Hey fellow REIT investors!

When we talk about core REIT holdings — the kind you buy, hold, and rarely lose sleep over — there are two in my portfolio that have consistently proven themselves over the years.

One is the textbook example of a core REIT: focused on prime retail and office assets in Singapore, with highly predictable cash flow and strong tenant retention. The other sits in the lodging and hospitality space — a little more exposed to global cycles, but backed by a well-diversified portfolio and a track record of disciplined asset management.

Both are backed by top-tier sponsors. Both continue to deliver, quarter after quarter. But they also represent two different shades of stability — and the market knows it.

The first is trading near a 3-year high on a price-to-NAV basis, with yields slipping below 5%. The second, while less stable, still offers a yield close to 7% and trades below book — even after reporting respectable results.

So in this post, I’ll walk you through both of these core REITs — what they’ve reported recently, how they’re managing their portfolios, and the big question I keep asking: Would you rather pay up for full quality… or get more yield with a little extra risk?

Before we start, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the REITs discussed, but what works for me might not work for you.

Alright, let’s start with the REIT I consider the poster child of stability.

CapitaLand Integrated Commercial Trust: Stability with Strategic Momentum

CapitaLand Integrated Commercial Trust, or CICT, is Singapore’s largest REIT by market capitalization, and often the default anchor in any Singapore REIT portfolio, and is definitely in mine.

For long-time followers of this channel, you’ll know I usually group CICT under my “core REITs” bucket — a stable pillar I can rely on. But I’ve rarely done a deep dive post on it, mostly because it’s so stable that not much needs to be said. Other than that memorable moment when they acquired ION Orchard that got me really excited.

However, in this quarter’s update, I found several key developments worth highlighting – from its solid Q2 2025 results, to an interesting disposal, and finally a new acquisition that reflects strategic timing.

Gold Quality Of Portfolio Stability

CICT is Singapore’s largest REIT, with a diversified portfolio of integrated developments, offices, and retail malls. It owns some of the most recognisable assets in the country — places like Raffles City, Funan, and Plaza Singapura. And with 96% of its portfolio in Singapore, it’s the ultimate local blue-chip REIT — familiar, regulated, and relatively low risk.

The beauty of CICT lies in its stability and predictability. Its leases are primarily based on fixed terms, with steady renewals across commercial, retail, and office tenants. In fact, its tenant retention rate remains impressively high — consistently above 75% — which speaks to the stickiness of its tenant base and the attractiveness of its properties.

Unlike hospitality REITs, CICT isn’t swayed by daily occupancies, seasonal travel patterns, or tourism trends. Instead, its income is anchored by longer-term leases, often driven by forward planning from institutional tenants and established retailers. This consistency — quarter after quarter — is what makes CICT such a reliable performer. It’s no surprise that many investors treat it as the anchor of their REIT portfolio… and why I do too.

Q2 2025 Results: A Steady Climb

CICT reported a 3.5% year-on-year increase in DPU to 5.62 cents for the first half of 2025. Distributable income rose 12.4%, supported by the full six-month contribution from ION Orchard, better operating performance from existing properties, and lower finance costs. While revenue and net property income saw a slight dip due to the absence of income from divested 21 Collyer Quay and ongoing A.E.I.s at Gallileo, the underlying portfolio remained strong.

What stood out to me was the quality of the core portfolio. Retail occupancy is at 98.6%, integrated developments at 97.8%, and office at 94.6% — leading to an overall portfolio occupancy of 96.3%. Rent reversions are solid too — 7.7% for the retail segment and 4.8% for offices. And more, tenant retention remained high — 81.8% for retail, and 76.8% for office. These are strong signs of asset quality, demand, and tenant stickiness.

Every time I review CICT’s numbers, I find myself thinking — do I even need to spend so much time looking at other REITs? And of course, the answer usually lies with diversification and potentially higher yields, though with a bit more risk. But CICT’s quality continues to justify its place as a cornerstone in my portfolio.

Proactive Asset Management: Quiet but Meaningful Moves

Beyond the headline numbers, I also appreciate how CICT has been working proactively to refresh its portfolio.

They’ve just completed the divestment of the serviced residence component of CapitaSpring — 20 floors to be exact, which were originally meant for short-stay accommodations but underutilised post-pandemic. This fetched $141 million and is in line with the appraised value. It shows how management is pruning non-core assets and refocusing on what works.

CICT is also moving forward with two new A.E.I.: one at Tampines Mall, with a $24 million facelift to the entrance and tenant mix; and another at Lot One, converting carpark space into 15,000 square feet of additional retail. Both A.E.I.s are projected to earn R.O.I. of 7% and above — decent numbers that enhance long-term value without huge execution risk.

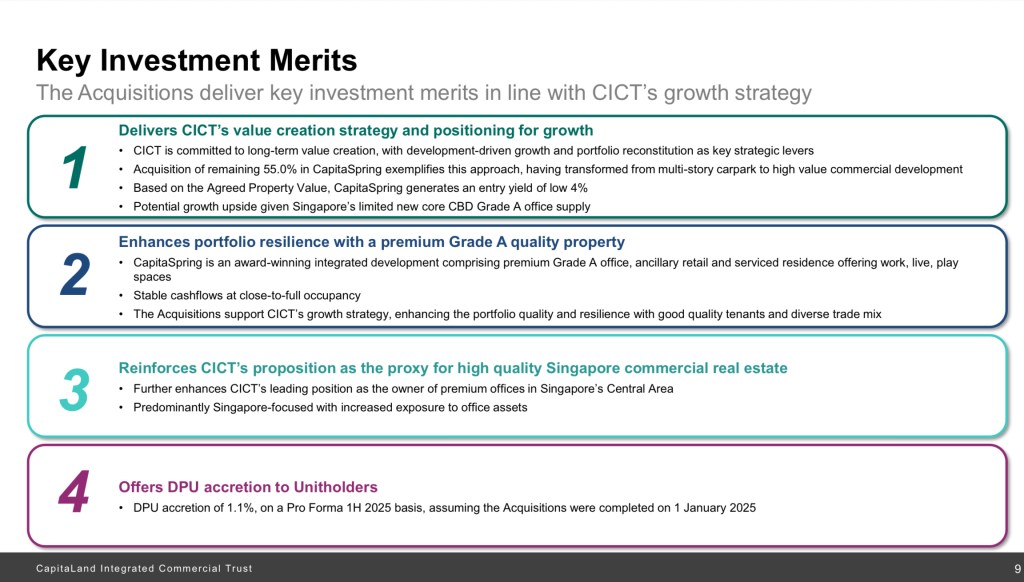

Acquisition of the Remaining 55% Stake in CapitaSpring

Now, let’s talk about the headline act: the acquisition of the remaining 55% of CapitaSpring.

CapitaSpring is one of the newest, highest-quality Grade A developments in Singapore — housing tenants like JP Morgan and Sumitomo. Occupancy is nearly full, and the cap rate used in the transaction is between 3.65% to 3.7%, which is tighter than before, reflecting the prime quality of the asset.

The reason this deal is happening now? The call option expires in late 2026, and management made it clear that executing the deal now, rather than waiting, avoids unnecessary market speculation and financing overhang. CICT’s share price has gone up about 17% year-to-date, which makes equity fund raising cheaper; and Singapore interest rates have also fallen, which makes debt financing cheaper too. So this could be as good a timing as it goes.

Funding-wise, CICT raised $600 million via a private placement at $2.11 per unit — nearly 5 times oversubscribed. Sadly, this round was not open to retail investors. But I’m not blaming them — placements are faster to execute. And to be fair, CICT did include retail investors in the previous public offering for the ION Orchard acquisition. So they’re somewhat fair, and I’m not complaining too much.

The good news? This deal is 0.9% accretive to DPU and keeps pro forma gearing at 37.9% — very respectable and manageable for a REIT of this scale.

Falling Interest Rates: A Quiet Tailwind That Matters

The part that excites me most is actually what’s happening quietly behind the scenes — borrowing costs are falling.

CICT’s average cost of debt declined from 3.6% to 3.4%, and management expects this could fall further to around 3.2%, thanks to a new lower-cost loan they’ve secured for CapitaSpring.

Now this is something I’m keeping a close watch on. Because as many of you know, interest rates are one of the biggest headwinds REITs have faced in recent years. But with Singapore’s SORA and T-bills dropping, the tide is starting to turn — especially for REITs that are highly exposed to local debt.

And here’s the beauty of CICT: with almost its entire portfolio and debt in Singapore, it stands to benefit directly and more immediately from the local rate decline.

As financing costs fall, we could see higher distributable income, improved DPU, and even better valuations if the cap rates start to compress again.

Summing Up: Valuations Reflect the Strength

All this strength doesn’t come cheap — and the market has taken notice.

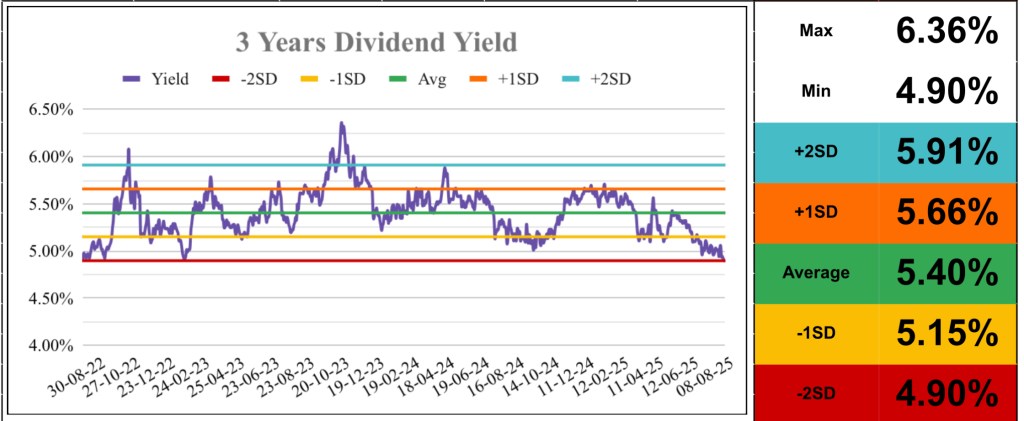

CICT’s dividend yield has now dropped below 5% once again — currently sitting at 4.9%, which is close to its 3-year low. At the same time, its price-to-NAV ratio has climbed to 1.06, the highest it’s been in three years. That means investors are willing to pay a premium for the quality, stability, and visibility that CICT offers.

Source: http://www.reit-tirement.com

To me, this isn’t unjustified. In a world full of REITs with uncertainties, especially around overseas portfolios or refinancing risks, CICT stands out as a steady ship in calm waters. But it also means the upside from here might be more moderate — unless we see a big re-rating in the broader REIT sector.

So while I continue to hold CICT as a cornerstone of my portfolio, it’s worth acknowledging that the market has already priced in much of its strength — and that’s where the comparison with the next REIT gets even more interesting.

But before we move on, if you’ve found this breakdown useful so far, do help support the channel by giving this post a thumbs up. It really helps the YouTube algorithm and tells me to keep doing more of these deep-dive REIT updates.

Alright, let’s dive back in!

CapitaLand Ascott Trust: 7% Yield Core REIT That Moves To A Different Beat

Now if CICT is the gold standard of stability, then CapitaLand Ascott Trust — or CLAS — is the more adventurous sibling. It’s still part of my core holdings, but it behaves a little differently. Less boring, but also less predictable. And that’s partly why the market has priced it very differently. So let’s take a closer look.

Portfolio Lease Structure That Is Less Volatile Than Expected

CLAS is the largest hospitality trust in Asia-Pacific, with a global portfolio spanning over 100 properties in more than 15 countries. But don’t let the term “hospitality” fool you — this isn’t just about hotel nights and tourist arrivals.

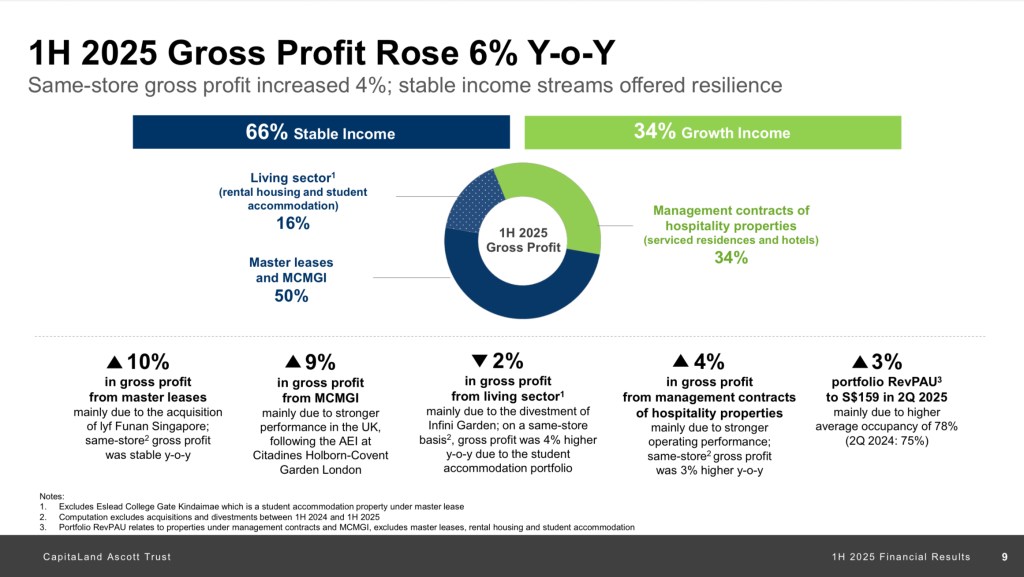

What sets CLAS apart from most hospitality REITs is its blend of income structures. In the first half of 2025, 66% of its gross profit came from stable income sources, like master leases and management contracts with minimum income guarantees. These fixed or minimum-guaranteed leases provide much more income visibility compared to traditional hotel REITs, where earnings swing wildly with travel cycles.

Another 16% of gross profit came from long-stay “living sector” assets — think student housing, rental apartments, and co-living residences — which tend to offer more predictable returns and are less exposed to seasonal travel volatility.

In other words, while CLAS is technically a hospitality REIT, it behaves more like a hybrid — offering the upside of variable income, but with meaningful downside protection built in.

That said, it’s still more sensitive to global travel trends than a REIT like CICT. CICT’s leases are almost entirely fixed and based on commercial contracts in Singapore — making it one of the most predictable REITs around. CLAS, by contrast, has greater geographical spread and exposure to short-stay demand, which introduces more variability.

But here’s the key trade-off: the market has priced in that risk. CLAS trades at a significantly lower valuation than CICT and offers a much higher yield — and that’s exactly what makes this comparison interesting.

Results Holding Steady Amid Variability

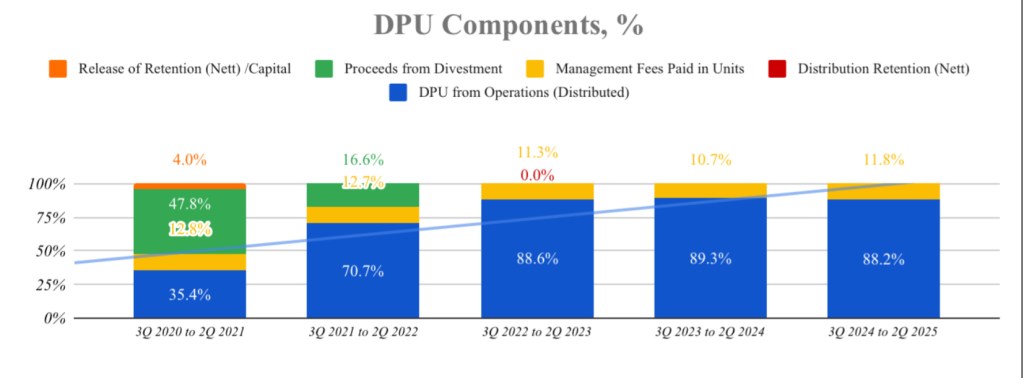

CLAS reported a distribution per stapled security of 2.53 cents for the first half of 2025 — essentially flat compared to 2.55 cents a year ago. Core DPS, adjusted for non-periodic items, came in at 2.4 cents, just a whisker below last year’s 2.41 cents. To me, this reflects resilience more than weakness, given that CLAS operates in the hospitality space, where demand patterns are more volatile.

What’s interesting is that revenue still grew 3% year-on-year to $398.5 million, and total core distribution actually inched up 1% to $91.6 million. This means the drop in headline DPS isn’t from operational weakness, but more from how gains are recognised and distributed.

The important point I found reassuring: about 66% of CLAS’s gross profit now comes from stable sources, including 16% from the living sector — think longer-stay assets like student housing and serviced apartments. This shift toward greater stability within a traditionally volatile segment is something I’ve been tracking for some time.

Proactive Recycling: Unlocking Value For Investors

CLAS continues to demonstrate excellent capital recycling discipline.

They’ve just announced the sale of Citadines Central Shinjuku Tokyo for ¥25 billion, or about S$227 million — at a stunning 100% premium to book value, and a 40.4% premium over independent valuations. That’s not a typo — 100%.

The property was mature and due for significant capex, so instead of pouring money into it, CLAS chose to exit at a strong price. The yield on exit was just 3.2%, which means this was a low-return asset compared to what they can potentially reinvest in.

The net proceeds of S$187 million will be used to repay more expensive debt, including yen and pound-denominated loans. This move alone will shave their gearing down from 39.6% to 37.8% and is projected to add 1% to DPU on a pro forma basis.

This is a good example of a REIT using divestment to both strengthen the balance sheet and boost unitholder value.

AEI And Forward Growth: Laying The Groundwork

CLAS has also been active on the A.E.I. front, which is something I always view positively when done right. And for the hospitality sector, regular upgrades to their properties will provide a boost to repeat customers.

They’ve completed an upgrade of ibis Ambassador Seoul Insadong, and four more A.E.I.s are planned through 2026, with a total capex of about $205 million. These aren’t just cosmetic facelifts — they’re value-adding initiatives aimed at improving returns, guest experience, and long-term competitiveness.

Interest Rates: Well Managed And Still Competitive

Now let’s talk about financing — because this is where many hospitality trusts could struggle if not properly managed.

CLAS has maintained its average cost of debt at 2.9% as of June 2025 — relatively low and stable compared to other REITs. They’ve also increased their fixed-rate debt from 76% to 82%, and their interest cover stands at a healthy 3.1 times. The weighted average debt maturity is 3.4 years, so there’s no near-term refinancing stress.

This is where I need to highlight the riskier side of CLAS. While its reported gearing stands at 39.6%, that number excludes hybrid instruments like perpetual securities. If we factor those in, the effective gearing climbs to around 44.5% — a significantly higher level of leverage.

In contrast, CICT keeps things straightforward. It has no hybrid debt, so its reported gearing of 37.9% reflects the full picture — what you see is what you get.

Yield And Valuation: Discounted, Despite The Quality

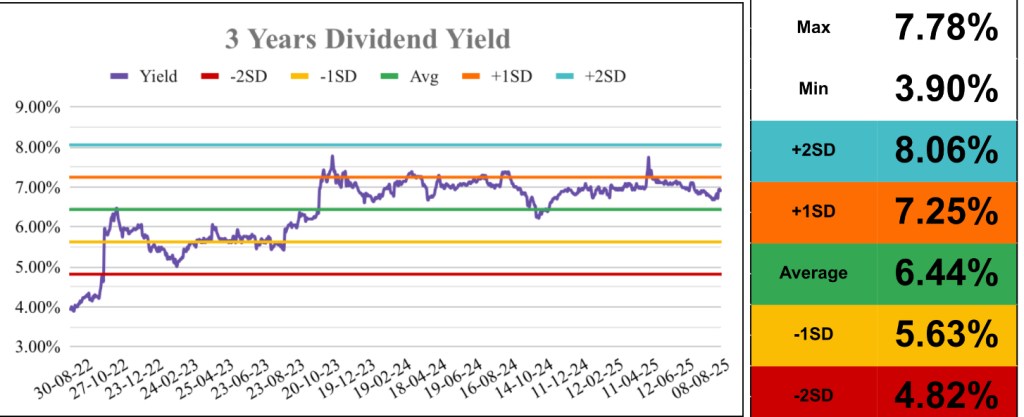

Here’s the kicker — despite its quality and strategic execution, CLAS is still heavily discounted by the market.

CLAS is currently trading at a yield of about 7.0%, which is close to the highest level seen in the past three years. But note that around 12% of its yield is actually made up of the issues of units to management as payment for fees. Taking that out still leaves us with a mouth-watering yield of about 6.2%.

Source: http://www.reit-tirement.com

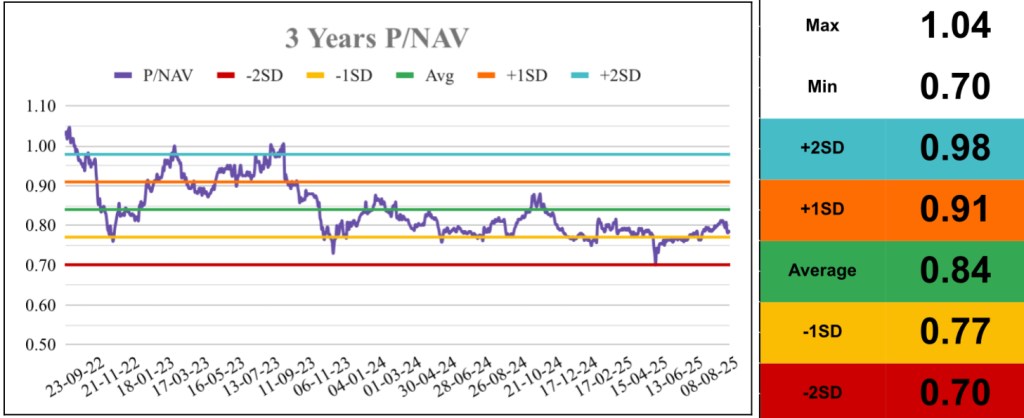

Its price-to-NAV is about 0.80, meaning the market is valuing its portfolio at a 20% discount to book, again, near three-year lows.

Source: http://www.reit-tirement.com

This is in stark contrast to CICT, which trades at a yield of 4.9% and a price-to-NAV of 1.06. Both REITs are backed by the same sponsor, and both are executing well. But while CICT is priced like a fully-trusted national champion, CLAS is still being treated like the “risky cousin” — even though it has been delivering consistent results.

To me, this discount is more a reflection of investor psychology than actual weakness. CLAS is in hospitality, and many investors still associate that with volatility. But with over 66% of profits now coming from stable sources, and visible progress in A.E.I.s and capital recycling, the gap between perception and reality is starting to look like an opportunity.

The Dividend Uncle’s Take

So here’s how I’m looking at it.

CICT is the gold standard. It’s well-diversified, fully Singapore-based, and backed by strong demand and tenant retention. It’s also priced that way — with a price-to-NAV above 1.0 and yields falling below 5%. For me, this is a true core holding — the kind you can hold through thick and thin, without losing sleep.

CLAS, on the other hand, is what I’d call core-plus. It’s also backed by CapitaLand, has strong financial discipline, and is showing good results. But the nature of its assets — particularly the exposure to short-stay lodging — makes it a bit less predictable. And its higher gearing, albeit with lower average interest rates, is exactly why the market is pricing it at a discount.

So the question really is: what kind of investor are you?

If you prioritise maximum stability and are okay with a lower yield, CICT is hard to beat. But if you’re comfortable with a bit more variability — and you’re looking to capture more yield and capital upside — then CLAS offers real value.

Personally, I own both. CICT forms the bedrock of my REIT portfolio. But CLAS is the one I’ve been topping up more recently. Because if the gap between perception and fundamentals closes, the returns could be very rewarding — especially when you’re getting paid nearly 7% to wait.

That’s it from me — but I’d love to hear your view. Would you pay up for certainty, or take the risk for higher yield? Drop your thoughts below.

And if you found this helpful, do like, share, and subscribe. It helps more than you think.

Until next time, stay invested… and stay steady.

![2 Core REITs In My Portfolio – But I’m Adding Only One [CICT vs CLAS]](https://thedividenduncle.com/wp-content/uploads/2025/08/llp-copy-14.jpg?w=1024)

Leave a comment