Hey there fellow dividend investors, welcome back to the channel!

This series — where I share the actual stocks I’m buying, selling, and watching — has been one of the most popular on the channel. The support has been amazing, and I want to thank you all for that.

I’m glad that many of you are seeing value in the real decisions I’m making in my own investment portfolio, not just pure commentary or theories with no skin-in-the-game. At the same time, I’m sure you understand that these are my personal decisions for your reference only, and may not be suitable for your portfolio.

So here we go again. I’ve made some important moves. I added two dividend stocks, trimmed two others, and there’s one I’m still eyeing in November 2025 but haven’t bought yet. And the mix this time might surprise you — because some of these names are market favourites, while others are still being overlooked.

As always, a reminder that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed adviser before making any investment decisions. I own some of the shares discussed, but remember what works for me might not work for you.

Alright, let’s dive in.

CapitaLand Investment – A Value Buy Hiding in Plain Sight

Let’s start with CapitaLand Investment, or CLI for short.

This is one of Singapore’s most important real estate and fund management players. It was spun off in 2021 when CapitaLand split into two — CapitaLand Development for the property development side, and CLI for investment management and recurring income. Today, CLI manages a portfolio of listed REITs, private funds, and property investments across Asia and beyond.

But here’s the interesting part: despite being such a central player in Singapore’s REIT ecosystem, CLI’s share price has barely moved this year. Year-to-date, it’s up only about 1%. Compare that with other blue chip stocks and REITs in Singapore — many of them have re-rated upwards as interest rates came down. For instance, SingTel is up almost 40%, while Keppel Corp is up almost 50% year-to-date. CLI, on the other hand, feels overlooked.

Yet at current prices, CLI offers a dividend yield of about 4.5%, which is fairly attractive compared to the other blue chips. And this is not some small-cap with uncertain cash flows. This is the group that sits behind the top Singapore REITs we all know: CapitaLand Integrated Commercial Trust, CapitaLand Ascendas REIT, CapitaLand Ascott Trust. All managed under CLI.

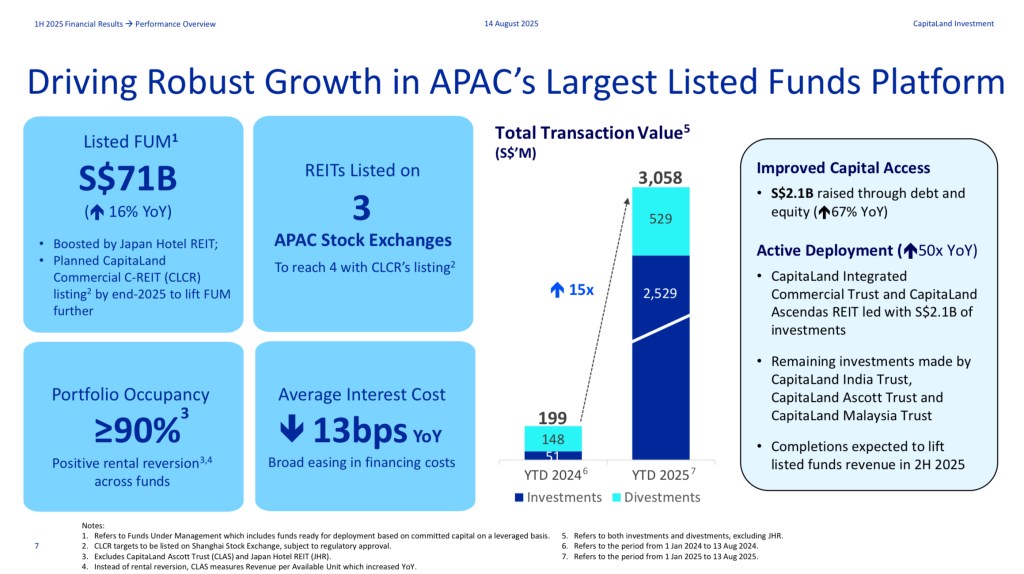

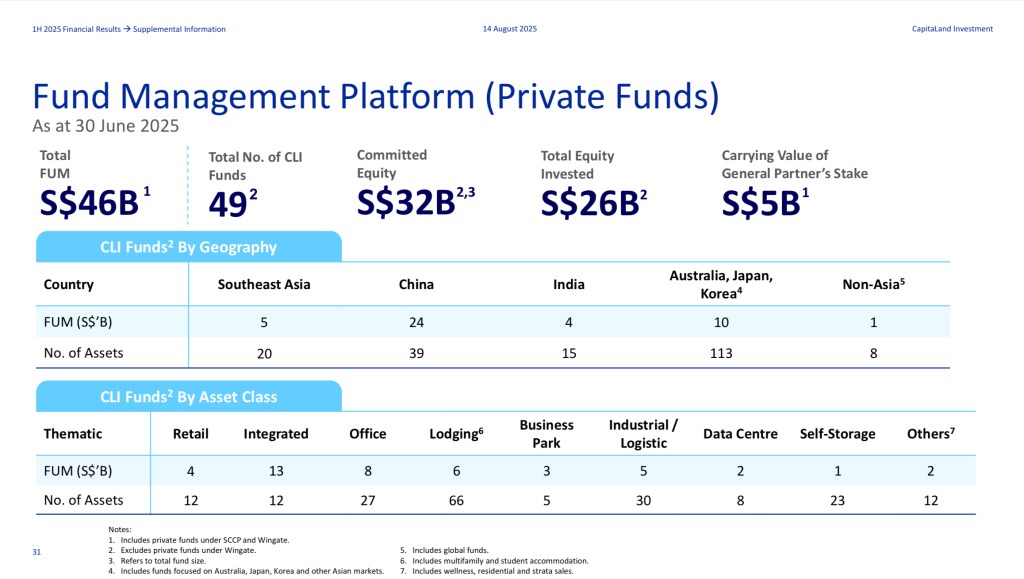

Let’s put numbers to it. CLI’s listed funds under management (or F.U.M.) now stand at $71 billion, up 16% year-on-year. It is APAC’s largest fund management platform. For comparison, Brookfield and Blackstone are in the $900 billion-plus league — but CLI is building scale in Asia the way they did in North America. It has deployed $635 million of funds year-to-date and is targeting another $2 billion F.U.M. over the next 12 months.

The recent listing of CapitaLand China Retail Trust (or CLCR) was another milestone. This adds to their suite of listed REITs and proves they can execute even in a tough environment for Chinese assets. And speaking of China — CLI still has heavy exposure there. Many investors see this as a risk, but I see it as a value opportunity. Chinese recovery may be gradual, but the market hasn’t priced in much optimism at all.

Now, if you’ve been following the channel, you’ll know I just covered Keppel’s five-year transformation last week. Keppel is also positioning itself as a global asset manager, and it’s done a great job so far. But here’s the difference: Keppel’s share price has already surged about 230% over five years, and almost 50% year-to-date. CLI, by contrast, has hardly moved.

Valuations reflect this. At current levels, Keppel trades at about 18x forward PE, while CLI trades at around 15x forward PE. Both are credible managers with scale and ambitions, but CLI feels like the one where the market hasn’t woken up yet.

To me, that’s exactly the appeal. CLI gives me exposure to Asia’s top REIT manager, growing recurring fee income, and a 4.5% dividend yield — all while being overlooked. That’s the kind of value buy I like to tuck into my portfolio over the long term.

JPMorgan Equity Premium Global ETF (JEPG) – My Dividend Yield Booster

Next up, the second stock I bought recently is not a Singapore stock but a global ETF listed in London: JEPG.

Now, some of you may remember I’ve covered JEPG before. This is the JPMorgan Equity Premium Global ETF, designed to deliver steady income through an option-writing strategy. Essentially, the fund buys a diversified portfolio of lower-beta global equities, then writes call options to generate additional income.

So why did I add more? The answer is simple: dividend yield.

In 2025, we’ve seen interest rates finally coming down, both in Singapore and in the US. As a result, a lot of blue-chip dividend stocks have rallied. Think the banks and defensive names like NetLink Trust and Singtel. Their share prices are up, which means their yields are compressed. A stock yielding 5% a year ago might now be giving you less than 4%.

JEPG, however, continues to deliver around 7% yield, paid monthly. On top of that, the ETF has managed about 3% per annum in capital appreciation since launch 2 years ago. Put the two together, and you’re looking at a total return of around 10% per annum.

Of course, there’s no free lunch. The upside for JEPG is capped. Because of its option-writing strategy, you won’t get the kind of big capital gains you might see from growth stocks or even broad equity ETFs. But I don’t expect that here. For my dividend portfolio, I want reliable income. And JEPG has been delivering exactly that.

For context, compare it with its US-listed sibling, JEPI. That fund yields around the same but is more US-heavy. JEPG is globally diversified, which helps reduce single-country risks.

So I’m not buying JEPG for growth. It’s not in my growth portfolio. I’m buying it for the yield. It’s my dividend booster, complementing my core holdings in Singapore REITs and blue chips.

Before I move on, I just want to take a quick moment to thank all of you for the support — and a warm welcome to our new channel member, Huan Shan. Really appreciate you joining the community.

And if you’ve been enjoying this post, do me a favour — hit the like button so the algorithm knows this is worth showing to more dividend investors. And if you’re new here, subscribe so you won’t miss the next update.

Alright, let’s get back into the stocks.

City Developments – Time to Say Half A Goodbye

Now let’s talk about one of the two stocks I sold. And this one has been in my portfolio for a long time: City Developments, or CDL.

CDL is one of Singapore’s largest property developers, with a footprint in residential projects, commercial buildings, and hospitality assets worldwide. Many of us know their projects — from South Beach in Singapore to properties in China, the UK, and beyond.

Unfortunately, CDL has been a frustrating stock to own. I first bought it back in 2021, thinking the worst was behind it in China. But it turned out, that was just the start of the pain. Over the past few years, CDL has faced high debt, FX losses, and even boardroom drama that eroded investor confidence.

2025 looked like a turnaround year. The stock is up about 40% year-to-date. Profits in 1H FY2025 came in at $91.2 million, up 3.9% year-on-year. Interest costs have come down slightly, from 4.4% to 4.0%, thanks to falling rates. Projects like Copen Grand and The Myst were completed and recognised, contributing to earnings. And the sale of their stake in South Beach is set to add about $465 million in gains.

All of this explains the rally. But here’s the issue: gearing remains at around 70%, among the highest in its peer group. UOL, for instance, runs at a much more conservative level. CDL’s debt profile still worries me. FX losses continue to pop up. And while falling rates are a tailwind, I don’t see them fixing the deeper structural risks.

For me, the clincher was psychological. After years of holding, I finally broke even. And sometimes the best decision is the simplest one: take the chance, say thank you, and move on. With CDL’s rally driven more by sentiment than long-term fundamentals, I chose to sell half my holdings, and reallocate my cash elsewhere.

ST Engineering – Trimming Into Strength

The second stock I sold — or rather, trimmed — is ST Engineering.

ST Engineering is one of Singapore’s crown jewels in engineering, spanning defence, aerospace, and urban solutions. It’s a name synonymous with reliability. And in 2025, it’s been delivering.

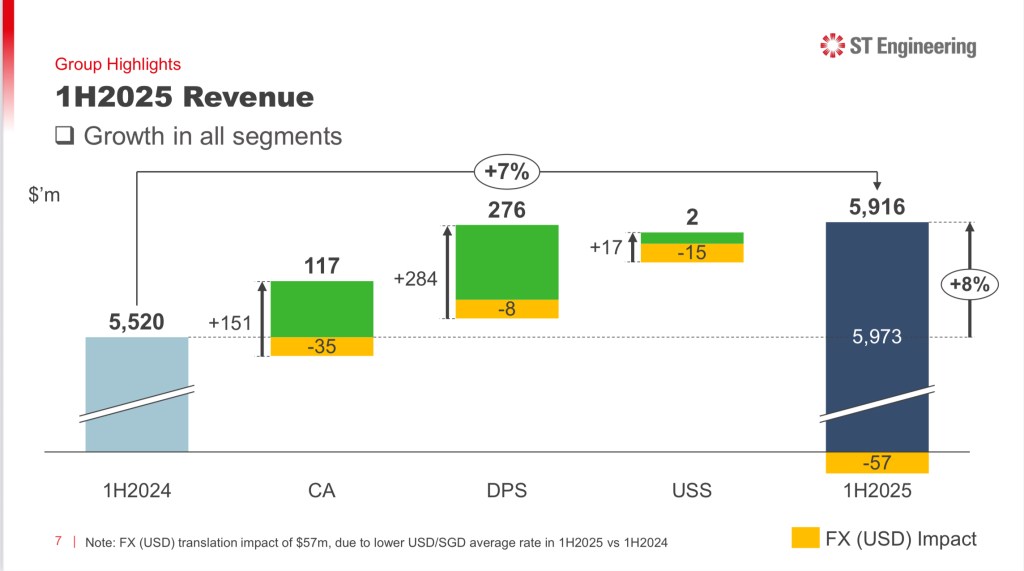

The numbers show it clearly. In 1H 2025, revenue rose about 7% year-on-year. PATMI jumped nearly 20%. Interim dividends remained steady, supported by strong cash flows. The order book hit a record $31.2 billion, with $5 billion scheduled for delivery in the rest of 2025.

On the aerospace side, ST Engineering opened a new M.R.O. facility in Paya Lebar, doubling its production capacity to over 300 engines a year by 2027. Combined with its Xiamen facility, total capacity will exceed 400 shop visits annually. This positions the group squarely in the global LEAP engine maintenance cycle, which is set to spin for years.

Urban solutions have also been adding. ST Eng secured contracts for the Thomson-East Coast Line Extension, covering communications and platform screen doors. Defence, of course, remains a steady long-cycle anchor.

So why did I trim? Simply put: valuation.

ST Engineering’s stock has had a strong run-up, rallying 80% year-to-date, to trade at a forward PE of around 28x, above its 5-year average of 17x. The dividend yield, once comfortably above 4%, has now compressed to below 2%. At these levels, I felt it was prudent to ring the register.

Don’t get me wrong — I’m not exiting entirely. This is still a quality company with global visibility few Singapore names can match. But after such a rally, the risk of underperformance grows. So I took some profits off the table, while keeping a core stake for the dividends and long-term exposure.

Boustead Singapore – Eyeing a Potential REIT Catalyst

Finally, let’s talk about the one stock I’m eyeing but haven’t bought yet: Boustead.

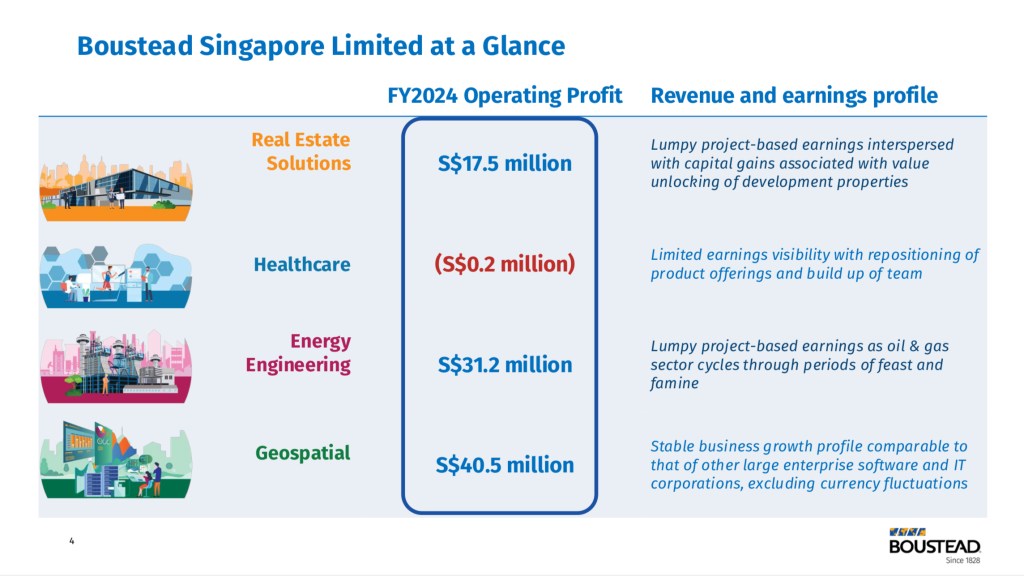

Boustead Singapore is a multi-industry conglomerate with businesses spanning real estate, engineering, and geospatial solutions. Recently, though, its spotlight has been on one transformational move: the proposed listing of U.I. Boustead REIT.

The planned REIT will start off with a portfolio of 23 properties valued at around $1.9 billion. Most of these are leasehold industrial and logistics assets in Singapore, with 2 freehold assets in Japan. Boustead is expected to retain close to 17% of the units upon listing, giving it both liquidity from the divestment and recurring income through distributions. On top of that, the structure comes with a right of first refusal pipeline, meaning Boustead could monetise more assets in the future through the REIT while still keeping exposure. It’s a model we’ve seen play out successfully in other spin-offs — Centurion’s Centurion Accommodation REIT or CAREIT for short, which is a living accommodation REIT investing in purpose-built worker and student accommodation assets, being one example.

What makes this more interesting is Boustead’s financial strength going into the deal. The company is sitting on a net cash pile of $326 million, which is nearly 35% of its market cap. Debt is negligible. Management even had the confidence to lift dividends by 36% to 7.5 cents per share for FY2025, including a special dividend of 2 cents. That’s the conviction of the underlying businesses.

The operating numbers are also holding their ground. The Geospatial division delivered record operating profit of $51.9 million, driven by a high-margin product mix. The engineering arm secured $377 million of new contracts, more than double the year before, building up a healthy backlog of $349 million. Together, these give visibility that the topline weakness may be reversing. At its recent share price of about $1.79, Boustead offers a 4.2% dividend yield that looks sustainable even if margins in Geospatial normalise.

So where does this leave me? Boustead has already surged more than 70% year-to-date, as investors priced in both small-cap optimism and anticipation of the REIT spin-off. The fundamentals — strong cash, low debt, resilient divisions — mean this isn’t just speculation. But after such a big run-up, the challenge is whether there’s more upside left once the listing excitement is baked in.

For now, I’m keeping Boustead firmly on my radar. The REIT listing could be a game-changer that unlocks long-term value, but I want to study the valuation of the IPO portfolio and see how management redeploys recycled capital before committing my hard-earned cash.

The Dividend Uncle’s Take

So what ties all these moves together?

For me, it’s discipline. Knowing when to buy value that’s overlooked, when to trim after a strong run, and when to simply wait and watch. Dividend investing isn’t about chasing every rally — it’s about building a portfolio that can deliver income steadily, year after year.

And I think this is exactly why these posts have become some of the most popular on the channel. It’s not theory, and it’s not hype. It’s me showing you the actual decisions I’m making — the good, the bad, and sometimes the tough ones. And along the way, I hope the lessons I’ve learned help you with your own portfolio.

This month, I bought where I saw overlooked value, trimmed where the market looked stretched, and kept one interesting stock on my radar. It’s not about being perfect. It’s about staying patient, disciplined, and always focused on dividends.

If you want me to keep doing these portfolio updates, let me know by hitting the like button — it really tells me these posts are valuable to you. And of course, subscribe if you haven’t already, so you won’t miss the next update.

Thank you again for supporting this series — your encouragement is what keeps me going. Until next time, stay patient, stay disciplined, and happy investing!

Leave a comment