Hey there fellow REIT investors, welcome back to the channel!

If you’ve been following me for a while, you’ll know I often call the U.S. 10-year Treasury yield my personal fear index for REITs. Why? Because whenever it shoots higher, REITs tend to struggle — borrowing costs rise, valuations compress, and dividend yields suddenly don’t look so attractive compared to “risk-free” Treasuries.

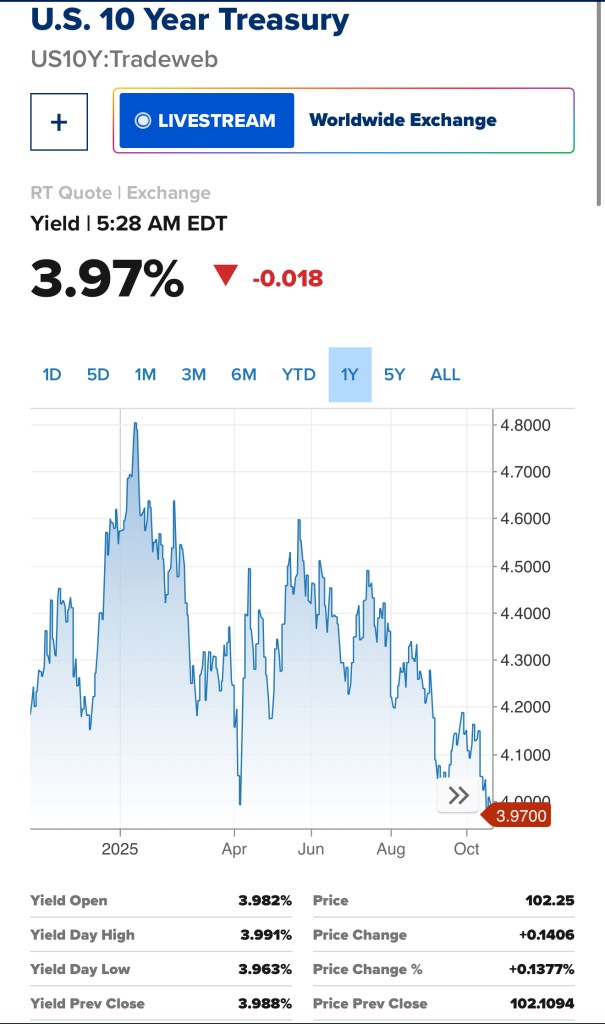

But something interesting just happened that I thought I must make this mid-week post! After months of hanging above 4%, the U.S. 10-year yield has finally dipped below that mark. When my fear index falls, does it simply mean REITs are entering a friendlier environment?

In today’s post, I’ll explain why this drop matters, what it means for REITs globally, and more importantly, the direct implications for Singapore REITs. We’ll also look at which REITs might benefit most, and how I’m personally positioning my portfolio.

Before we dive in, the usual disclaimer: this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the REITs discussed today, but remember — what works for me might not work for you.

Alright, let’s get into it.

Why the 10-Year Treasury Is My Fear Index

The U.S. 10-year Treasury yield is arguably the most important number in global finance. It influences mortgage rates, corporate borrowing, equity valuations — and yes, REITs.

When the 10-year shoots above 4% or even 5%, it usually means the bond market is worried about inflation, the Fed staying hawkish, or sticky high rates. For REITs, that’s a nightmare scenario. Every refinancing gets more expensive, property valuations get discounted harder, and suddenly a 6% REIT yield doesn’t look too compelling if Treasuries are paying 4.5%.

That’s why I call it my fear index. It’s not a perfect predictor, but it’s a simple gauge. When the yield climbs, I get more cautious. When it falls, I start to breathe easier.

Right now, we’ve just seen it dip below 4% after a long time. And that’s significant because in this cycle, 4% has been something of a psychological dividing line. Above 4%, REITs struggle to get attention. Below 4%, investors may start reconsidering them as attractive yield plays.

Why the Drop Below 4% Matters for REITs

So what does this move really mean? Let’s break it down.

First, borrowing costs.

REITs are debt-heavy vehicles. The average Singapore REIT runs gearing of about 38% to 43%, which means they rely on cheap funding to support acquisitions and distributions. When the benchmark 10-year falls, it filters into lower swap rates, lower refinancing costs, and ultimately more distributable income.

In fact, average funding costs across S-REITs have already come down by around 10 basis points quarter-on-quarter. That may sound small, but across billions in debt, it translates into millions in savings.

Second, yield spreads.

C.I.C.T. is yielding about 5%. That’s a 1% spread over Treasuries today — not massive, but remember, just a few months ago Treasuries were yielding close to 5%, wiping out REITs’ relative appeal. Now with Treasuries below 4%, the gap is widening again, and that could be the spark investors needed.

Third, property valuations.

Lower long-term yields reduce the discount rate applied to future rental cash flows. That lifts net asset values. Many REITs are still trading at around 0.9x book value, so there’s room for re-rating if yields remain low.

So in short: falling yields bring down financing costs, improve relative attractiveness, and support asset values. All three are clear positives.

The Singapore Context: Are We at the Start of the Next Leg Up?

One thing to keep in mind. REITs in Singapore have already staged a strong rally since the start of the year, helped first by falling local interest rates. When the U.S. Fed finally began cutting rates in September, the rally gained more momentum, and the C SOP iEdge S-REIT Leaders Index moved even higher.

So the question now is this: with the U.S. 10-year yield breaking below that key psychological level of 4%, could this be the trigger for the next leg of the upturn? Historically, big moves in the U.S. 10-year have acted as inflection points for REITs globally, not just in the U.S. If investors start believing that the era of elevated rates is firmly behind us, we could see valuations re-rate further, and capital flow back into the REIT sector in a bigger way.

That’s why this drop below 4% matters. It’s not just a number on a chart — it could be the catalyst that determines whether the current rebound has more legs, or whether it stalls.

And if you’ve made it so far, I thank you for your support! I’d truly appreciate it if you can hit the ‘like’ button and subscribe to the channel. Let’s jump back in!

What Could Go Wrong?

Now, before we all celebrate the drop in yields and rush to buy REITs, let’s pause for a reality check. Lower bond yields are a tailwind, but they don’t magically remove every risk.

First, the global economy is still fragile.

The reason yields are falling is partly because inflation looks under control, but also because bond investors are increasingly pricing in weaker growth. If the U.S. slips into a sharper slowdown, or if Europe and China continue to drag, lower financing costs don’t help much if tenants are struggling to pay rent or if new leases are signed at lower rates. That’s the key risk for overseas-focused S-REITs like Prime, Manulife US, or even CapitaLand China Trust.

Second, let’s not forget the risks at home in Singapore.

Even Singapore-focused REITs — which many investors see as safe havens — aren’t immune. Yes, suburban malls like those owned by Frasers Centrepoint Trust are more resilient, but retail sales growth has softened, and households are tightening discretionary spending under inflationary pressures.

On the office side, CapitaLand Integrated Commercial Trust has shown strong reversions, but Singapore’s CBD office supply pipeline in the coming years could bring more competition. Hospitality REITs like C.D.L. Hospitality Trust may benefit from tourism, but a global recession would put pressure on travel demand again.

Third, refinancing risks are still very real.

Yes, yields are falling, but the absolute cost of debt is still higher than what REITs were used to five years ago. Many S-REITs locked in loans at ultra-low rates around 2%. Even refinancing today at 3.5% is a jump that eats into distributable income. Lower yields help, but they don’t bring us back to the 2020 era of cheap money.

So, while I’m positive that my fear index falling below 4% is a big relief, I’m also very aware that it’s not a silver bullet. Investors who jump in expecting an immediate REIT bull run may be disappointed if property fundamentals stay sluggish.

The Dividend Uncle’s Take

So where does all this leave us?

Yes, the U.S. 10-year yield falling below 4% is great news. It’s my fear index dropping, and it removes a huge headwind for REITs. Financing costs will ease, yield spreads look attractive again, and valuations have room to re-rate. That’s the core message of today’s post.

But let’s be clear: lower interest rates are not the be-all and end-all for REITs. Interest costs are just one side of the equation. You can have cheaper debt but still face big challenges if retail sales growth is sluggish, if new office supply is coming into the market, or if tenants are struggling in a weaker economy. Even Singapore-focused REITs, which many people treat as safe havens, are not immune to those risks.

And then there are the idiosyncratic risks of individual REITs. Suntec REIT, Lendlease Global Commercial REIT, are just some of the REITs I discussed last week. Watch it if you have not.

Even a blue-chip like Mapletree Logistics Trust isn’t risk-free. While it benefits from strong demand for warehouses, trade volumes in Asia have been slowing, and any prolonged downturn in exports could still dent rental growth.

The point is: while the macro environment is turning supportive, we can’t ignore the fundamentals or the discipline of each REIT’s management team. Lower rates give the sector breathing room, but they don’t guarantee strong distributable income growth or eliminate execution risk.

That’s why I personally stay focused on the high-quality, core names — C.I.C.T., CapitaLand Ascendas REIT, and Mapletree Industrial Trust — because they combine lower financing costs with strong sponsors and resilient assets. For the rest, I’ll only get comfortable once I see the risks addressed, whether that’s strengthening the balance sheet, proving rental demand, or showing capital discipline.

So, what’s the lesson today? My fear index — the U.S. 10-year Treasury yield — has dropped below 4%. That’s a green light for REIT investors. Financing costs are set to fall, spreads are improving, and valuations have room to re-rate. It doesn’t solve every problem, but it removes one of the biggest obstacles we’ve faced in the past two years.

So what about you? Do you think this break below 4% marks the start of the next big REIT rally, or is it just a temporary dip? Let me know in the comments — I’d love to hear your take.

Until next time, stay patient, stay disciplined, and keep chasing those dividends. Your Dividend Uncle, signing off.

Leave a comment