Hey there fellow REITs investors! Welcome back to the channel.

Today’s post is part of a regular update I provide on ‘The Dividend Uncle’ channel — sharing the REITs I’ve recently bought and the few more that’s currently on my watchlist.

From your feedback, I think this has been one of the more useful posts, not because I’m always right, (definitely NOT!), but because it gives a window into my thinking of individual REITs, and also how I apply the discussions on current market conditions into making investing decisions.

But if sharing my thought process helps you clarify your own decisions — whether you agree with me or not — then I think that’s value already.

And let’s be upfront — the past month has seen a broad rally across Singapore REITs. That tailwind definitely helped the recent buys perform well. But whether these turn out to be truly good investments? That depends on how things unfold over the longer term.

After all, we’re long-term investors… most of the time. But occasionally, when the opportunity feels timely, I may make a more tactical move too — and you’ll see a real-life example of that in this post!

Before we start, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own the REITs discussed, but what works for me might not work for you.

Let’s dive in.

CLAR: Buying More Of This Core REIT – Here’s Why?

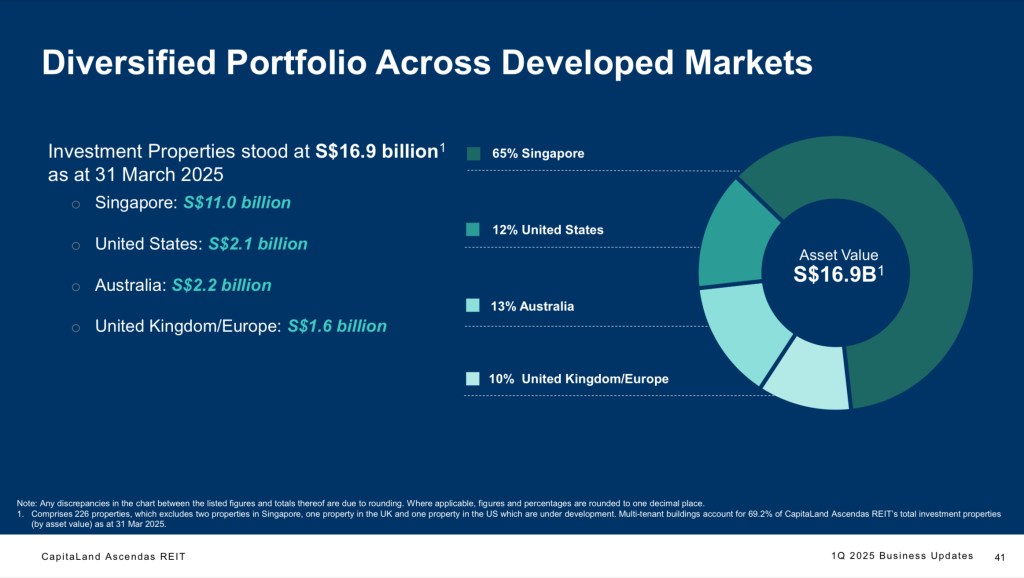

Let’s start with one of the largest and most stable REITs in Singapore — CapitaLand Ascendas REIT, or CLAR. For those newer to REIT investing, CLAR is a heavyweight in the industrial and business space segment, with a whopping S$16.9 billion worth of assets across Singapore, Australia, the US, and Europe. Its largest exposure is in Singapore, making up about 65% of its portfolio, which I personally like — especially in the current environment where Singapore assets are seen as relatively more resilient.

CLAR is also one of my Core REIT holdings, and I added more recently after its S$700 million acquisition of new Singapore properties. Now, some investors were worried that the private placement for this acquisition — priced at $2.47 per unit — might weigh on the share price. And that’s a valid concern. After all, when new units are issued at a lower price, it can temporarily dilute existing holders.

But here’s why I remained positive: first, I believe this acquisition strengthens CLAR’s Singapore footprint at a time when local exposure is highly valued. Second, the properties acquired have rents that are up to 15% below current market rates, which means there’s potential upside as leases get renewed or repriced.

Operationally, CLAR is still in good shape. Occupancy sits at 91.5%, which is healthy given the current market. And in Q1 2025, they achieved a strong positive rental reversion of 11% — meaning the new leases signed were, on average, 11% higher than the previous ones. That tells us demand for its properties is holding up well.

On top of that, the current dividend yield is around 5.5%, which is attractive for a REIT of this scale and quality.

Of course, I couldn’t buy at the private placement price — but there was a stretch of share price weakness around the placement and that’s when I went in. Since then, the unit price has moved up nicely. In fact, share price alone is up around 8% over the past month, excluding any dividends. That’s a good outcome, but I’m not chasing short-term gains here. For me, CLAR remains a steady compounder, and I’m happy to hold it for the long run.

CDLHT: Positioning For Lower Rates

CDL Hospitality Trust is a familiar name to many income investors, especially those who follow the hospitality REIT space. It owns a portfolio of 22 properties across 11 cities in 8 countries, with a strong anchor in Singapore. In fact, around 62% of its $3.5 billion in total assets are located here — giving it both a local core and international diversification.

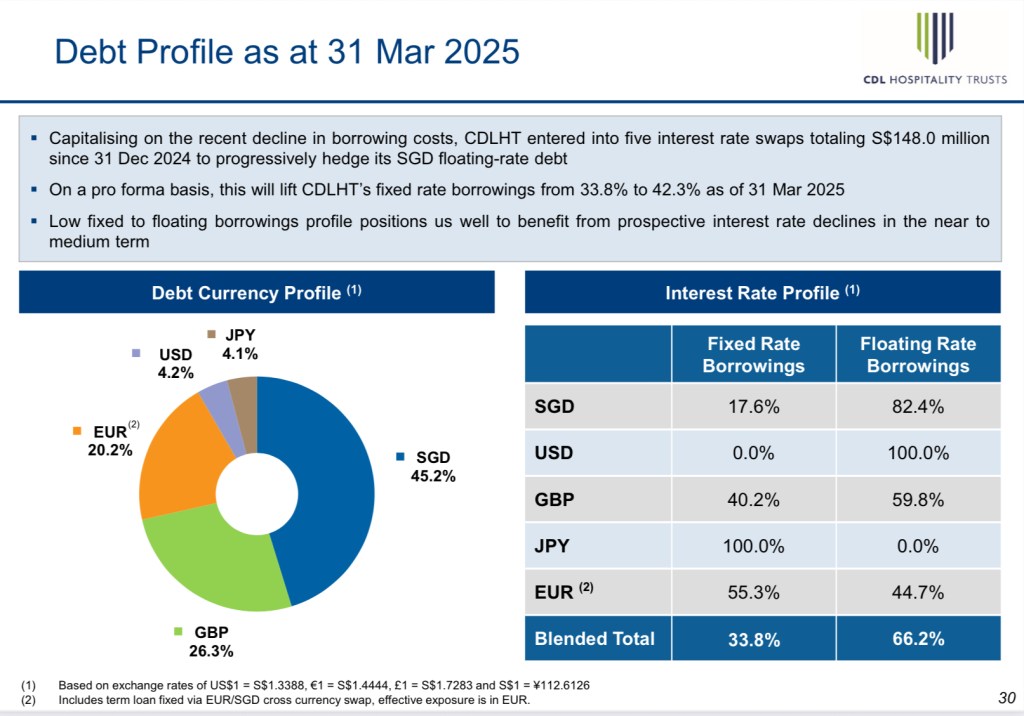

This is a REIT I’ve held before, and recently, I decided to add more. The main reason? Interest rate positioning.

You see, CDLHT has long been penalised by the market for keeping its fixed-rate debt hedging relatively low — just 33.8% as of Q1 2025. That means a large portion of its debt floats with market rates, which was painful when interest rates were rising. But now, we may be entering a period where that strategy could finally pay off.

From Q3 2024 to Q1 2025, CDLHT’s average cost of debt has already edged down — from 4.4% to 3.9% – this is significant to its DPU. With 27.9% of its debt due to be refinanced this year, and interest rates easing in more than 90% of the currencies it operates in, there’s a window here for the REIT to reduce its borrowing costs meaningfully. That, in turn, could support future DPU growth.

Of course, this is not guaranteed. We’ll need to watch how much of those cost savings can be captured in Q2 and beyond. But the market does seem to be taking notice — CDLHT’s share price has risen over 8% in the past month alone. And to be fair, some of that upside is helped by the broader REIT rally we’ve seen recently.

Still, I see this as an opportunity to add on to a REIT with strong assets in Singapore, a globally diversified footprint, and a capital structure that’s now potentially working in its favour.

Let’s see if management can execute. I’ll be watching their Q2 results closely. And I might even add more to my holdings!

By the way, if you’ve found this post helpful for navigating the REIT market, do help this Uncle out by giving it a thumbs up. Really appreciate all your support — we’ve crossed 7,000 subscribers on YouTube and counting, and I’m grateful to have you on this journey!

KORE: A Tactical Move This Time Round

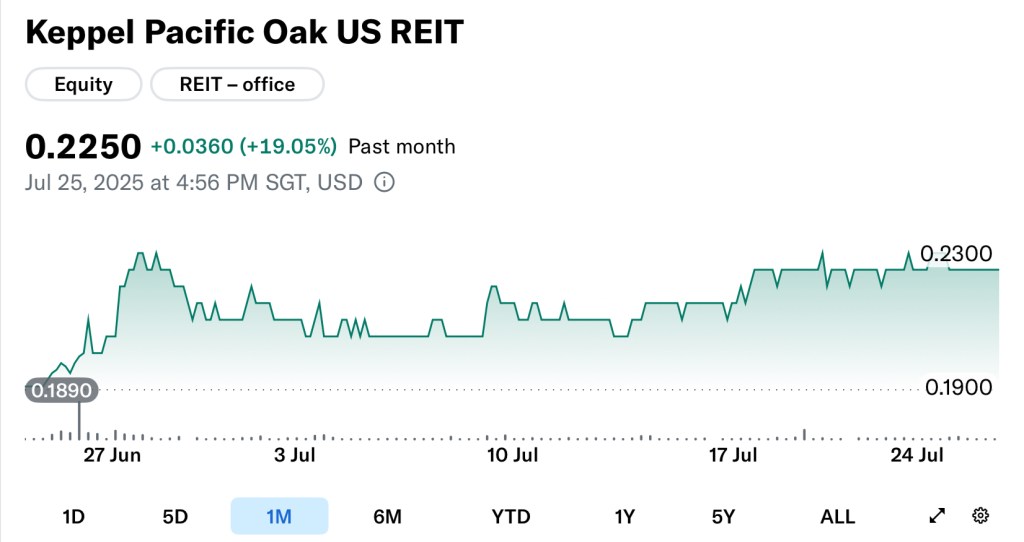

Keppel Pacific Oak US REIT — or KORE — is a US-focused office REIT with a portfolio of 13 freehold properties across key growth cities like Seattle, Austin, Denver, and Atlanta. Its total asset base is around US$1.3 billion, and unlike traditional downtown office REITs, KORE focuses on business parks and mixed-use offices in suburban tech hubs — a strategy that was meant to offer more resilience.

Now, let’s be honest. US office REITs have been hammered over the past two years — and for good reason. Weak leasing demand, high vacancies, and concerns over remote work trends. But recently, things have turned. Or at least… they’ve shown signs of turning.

In my previous post, I mentioned that over the past 3 months, Prime US REIT — another beaten-down US office REIT — has been one of the best-performing Singapore-listed REITs. And KORE has rallied alongside it.

That’s a big move — and for me, I’ve decided it should not just be a passive observation. I took a deep breath and plunged into a tactical position in KORE recently, seeing it as a short-term opportunity based on improving sentiment and expectations that the Fed will eventually cut rates. That optimism has been priced in quite quickly though, with its share price up 19% over just the past month. And given the sharp rebound, I’ve already sold half of my position to lock in some of those unrealised gains.

So to be clear, while I do have long-term holdings in KORE, this recent addition was more of a “trade” than a buy-and-hold move.

Still, I think KORE is worth watching. If it continues to show progress in leasing, and if rate cuts materialise, we could see further recovery. It’s also expected to resume dividend payouts in 2026 — which could be a meaningful catalyst for re-rating.

But risks remain high, so sizing is important. For me, it’s part of my satellite portfolio, not my core.

The REIT (Or 2) I’m Eyeing: A Steady Giant That’s Not Moving

Now for the part you guys have been waiting for! Actually I’m eyeing 2 REITs in August 2025. I’ve hinted at the first one in earlier sections, and it is none other than CDLHT. I believe they will continue to benefit from the lower interest rates in the coming quarters to come, but will be waiting for the upcoming results to confirm the trend.

And the other REIT I’m eyeing in August 2025 is… Parkway Life REIT — and it’s not because it’s exciting. In fact, it’s quite the opposite.

Parkway Life REIT is one of Asia’s largest listed healthcare REITs, with about S$2.46 billion in assets under management. Its portfolio spans 75 properties across Singapore, Japan, and Malaysia, and over 60% of those assets are in Singapore’s private hospital sector — including iconic names like Mount Elizabeth, Gleneagles, and Parkway East.

Now here’s something I’d give you permission to scold this Uncle. Because while many REITs have rallied sharply over the past month — especially those that were previously oversold — Parkway Life’s share price has gone almost nowhere. It’s been flat. So have this Uncle finally gone mad?

But that’s precisely why I’m interested.

Because unlike the REITs bouncing off the bottom, Parkway Life already had a strong run before this rally began. Over the past 12 months, it’s delivered 12.8% in capital gains. And it’s done this the boring, stable way — through consistent distributions, inflation-linked rent increases, and careful capital management.

And as I mentioned in my recent post — while the market is optimistic now, I’m still preparing for possible volatility. That means building a portfolio with stronger defensive foundations. Parkway Life REIT fits that role perfectly.

Its gearing remains low at around 37%. Its Singapore hospital leases are structured with inflation-linked rental escalations, providing a steady income base. And its dividend has grown every year for the past 15 years — even through crises.

So while I haven’t bought more yet, Parkway Life is firmly on my radar. If we see any weakness in the coming weeks — maybe due to broader market jitters — I’d be happy to accumulate.

Sometimes, it’s the REITs that stay calm in a rally that give you the calm you need when markets turn.

The Dividend Uncle’s Take

So how do I feel about these moves?

To be honest, I don’t think I’ve uncovered any hidden gems or made especially brilliant timing calls through the good returns over the past month. I’ve simply stuck to my approach — looking for solid fundamentals, aligning with market trends, and staying diversified.

CapitaLand Ascendas REIT is a core holding for me, and I was comfortable adding even at a slight premium to the placement price. CDL Hospitality Trust stood out for its potential interest cost advantage, and Keppel Pacific Oak… well, that was more tactical. Sometimes you take smaller trades when the risk-reward looks compelling. Most of the time, I’m a long-term investor — but not all the time.

As for Parkway Life REIT, I like how it’s just sitting there quietly, offering consistency and resilience. In a market where volatility can return at any time, having a stable counter like this on standby is part of building a balanced portfolio.

Of course, I’ve also benefited from the broader REIT rally this past month. But as we always say — only time will tell if these are truly good investments. What matters is that the rationale makes sense based on what we know today.

Alright, that’s it for today, folks. Thanks for sticking around as I walked through the REITs I’ve recently added — and the one I’m eyeing next. More than just the names, I hope the rationale behind each move gave you something to think about. Because ultimately, it’s the story and conviction behind each decision that matters.

If you’re buying REITs yourself, never just follow my picks. Use them as a reference point, and ask: What fits your own portfolio? What story do you believe in, and risk are you trying to manage?

And remember — there’s always a value stock somewhere. You just have to know where to look, and be patient enough to let it work for you. Until next time, happy investing!

Leave a comment