[Watch this on YouTube as well!]

Hey fellow REIT investors! You all know I love digging into what the big research houses are saying — definitely not to follow their advice blindly, but to see where their thinking lines up with mine… and where it doesn’t.

Recently, I came across Morningstar’s latest Asia investment outlook. It was packed with updates on how they’re viewing the markets in light of the trade tariffs and rising global uncertainty. But what really caught my eye was this:

Morningstar had just named 16 top cyclical picks across Asia. These were their “five-star” stocks — companies that they believe are trading well below fair value and have strong long-term upside. Among these, just one — only one — was a Singapore-listed company.

Naturally, I had to see what it was. Was it a resilient retail REIT? A hospitality play with upside from tourism? Or maybe a healthcare REIT that’s bulletproof in any downturn?

Well… no. The answer might surprise you. And to be honest — I’m not buying this REIT. Not because it’s a bad REIT — far from it — but because once we dig deeper, there are reasons why I’m staying on the sidelines.

So in today’s post, I’ll walk you through what Morningstar said about this REIT, why I think they made some good points — but also the one big reason why I’m not buying in. I’ll also explain what I’m doing instead, and how it fits into my REIT strategy.

But before we dive in, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the REITs discussed, but what works for me might not work for you.

Alright, let’s get started!

Morningstar’s Surprising Pick

First, let’s understand Morningstar’s perspective.

Morningstar’s top picks are based on their five-tier rating scale — with five stars reserved for companies they believe offer appreciation beyond a fair risk-adjusted return over a multi-year timeframe. In other words, these stocks are deeply undervalued. They even say a five-star stock’s current price represents an “excessively pessimistic outlook,” limiting downside risk and maximizing upside potential.

In the context of rising global uncertainty and the latest tariff war between the US and China, Morningstar is urging investors not to panic-sell but instead to look for quality names with strong fundamentals that the market may be unfairly punishing.

That brings us to their one and only Singapore-listed top cyclical pick: Keppel REIT.

Morningstar argues that Keppel REIT is resilient, with low vacancy rates and solid operational metrics. The REIT owns stakes in some of Singapore’s most iconic commercial buildings — like Ocean Financial Centre, Marina Bay Financial Centre, and One Raffles Quay — along with assets in Australia, South Korea and Japan. According to Morningstar, with portfolio occupancy at 96% and positive rental reversion of 10.6% in 1Q2025, Keppel REIT stands out as a high-quality play on office recovery.

They also note that Keppel REIT was one of the better-performing REITs during the last trade war back in 2018–2019 — and think that history could repeat itself.

Sounds convincing on the surface, right?

Well… I think there’s more to the story. And that’s what we’ll dig into next.

A Deeper Look at That Dividend Yield – Not All It Seems

Here’s the real issue I have: the quality of the dividend yield.

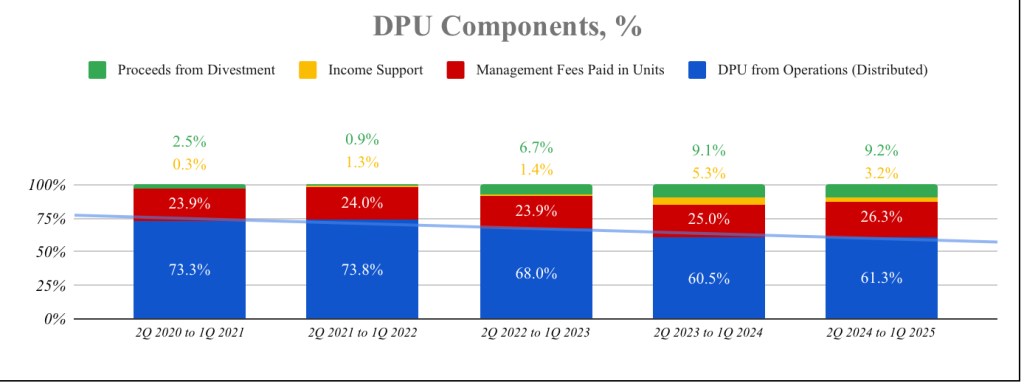

Keppel REIT’s published dividend yield may look attractive at around 6.7%, but when we dig into the components, the picture becomes less rosy.

- Only 61.3% of the total distribution comes from actual rental operations — the core business.

- A significant 26.3% comes from the issuance of management fees in units.

- Another 9.2% comes from past proceeds from divestments.

- And 3.2% comes from rental support, which are contractual payments from the sponsor or sellers of the buildings purchased previously.

[Source: www.REIT-tirement.com]

While all these contribute to the dividends that you and I get as investors, they come with downsides and many a times, are not the true reflection of the longer term earning powers of a REIT. Let’s break it down.

Management fees paid in units might boost distributable income in the short term, but over time, it leads to unit dilution. More units = less earnings per unit.

Distribution of divestment proceeds is something I generally frown upon — especially for REITs with high gearing. In today’s high interest rate environment, I believe proceeds should be used to reduce debt, not to maintain yield.

And finally, rental support is temporary and usually masks the true rental performance of properties. More often than not, investors get a rude shock when the rental support expires.

So, if we strip out all the non-operational components, Keppel REIT’s true operating yield is only around 4.1%, which makes it much less attractive.

Many Attractive Alternatives to Keppel REIT?

The adjusted yield of 4.1% makes a whole lot of difference to me. It just doesn’t excite me — especially when I can get similar sector exposure at higher yields or even more stable REITs at similar long-term yields.

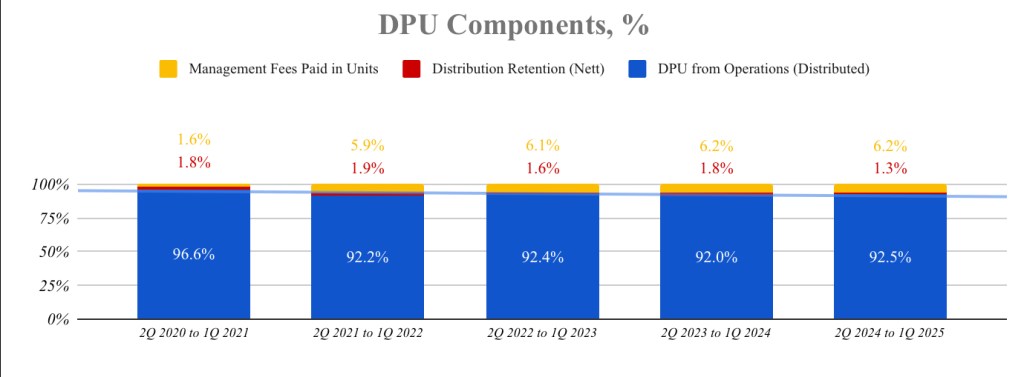

If I’m looking for core Singapore office exposure, why wouldn’t I choose CapitaLand Integrated Commercial Trust or CICT instead?

CICT has a dividend yield of around 5.1%, almost entirely backed by recurring income. Little gimmicks – management fees paid in units account for only 6% of distribution. Plus no distribution of divestment proceeds and no support.

[Source: www.REIT-tirement.com]

CICT isn’t just an office REIT — it’s diversified across office, retail, and integrated developments. That adds resilience, especially in uncertain economic conditions where suburban retail assets tend to hold up better than offices.

Operationally, CICT’s Singapore offices have also done well. So if I had to pick one for core exposure to Singapore’s Grade A commercial space, CICT simply makes more sense to me — both in terms of yield and balance sheet quality.

And if I’m looking for a stable REIT with predictable distributions, Parkway Life REIT arguably offers even better fundamentals.

Let’s just talk about their business model. Parkway Life REIT’s portfolio is heavily focused on healthcare — a highly defensive sector. Its Singapore hospitals are backed by long master leases with built-in CPI-linked rental escalations. In Japan, its nursing homes are leased out under stable triple-net lease structures. The result? Extremely stable, growing income streams that are less affected by economic cycles or market volatility. Its distribution per unit or DPU has grown every single year since its IPO.

Compare that to Keppel REIT, which is more exposed to office properties across Singapore and overseas. Office demand can fluctuate more with business cycles, and while Keppel’s occupancy and reversion numbers are solid, its income can still be more volatile. Parkway Life REIT’s gearing is also much lower at 36.1%.

Parkway Life REIT’s current dividend yield is about 3.6%, which is lower than Keppel REIT’s 4.1%, but completion of A.E.I. at Mount Elizabeth Singapore is expected to provide upside to the distributions. You’re getting significantly more stability and visibility — and in a volatile market, that’s a trade-off I’m happy to make.

Before we move on, whether you agree or disagree with my take, I hope the discussion so far has given you some useful perspectives to think about. If you’ve found it helpful in shaping your own investing decisions, do this Uncle a small favour — tap that like button. It really helps the channel, and I’ll appreciate it from the bottom of my heart. Alright, let’s jump back in.

Frankly, I’m Not Bearish on Keppel REIT Either

Now, just to be clear — I’m not bearish on Keppel REIT either. In fact, operationally, they’ve delivered some pretty solid numbers in the latest quarter.

Let’s start with the basics: portfolio occupancy still looks strong at 96.0% as at 1Q 2025, which is healthy by any standard. Yes, it’s a drop from 97.9% last quarter, but the absolute level is still high, especially considering the broader challenges in commercial leasing.

Rental reversions were also very impressive: +10.6% in 1Q 2025. That means tenants renewing their leases are generally agreeing to pay higher rents than before. In a softening global environment, that kind of rental growth is no small feat. It speaks to the quality and location of Keppel REIT’s assets.

One area that raised a slight eyebrow for me is the tenant retention rate, which came in at 67.0%. That’s a huge drop from 79.1% for Financial Year 2024, and lower than CICT’s retention rate of 75.7% in 1Q 2025. But before you panic, let me also say this: only 6.5% of Keppel REIT’s leases are expiring in 2025, so the risk of further tenant turnover this year is fairly limited. In other words, the leasing calendar for the rest of the year is relatively light, which helps cushion any pressure on the occupancy front.

So while I’m not buying Keppel REIT right now for reasons I shared earlier, I don’t think it deserves to be written off. If management continues to improve the sustainability of its distributions, reduce reliance on fee income paid in units, and maintain strong leasing momentum, I’d be open to reassessing it in the future.

The Dividend Uncle’s Take

So what’s the final verdict?

Well, I’m not saying Keppel REIT is a bad investment. Far from it. It’s operationally strong, backed by a reputable sponsor, and its properties are in prime locations. I can see why Morningstar gave it five stars — and for some investors, especially those looking for exposure to high-grade office REITs, it might still be worth considering.

But for me? It just doesn’t fit into my core-satellite REIT strategy.

In my previous posts, I’ve talked about how I construct my REIT portfolio. My core holdings include diversified giants like CICT, MIT, and Parkway Life. For office exposure, I prefer CICT — which gives me office, retail, and integrated developments, all under one roof. And among the satellite picks, I already hold more niche or tactical REITs.

So for now, Keppel REIT doesn’t earn a spot. Not because it’s flawed, but because I find other options more compelling.

As always — your portfolio is your own. You may have different goals, risk tolerance, or views. So don’t just take my word for it. Read the reports, run the numbers, and decide what works best for your strategy.

And hey — just because I’m not buying now doesn’t mean I won’t ever. If Keppel REIT improves the cash proportion of its dividend, and if the adjusted yield becomes more attractive — I’ll definitely take another look.

Alright, that’s all for today. Let me know what you think in the comments! Do you agree with Morningstar’s pick? Are you holding Keppel REIT, or do you prefer other office-focused REITs?

If you found this post helpful, give this Uncle a like and share it with others who follow REITs closely. And if you haven’t already, consider subscribing — we dive into everything from REIT strategy to market outlooks, always with a steady, long-term mindset.

Until next time, stay steady, stay informed… and invest wisely.

Leave a comment