it rebalances regularly, and it avoids overvalued stocks. These are all solid principles that I strongly believe in.

But after analyzing its actual performance, I’ve come to a different conclusion: MOAT doesn’t fit my portfolio strategy. It doesn’t provide real downside protection, dropping just as much as the broader market during corrections. It has underperformed the S&P 500 in most years, showing that its smart beta strategy doesn’t necessarily lead to better returns. Finally, its correlation with SPY is too high, making it redundant for a portfolio that already holds broad market ETFs.

Rather than investing in MOAT, I’m sticking with RSP, the Invesco S&P 500 Equal Weight ETF, which I covered in an earlier post, with the link to the post right here.

Why? Because RSP is simpler, more transparent, and actually delivers on diversification. Unlike MOAT, which tries to identify undervalued stocks but often underperforms, R.S.P. systematically equal-weights all S&P 500 companies, ensuring that no single sector or group of stocks dominates the portfolio.

We’ve seen how market-cap-weighted ETFs like SPY have become overly concentrated in just a few tech stocks. While MOAT tries to adjust for this, its strategy hasn’t translated into consistent outperformance. In contrast, RSP naturally balances exposure across all sectors, making it a more effective way to reduce concentration risk.

So for me, I prefer RSP’s approach because it provides equal-weight exposure and aligns better with my diversification goals, which does exactly what it says, providing balanced exposure to all S&P 500 companies in a disciplined and transparent way.

Alright folks, that’s all for today. I know many investors love MOAT, and if it works for you, that’s great! But for me, after digging deeper, I just don’t see the need to pay higher fees for an ETF that doesn’t significantly outperform and still moves like SPY.

What do you think? Are you holding MOAT ETF, or are you reconsidering it like I am? Let me know in the comments below!

And if you found this analysis helpful, don’t forget to like, subscribe, for more investing insights.

Until next time, happy investing!

Leave a comment