Hey fellow REIT investors, welcome back to the channel.

Some REITs make headlines with huge moves. Others make money by quietly doing their job regardless of what the economy throws at them. Today, I want to talk about two of those quiet achievers — CapitaLand Ascendas REIT and Mapletree Industrial Trust.

Both are giants of Singapore’s industrial REIT space. We love them because both have kept their dividends relatively steady through one of the most challenging interest-rate cycles we’ve seen in years. Yet under that calm surface, they’ve been taking very different paths to achieve that same amazing outcome.

With one REIT still building strength and the other repairing past cracks, the key question now isn’t just how they’ve performed — it’s whether both still deserve a place in our portfolios for the years ahead.

As always, a reminder that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed adviser before making any investment decisions. I own some of the REITs discussed, but remember what works for me might not work for you.

Alright, let’s dive in.

CapitaLand Ascendas REIT – The Steady Builder

Let’s start with CLAR, because this is the REIT that feels like that dependable friend — the one who doesn’t chase excitement, but always shows up when you need them.

Across the past few quarters, CLAR has done exactly what a core REIT should: deliver consistency.

Strong Yet Predictable Financials

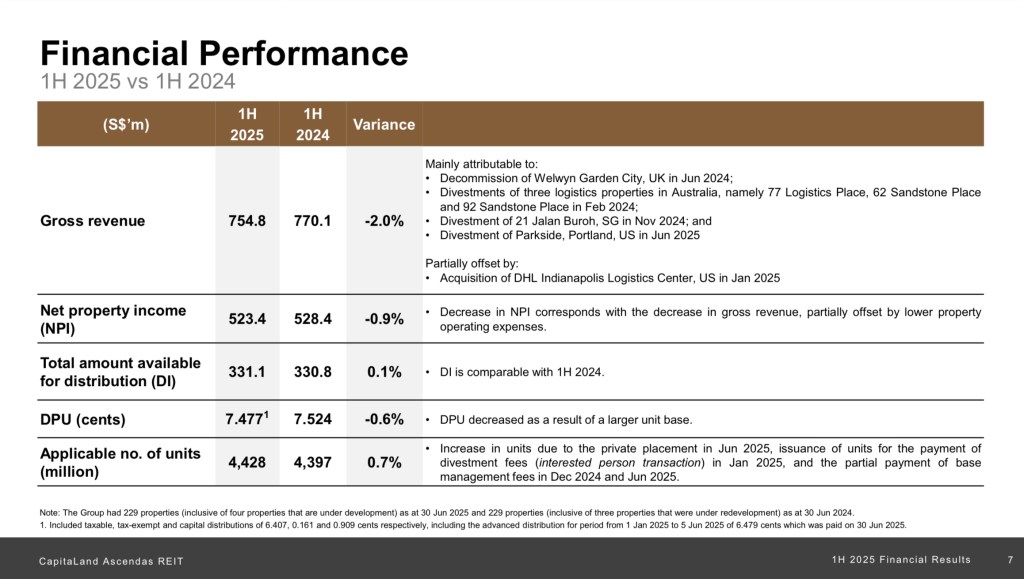

For 1H 2025, CLAR’s DPU came in at almost flat year-on-year, at 7.477 cents. That may sound boring — but in the REIT world, which has been bombarded by higher interest rates, boring can be beautiful.

In the latest quarter, occupancy dipped slightly to 91.3% from 91.8% the previous quarter, largely because of ongoing asset-enhancement works. Rental reversion stayed positive, easing from +8.0% to +7.6% — still strong by any measure.

And even after a $1.3 billion spree of Singapore acquisitions, cost of debt remained stable at 3.6%, with leverage still under 40%.

That’s financial discipline in action.

Singapore as the Engine Room

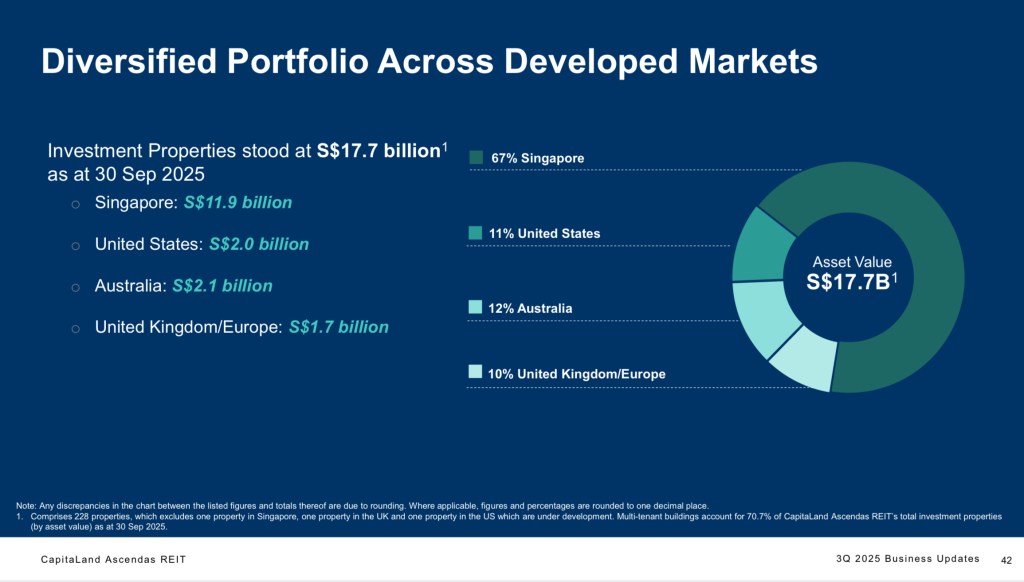

CLAR’s pivot toward Singapore is unmistakable. About 60% of portfolio value sits at home, concentrated in high-spec industrial properties, logistics hubs, data-centre facilities, and science-park assets.

Its recent buys — the 9 Tai Seng Drive data centre and 5 Science Park Drive life-science hub — both yield around 6% to 7% and would benefit from long-term structural demand. These assets strengthen CLAR’s exposure to two powerful megatrends: digitalisation and biomedical innovation.

At the same time, the REIT sold off $381 million worth of older properties at 7 percent above book value and reinvested the proceeds into newer, higher-yield assets. It’s a classic capital-recycling loop — pruning mature trees to plant new ones. Management’s ability and willingness to do that consistently reflects well on the REIT.

Global Diversification & Tenant Diversity: Steady but Strategic

While Singapore remains CLAR’s anchor, its overseas exposure — across Australia, the United States, and Europe — adds a quiet but important layer of diversification.

These foreign assets make up about 40% of portfolio value, and they aren’t just passive holdings just for the higher yields. In Australia, for instance, logistics and warehouse assets have enjoyed strong tenant retention, supported by long WALEs and inflation-linked rent structures. The U.S. and Europe exposures are smaller but targeted — focusing on technology parks and light industrial nodes tied to established tenants rather than speculative builds.

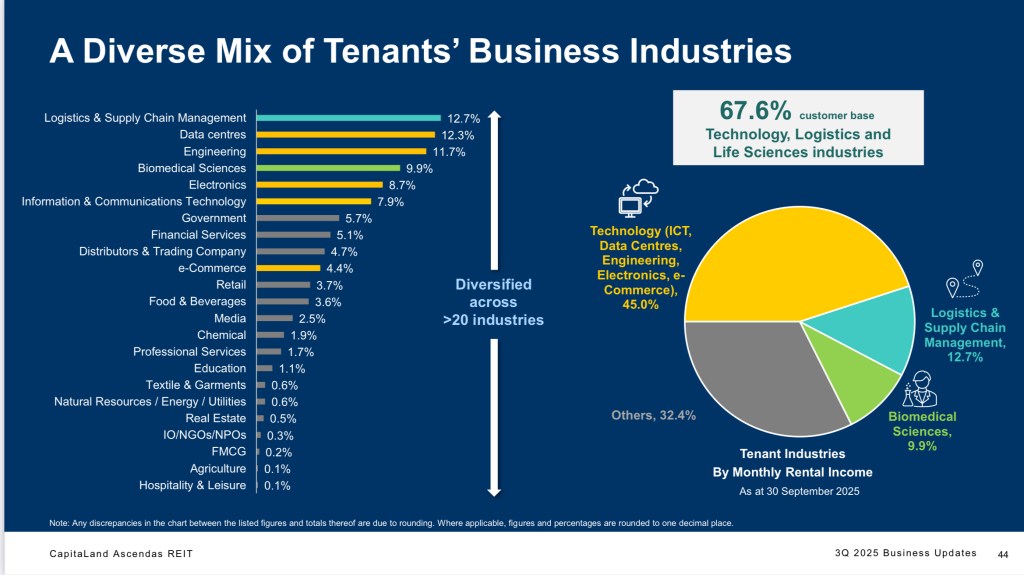

Another often-overlooked strength lies in tenant diversity. No single tenant contributes more than 5% of gross revenue, and the top ten tenants collectively make up less than a quarter of total income. That means CLAR’s cash flow isn’t reliant on any one sector. Its tenant base spans technology, logistics, biomedical, and engineering industries, giving the REIT a broad earnings cushion even if one segment slows.

The key contrast would be against data centre REITs, like Keppel DC REIT, with the top tenants often accounting for up to 40% of gross revenue.

Together, these features explain why CLAR’s numbers often look unexciting — because it’s designed that way. It’s not chasing hot trends; it’s built to smooth out cycles.

Redevelopment: The Quiet Growth Catalyst

Beyond acquisitions, CLAR’s ongoing redevelopments — like 1 Science Park Drive and 5 Toh Guan Road East — are adding modern, energy-efficient space with better tenant quality and higher rent per square foot. These projects don’t grab headlines, but they build resilience year after year.

In Singapore’s tightening supply of prime industrial space, those upgraded buildings are likely to command premium rents — which is why analysts often call CLAR a slow compounding machine rather than a cyclical trade.

Why the Cost of Debt Hasn’t Fallen

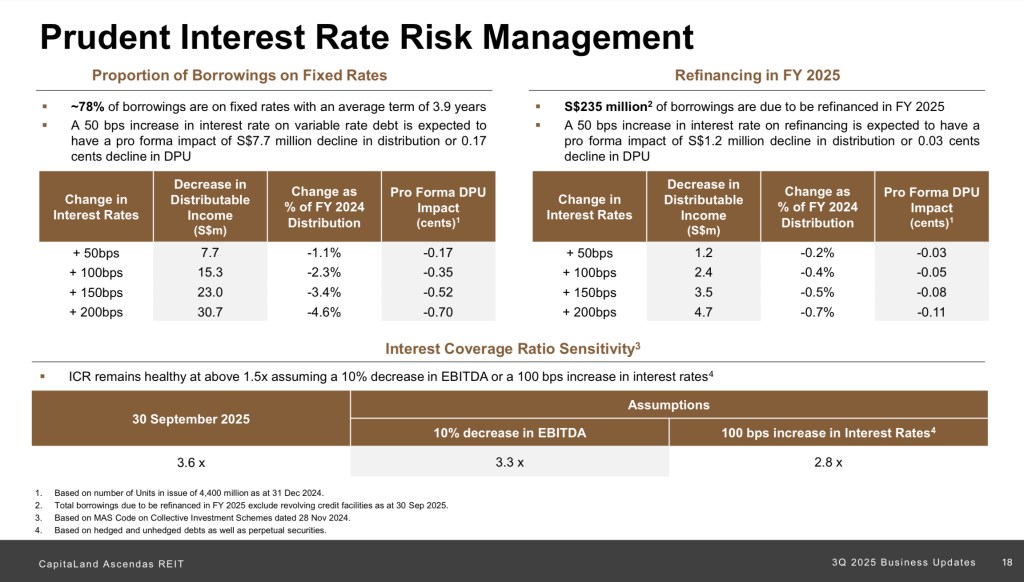

Many investors asked me: “Interest rates are falling — why is CLAR’s cost of debt still 3.6 percent?” This is similar to 4 quarters ago.

The reason is structural. About 78% of CLAR’s borrowings are fixed-rate, and a good portion of its bonds were issued when global credit spreads were still wide. That fixed structure has protected CLAR from volatility — but it also delays the benefit of lower rates until those loans roll off in FY2026 or later.

In other words, CLAR is deliberately trading short-term gains for long-term certainty.

Valuation and Yield Perspective

At recent prices, CLAR’s yield sits around 5.4%, close to its ten-year average. That means it’s not “cheap” — but it’s also not stretched. What you’re really buying here is reliability: a portfolio of future-ready assets backed by both its parent CapitaLand’s scale, and its own size.

Personally, I’m an investor who values predictable income with low drama. That’s why CLAR remains one of the most solid anchors in my Singapore REIT portfolio. Its growth is measured, its leverage is disciplined, and its operational playbook is built for compounding.

If you find this sharing of my in-depth, data-driven analysis useful, you can support the channel simply by giving this post a “like” — it helps the algorithm reach other dividend investors who appreciate steady income over hype. And of course, subscribe if you’d like to stay updated on Singapore REITs, dividend stocks, and the broader income-investing world.

Alright, back to the post.

Now, let’s switch gears — because while CLAR is busy building strength, MIT’s story right now is about fixing weakness. And for investors like us, that contrast is exactly what makes both worth holding.

Mapletree Industrial Trust – The Patient Rebuilder

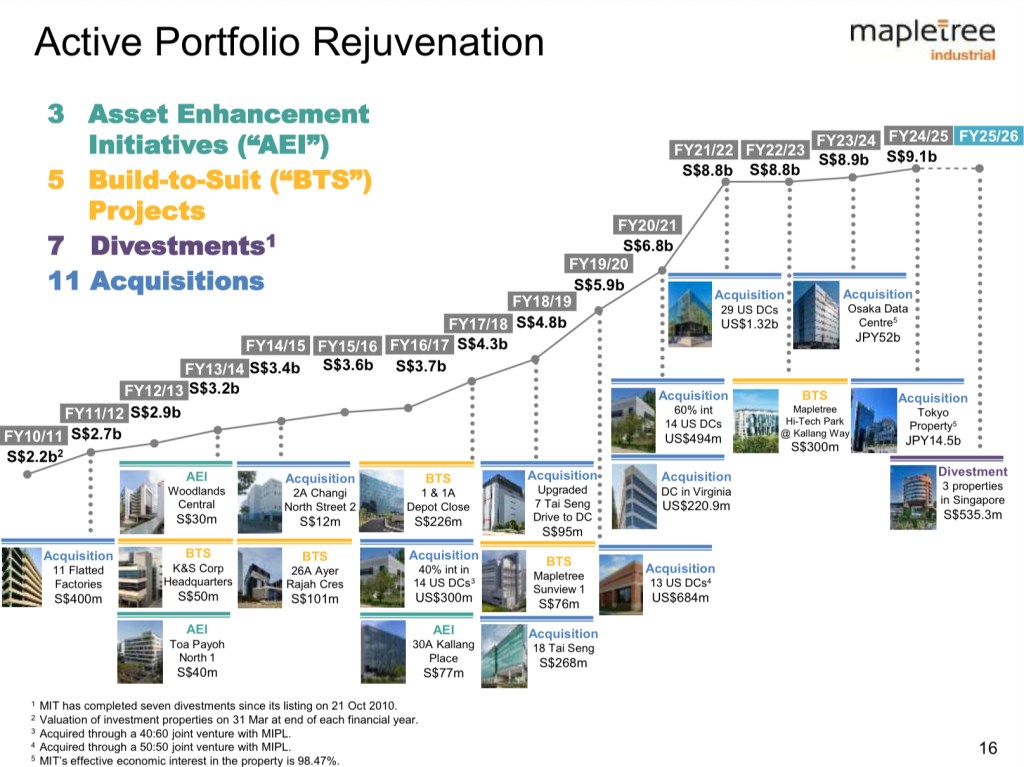

MIT has been one of the most talked-about REITs in recent quarters, and for good reason. After years of expanding into North American data centres, the trust is now navigating the tricky middle phase — managing lease expiries, stabilising occupancy, and proving that those overseas assets can deliver consistent cash flow.

Financial Trends: Short-Term Pressure, Stable Core

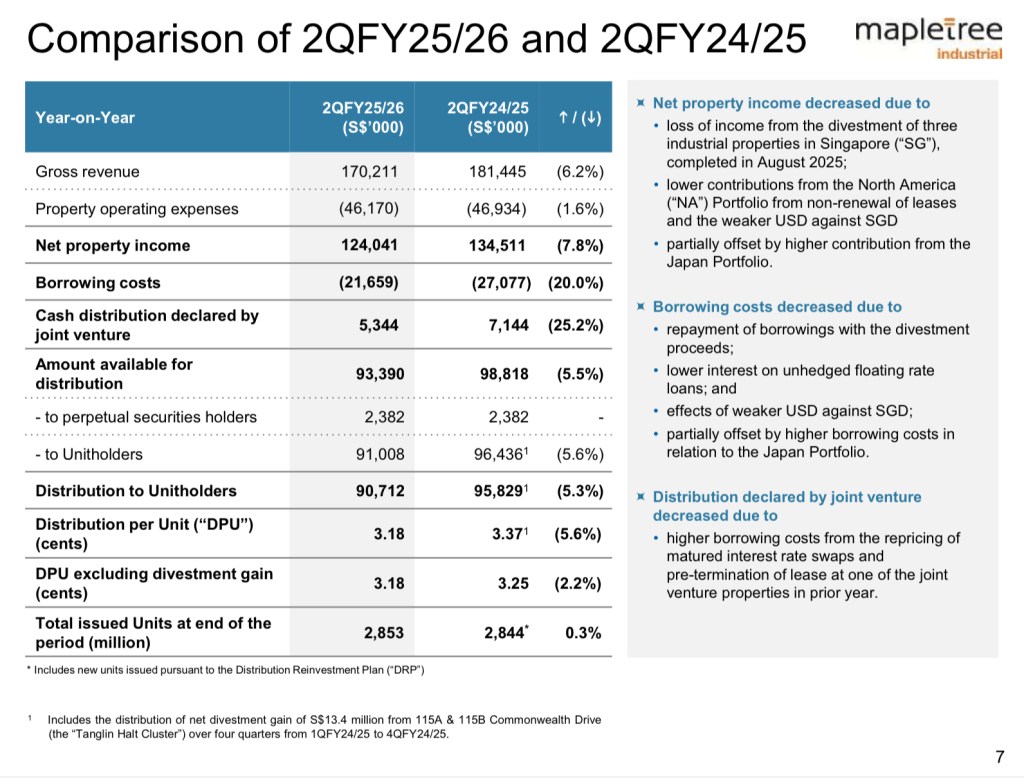

In the latest quarter, MIT’s DPU drifted lower from 3.37 cents a year ago to 3.18 cents. That’s about a 5.6% decline year-on-year — not ideal, but controlled. To me, that’s very mild, especially given market concerns about the impact of the North American data centre properties, which I’ll discuss further in a while. In fact, if we exclude the one-time divestment gains a year ago, the decline in DPU is much lower, at only 2.2%.

For context, NPI fell 7.8% to $124.0 million in Q2 FY25/26, but was helped by a 20.0% decline in borrowing costs at $21.7 million. The recent soft patch came from loss of income from the divestment of Singapore properties, a weaker U.S. dollar, and temporary vacancies in a handful of smaller U.S. data centres.

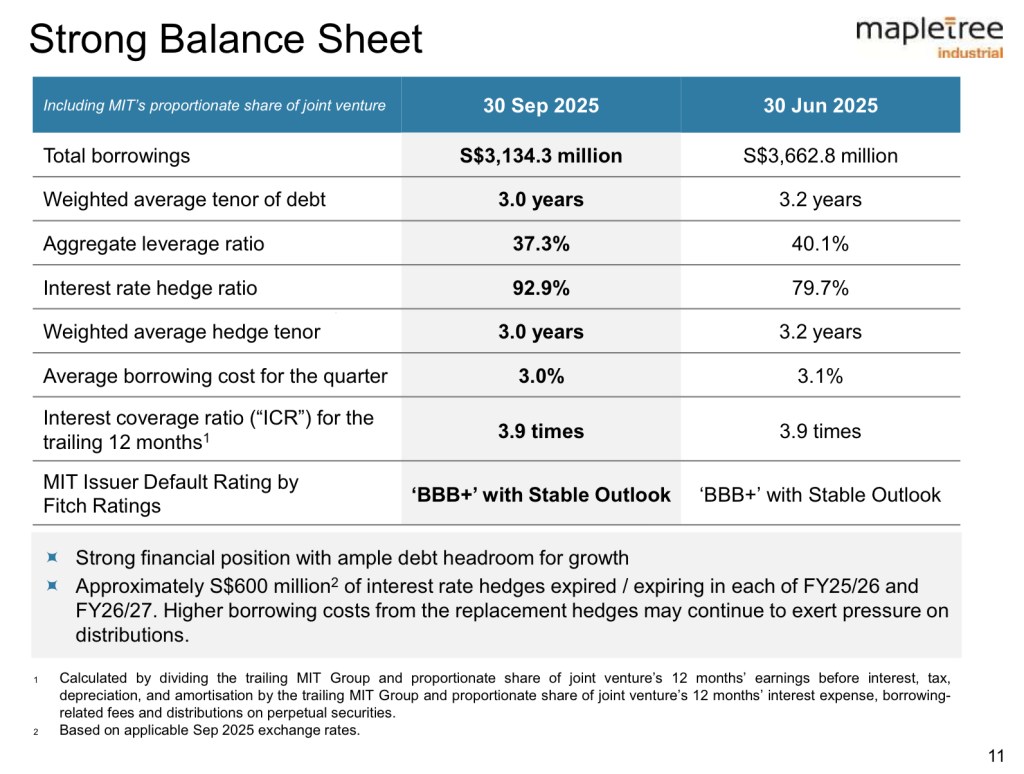

Meanwhile, the balance sheet is healthy: gearing is 37.3%, cost of debt is about 3.0%. And these are even more reassuring: nearly 93% of borrowings are fixed or hedged, with interest coverage ratio or ICR at 3.9 times. That means even as income softens temporarily, the financial risk remains contained.

North America Data Centres – The Pressure Point

Let’s zoom into the elephant in the room — those North American data centres.

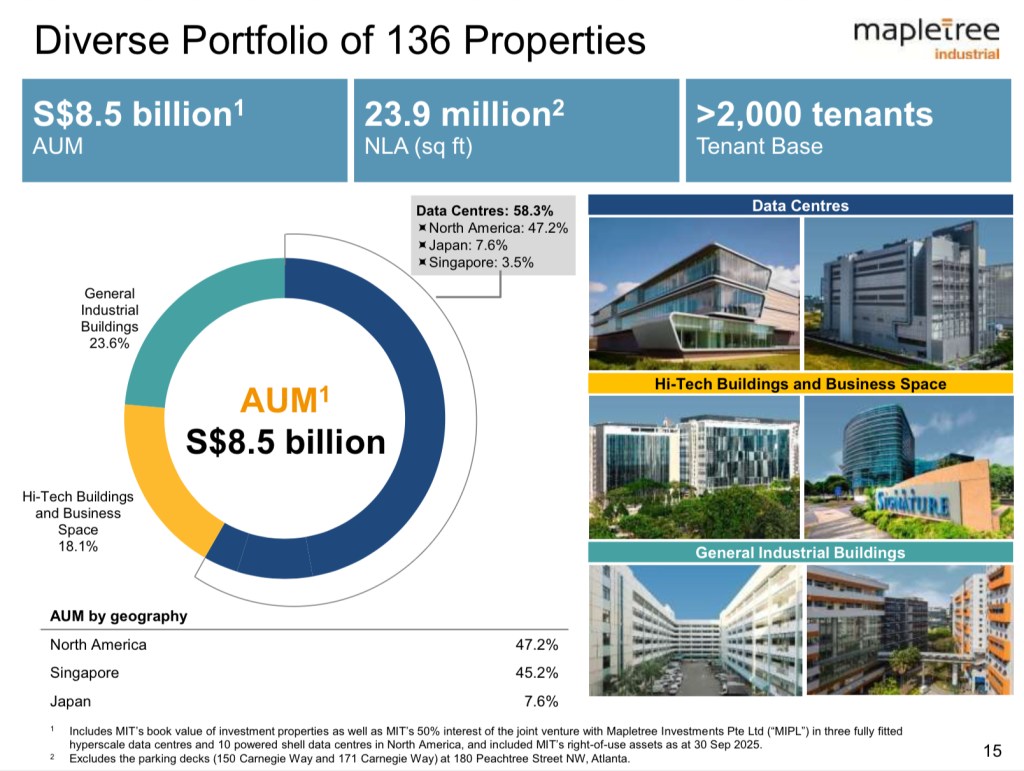

About half of MIT’s portfolio value is now in the U.S., at 47.2%, but not all data centres are created equal. As I mentioned in my previous post, the trust’s exposure splits roughly into three categories:

1. Lower-risk hyperscale JV assets in Northern Virginia — the crown jewels.

2. Mid-tier multi-tenant sites in Dallas, Silicon Valley, and Phoenix — steady performers.

3. Higher-risk secondary-market assets, roughly 22 percent of U.S. portfolio value, where tenant concentration or short leases raise concerns.

That last group — including 7337 Trade Street in San Diego (leased to AT&T) and 250 Williams in Atlanta — is where investors have focused their worry.

The good news is that management hasn’t been idle. For 402 Franklin in Brentwood, it is fully re-leased to Vanderbilt University Medical Center on a long-term deal. For 2775 Northwoods at Norcross, it has been sold above valuation, removing rollover risk. Finally, for Trade Street & Williams, the options are still on the table for backfilling, repurposing, or eventual sale.

Each quarter, the proportion of income at risk from confirmed non-renewals has shrunk — from 1.7% of group revenue to just 1.2%. That tells me the repair work is progressing.

Why Re-Leasing Takes Time

Many ask, “If data-centre demand is booming, why not just find new tenants immediately?” I don’t want to sound as if I know the exact answer, because I haven’t found any announcements from management on this. But I think the reason could be because this industry isn’t like leasing retail shops. Data-centre tenants need custom power, cooling, and connectivity setups — all of which require regulatory approvals and months of fit-out.

So even in a strong demand environment such as U.S., data centre vacancy averages just 1.5%, with 75% of new supply pre-leased, transition downtime is inevitable. The market’s impatience is understandable, but operationally this lag is normal.

That’s why management guides for stabilisation around FY26 to FY27. The key is that with management proactivity, it is likely that every “problem asset” could have a plan — and that’s a major shift from the uncertainty we saw a year ago.

Singapore and Japan: The Steady Counterweights

While North America grabs the headlines, Singapore remains MIT’s stabiliser. Occupancy across its Singapore industrial properties is steady at 95 percent, and rental reversions have stayed positive at 6.2% in the latest quarter.

I like it that Japan is now the new quiet contributor. MIT’s entry into Osaka and Tokyo in FY23/24 is already paying off — both data-centre assets are fully leased on long contracts. It’s some proof that management had foresight to diversify early, so that even as the U.S. side cools, Asia adds ballast.

Put simply, Singapore provides the cash flow base, Japan adds a new growth leg, and the U.S. offers medium-term optionality once the repair phase ends.

Financial Position and Rate Sensitivity

Currently, MIT has one of the highest proportions of debt fixed or hedged, at about 93%. This is a huge jump from 80% just last quarter. While its cost of debt has eased slightly to around 3.0%, that’s where the good news ends for now.

Management guided to potentially higher interest rates as $600 million of interest rate hedges expire through the next year. As the current interest rates are still higher than the hedges, there could be upward pressure on borrowing costs going forward.

The plus point is the more moderate gearing of 37.3%.

Investor View: Contrarian Opportunity or Value Trap?

That’s the real question investors must ask.

To me, MIT’s current yield — around 6.5% — prices in a lot of fear. In the past 5 days alone, after the results announcement, MIT’s share price declined by almost 5%!

Yes, there’s execution risk. But even under a conservative scenario where those few secondary U.S. assets remain under-utilised, analysts estimate at most about to 4% drag on DPU.

That’s manageable, especially when half the portfolio (Singapore and Japan) continues to generate stable income. And we have seen that over the past 4 quarters.

So, is MIT a value trap or a recovery play?

It depends on your risk appetite and time horizon. If you can hold through FY26 and trust management’s track record — remember, this is the same team that grew the REIT from $2 billion to over $9 billion in assets — then MIT represents a patient investor’s opportunity rather than a falling knife. To me, I continue to look at MIT as a recovery play for my portfolio.

The Dividend Uncle’s Take – How Investors Should View Them

For anyone wondering why I’m holding both despite their very different paths, here’s how I think about it.

I’m not choosing between “good” and “bad.” I’m choosing between two kinds of reliability.

If you prioritise capital preservation and predictable income, CLAR is the safer pick. It’s like the dependable colleague who never misses a deadline — maybe not the flashiest, but rock-solid.

If you’re willing to take a bit more volatility for potentially higher total return, MIT offers that through its ongoing recovery. It’s the friend who stumbled slightly but is confident of rebuilding — and when they regain stride, the payoff can be satisfying.

From my portfolio’s perspective, I stay invested in both — but for different reasons. CLAR gives me confidence: stable income, prudent leverage, and a sponsor that compounds quietly. MIT gives me conviction: the patience to ride out a turnaround that could re-rate once sentiment catches up.

Ultimately, both have done what great REITs are meant to do — keep the distributions flowing while adapting to change. And in a market still feeling its way through rate cuts, that resilience deserves more attention than it gets.

So that’s how I see it — one REIT building strength, one fixing weakness, both proving that steady income isn’t about being perfect, but about staying resilient through every cycle.

As always, don’t take my views blindly — use them as a reference point. Do your own homework, think about your own goals, and decide whether you want the steady builder or the patient rebuilder in your portfolio… or maybe a little of both.

And whichever path you choose, remember: in dividend investing, slow and steady really does win the race. Until next time, happy investing!

Leave a comment