[Watch this on YouTube too!]

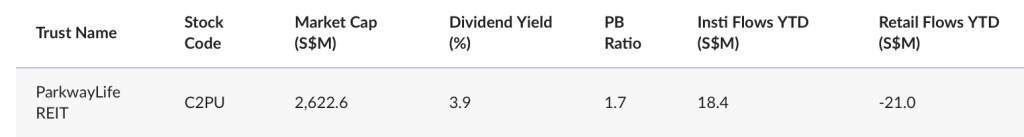

Hey there, fellow REIT investors! You know something strange is happening when one of Singapore’s most dependable REITs—Parkway Life REIT—is quietly seeing $18 million of institutional inflows…

But at the same time, retail investors are pulling out $21 million.

Source: SGX Research; Bloomberg data (as at 15 May 2025)

Let me repeat that: institutions are buying in. Retail is walking away.

It’s like watching hikers on a long trail leave a rain shelter just as thunderstorms are forecast—while other seasoned hikers are quietly heading inside.

Now, Parkway Life REIT is no stranger to being “boring”—but in investing, boring is often beautiful, and a shelter in times of volatility in the markets like right now. We’re talking about an investment with C.P.I.-linked rental growth, recession-proof healthcare assets, and a track record that most REITs would envy.

And yet… retail is bailing?

So today, let’s break this down. Why are retail investors giving up? Why are institutions stepping in?

And should you—yes, you—still hold on to this healthcare REIT gem?

Because if the market is split this sharply, someone must be seeing something the others aren’t or simply ignoring.

Before we dive in, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the REITs discussed, but what works for me might not work for you.

Alright, let’s get started.

What The Market Is Doing

Let’s start with the numbers. Based on Bloomberg data, as of mid-May, Parkway Life REIT saw eighteen point four million dollars in net institutional inflows this year. But retail investors pulled out twenty-one million over the same period.

That’s not a minor difference. That’s a tug-of-war.

So what’s going on?

Let’s start with the retail side.

Right now, Parkway Life’s yield sits at just 3.9%. That’s lower than the six-month T-bill, which is above two percent. It’s lower than the STI ETF, which gives you over 4%. And it’s way lower than some REITs like First REIT, which is throwing out nearly 9%.

From a pure dividend perspective, Parkway looks… underwhelming.

And I hear this all the time in the comments.

“Hey Uncle, Parkway’s yield too low lah. There are better dividend options.”

And honestly, I get it. If you’re scanning for income today, Parkway doesn’t exactly pop.

But here’s what I always say in return. Parkway Life REIT isn’t about headline yield. It’s about total return and long-term stability.

It’s built on inflation-linked rental growth, backed by strong sponsors, and supported by a rock-solid balance sheet. It doesn’t spike, but it doesn’t collapse either.

And that, I believe, is what institutions are paying attention to.

They’re not reacting to short-term trends. They’re looking at long-term cash flows and total returns. They see Parkway Life as a steady, low-volatility, inflation-protected income stream. Something that still delivers even when the rest of the market is on edge.

Some retail investors wants more kopi money now. Institutions want kopi money every day for the next 20 years—without the heartburn when volatility hits.

Who’s Right? Retail or Institutions?

So here’s the big question. Who’s got it right?

Retail investors—who are selling because the yield is too low?

Or institutions—who are quietly adding to their positions?

Here’s the twist: maybe both are right.

Retail investors are responding to what they see. A low yield. A weak REIT sector overall. Rising US interest rates. And Parkway, despite its stability, gets lumped in with the rest and sold off.

It makes sense if your goal is income today, or if you’re following the momentum of the market.

But institutions see something else. They’re not focused on the next quarter. They’re thinking long-term.

To them, Parkway Life REIT offers stable, inflation-linked rental income. It owns defensive healthcare assets. It carries low gearing. And it doesn’t keep surprising the market with rights issues or big risks.

It’s not about finding the highest payout. It’s about preserving capital while delivering slow, steady compounding.

So maybe both sides are correct, both sides are acting rationally.

Retail investors want yield now. Institutions want resilience.

But here’s the part that matters to you and me: what are you building?

Are you chasing income this year? Or are you building a portfolio that lasts for decades funding your retirement while you enjoy yourself on a holiday?

Because if it’s the latter, Parkway Life REIT might still deserve a place.

The Dividend Uncle’s Take

Now, you already know—I hold Parkway Life REIT. It’s not the highest yielder in my portfolio, and that’s fine by me. I’ve never expected it to be.

Because Parkway’s job isn’t to give me the biggest payout today. It’s to protect my capital, grow its DPU steadily, and help me sleep well at night.

When I look at Parkway Life, I’m not thinking about the next quarter’s dividend. I’m asking: can this REIT quietly compound and support my income stream over the next 10, 15, 20 years?

And so far, it has.

But here’s what many investors might have missed—investing is not about picking the best individual stock. It’s about building the right portfolio of stocks.

In my portfolio, I want a few higher-yielders to give me decent income, like C.I.C.T.. I want some growth REITs to capture upside. And I definitely want something like Parkway Life REIT—a stabiliser.

Parkway doesn’t jump. It doesn’t tank. It doesn’t surprise you.

And in times like these, that kind of predictability is worth something.

So while the institutions aren’t buying Parkway for thrills, they’re buying it for the same reason I am: because when things get rough, this is the REIT you’ll want in your corner.

And for me, that’s more than enough.

If you found this post helpful, give it a like so more people can discover it. And leave me a comment—are you holding Parkway Life REIT? Are you buying, selling, or sitting on the sidelines? I’d love to hear your thoughts.

And if you’re new here, hit subscribe for calm, clear, data-driven investing content every week—focused on dividends, REITs, and building portfolios that last.

Until next time, stay steady, stay invested, and don’t just chase yield—build your portfolio the way you want your future to look.

Leave a comment