Hey savvy investors! Three months ago, I posted about one of my biggest concerns for 2025—how the sky-high valuations of the U.S. stock market could impact our investments. Back then, I shared my thoughts on how the Shiller PE Ratio was flashing warning signs, and I laid out what I intended to do about it.

For those who remember, I said I would firstly, focus on quality dividend stocks and REITs with strong fundamentals. Because if the market turned volatile, namely go down, I wanted steady income to cushion the ride. Secondly, to avoid chasing overvalued stocks in the US market, even though the market was still pushing higher. And finally, to rebuild my cash reserves, since I had almost completely deployed all my cash last year into undervalued REITs and dividend stocks.

Now, three months later, stock valuations are still at extreme highs. The Shiller PE Ratio has became even more elevated. Markets are still driven by optimism over AI but there have been some scares along the way. And so far, my strategy has been playing out just fine but I’m still low on cash reserves.

But there’s something else that has been brewing in the background. It’s not like we haven’t noticed it—but now, it’s grown so large that it might just be signaling that something is seriously off.

Warren Buffett, along with other prominent investors, have been quietly building their cash reserves. Berkshire Hathaway is currently sitting on a record-breaking US$334 billion in cash, after aggressively selling stocks last year. The stocks sold down include what Jim Cramer, the amazing CNBC host of ‘Mad Money’ would describe as a “own it, don’t trade it” share: I’m talking about Apple! If one of the greatest investors of all time is holding so much cash, and the market’s valuation indicators are flashing red, what does this mean for the rest of us?

And to add to that, the US stock market has failed to push higher so far in 2025, with attempts of rallying failing. Just last week, we saw a sudden plunge in US share prices, triggering fresh concerns about consumer confidence and inflation risks.

So, here’s the big question on my mind: have market conditions shifted so much in the past three months that the strategies I laid out in my previous post no longer apply? And if heavyweights like Buffett and major institutional investors believe the market is peaking, should I stop chasing stocks altogether and just focus on saving all my cash?

Before we jump in, let me remind you that this post is for informational purposes only and not financial advice. Always consult a licensed financial adviser to ensure your decisions align with your goals. And yes, I’m rebuilding my own cash reserves after nearly using them all up last year, but remember, what works for me might not work for you.

Alright, let’s get started!

Is the Recent Market Volatility Indicative of More to Come?

Let’s first address what’s fresh on everyone’s minds: why did the stock market suddenly tank at the end of Friday? Well, the S&P 500 dropped 1.7%, its biggest decline in two months. The Nasdaq fell even more, by 2.2%.

While last Friday’s drop caught attention, it’s not an isolated event. If we zoom out and look at the market since the start of 2025, it’s been a choppy ride.

The S&P 500 has struggled to push higher despite starting the year strong. Every attempt to break new highs has been met with sharp reversals. And if you’ve been following the so-called Magnificent Seven tech stocks, you’d know that performance has been surprisingly flat, except for Meta.

So what’s behind this volatile and directionless market?

Analysts think there are a few reasons to this. Firstly, sticky inflation concerns. Just when the market started pricing in multiple interest rate cuts, inflation data surprised to the upside. Investors who were betting on aggressive rate cuts are now second-guessing.

Secondly, US’ tariff policies and geopolitical risks. The recent moves to impose higher tariffs on imports, particularly in autos, semiconductors, and pharmaceuticals, have fueled concerns about higher prices and inflationary pressures.

Thirdly, weak consumer and business sentiment. The latest University of Michigan Consumer Confidence Index dropped sharply, showing that Americans are less optimistic about the economy than before. Business surveys are also indicating a slowdown in services activity for the first time in two years.

Finally, there could be market exhaustion after a record 2024 rally. Let’s not forget that last year was an incredible year for stocks, particularly tech stocks. The S&P 500 rallied over 20% in 2024, after an equally impressive performance in 2023. Some investors are now asking: How much higher can this really go without a pullback?

With all of these factors in play, the market isn’t collapsing, but it’s also struggling to find direction. Instead of a clear bull run, we’re seeing more violent swings. I can only conclude that the market’s attempts to move higher so far has failed to materialize, with each upswing followed by sharp pullbacks.

The big question now is: Is this just noise, or is it signaling something bigger? That’s where Buffett’s record cash hoard becomes interesting.

Buffett is Holding Record Cash: Should We Be Worried?

Now, let’s talk about Buffett’s massive cash pile, a staggering $334 billion sitting idle in Berkshire Hathaway’s books. That’s not just a record for Berkshire; it’s one of the largest corporate cash reserves ever seen.

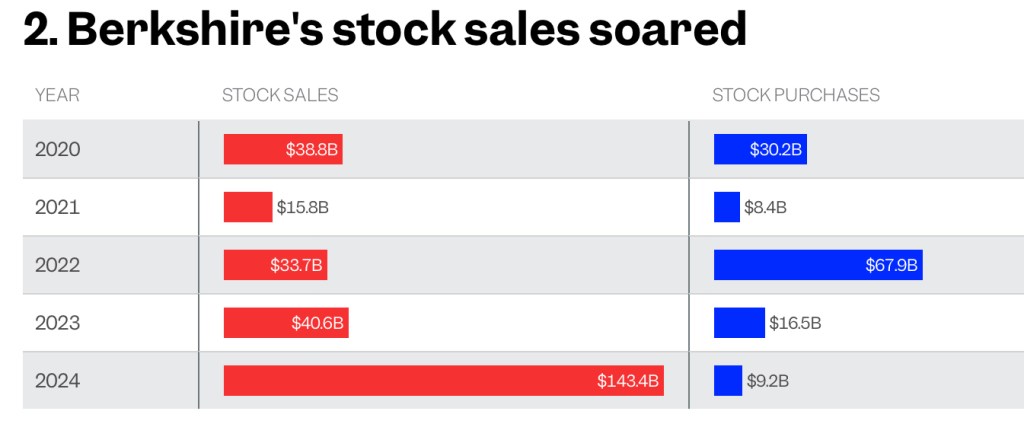

Buffett has always been clear that he prefers owning great businesses over holding cash. Yet, despite that, Berkshire sold more stocks than it bought for the ninth straight quarter in Q4 2024. In total, Buffett dumped $143 billion worth of stocks last year, including reducing stakes in Apple, Citigroup, and Bank of America. On top of that, he has been saving most of the truck-loads of cash generated from his stable dividend-focused investments and insurance businesses.

So why is Buffett building such a mountain of cash instead of investing it? The answer might lie in two key reasons.

First, valuations are too high. Buffett is well known for his mantra: “Be greedy when others are fearful, and fearful when others are greedy.” And right now? The market is looking extremely greedy.

Second, interest rates are making cash more attractive. A big portion of Berkshire’s cash isn’t just sitting idle. It’s parked in Treasury bills, earning a steady return. In fact, Berkshire’s insurance subsidiary made $11.6 billion in interest income last year, comfortably exceeding the dividends from its stock portfolio. That’s a huge shift from previous years when cash earned next to nothing.

But here’s where things get really interesting. Buffett hinted that Berkshire might increase its stakes in five major Japanese trading firms, and at the same time, he issued a warning about fiscal risks in the U.S., cautioning that “paper money can see its value evaporate if fiscal folly prevails.”

Does this mean that Buffett, a long-time champion of U.S. stocks, now sees better opportunities abroad while growing wary of the fiscal health of the U.S.? I’m not here to spread fear – if you’ve followed this channel, you’d know I can’t stand analysts who stir up panic without solid evidence. But I have to admit, this thought sent a shiver down my spine.

This Ties Back to a Bigger Problem: The Market’s Valuation

Buffett isn’t the only one waving a warning flag. If you take a step back, his decision to sit on record cash aligns perfectly with what the famous market indicator is telling us: The Shiller PE Ratio.

I’ve discussed the Shiller PE Ratio in details in my previous post, but to refresh, the Shiller PE Ratio, is also known as the cyclically adjusted price-to-earnings or CAPE ratio. It measures stock market valuation by comparing prices to the average inflation-adjusted earnings of the past 10 years. Unlike the regular PE ratio, which looks at just one year’s earnings, the Shiller PE smooths out short-term fluctuations, making it a better gauge of whether the market is overvalued or undervalued in the long run.

Now, this metric is currently flashing red, signaling that U.S. stocks are priced for perfection. In fact, right now, the Shiller PE Ratio is sitting at 38, a level we’ve only seen during the dot-com bubble and just before the 2021 market correction.

Historically, when valuations get this stretched, market returns over the next decade have been weak, typically around 4% or lower compared to the long-term average of 8% to 10%. And if history repeats itself, that could mean the stock market is headed for lower returns or even a major correction.

So, Buffett’s actions and the Shiller PE Ratio are both pointing to the same thing, that is a market that looks dangerously overvalued. But does that mean we should prioritise building cash reserves for now?

Before we dive into my personal take on the situation, if you’ve found the content useful so far, do me a favor: hit the ‘like’ button and subscribe to the channel! It helps support your friendly, neighbourhood uncle and keeps these deep-dive discussions coming. Alright, let’s get back to it!

The Dividend Uncle’s Take: Cash or Stay Invested?

So, what’s my take on all this? Am I going all-in on cash, or staying invested?

Let me share my personal situation first. Last year, I almost completely used up my cash reserves. Why? Because I saw opportunities in undervalued REITs and dividend stocks, and I wanted to lock in those higher yields.

But now? I’m working on rebuilding my cash position. Not because I’m predicting a market crash, but because I want to be ready for future opportunities. Given the high valuations, it is probably not a good idea to be 100% invested right now. In fact, my personal view is that it is more likely to be rewarding to be ready to pounce on opportunities that come along.

Hence, these are what I intend to do.

1. Rebuilding Cash While Staying Invested

Unlike Buffett, I’m not putting 100% into cash. I’m just a small-time retail investor and can nibble attractively-priced stocks and REITs along the way. But I am slowing down new investments and gradually setting aside more cash, so if a correction happens, I’ll be ready to buy.

2. Only Holding Cash That’s Productive

Buffett is earning 5% on his Treasury bills. For us retail investors, options like high-yield savings accounts, money market funds, or short-term bonds can provide similar benefits of around 4% to 5%. I personally use SSBs and short-term fixed income funds to park some of my cash while waiting for opportunities.

3. Investing in Strong Dividend Stocks & REITs

Even if markets decline, strong dividend-paying stocks and REITs provide income. You know me, I’m still holding on to my core REITs like CapitaLand Integrated Commercial Trust and Parkway Life REIT while selectively adding undervalued plays from my satellite portfolio.

4. Keeping an Eye on Market Psychology

Valuations alone don’t cause crashes—investor sentiment and external shocks do. That’s why I’m closely watching 3 key factors. They are inflation, geopolitical risks and earnings growth in the US. If the high-flying AI-related companies start to struggle to grow profits, markets could lose confidence. And when the US market falls, everyone will be affected.

So, am I following Buffett’s lead? Partially. I think cash reserves are important, especially in current volatile times. But I don’t believe in going all-in on cash while waiting for the market to correct. There are still strong investment opportunities around us.

Alright, folks, that’s my take on the big money hoarding cash. But what do you think? Are you holding more cash in your portfolio? Do you believe a major market correction is coming? Or are you staying fully invested and riding the market higher?

Drop your thoughts in the comments below! And if you found this post useful, don’t forget to like and subscribe for more insights on dividend investing and REITs. I’ll be keeping a close watch on the markets and updating you on any big moves.

Until next time, happy investing!

Leave a comment