Hey fellow REITs investors! You know, last year — around October and November — the mood around Frasers Centrepoint Trust (or FCT) was downright gloomy. You say “FCT” and people flinch. Why? One word: RTS.

The Johor–Singapore Rapid Transit System wasn’t even built yet, but the fear was already built in. Investors worried about “spending leakage,” about suburban malls in Singapore losing footfall, and definitely about FCT’s Causeway Point turning into a ghost town. And when fear shows up, Mr. Market does what it always does — sell first, think later.

Fast forward to now? Oh, how the tone has changed.

The major Northpoint City South Wing acquisition is done. FCT’s DPU is up. Footfall is strong across all its malls. Confidence in FCT has come back like kopi after a long night shift. Suddenly, no one’s talking about RTS anymore.

But that’s exactly why I’d like to discuss this with you right now. Because I believe the next wave of fear will hit again — probably as the RTS nears completion. Now, I’m not forecasting prices or pretending I have a crystal ball. But I’ve been in the market long enough to know how these things go. The market flashbacks, when forgotten risks suddenly feel urgent again. If and when the market pushes down the price of FCT, how will you react? Run along with the market, or take the opportunity to load up on a potential longer term winner?

In today’s post, I’m diving into the unusual ups and downs of one of the most dependable REITs in the market. We’ll unpack what’s really behind the swings, the key lessons for long-term investors — and what this Uncle is planning to do to make the most of it.

But before we dive in, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the shares discussed, but what works for me might not work for you.

Alright, let’s get started!

What Happened Last Year

Let’s rewind the tape to late 2024.

FCT had just reported its results — solid results, mind you — but investors couldn’t care less. The fear in the air wasn’t about numbers. It was about the looming RTS line linking Johor Bahru to Woodlands North.

The fear was simple: once the line opens, Singaporeans will rush across the border for cheaper shopping, cheaper meals, even cheaper pedicures. The headline fear? That malls like Causeway Point, which contributes nearly 28% of FCT’s revenue, could lose shoppers. That suburban malls in the north would see footfall fall off a cliff.

To be fair, the comparisons were everywhere — Hong Kong to Shenzhen, SGD to MYR, Singapore’s cost of living vs JB’s affordability. People imagined queues of Singaporeans leaving every weekend and coming back with bags full of groceries, toiletries, and fried chicken from KFC Malaysia.

And guess what? That fear hit hard.

FCT’s share price dipped. Sentiment soured. Even though CEO Richard Ng calmly explained that FCT’s malls are focused on daily necessities, and that tenants still wanted in — it didn’t matter. When fear hits, logic goes out the window.

And as a long-term investor watching this unfold, I could only shake my head and think — this is the kind of emotional overreaction that creates opportunity.

The Confidence Came Roaring Back

Fast forward to today… and suddenly, everybody loves FCT again.

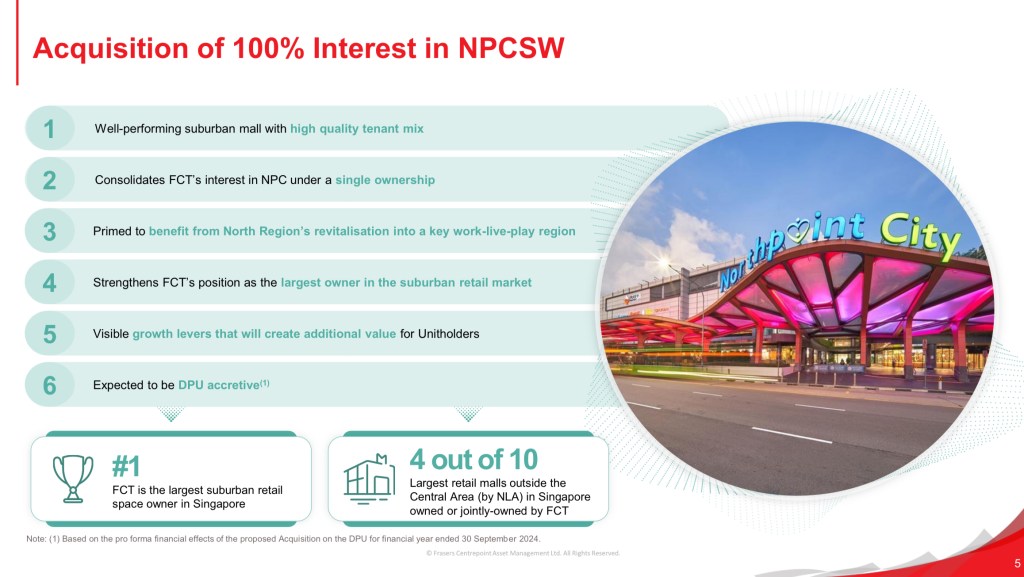

Why the sudden shift in mood? Two words: Northpoint Acquisition.

In March 2025, FCT announced it was buying the South Wing of Northpoint City for over $1.1 billion. The market’s reaction? Extremely positive. The placement was 4 times oversubscribed, and the unit price stayed resilient despite some dilution. Even JP Morgan — which pointed out some concerns — had to acknowledge the 2% DPU accretion, stronger portfolio positioning, and the strategic boost in suburban dominance.

Add to that FCT’s latest results: higher rental income, a 0.5% increase in DPU, and lower borrowing costs at 3.9%. Even leverage dipped slightly to 38.6%. In short, FCT looked — and still looks — like a fortress among suburban retail REITs.

And just like that, the crowd switched tunes.

Retail investors started buying again. Analysts turned positive. Suddenly no one’s talking about the RTS anymore. It’s all about population growth in Yishun and Canberra, untapped leasing potential at Northpoint, and FCT’s track record of execution.

But here’s the thing…

This whole saga shows just how emotional markets can be. Just a few months ago, FCT was a REIT to avoid. Now, it’s one to chase.

And if you ask me — both reactions miss the point.

The One Thing To Remember

So what’s the lesson here?

If you were one of those who sold FCT last year during the RTS panic, you probably missed this rebound. And if you’re only now thinking of buying in — well, you might be late to the relief rally.

But the truth is… this probably won’t be the last time fear hits FCT.

The RTS link is still being built. The trains haven’t even started running. Once commuters start zipping from Johor to Singapore in under 10 minutes — you can bet the old headlines will return: “Economic leakage!” “Retail exodus!” “JB malls eating our lunch!”

And just like last year, the crowd might panic again. Unit prices may come under pressure. Forums will light up. Analysts might downgrade.

That’s why I’m asking you — right now, while confidence is high — to remember this moment.

Remember how solid FCT looks today. Remember the queue of investors fighting for the Northpoint placement. Remember the DPU growth, the high occupancy, the stability.

Because when the fear creeps back in 2026, you’ll want to stay grounded. Not follow the herd. Not sell in a panic.

That’s the power of long-term investing — we zoom out. We focus on fundamentals. We don’t get shaken by every wave of crowd psychology.

Quick pause here — if you found this kind of practical investment discussion useful, give this post a thumbs up to tell the YouTube algorithm Uncle’s still got it. And if you haven’t subscribed yet, now’s a great time. We don’t just chase headlines — we dive deep, we ask the tough questions, and we stay level-headed when others panic. Alright, back to the action.

The Dividend Uncle’s Take

Here’s my take, fellow investors.

I’ve held FCT for a while — and yes, when all the RTS noise exploded last year, I felt the jitters too. But I held on. Because when I looked at the fundamentals, nothing had changed. The malls were still full. Tenants were still paying rent.

I reckoned that while there will be some spending shifting to JB, Singaporeans will ultimately be driven by convenience. Some spending just doesn’t move – dinner after work, convenience purchases, chilling out with friends at Starbucks, and tuition classes for your kids.

And the crowd panic just didn’t match the numbers.

Fast forward to today — and I’m glad I stayed the course. FCT is growing again, expanding its footprint, and rewarding unitholders. The acquisition of Northpoint City South Wing may not be the cheapest deal on paper, but it strengthens FCT’s grip on the Northern region, and the fundraising response shows investors still trust this REIT.

But I’m not blind. I know the RTS concerns will return. And honestly, I welcome it. Because if it triggers another panic sell-off — I might even buy more for my personal portfolio.

That’s the mindset I’ve come to adopt: use market fear to build positions in quality REITs. Prepare for the next dip.

What if the dip doesn’t come along? That’s okay lah. As The Dividend Uncle always says, there’s always a value stock somewhere.

So if you’re feeling good about FCT today, take a mental snapshot. Remember this feeling. Because when fear comes knocking again — and it will — that’s when your conviction will be truly tested.

Alright, that’s all for today folks. And the next time the market freaks out over RTS again? Don’t ask, “Should I sell FCT?”

Ask yourself, “Wasn’t I just feeling bullish about this REIT a few months ago?”

That’s how long-term investors win — by remembering when the crowd forgets. Until next time, happy investing!

Leave a comment