[Watch this on YouTube too!]

Hey there, fellow REIT investors! Long-time viewers of this channel will know—I once said I’ve given up on Mapletree Pan Asia Commercial Trust or MPACT.

Not because I hate it or gave up on REITs entirely, but because investing in MPACT started to feel like climbing a mountain made of sand. Singapore assets like VivoCity were giving us some firm footing to step up… but the rest of the portfolio just kept sliding away beneath our feet. And to make things worse, even parts of the Singapore base—like Mapletree Business City—started shifting and dragging us down too.

Since then, many of you have left comments—some defending MPACT, others urging me to take another look. And to be fair, I’ve been monitoring the results quietly, waiting for signs of a real turnaround.

Well, the latest results are out, so today I’m revisiting MPACT to see: have the concerns been addressed? Or are we still scrambling on unstable ground? And more importantly, I’ll share whether my views on MPACT have changed in “The Dividend Uncle’s Take”.

Before we start, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the REITs discussed, but what works for me might not work for you.

Alright, let’s dive in.

MPACT’s Q2 2025 Results – A Quarter That Looks Steady, At First Glance

MPACT’s latest results are out, and on the surface, it looks like a fairly steady quarter.

Revenue came in at about S$218.6 million, down 7.6% from last year. Net property income also dipped by 7.5% to S$166 million. As for unitholders, the DPU for the quarter was 2.01 cents, which is 3.8% lower year-on-year.

Now, the drop in income was partly offset by lower expenses. Property operating costs fell by 8.1%, and finance expenses were down even more—by 16.4%. This was mainly due to two things: the sale of Mapletree Anson last year, and lower utility rates at the Singapore properties.

On the debt front, MPACT stayed disciplined. Gearing held steady at 37.9%, and the average cost of debt dropped slightly to 3.3%. Around 78% of borrowings are on fixed rates, which helps with stability, and interest coverage improved to 2.9 times.

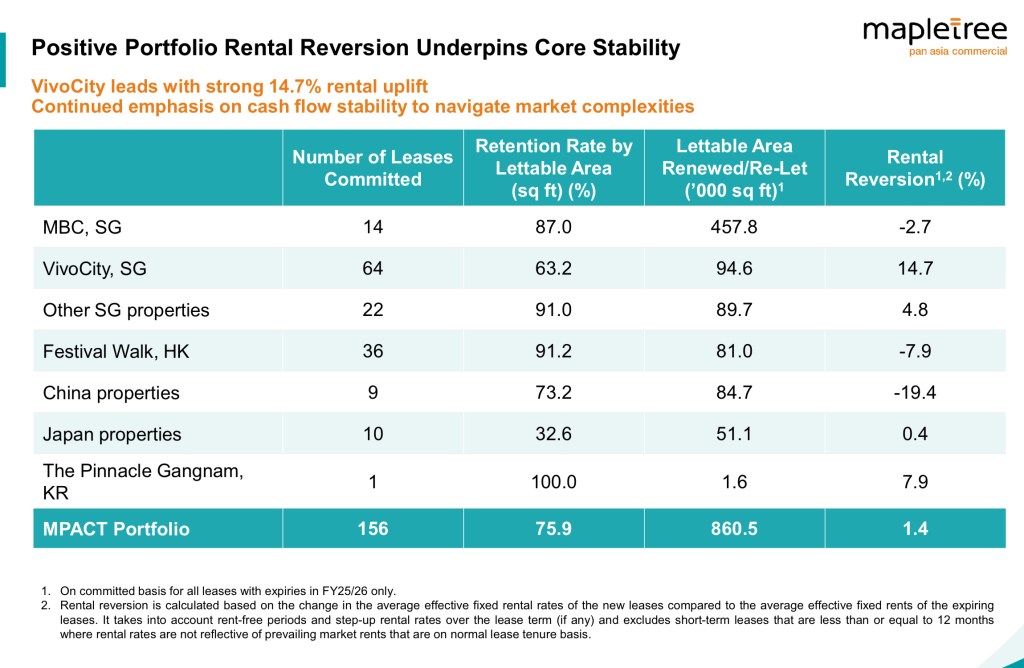

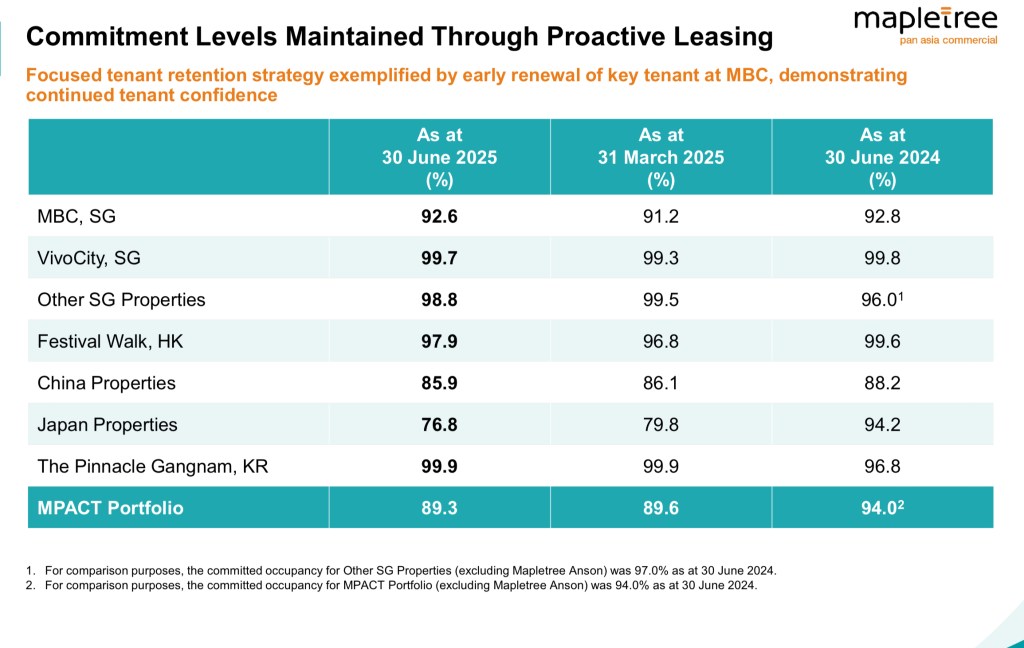

Portfolio occupancy, however, ticked down again—this time to 89.3%. It’s a small drop, but it continues a soft trend we’ve seen for a while. Rental reversion across the portfolio was modest, at +1.4%, with strong contributions from VivoCity, but more mixed results elsewhere.

So overall, it’s a quarter where lower costs and strong capital management helped support the numbers, even as operating income continued to slip. Whether that’s a sign of real progress or just holding the line—that’s what we’ll explore next.

One Single Thing Is Driving the ‘Improvement’

One of the clearer shifts this quarter was the reduction in expenses. Property operating costs came down by about 8.1%, and finance expenses fell even more—by 16.4%. At first glance, that might look like a sign of leaner operations or better cost control.

But when we look closer, most of these savings came from the sale of Mapletree Anson in July last year. Without that property in the mix, MPACT no longer bears its upkeep costs. And the proceeds from the sale were used to pay down debt, which helped bring down interest payments.

So rather than coming from operational improvements—like better rental income or higher occupancy—this quarter’s support to DPU mainly came from portfolio reshaping.

That’s not necessarily a bad thing. In fact, in a higher interest rate environment, selling a non-core asset to strengthen the balance sheet is a reasonable move. But it also raises the question of sustainability. These types of divestments aren’t something MPACT can repeat indefinitely.

And with fewer Singapore assets in the portfolio, there’s naturally more weight now on the remaining properties to deliver consistent performance. We’ll take a closer look at those in the next sections.

The Pressure Is Still On: Looking Beneath the Surface

Now that we’ve gone through the headline numbers—and the Mapletree Anson sale—it’s time to look deeper into the rest of the portfolio. Because if MPACT is going to recover meaningfully and win back my confidence, the improvement has to come from its core operations, not just cost-cutting or one-off moves.

1) Festival Walk – Still a Major Drag

Festival Walk remains the single biggest concern. Yes, occupancy rose to 97.9%, from 96.8%, which is impressive. But rental reversion weakened further to -7.9%. And imagine this: tenant sales fell 3.2% despite a 7.8% rise in shopper traffic. That’s a worrying disconnect – are shoppers visiting the mall but mostly to window shop or worse, cannot find the things they want to buy?

Management continues to push marketing and celebrity events—but the bigger problem remains: shoppers are still heading to Shenzhen, and new retail supply in Kowloon East is adding pressure. I’m worried that this is not a temporary issue— if it’s structural, we’re in trouble.

2) China Properties – Even Weaker Than Before

Occupancy at MPACT’s China assets fell slightly to 85.9%, but the more alarming figure is rental reversion: -19.4%, a huge deterioration from -9.3% previously. That suggests tenants are renewing leases at far lower rates, or MPACT is struggling to attract demand without slashing rents.

3) Japan Properties – Low Occupancy, and Now Selling Some

Japan occupancy dropped again to 76.8%, though rental reversion just turned positive at +0.4%. That’s a welcome change—but only just.

MPACT is also selling two fully occupied Japan offices at ~4% NPI yield. Management says this is to reduce single-tenant risk and recycle capital. It’s a sensible step, but not a game-changer. It doesn’t address the broader underperformance across Japan, and the divestments are small in scale.

4) Currency Headwinds – Quiet but Relentless

And as a reminder, these results are further weakened by currency translation. With the RMB sliding against SGD, DPU gets hit on both ends—lower local earnings and less value in SGD terms.

HKD and RMB have continued to depreciate against SGD, dragging reported earnings. Around 43% of MPACT’s AUM is outside Singapore. While MPACT has 88% of expected distributable income derived from or hedged into SGD—but that still leaves exposure. And with global FX volatility expected to continue, this is a quiet but persistent pressure point.

But before we talk about whether a crack is starting to appear in MPACT’s Singapore portfolio—the one part that’s been holding everything else together—if you’ve found this post helpful so far, do give it a like to support the website.

It really helps more viewers discover this content, and keeps me motivated to keep digging into the details for all of us dividend investors.

Alright, let’s get into it—starting with Mapletree Business City.

5) MBC – Stable for Now, But Long-Term Outlook Unclear

Let’s talk about Mapletree Business City—or MBC—which has been a key concern in past quarters.

This time, there’s some improvement to note. Occupancy ticked up from 91.2% to 92.6%, helped by an early lease renewal from one of the key tenants. That’s a small but welcome step in the right direction.

But when we dig into the numbers, the overall picture is still mixed. Rental reversion for the quarter came in at –2.7%, and tenant retention was 87.0%. Both figures suggest that demand for business park space—while not collapsing—is definitely softening. New tenants are harder to attract at higher rents, and existing ones are more selective about staying on.

Whether MBC sees stronger performance in the longer term really depends on the broader demand for business park space in Singapore—something that’s still facing headwinds from hybrid work and slowing tech sector growth.

So, all things considered, MBC is no longer sliding—but whether it climbs or stays stuck, we’ll have to wait and see.

6) VivoCity – The Bright Spot, But Not Enough on Its Own

Leaving the best for last, if there’s one part of the portfolio still doing the heavy lifting, it’s VivoCity.

Despite ongoing AEI works, VivoCity continued to deliver strong performance. Net property income rose 6.0% year-on-year, and rental reversion was an impressive +14.7%. That’s not just healthy—it’s top-tier for a retail asset in today’s market. Footfall remains strong, tenants are willing to pay higher rents, and AEIs are on track for completion in the second half of the year.

This shows that, when it comes to flagship Singapore retail, MPACT still has a dependable anchor.

But here’s the limitation—VivoCity, while important, makes up only about 24% of MPACT’s total portfolio by valuation. It’s a solid performer, but it simply isn’t large enough to offset weakness elsewhere. And in a portfolio that spans multiple markets and sectors, relying on one bright spot isn’t a sustainable recovery strategy.

So while we can be confident about VivoCity holding steady, the bigger challenge lies in what’s happening across the rest of the REIT.

The Dividend Uncle’s Take

So… do the latest results change my view on MPACT?

Well, not quite.

There are a few positives. VivoCity continues to shine—with strong rental reversions and solid footfall. The drop in finance and operating costs also helped to stabilise DPU. And MBC, which had been under pressure, saw a slight bump in occupancy.

But let’s be clear—the improvement came mostly from selling off Mapletree Anson. That’s not a recovery—it’s portfolio shrinkage. And it’s not something MPACT can keep repeating without hollowing out its Singapore base.

The broader picture still worries me. Overall occupancy has slipped again, tenant retention is showing signs of strain, and rental reversions outside VivoCity are weak or even negative. Festival Walk remains structurally challenged. China’s rental reversions have worsened. Japan is still soft. And FX pressures are here to stay. There’s no strong indication that demand across the portfolio is turning around.

So for me, this quarter feels like a holding pattern—not a turnaround.

I’m still staying out for now. I’ll keep monitoring, especially if market conditions improve or if MPACT takes more decisive action on its overseas assets. But until I see signs of a true operational recovery—not just cost savings or asset sales—MPACT remains on my watchlist, but not on my personal buy list.

And that’s it for this update on MPACT.

To those of you who disagreed with my earlier stance or encouraged me to take another look—thank you. I’ve been following the developments closely, and I hope this review shows that I’m always open to changing my mind when the facts change.

As I always say—there’s always a value stock somewhere. But for now, MPACT may not be it.

If you’ve found this post helpful, do give it a like—it helps more investors find the website. And if you haven’t already, subscribe for more thoughtful takes on REITs, dividend stocks, and income investing.

Till next time, stay patient, stay invested, and stay curious.

Leave a comment