Hey fellow REIT investors! Welcome back to the channel. Today’s topic really caught me by surprise – not because of Paragon REIT’s proposed privatisation itself. By now, probably every REIT investor knows that is coming. What surprised me was the ripple effects this could have on other similar REITs, once I had time to sit down and give it some thought.

With Paragon REIT being taken private at a Price-to-NAV of 1.07, it raises a big question: could certain retail REITs be undervalued if we use this as a benchmark? While the offer prices for privatisations usually typically come with a premium to entice existing shareholders, the significant gap between Paragon REIT’s valuation and other REITs might just help us uncover some hidden values. And trust me, what I found is rather exciting.

In this post, I’ll first break down Paragon REIT’s privatisation details, and compare its valuation to not just other similar retail-focused REITs like Starhill Global REIT, Lendlease Global Commercial REIT, but also the ever-popular Frasers Centrepoint Trust. Could any of these REITs be hiding hidden value?

And here’s the kicker: there may be a potential opportunity among these REITs, and I’ll share my thoughts on which one at the end of the post.

But first, let me remind you that this post is for informational purposes only and not financial advice. Always consult a licensed financial adviser to ensure your decisions align with your goals. And yes, I hold the REITs discussed in my portfolio, but remember, what works for me might not work for you.

Alright, let’s get started!

Paragon REIT’s Privatisation: What’s the Deal?

Let’s kick things off with the news that every REIT investor knew was coming – Paragon REIT is going private. The offer was announced on February 11, with Cuscaden Peak, a real estate firm backed by Temasek Holdings, proposing to acquire the remaining shares of Paragon REIT at $0.98 per unit. This values Paragon REIT at S$2.78 billion.

Now, here’s where it gets interesting: the offer represents a 10.1% premium over the REIT’s last closing price and a 7.1% premium to its adjusted NAV, which translates to a Price-to-Net Asset Value or NAV of 1.07.

Paragon REIT’s crown jewel is of course Paragon Mall, a well-known luxury retail complex on Orchard Road. Just ask your Mum and Dad – even they know Paragon Mall is very “atas”! But here’s the implication of that – Paragon Mall is an old mall by now, and is facing growing competition from newer, neighboring malls, and a slowdown in luxury spending especially among the Chinese tourists visiting Singapore. Based on the REIT’s projections, it needs a massive refurbishment costing between S$300 million and S$600 million, to stay ahead.That’s like more than 20% of the valuations of all the properties under the REIT, which includes Clementi Mall.

Cuscaden Peak believes that this transformation will be more effectively managed if Paragon REIT becomes a private entity, free from the constraints of public market scrutiny. The REIT expects the entire refurbishment exercise will take three to four years, during which dividend distributions are likely to be severely impacted.

If the privatisation is approved at the upcoming extraordinary general meeting in April, Paragon REIT will be delisted by May 2025. This move isn’t just about upgrading Paragon Mall; it’s also about solving the challenges Paragon REIT has faced as a listed entity, things like low trading liquidity, limited analyst coverage, and difficulties raising capital.

Setting the Benchmark: What 1.07 Price-to-NAV Could Mean

Now that we know the details of Paragon’s privatisation, let’s explore what this could mean for other similar REITs.

The Price-to-NAV of 1.07 sets a potential benchmark for Singapore’s retail REIT valuations. If we can trust that the offer price for Paragon REIT’s properties is representative of the market, it suggests that high-quality retail properties in Singapore can still command a premium, especially if there’s a strategic buyer willing to invest for the long term.

At this point, you may feel like throwing stones at The Dividend Uncle: “Oi, all REITs are different, especially retail REITs!” But, I totally agree: differences in asset quality, location of the mall, tenant mix within the mall, and financial health at the overall REIT-level can significantly impact valuations. So it doesn’t necessarily mean that other REITs should trade at similar levels.

Still, I think it’s worth taking a closer look at some of Paragon’s peers: Starhill Global REIT, Lendlease Global Commercial REIT, and even Frasers Centrepoint Trust, to explore why different retail REITs are valued at a discount. Could these REITs be currently undervalued, even after taking into account their key differences with Paragon REIT?

Stay with this uncle, as I break it down REIT by REIT.

Could Orchard Road REITs Be Undervalued?

When we talk about Orchard Road REITs, Starhill Global REIT and Lendlease Global Commercial REIT are the two most obvious ones other than Paragon REIT. Both own significant assets along Orchard Road. I’m not considering CapitaLand Integrated Commercial Trust or C.I.C.T. in this analysis because other than the newly acquired ION Orchard, which is significant on its own, but represents only a small proportion of C.I.C.T.’s total assets.

Elephant In The Room: Price-to-N.A.V Ratio

Now, the most significant gap between Paragon REIT and the other two Orchard Road REITs is obviously the differences in their Price-to-NAV ratios compared to Paragon’s 1.07.

Both Starhill Global REIT and Lendlease Global Commercial REIT are trading at about 0.7 times of their respectively NAV. At first glance, these discounts to Paragon REIT might seem like a not-to-be-missed opportunity! But more than often, it’s not that simple. Let’s dig a little deeper to understand the differences and why they’re priced this way.

Asset Enhancement Potential

One of the key factors influencing retail property valuations is the need for asset enhancements. Paragon Mall, for instance, is planning to undergo a massive refurbishment costing between $300 million and $600 million to remain competitive. This reflects the reality that older retail properties, especially shopping malls that cater to the more luxurious spendings, need significant capital re-investments to keep up their image, the ‘atas’ feel and even smell, with newer, upgraded ones. In case you’re wondering, I mentioned “smell” because my wife tells me that that’s a perfume just for ION Orchard, which features a signature scent crafted from a blend of 20 individual fragrances! I only remember that some malls have delicious food smells, due to poorer air circulation.

Okay, back to business. For Starhill Global REIT, this is a pressing issue. Its flagship properties, Wisma Atria and Ngee Ann City, are iconic but definitely aging assets. In fact, their land leases are very low in my views, with Wisma Atria’s being left with 36 years, and Ngee Ann City being left with 47 years. That’s a significant risk to investors, but it is another story for another post.

The key point is that without substantial investment in asset enhancements, these properties risk losing their competitive edge. But here’s the problem: Starhill Global REIT’s financial position may not be strong enough to take on such large-scale A.E.I.s anytime soon. REITs have to pay out at least 90% of its earnings, so the cost of major A.E.I.s would have to be raised from shareholders. Such potential dilution of distribution and loss of revenue during the A.E.I. period could justify the huge discount to its NAV.

On the other hand, Lendlease Global Commercial REIT’s 313. @ Somerset is a much newer property, having undergone recent upgrades and AEIs. This puts it in a stronger position, as it’s less likely to require a massive refurbishment like Paragon Mall or Wisma Atria.

Tenant Mix and Resilience

Another key difference lies in tenant mix and customer base. Paragon Mall and Starhill Global REIT’s Wisma Atria and Ngee Ann City is heavily skewed toward luxury retail and tourist spending, which can be volatile depending on global economic cycles and conditions.

Lendlease REIT, however, has a more local consumer-focused tenant mix at 313@Somerset. With more affordable brands and lifestyle stores, like Cotton On, Genki Sushi and Koi Express, it caters to local shoppers and more budget conscious tourists. This makes its income stream potentially more resilient compared to Paragon and Starhill Global, especially in times of slowing tourist recovery, and trend of experience-focused travel rather than spending on material goods.

So, based on the above discussions, while Starhill Global may look cheap at around 0.7x NAV, investors need to weigh the risks of its aging assets and the potential for higher capital expenditure. Meanwhile, Lendlease Global’s more diversified tenant base and newer Orchard Road property might justify a smaller discount compared to Starhill, but it could still benefit from improved market sentiment.

Before we move on, if you’ve enjoyed the content so far, and you’re looking forward to exploring potential hidden gems with a group of like-minded investors, please hit the ‘like’ button and subscribe to ‘The Dividend Uncle’ channel. Thanks for your support!

The Dividend Uncle’s Take: Is Lendlease REIT Undervalued?

So, after going through all the comparisons, what’s my take on the attractiveness of retail REITs in light of the Paragon REIT privatization deal?

Well, it really depends on what kind of investor you are. If you’re looking for long-term stability, suburban-focused REITs like Frasers Centrepoint Trust might be your best bet. Their dominant suburban malls generate resilient cash flows, supported by necessity-driven tenants like supermarkets and F&B outlets.

But if you’re willing to take on a bit more risk for higher potential returns, here’s where things get interesting. Personally, I think Lendlease REIT could be worth a closer look. And here’s why.

Why Lendlease REIT Stands Out

First, 313@Somerset is a newer asset and doesn’t require as much capital for asset enhancement, which reduces the risk of sudden large-scale capex. Compare this to Paragon Mall, which needs a S$300 million to S$600 million revamp—major spending that could impact distributions.

Second, 313@Somerset enjoys a balanced tenant mix that attracts both local consumers and tourists. Unlike Paragon, which is heavily skewed toward luxury retail, 313@Somerset has a mix of lifestyle brands, affordable fashion, and dining. This makes its income stream more resilient during economic slowdowns when discretionary spending tightens.

Third, valuation. If we apply Paragon REIT’s 1.07 Price-to-NAV as a benchmark for high-quality Orchard Road properties, Lendlease REIT looks severely undervalued at just 0.7 times of NAV That’s a huge discount for a portfolio that still holds some of Singapore’s most prime retail locations.

Of course, Lendlease REIT isn’t just 313@Somerset. It also owns Jem, which is a mixed-use retail and office property in western Singapore. But the elephant in the room? Sky Complex in Milan, Italy. Investors will remember that Lendlease REIT’s Milan exposure caused concerns when its sole tenant reduced space, although things seem more settled now.

Hypothetical Exercise: Removing the Risky Parts

Now, let’s do something fun. What if we strip away the most questionable part of Lendlease REIT’s portfolio?

Most of us would agree that its Singapore properties, 313@Somerset and J.E.M. are solid assets. These malls enjoy high occupancy, strong foot traffic, and quality tenants. But what about Milan? That’s where investors hesitate.

So, let’s do a quick thought experiment. What if we completely remove the Milan assets from the equation, meaning, we assume their value is zero?

Lendlease REIT’s adjusted Price-to-NAV would jump from 0.7 to 0.88. That’s still a discount, but it closes the gap significantly. However, if we assume it should trade at Paragon’s 1.07x Price-to-NAV, the potential upside is about 22% which is not too shabby.

Now, before anyone rushes out to buy, let me be clear: this is not a prediction or a forecast. This is purely a hypothetical scenario for discussion purposes and should not be taken as an actual valuation model.

Other Risks of Lendlease REIT to Consider

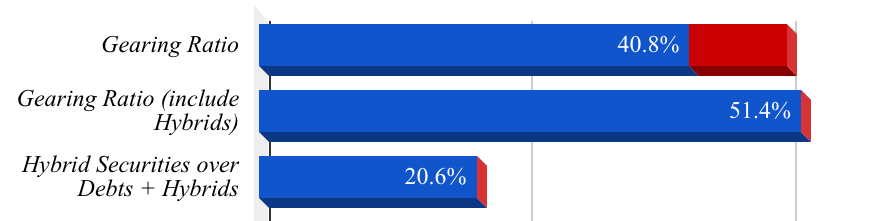

In addition, let’s not forget that Lendlease REIT has a few risks that I’ve mentioned before in previous posts. I would like to reiterate two bigger ones. First, its gearing ratio is relatively high at 40.8%. But that’s not all. It also has substantial amount of hybrid and perpetual debt securities, which will increase its gearing ratio to more than 50%. While this high debt level was taken into account in the computation of NAV, it nevertheless means that the REIT has less financial flexibility compared to REITs with lower debt levels. Any further increase in interest rates or refinancing challenges could impact distributions.

[Image extracted from http://www.reit-tirement.com]

Second, there’s also the factor of Lendlease REIT’s sponsor, Lendlease Group listed in Australia. While it’s a reputable global developer, it has faced financial challenges, including cost overruns in certain projects. While this doesn’t directly impact the REIT, investors should always keep an eye on the sponsor’s financial health and alignment with unitholders.

Alright folks, that’s all for today! So, are retail REITs undervalued? It really depends on how you interpret Paragon’s 1.07x NAV.

For Starhill Global, the lower valuation may reflect its aging assets and higher capital expenditure requirements. But for Lendlease Global Commercial Trust, the combination of newer properties, balanced tenant mix, and potential for future recovery could make it an interesting opportunity to watch closely.

What do you think? Are retail REITs undervalued? Would you consider buying any of these REITs, or are you staying on the sidelines for now?

Drop your thoughts in the comments below! And if you found this helpful, like and subscribe for more deep-dive REIT analysis. Stay tuned, because in future posts, I’ll be diving into even more REIT opportunities and updates.

Until next time, happy investing!

Leave a comment