Hey there, fellow dividend investors!

We’re now heading into the final month of Q3 2025—and I must say, it’s been a surprisingly decent few months for the Singapore market. Since the start of July, the Straits Times Index has climbed around 6%, and if you look beyond the big caps, the FTSE ST Small and Mid Cap Index is up nearly 9%. Not bad, considering where we were earlier this year with all the tariff drama and interest rate uncertainty.

So it’s in this upbeat market that I’m going to share with you the dividend stocks I’ve bought, and the 1 I’m eyeing for September 2025. Now, when markets are rising, it’s easy to get excited about what’s working and who’s winning. But, to be very clear—these regular updates on what I’ve bought or eyeing aren’t a list of “hot picks.” It’s just me sharing what I’ve done recently, why I did it, or why I’m still thinking about it but haven’t bought it yet. I do this not to make recommendations, but to be transparent—and to walk you through how I think about dividend investing in real time.

Hopefully, it gives you some useful perspectives as you think through your own strategy—whether you’re averaging down, deploying fresh capital, or just observing for now. And even if you disagree with my decisions, that’s okay—as long as it sparks some thinking.

Before we dive in, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the shares discussed, but what works for me might not work for you.

Alright—let’s dive in.

Kimly – A Dying Breed, But Still Brewing With Gusto

If you’ve lived in Singapore long enough, Kimly probably needs no introduction. It’s one of the few remaining traditional coffeeshop operators listed on SGX. After Kou-fu and Kopitiam were taken private, Kimly stands out like the last stall still open after 10pm for hungry night owls. It’s a steady, familiar business model—own or lease coffeeshops, collect rent from food stall operators, and run some of its own food stalls under brands like Tonkichi and Tenderfresh.

And by the way… have you ever noticed something odd? Kou-fu, Kopitiam, Kimly—how come all the coffeeshop stocks start with K? Maybe “K” really stands for kopi, kway teow, and kaya toast.

But jokes aside, I bought a small position in Kimly recently—not to swing for the fences, but to get some stable dividend exposure to the heartland economy. Coffeeshop operations may not be glamorous, but they tend to generate reliable cash flow, especially when managed well and not being overly aggressive in expansion.

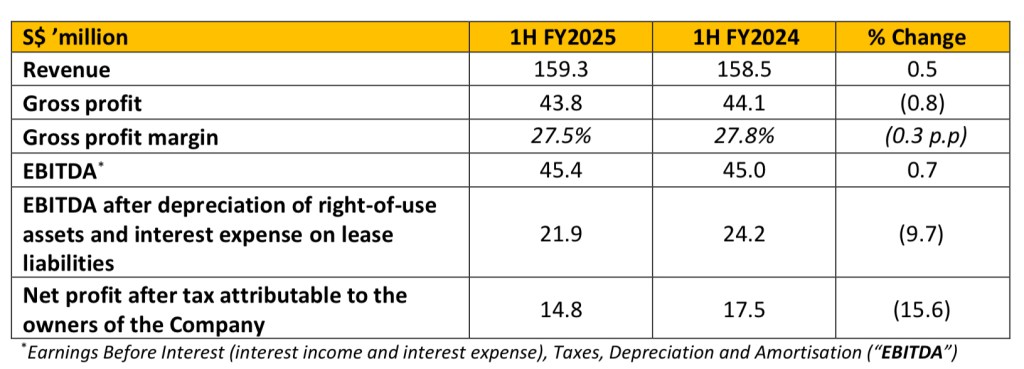

That said, the latest 1H FY2025 results show why I’m keeping my exposure small. Revenue inched up just 0.5% to $159.3 million, driven mainly by the outlet management side. But net profit fell 15.6% year-on-year to $14.8 million, largely due to higher lease and depreciation expenses. Cost pressures from manpower and utilities are clearly weighing on margins.

Still, Kimly declared an interim dividend of 1 cent per share, which works out to a dividend yield of about 5.6% on an annualised basis at current prices. That’s quite respectable for a relatively defensive business, especially one that still has net cash of $76.4 million on its books, even after acquiring a new coffee shop at Serangoon Central.

There are 2 key things to monitor, in my view. Firstly, the performance of existing shops. The Food Retail division reported lower revenue from existing stalls and outlets. If this trend continues, it could spell trouble for Kimly. However, management seems to be focusing on this one. It has closed 12 underperforming food stalls and 1 restaurant, while opening 19 new stalls and outlets recently.

Secondly, is acquisition discipline. As long as they don’t overpay for new coffee shops just to grow revenue, the business should remain steady. But if bidding wars start, or if they stretch their balance sheet too far, that’s where things can turn.

For now, I’m happy to hold a small position, collect the dividends and not expect a big capital appreciation, and just watch how the story unfolds.

Genting Singapore – Waiting for the Big Reveal

Next, let’s talk about Genting Singapore. This is one I’ve followed for quite some time… and in Q3 2025, things are finally getting interesting.

I bought Genting in anticipation of the Resorts World Sentosa 2.0 transformation—new attractions, expanded retail and dining, and the highly-anticipated Singapore Oceanarium, which just opened in July. Another big milestone is The Laurus, a luxury all-suite hotel opening in October. These are major updates that could finally reignite footfall and spending at RWS, which has been patchy in recent years.

But while I’m optimistic about the upside from these projects, I also want to be upfront about a key risk that came up late last year—the two-year casino license renewal.

Now, this might sound like a routine update, but it’s actually a big deal. Traditionally, Singapore’s casino licenses are renewed every three years. But this time, the Gambling Regulatory Authority (or GRA) issued Genting Singapore’s RWS casino license for just two years, effective from February 2025. This is the first time ever that a shorter tenure has been granted.

Why? According to the GRA, RWS was found lacking in its tourism performance between 2021 and 2023. An evaluation panel said the resort did not meet expectations in promoting itself as a compelling tourist destination. And areas needing rectification and substantial improvement have been highlighted.

In other words, this is a warning shot from the regulators: you’ve got to step up your game.

To me, that’s both a risk and an opportunity. On one hand, a shorter license renewal adds regulatory pressure and reputational risk. On the other hand, it forces Genting to sharpen its focus and deliver on the promises of RWS 2.0. That could mean tighter execution, better cost discipline, and more urgency in capturing market share—especially as regional competition from Macau, Korea, and potentially Thailand heats up.

From a financial standpoint, the 1H2025 results were mixed. Revenue fell 10% year-on-year, and net profit dropped 35% to $233.1 million, partly due to renovations and higher staffing costs. But Q2 revenue improved sequentially, and Universal Studios Singapore saw increased visitors. Analysts remain broadly positive, citing bargain valuations, a yield of around 5.3%, and medium-term uplift once the new attractions gain traction.

For me, I see this as a long-term repositioning story. The stock got cheaper on weak short-term results and that 2-year license news. But with new developments coming on-stream and the new leadership executes well, the tourism narrative can turn—and so can investor sentiment. This is what I’m looking forward to, while I enjoy the juicy dividends.

INC ETF – Steady Yield Amid China’s Volatility

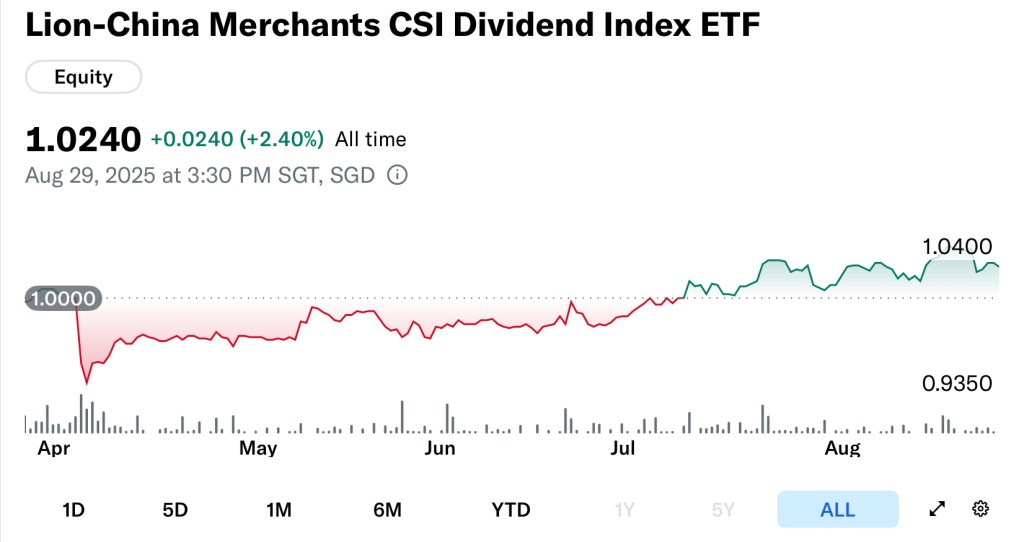

The third one I bought is a newer entrant—Lion-China Merchants CSI Dividend Index ETF, or just INC ETF. I introduced this ETF in a past post as one of the 3 ways to ride China’s recovery, and it continues to be my preferred vehicle among the China equity space.

Why? Because this ETF is built specifically for income investors like us. It tracks 100 A-share companies listed in Shanghai and Shenzhen, selected based on strong dividend consistency and financial health. Some of the top holdings include COSCO Shipping, Jizhong Energy Resources and Bank of Cheng-du —a mix of financials, industrials, and energy with established track records of dividend payouts.

The average index yield is around 4.6%, and while the ETF pays only once a year—with the first payout coming in December 2025—that yield still offers a decent cushion in a volatile market like China. For income investors like me, this is more palatable than trying to time a growth rebound.

In terms of performance, it’s done alright. After dipping to a low in April 2025, the ETF has since recovered about 10%. But if we take a step back, it’s only up around 3% from its IPO price of $1, so it’s not shooting the lights out either. That said, I’m not in this for capital gains alone. If I’m collecting 4%–4.5% in dividends annually, a 3% capital appreciation over a few months is perfectly reasonable—and more importantly, sustainable.

This is why I view INC ETF as a stable way to gain exposure to China’s recovery. Unlike pure growth ETFs or volatile single stocks, this one gives you diversified exposure to companies that are actually returning cash to shareholders. And with a 0.5% management fee, I think it’s a reasonable trade-off for convenience and peace of mind.

I opted for the SGD-denominated version for simplicity, but of course, currency risk is still there, since the underlying assets are in RMB. Just something to be aware of.

If you’re finding this helpful so far, do share this post with a like-minded friend, or better still, head to my YouTube channel and subscribe —it really helps more people discover the channel. And if you’re new here, I post regular updates like this on dividend stocks, REITs, and income investing strategies, so consider subscribing if that’s your thing.

Alright—on to the one I’m still eyeing in September 2025.

Still Eyeing: ComfortDelGro – A Mental Tug of War

Now for the one I’m still sitting on the fence about: ComfortDelGro.

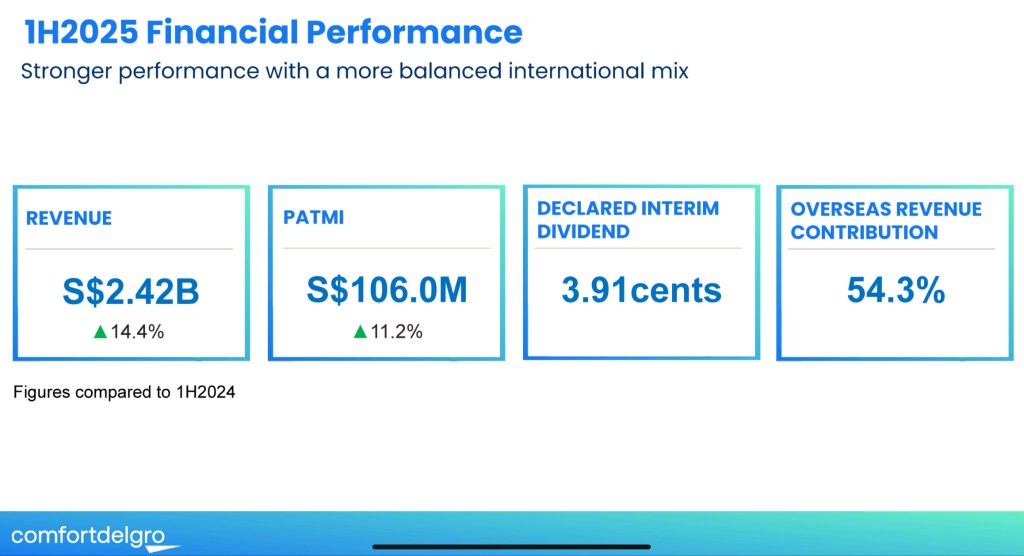

Many of you know I already hold SBS Transit, which is a major subsidiary of CDG. So in a way, I already have partial exposure. But CDG itself is much broader. It’s a global transport operator now, with over 54% of revenue from overseas—including London, Manchester, Australia, and Europe.

The recent results were decent—1H2025 revenue up 14.4%, net profit up 11.2%, and a dividend increase to 3.91 cents per share. Analysts expect stronger second-half earnings, helped by seasonality and new contract wins. Some are even optimistic about margin improvements in London and further tender opportunities globally.

So why haven’t I bought?

Honestly, it comes down to familiarity and volatility. CDG is involved in many markets I’m less familiar with. And compared to something like Kimly or Genting—which I can see and feel in Singapore—CDG’s story is more spread out. The domestic market is also highly competitive, and fleet size has declined slightly.

I’ll admit—it’s not that CDG is a bad company. In fact, I have a lot of friends who are bullish on it, and I trust their judgment. It’s just that for me, it hasn’t yet crossed the threshold of conviction.

That said… it recently dipped below $1.50, and I’m watching closely. Maybe with more clarity or a better price, I’ll change my mind. But for now, I’m staying on the sidelines.

The Dividend Uncle’s Take

Every few months, I like to take a pause—not just to show what I’ve bought, but to reflect on why I bought them. And this round reminded me of something important: in dividend investing, it’s not always about chasing the highest yield or most exciting story… it’s about positioning with purpose.

With Kimly, I’m leaning into something familiar and grounded. It may not grow fast, but it reflects a part of the Singapore economy that’s quietly dependable—as long as management stays disciplined.

Genting Singapore, on the other hand, is a more complex turnaround story. It’s under pressure, yes—but that pressure might just be the catalyst it needs to raise its game. RWS 2.0 is a bold bet, and I’m taking a stake in the belief that execution will improve.

INC ETF is my way of staying in China’s recovery—not through headlines or hype, but by owning stable, dividend-paying companies with long-term resilience. It’s not flashy, but it’s doing what I expect: generate income, smooth out volatility, and slowly participate in upside.

And with ComfortDelGro, I’m reminded that even for seasoned investors, there are positions that give us pause. It’s okay to be uncertain. It’s okay to wait. Sometimes, not acting is just as much a decision as buying.

So whether you agree or disagree with my choices this round, I hope this has given you something to think about. Because ultimately, what we’re building isn’t just a portfolio—it’s a mindset. One that balances optimism with caution, opportunity with patience.

So that’s it for this month’s update—3 dividend stocks I’ve added to the portfolio, and 1 I’m still considering. No magic formula here, just a steady process of reviewing opportunities, assessing risks, and making moves that fit my overall income strategy.

Some of my investments may work out well, some may take time, and some might even go the other way. But what matters is that we stay thoughtful, stay disciplined, and keep learning.

Let me know what’s on your radar right now. And if you’ve found this post useful, do give it a like and share it with someone who might appreciate it. Until next time, stay steady, stay invested… and may your dividends keep flowing.

Leave a comment