Hey fellow dividend investors! Over the past few years, if you’ve been invested in US growth stocks, you’ve probably been smiling all the way to the bank. Even if you are more risk averse, and have been focusing on US dividend-focused ETFs, you’d have a great few years too!

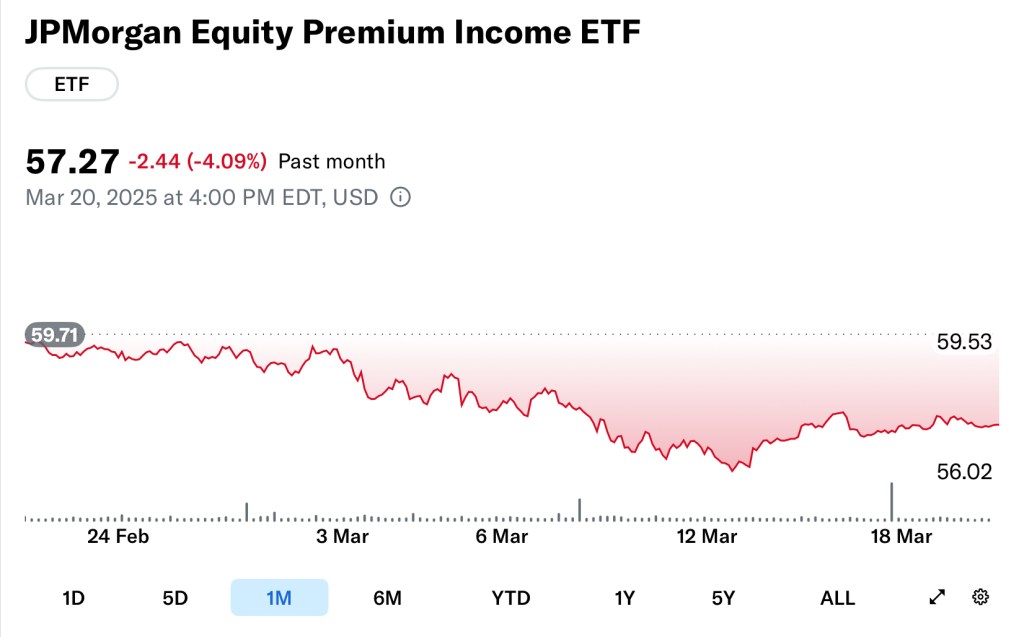

Take JEPI, for example, the J.P. Morgan Equity Premium Income ETF. This ETF has been a darling among income investors, offering high monthly payouts of at least 7% to 8% per annum while still capturing some upside in the US S&P 500 index. In fact, JEPI’s total returns have been solid: up 10% and 13% in 2023 and 2024 respectively! Not too bad for an ETF designed to focus on stability and income.

But here’s the thing—the market is shifting.

If you’ve been watching the news, you’ll know that US stocks have been struggling recently. The S&P 500 has officially entered correction territory, dropping more than 10% at its lowest point, within one month. The very same stocks that drove the market to new highs, the big tech and AI names such as Nvidia and Tesla, are now dragging it down.

Meanwhile, Europe and the rest of the world have quietly been doing much better. European stocks, for instance, have outperformed the US this year, with indices like Germany’s DAX surging more than 14% so far in 2025! In Asia, markets like Japan and Hong Kong have also held up well compared to the recent US weakness.

And that brings us to the key question for today: If the US market is faltering, is it time to look at a more globally diversified dividend ETF?

For investors who have relied on JEPI and similar US-focused income ETFs, this could be an important moment to rethink their strategy. Because as much as we love those juicy dividends, total returns matter too. And right now, the US market downturn is eating into those returns.

So, today, I’m very excited to share with you a dividend ETF that I’ve personally owned for some time – a dividend-focused ETF that provides global exposure, potentially offering more resilience in volatile markets and dividends of at least 6% to 8%. We’ll look at how it works, how it compares to JEPI, and whether it’s worth considering in today’s environment.

Stick around because this might just be the next evolution of a dividend investor’s strategy!

Before we dive in, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own the ETFs discussed, but what works for me might not work for you.

Alright, let’s get started!

Looking Beyond the US – A Better Alternative?

Now that the US market is faltering and JEPI, despite its high dividends, is struggling with share price declines, many investors are asking: Should we stick with US-focused dividend ETFs, or is it time to look beyond the US for more diversification?

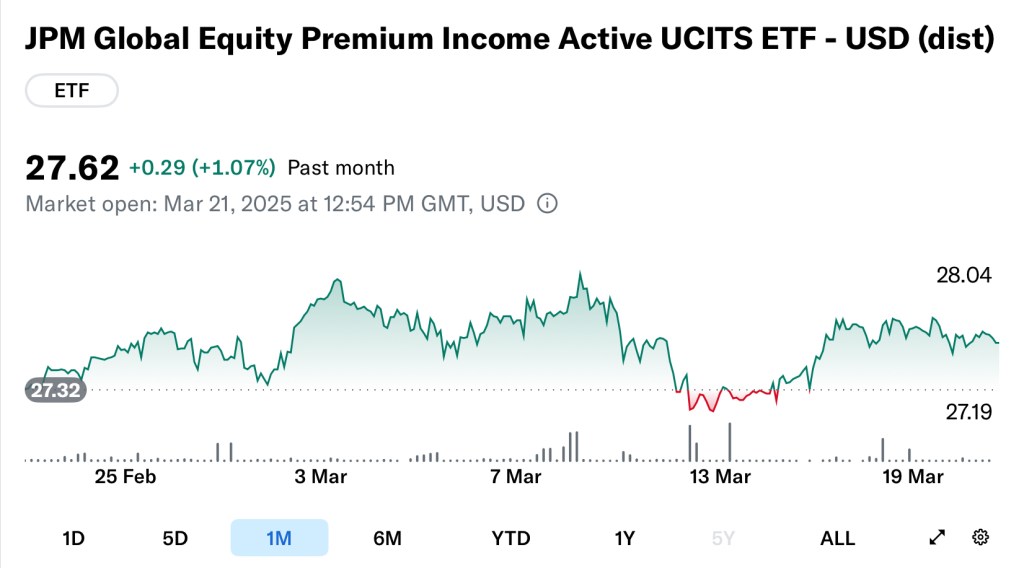

This is where today’s ETF comes in: JEPG, the J.P. Morgan Global Equity Premium Income ETF, which is listed in several key European stock exchanges including London Stock Exchange, Swiss Exchange and Deutsche Borse. For Singapore investors, the LSE versions will of course be most tax efficient with zero withholding taxes.

JEPG is the globally-diversified version of JEPI, offering a similar covered call strategy but with one key difference – a broader geographical reach. The underlying exposures it is holding is globally diversified, with exposure to Europe, Asia, and other developed markets, instead of focusing solely on the US. It is designed to generate high monthly income while maintaining exposure to global equities, making it an appealing choice for dividend-focused investors looking for diversification beyond the US.

And guess what? While JEPI is down 4.1% in the past month, due to the S&P 500 declining by 7.4%, JEPG is actually up 1.1%! Don’t get me wrong, the performance of JEPI when the US market dipped into correction territory is amazing and definitely commendable, but the key consideration is whether it is time to switch to a more globally diversified investment.

On a year-to-date basis including dividends, JEPI returned 3.9%, compared to JEPG’s 7.8%, showing better performance during this volatile period.

This outperformance during the recent volatility comes down to the several drivers. So, let’s break down JEPG’s key drivers of outperformance, and why it’s gaining attention as a potential alternative to JEPI for dividend investors looking beyond the US.

1. Global Diversification – Spreading Risk, Capturing Growth

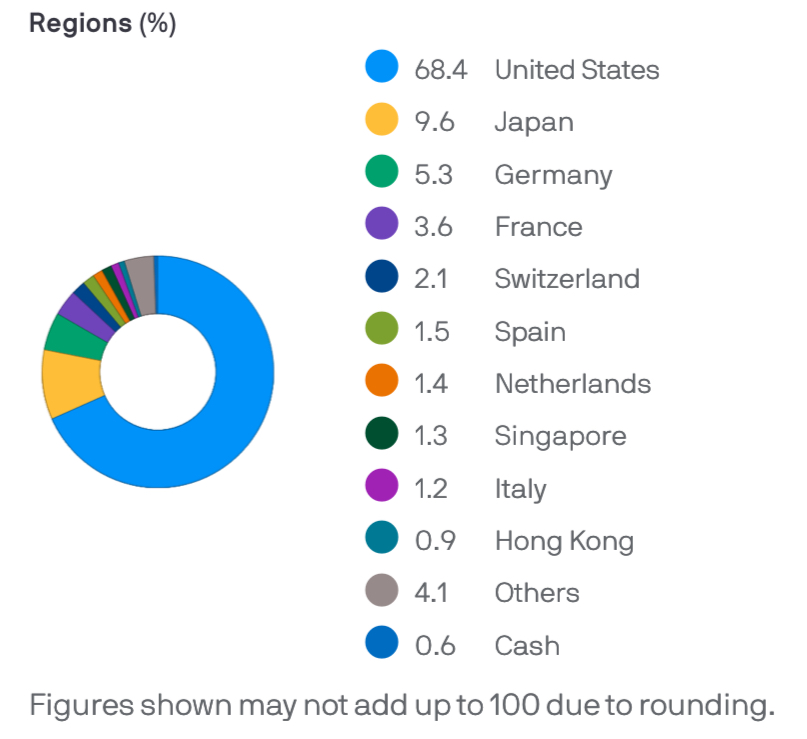

Unlike JEPI, which focuses solely on US large-cap stocks, JEPG takes a global approach by investing in a diversified mix of US, European, and Asia-Pacific equities. Here’s the breakdown of its geographical exposure:

US: 68.4% – Majority allocation. I know what you are thinking of – only 31.6% of its holdings outside the US. If we are trying to diversify away from the US, is this sufficient? Well, I think while we should diversify away from the US, the market is too dynamic to ignore. In addition, JEPG has the mandate to not adhere to any stock benchmarks which are largely based on market cap, and can select stocks which are deemed to be more undervalued while ignoring stocks which are more overvalued. We’ll discuss this further in the next section.

Europe: 17.8% – Exposure to stable dividend-paying companies from the Eurozone and the U.K. which have been relatively more undervalued. Other than recent outperformance of the European stock markets, something is changing in Europe – spending. The countries are coming together and agreeing to issue more debt to spend on defense. I suspect the increased spending will have an economic multiplier effect on the rest of the economies. In addition, interest rates in Europe and the UK have been on a down trend. We all know the positive effects of lower borrowing costs on the economies and consumption.

Asia-Pacific: 13.8% – Includes Japan, which is the second largest country allocation, Singapore and Hong Kong. This reflects the optimism of Japan, the long sleeping economic giant, whose economy is slowly but surely gathering steam.

This broader geographic allocation helps JEPG reduce reliance on any single market’s economic cycle. While JEPI is highly dependent on the US economy and interest rate policies, JEPG benefits from different market conditions across multiple regions, making it less vulnerable to US market downturns.

2. Value-focused Stock Allocation & Resilient Sector Exposures

JEPG doesn’t simply hold an equal proportion of global stocks. Instead, it follows a quantitative selection process to identify high-quality, lower-volatility stocks that provide sustainable income. The weightage of each stock is determined based on several factors.

But I must say this one excites me the most – JEPG uses a bottom-up fundamental proprietary research process designed to identify over- and undervalued stocks with attractive and undervalued stocks with attractive risk/return characteristics to construct a diversified, low volatility portfolio.

This means that JEPG can shift away from sectors or stocks that are the flavours of the month or have been traded up substantially. Technology shares have been struggling, which is in JEPG’s favor as it focuses on more defensive sectors which are relatively more value-oriented. This explains why it has been able to produce positive returns while the US market went into correction territory.

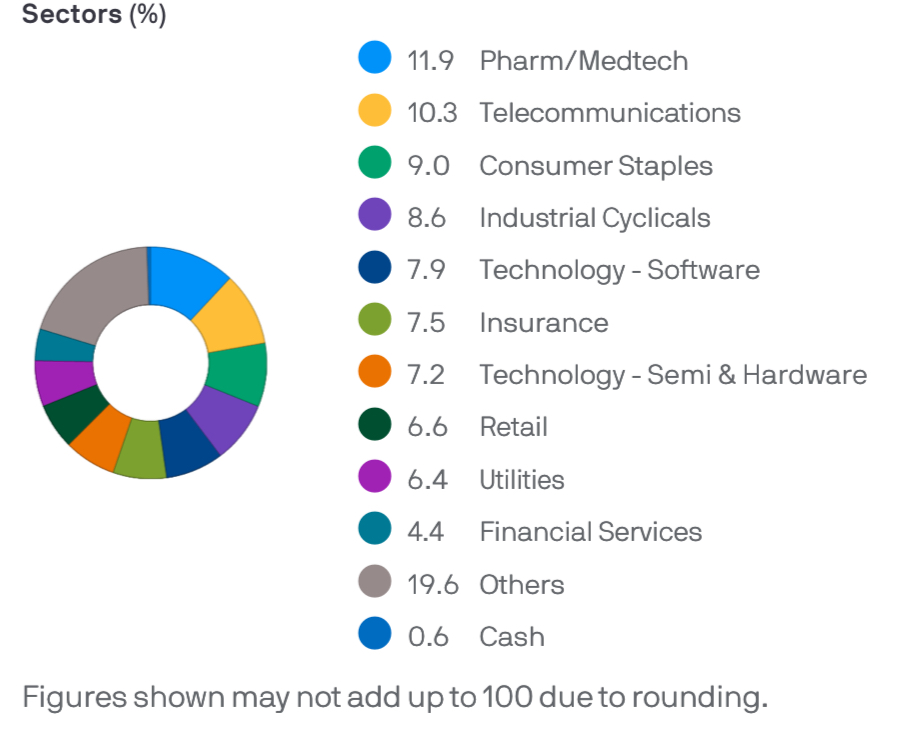

Resilient Sector Allocation

JEPG’s sector allocation leans toward defensive and resilient industries, which may explain why it has outperformed JEPI in the recent market downturn. Healthcare (Pharma /MedTech) is the largest sector at 11.9%, followed by Telecommunications and Consumer Staples at about 10% each. These sectors tend to perform well in times of market uncertainty because they provide essential goods and services that consumers continue to rely on, regardless of economic conditions.

Compare this to JEPI, which has a higher exposure to technology at 14.3% and financials at 14.5%, sectors that are more sensitive to economic cycles and interest rate fluctuations, we can understand why JEPG outperformed JEPI over the past few months.

Defensive Top Holdings

Looking at more closely at some of JEPG’s top holdings, we can see this defensive tilt in action:

Deutsche Telekom AG (2.18%) – A major European telecom provider with stable revenue streams;

T-Mobile US Inc. (1.6%) – A leading US telecom company benefiting from long-term 5G expansion;

Berkshire Hathaway Inc. (1.5%) – Warren Buffett’s diversified holding company with exposure to recession-resistant businesses;

And of course, PepsiCo Inc. (1.4%) – A global consumer staples giant known for steady demand across economic cycles.

This defensive positioning has given JEPG an edge during the recent market sell-off. While JEPI has struggled alongside the broader US market, JEPG’s global diversification and focus on stable, cash-generating businesses have helped it deliver positive returns.

Before we move on, if you’ve found the content useful so far, do this introvert uncle a favor and tap that ‘like’ button! Think of it as my little reward for spilling all my well-guarded investment secrets, some of which even my wife doesn’t know about! Alright, let’s jump back in.

3. Covered Call Strategy – Generating High Monthly Income

The second major feature of JEPG is its covered call strategy, which is the same strategy JEPI uses to boost monthly income.

I know this sounds complicated, so for newer investors, here’s how it works in simple terms.

What Are Covered Calls?

A covered call is a conservative options strategy where an investor sells call options on stocks they already own. This means that JEPG holds a portfolio of global dividend stocks. It sells call options on a portion of those holdings. This call options allows the buyers of these options to purchase the underlying shares held by JEPG at certain prices that are higher than the current market price.

Why Does JEPG Use This Strategy?

Well, there are several benefits of doing so. Let’s run through the details.

Firstly, higher yield – The premiums collected from selling calls enhance total income, making JEPG more attractive for dividend-focused investors. JEPG has delivered dividend yields of 6% to 8% over the past years, but of course I must let you know that dividends can fluctuate based on market conditions.

Secondly, lower volatility – Since the income from options offsets price fluctuations, the ETF tends to have smoother returns compared to traditional equity ETFs.

Thirdly, more consistent returns – Even in sideways or slightly declining markets, JEPG can still generate positive returns through its options income.

But of course, while the covered call strategy can enhance income, it’s important to understand the risks and trade-offs involved. If markets rally significantly, JEPG won’t capture all the upside because of the options it has sold. This means that if the prices trade above the exercise price of the options, the buyers of the options will be able to buy these shares from JEPG. So JEPG would have to give up the further capital gains of these shares beyond the exercise price.

However, this strategy works exceptionally well in uncertain or choppy markets, where steady income is preferable over pure capital appreciation. Does it sound like the investing climate currently?

The Dividend Uncle’s Take – A Timely Option for Income Investors?

So, after everything we’ve discussed, what do I think about JEPG?

First, I like that JEPG offers a strong balance between income and global diversification. While I still think JEPI is a great ETF, its 100% US focus means it is more vulnerable to US market downturns, which, as we’ve seen recently, can have a big impact on total returns. JEPG, on the other hand, still provides a good yield of 6 to 8%, but with exposure to multiple regions. That means if the US continues to struggle, there’s a chance that Europe or Asia can help balance things out.

Second, the more defensive sector allocation makes a lot of sense right now. We are in a period of economic uncertainty, where investors are rotating into more resilient businesses. JEPG’s higher weightage in healthcare, telecom, and consumer staples makes it more suited to weather market volatility. While JEPI has served income investors well, its larger exposure to technology and financials means it could be more affected if the US slowdown continues.

So, Will I Be Buying JEPG?

Well, I already own some JEPG, amount to around $9,000. While I’m not rushing to buy more, I’ve been adding to JEPG at about $1,000 a month. But if the trend of global outperformance over the US continues, I might slowly increase my allocation over time. Right now, I see JEPG as a complement to JEPI, rather than a replacement, meaning I’m not selling JEPI, but rather using JEPG to diversify and balance my portfolio.

Alright folks, that’s all for today!

Share your views in the comments below. Have you considered global dividend ETFs like JEPG, or are you still sticking with JEPI and US-focused options? Let me know in the comments! And if you found this post useful, remember to tap that like button and subscribe, your support helps this uncle keep bringing you these dividend insights!

Until next time, happy investing!

Leave a comment