Hey there fellow REIT investors!

Over the past 6 months, we’ve had quite a ride in the REIT market. Anticipation of US interest rate cuts pushed many REITs higher, and optimism was running strong. The iEdge CSOP S-REIT Leaders ETF rallied about 8% at one point. But here’s the twist: when the cuts finally came in mid-September, REITs didn’t continue rallying. In fact, many fell back – the ETF fell back down by close to 2%.

That’s a reminder that markets don’t move in a straight line, even when the news seems positive. Which is why I like doing these updates — to share what I’m thinking to navigate these shifts in real time.

In today’s post, I’ll run through the three REITs I’ve added to my portfolio recently, and two more I’m keeping an eye on for October 2025. My hope is that by sharing my thought process, it helps you sharpen your own decisions — whether you agree with me or not.

Before we start, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the REITs discussed, but what works for me might not work for you.

Let’s dive in.

CapitaLand Ascott Trust: A Blue-Chip That’s Lagging

The first REIT I added is CapitaLand Ascott Trust, or CLAS. Among the blue-chip REITs, CLAS has been one of the laggards. While names like CapitaLand Integrated Commercial Trust and Frasers Centrepoint Trust have moved up strongly, CLAS’s unit price hasn’t kept pace.

CLAS, is Singapore’s largest hospitality and serviced residence REIT, with more than 100 properties across Asia, Europe, and the US. Its portfolio includes well-known brands like Ascott, Citadines, and Somerset, spanning both long-stay serviced apartments and short-stay hotels.

Financially, the latest numbers are steady. In 1H 2025, revenue per available unit rose 3% year on year to S$150, and gross profit increased about 6%. Its core distribution per unit or D.P.U.was 2.40 cents, with total D.P.U. of 2.53 cents — essentially flat from a year ago. On yield, that works out to around 6.5%.

Balance sheet-wise, CLAS’s gearing stands at 39.6%, with about S$1.8 billion in debt headroom. In May, it issued S$260 million of perpetual securities at a 4.2% coupon. That was sensible when rates were high, but with rates now coming down, refinancing in the future could be cheaper.

So while CLAS hasn’t outperformed like some peers, its yield remains attractive, and I believe when REITs recover more broadly, it has room to catch up.

That gave me a chance to buy in at an attractive yield. Even after the recent rebound, it’s still yielding around 6.5%. At one point, it was closer to 7%. For a blue-chip hospitality REIT with a diversified global portfolio, that’s not bad at all.

My thinking is simple: if the broader REIT market continues to recover, CLAS should have room to play catch-up. And if recovery takes longer, I’m still paid a decent yield to wait. That combination of value and income made it an easy buy for me.

NTT Data Center REIT: An Overlooked Story

Next up is NTT Data Center REIT. This one, I think, is underappreciated by the market.

NTT Data Center REIT is backed by Japan’s NTT Group, focusing on data center assets across Japan — mission-critical facilities powering cloud, AI, and digital services.

At IPO, the REIT projected yields of about 7.0–7.5% for FY25/26, rising to 7.8% for FY26/27. Occupancy is expected to climb to 97.6%, up from ~94% previously, while revenue growth is projected at ~5% per year.

Leverage is healthy at around 35%, with an all-in cost of debt of about 3.9–4.0%. That’s not overly stretched, and with global interest rates easing, there’s potential for debt costs to gradually improve when refinancing.

Here’s where it gets interesting. The unit price for the REIT fell from $1 at IPO, to $0.94 which is where I decided to enter. Since then, it’s climbed back to about $1. I’m of course happy with that rebound, but more importantly, I believe the fundamentals are stronger than the initial price action suggests.

Data centers are a long-term growth story — demand for digital infrastructure isn’t slowing. Yet NTT’s REIT hasn’t gotten as much attention as peers like Keppel D.C. REIT. That disconnect was my opportunity. Buying when sentiment is lukewarm, but the long-term demand drivers are intact, is the kind of move I like making.

Digital Core REIT: A Mix of Both Stories

The third REIT I bought is Digital Core REIT. My reasoning here is a mix of the CLAS and NTT stories.

Digital Core REIT is a pure-play data center REIT sponsored by Digital Realty, with freehold assets across key US and Canadian markets, leased to some of the world’s largest tech and cloud companies.

In 1H 2025, performance was solid: gross revenue surged 84% year on year, and net property income rose 52% to US$46.3 million, supported by acquisitions and stronger occupancy. Occupancy itself improved to 98%, up from ~97%.

Yet, the DPU was flat at 1.80 US cents, same as last year’s first half. On yield, the market is valuing it at about 6.8–7%. Its gearing is 38.3%, with average debt cost around 3.6% and a debt maturity profile of 4.2 years.

To me, this is a case where the market hasn’t rewarded the operational improvements. On the one hand, like CLAS, it’s lagged behind the broader REIT recovery. On the other hand, like NTT, it’s a data center play that the market hasn’t fully appreciated yet.

With US interest rates now easing, future refinancing could bring down borrowing costs further. So I see Digital Core as both underappreciated and well-positioned for the next leg of recovery.

Before we move on, if you’ve found the post useful so far, do help this Uncle out by giving it a ‘like’ — it really makes a difference for my YouTube channel. And if you’d like to go one step further, consider joining as a YouTube channel member. And a huge shout-out to Peter Low, our latest member! Just hit the “Join” button in the link.

What I’m Eyeing Next

Now let’s move on to the REITs I am eyeing, with these REITs firmly on my radar. Sometimes it’s just as important to watch patiently as it is to act. Prices, timing, and conviction all need to line up. These two names — one is the flagship in Singapore, the other is a tactical play in the US. Because sometimes patience is the real edge.

CapitaLand Integrated Commercial Trust: The Flagship REIT

The first REIT I’m eyeing for October 2025 is CapitaLand Integrated Commercial Trust or CICT.

This is Singapore’s largest REIT, with over S$24 billion in assets including iconic malls and offices such as ION Orchard, Plaza Singapura, Raffles City, and CapitaSpring.

The latest results were encouraging: in 1H FY2025, DPU rose 3.5% year on year to 5.62 cents, which annualises to a yield of around 5%. Distributable income grew ~12% year on year, helped by the Ion Orchard acquisition and lower interest expenses. Portfolio occupancy is healthy at 96.3%, with strong rent reversions — +7.7% for retail, +4.8% for office.

On the balance sheet side, gearing is about 38.3%, with borrowing costs for CapitaSpring around 2.7%. The overall debt profile has benefited from easing interest rates, which already lowered interest expenses in 1H. Analysts forecast DPU of about 10.9 cents in FY2025, growing to 11.3 cents in FY2026 — around 3% year on year growth.

For me, CICT is the flagship REIT that can lead the sector’s recovery. I was discussing with a channel viewer recently about entering CICT. Unfortunately, I missed getting in closer to $2.10. Since then, CICT surged all the way to $2.37 before stalling a little after the US cuts. It is currently around $2.25, which represents a more attractive entry point.

Despite the retracing of the upturn, I remain positive. If broader REIT sentiment picks up, CICT is likely to be at the front of the pack. For me, it’s not about chasing short-term price moves, but waiting for the right entry to own a flagship name that delivers steady distributions year after year.

Keppel Pacific Oak US REIT: Tactical Re-Entry

Finally, let’s move on to a tactical play.

Keppel Pacific Oak US REIT, or KORE, is a US-focused office REIT with 13 freehold properties in tech-driven cities like Seattle, Austin, Denver, and Atlanta. It focuses on business parks and suburban offices rather than downtown towers.

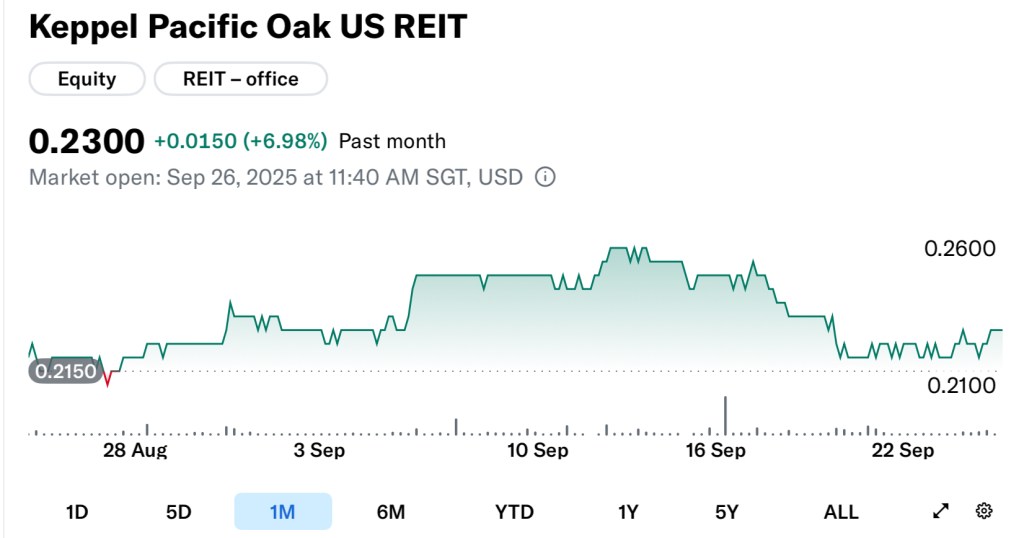

Two months ago, I bought KORE tactically. It rallied strongly on Fed cut expectations, and I sold part of my position at $0.25. But when the cuts were confirmed, the price fell back to around $0.22! Unfortunately I didn’t sell all my holdings at higher prices, but well, my timing is never perfect and that’s okay.

In fact, I’m looking to buy back some of what I sold. Why? Because I still think further US rate cuts in the coming months could support another leg up. This isn’t a core holding for me — more of a satellite, tactical play. But at current levels, the risk-reward looks interesting again.

The Dividend Uncle’s Take

Across these five names, I’m doing two things at once.

One, leaning into potential mis-pricing where fundamentals are sturdier than sentiment, or where dividend yields are still attractive relative to other REITs. And two, positioning for the rate path — letting falling average financing costs lift distributions over time.

As a value investor and a dividend focused one, the common thread is that I’m looking for opportunities where yields are still attractive, or where the market hasn’t yet priced in the full recovery story. Some are more tactical, like KORE. Others, like CICT, are about building core exposure.

As always, I’m not betting on perfect timing. My aim is to stay diversified, disciplined, and aligned with both short-term opportunities and long-term fundamentals. If I’m wrong on timing, carry yields pay me to wait.

But enough about me — what about you? Which REITs are you buying or eyeing right now? At the end of the day, investing isn’t about perfect timing — it’s about staying consistent, letting dividends compound, and being patient enough to let the recovery play out.

Drop your thoughts in the comments, and if this post has been useful, do help this Uncle out by giving it a thumbs up and subscribing if you haven’t already.

Until next time, happy investing!

Leave a comment