Hey there fellow REIT investors, welcome back to the channel!

You know I always love a good REIT story. And I’m always on the lookout to invest in quality REITs. But there is a twist among the strong REIT market this year. When I did a deep dive into the top three performers over the last three months, I realised something surprising: there is only one which I’d keep my hard-earned cash in today!

Now, sometimes the best performers can be indicative of a recovery story, and have plenty of legs to run. But other times, they could also look too expensive after a rally, and valuations alone can be a reason to stay away. This time, valuation is not the issue. Most REITs, especially the smaller caps, have lagged so badly over the past few years that even after this strong run, I don’t think these top performers are overvalued.

So the reason I’m not allocating money to two of these REITs is because of other risks I see when I dig deeper. And even for the one I’m holding, I also see risks — but whether they play out will depend a lot on management’s actions.

So in this post, I want to share why I’m not chasing some of these top performers, even though they’ve outshone the rest of the market. And more importantly, what I’d need to see before I’d be ready to invest.

Before we start, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the REITs discussed, but what works for me might not work for you.

Let’s dive in.

Macro Backdrop: Why Small/ Mid Caps Are Running

Before looking into the individual names, let’s zoom out a little.

Over the last quarter, smaller and mid-cap REITs have often outperformed the larger, core REITs. This include the REITs we are discussing today.

So why did the smaller REITs outperformed? Let’s run through a few reasons.

First, smaller REITs were more beaten down last year. Many were trading at huge discounts to book value, with price-to-NAV as low as 0.2 – the prices were implying doomsday scenarios. So when the overall sentiment for REITs improved, these are the ones to shoot up.

Second, many of these smaller REITs are higher leveraged, with gearing ratio close to 45%. This means that they are more sensitive to interest rates. When interest rates and bond yields fall, that sensitivity works both ways — the risks are magnified on the way down, but the upside is magnified on the way up. So when interest rates in both Singapore and the US started to decline, the rebound was sharper for them than for the bigger, steadier REITs.

And finally, here’s something important: many of these smaller REITs come with their own idiosyncratic risks — concentrated assets, weaker sponsors, or higher refinancing needs. During downturns, the market punishes them heavily. But in good times, some of these risks are often pushed to the sidelines, and investors chase the rebound.

This is where we should pay close attention. The real question now is: are these risks truly behind us, or is the market just ignoring them for the moment? That’s why, even though I enjoy seeing these rebounds, I remind myself to take a step back and reassess the risks before rushing in. And this is the focus of my personal research findings today.

Prime US REIT: The Dividend Comeback (With A Ceiling)

The REIT with the third biggest jump in share price over the past three months is Prime US REIT. Prime’s share price has been nothing but volatile over this period – reaching a high of 40% gain at one point, but moderated to about 12% more recently. The rebound over this period has been driven by two main things: the macro story of falling US interest rates, and a clear shift in its distribution policy.

Previously, Prime shocked the market by slashing its payout ratio down to about 10% of distributable income in 2024, which made investors doubt its long-term viability.

But in September 2025, tied to its private placement announcement, management said it will raise its payout ratio significantly to at least 50% starting from 2H2025. That’s a big step towards normalising distributions.

Prime also declared an advanced distribution — 50% of distributable income for the period 1 July to 5 October 2025 — before issuing the new placement units. That move reassured investors that they wouldn’t be diluted unfairly.

Together, these announcements signaled that Prime’s cash flow position was stabilising, and with rate cut expectations lifting sentiment across the US office sector, the unit price staged a strong rebound.

Why I’m not buying: Capped Distribution, Lingering Risks

But here’s my concern. Prime’s rally is built on its plan to raise distributions back up to at least 50% of income from 2H 2025. That sounds good on the surface — but the fact that management is already putting a cap on payout ratio makes me uneasy.

Look at its peers. Keppel Pacific Oak US REIT and Manulife US REIT have both suspended distributions, but neither has come out to say, “When we restart, we’ll limit it to a certain percentage.” The assumption so far is that when they eventually recover enough to pay, they’ll return to a normal payout policy.

Prime, on the other hand, is signalling to the market that even when things improve, it still can’t pay out fully. To me, that suggests their cash needs are tighter, or their confidence in cash flow is weaker, than what the headline announcements imply.

Add to that the dilutive effect of the recent US$25 million private placement, and the ongoing structural weakness in US offices — vacancy rates remain stubbornly high, and landlords are still offering heavy incentives to keep tenants — and the risks start to outweigh the optimism.

So while the 50% payout announcement has given the market a lot of comfort, I’m not convinced it’s the full story.

What would change my mind: Prove It’s A First Step

For me to reconsider Prime, I’d need to see that this 50% payout ratio is just a starting point, not the endgame. If management can show that cash flows are strong enough to gradually raise payouts closer to a full distribution — not just keep it capped — that would build confidence.

If they can strengthen their balance sheet and move towards a more normalised payout policy, then I’d take another look.

Suntec REIT: Riding the Rate-Cut Wave, But Still Stretched

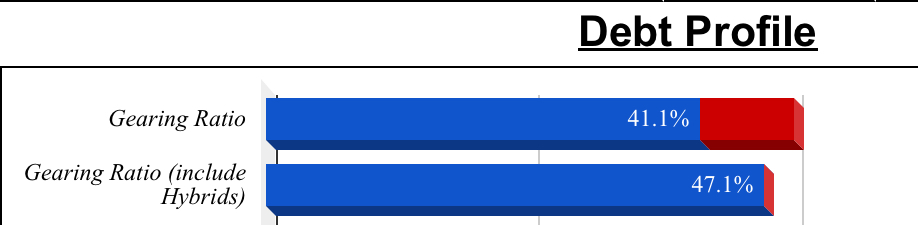

The REIT with the second biggest jump in the past three months is Suntec REIT at 16.8% – it has been one of the market darlings in recent months. Why? Because falling interest rates make highly geared REITs look more attractive. Suntec’s all-in financing cost has come down to 3.82% from 4.06%. Their gearing ratio also dropped to 41.1% from 42.4%, but more on that later.

On the operational side, the latest results showed DPU up 3.7% year-on-year to 3.155 cents in 1H FY2025, helped by cost savings. Rental reversions were strong: 10% for the Singapore office segment and 17.2% for retail. Those numbers gave the market confidence that Suntec’s properties are still competitive.

Why I’m not buying: Overall Gearing Still Too High

Suntec’s rally has been driven by optimism that high gearing matters less now that interest rates are coming down. But these are the issues I can’t ignore.

Firstly, while its gearing ratio has dropped to about 41%, which looks good on the surface, if we include perpetuals, the effective gearing is closer to 47%, not 41%.

[Source: http://www.REIT-tirement.com]

In fact, it recently issued $250m perpetuals to replace $200m of perpetual securities that are maturing – so overall gearing is up, not down.

In addition, Suntec’s interest coverage ratio or ICR is still relatively low. Although it has improved to 2.0 times from 1.9 times, it is still uncomfortably close to the regulatory threshold of 1.5 times.

Yes, their DPU ticked up 3.7% in 1H FY2025 and their all-in financing cost has eased to around 3.8%, but those positives don’t change the fact that their buffer on debt servicing is razor thin.

What would change my mind: Discipline, Not Just Sentiment

Here’s where I remain even more cautious. With Suntec, I haven’t heard the same commitment to reduce gearing and strengthen its balance sheet. Unlike the next REIT that we will be discussing, there’s been no clear message from management about reducing leverage or strengthening the ICR.

So for me, until Suntec shows a plan to actively lower gearing and improve ICR, not just ride on lower interest rates and strong reversions, I’ll stay skeptical. A few more good quarters might help sentiment, but without that capital discipline, I’m not ready to allocate money here.

By the way, if you’re finding this breakdown useful, hit the like button and subscribe so you won’t miss my next update. And if you’d like early access, consider joining as a member — it really helps me keep the channel going. Alright, let’s get back to the discussion.

Lendlease Global Commercial REIT: From Relief Rally To PLQ Fears

The top performing REIT over the past three months is none other than Lendlease Global Commercial REIT or LREIT. Its unit price has surged some 21% over the period, way ahead of the CSOP iEdge S-REIT Leaders ETF at about 6.7%.

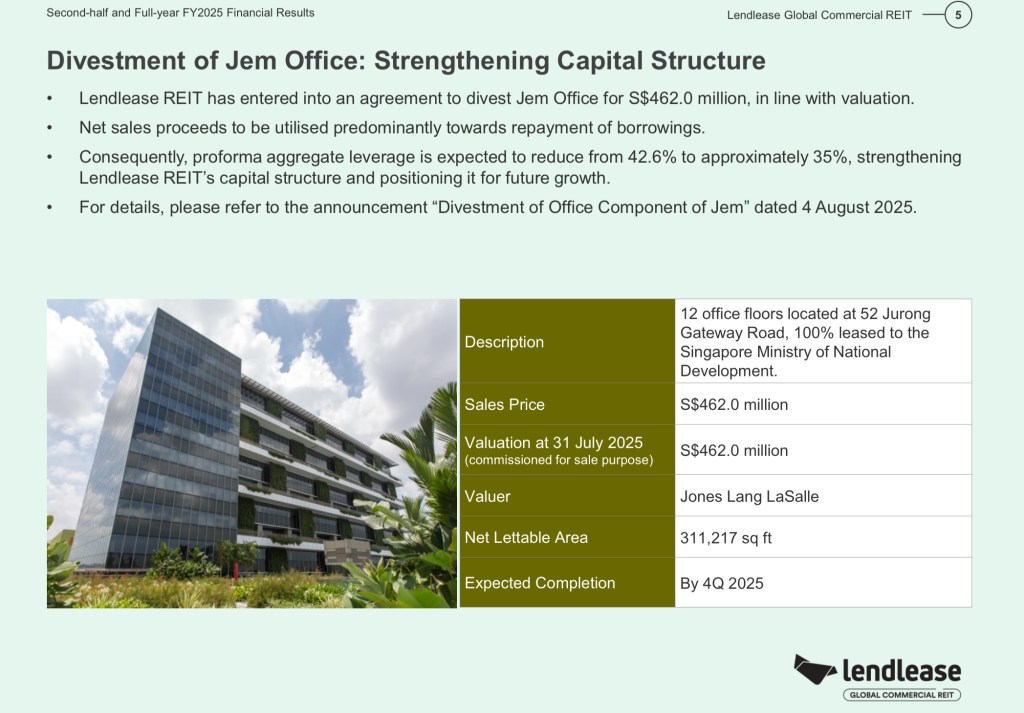

This came after it announced the divestment of its office component at JEM, which should bring pro-forma gearing down from around 42.6% to roughly 35%. This was a huge relief to the market, because previously, investors were worried about the REIT’s high gearing and very low interest coverage ratio (or ICR) — fears that went as far as questioning the longer-term viability of the REIT. And rightly so, because this situation didn’t come out of nowhere. LREIT had overextended itself with acquisitions like JEM and Parkway Parade, which raised debt levels without a significant improvement in yield.

So when the JEM office divestment was announced, investors felt like the REIT had bought itself breathing room. That sparked a relief rally — one that combined both balance sheet repair and continued strength in retail operations, where they reported positive rental reversions of about 10.4% in Q3 FY 2025. Add in the fact that the REIT trades at more than 40% discount to book value, and it’s easy to see why sentiment turned sharply.

What I’m not buying: PLQ Could Undo It All

Here’s the real sticking point for me: the market chatter about PLQ Mall. More and more analysts are talking about it, and many of them are actually cheering for L REIT to make the acquisition. But my view is the opposite.

The whole reason investors cheered the JEM divestment was because it reduced gearing and gave Lendlease breathing space. If management turns around and uses that space to buy a massive asset like PLQ Mall, then all that deleveraging effort would be undone.

And this isn’t just about numbers. It’s about capital discipline and strategy. If you’ve just sold down a stable office component to bring debt under control, why would you immediately regear and take on more risk? To me, that would send a worrying signal that management hasn’t learned from the overextension we saw with Parkway Parade. For me, until there’s clarity that PLQ is not on the cards, I’m not comfortable committing fresh capital.

On top of that, the interest coverage ratio is still extremely low at 1.6 times — right at the regulatory threshold of 1.5 times. That reflects a deeper problem: weaker property yields combined with high financing costs. And this isn’t something that gets fixed overnight. So even though gearing may look better on paper after JEM, the REIT is still running very tight on cash flow.

That combination — the fear of another large acquisition that analysts are applauding, plus an ICR problem that hasn’t gone away — is why I’m not buying Lendlease now, despite the relief rally.

Why I’m Holding: Commitment Shown, But Stay The Course!

At this point, you might be wondering: ‘Wait a minute Uncle, aren’t you still invested in one of these REITs?’ And yes — that’s right. LREIT is the top performer that I continue to hold. But let me be clear: I’m holding because management has so far shown commitment to strengthening the balance sheet. What matters now is that they stay disciplined and don’t deviate from that path.

Don’t get me wrong – I was impressed by LREIT management’s commitment to strengthen its balance sheet by going through with the sale of JEM office, but I’m concerned that market pressure to acquire another asset might be too big for them to ignore.

So until I’ve clarity, I’m applauding the rally from the sidelines with gains in my current holdings. And if they managed to retain discipline and improve their ICR, I’ll consider adding more.

The Dividend Uncle’s Take

So what’s the lesson here? When markets turn up, it’s always tempting to chase the top performers. After all, they’re the ones in the spotlight, they’re delivering headlines, and they make us wonder if we’re missing out. But here’s the truth: sometimes the biggest rallies come from the REITs with the biggest vulnerabilities.

With Prime, the promise of a higher payout is exciting, but it comes with a built-in ceiling and heavy reliance on market confidence. With Suntec, the operating numbers look better, but the balance sheet strain hasn’t really gone away — and unlike Lendlease, I don’t see management signalling that they’ll fix it. And with LREIT, the relief rally was real, and I’m impressed at the commitment, but the market is already cheering for another massive acquisition that could undo the hard work of deleveraging.

For two of these three top performers, the risks still feel bigger than the rewards. That doesn’t mean they can’t keep rallying — they very well might. But for me, investing is about sustainability, not just momentum. I’d rather wait for the fundamentals to truly line up before I put fresh cash in.

So my take? Celebrate the rally, enjoy the lift if you already own some of these names, but don’t feel pressured to chase them. Sometimes the best decision is to stay patient and keep your dry powder ready for when the right opportunity comes.

What about you? Would you chase the top-performing REITs while they’re hot, or would you wait for the fundamentals to prove themselves first? Let me know in the comments — I’d love to hear your take.

Leave a comment