[Watch on YouTube or Spotify as well!]

Hey there fellow dividend investors, welcome back to the channel!

Today I want to talk about something every investor is probably feeling right now in Singapore, but not everyone has caught on properly yet because it’s so rare for the Singapore market: momentum.

You’ve probably starting to notice this pattern. Some stocks just keep grinding higher quarter after quarter, because every set of results reinforces the positive story. The strong get stronger.

At the same time, other counters stumble, and each new result seems to confirm that things are still not quite right. The weak get weaker.

And then there’s the sweet spot we all hope to find – the stock where the fundamentals have bottomed and are quietly turning up, but the market hasn’t fully priced it in yet. That’s where momentum might be about to flip in your favour.

In this post, I want to walk through four well-known Singapore-listed companies. Two of them are showing powerful continuation signals — their financial results this year suggest that their strength may not only continue, but actually accelerate. One company is still struggling, and the numbers show that its challenges may take much longer to resolve. And perhaps most interestingly, one dividend stock looks like it may be entering an upward turn after years of going nowhere — but with risks we shouldn’t ignore.

Before we continue, a quick reminder that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the stocks discussed today, but what works for me might not work for you.

Alright, let’s dive straight into the first company.

Singtel: Strength That’s Building, Not Peaking

Let’s start with Singtel — a name almost every Singapore investor has opinions about.

For years, Singtel felt stuck. The Australia Optus issues, slow growth in Singapore, and weak sentiment around telcos held the stock down. But 2024 and 2025 have quietly shaped up to be some of Singtel’s best operational years in a very long time.

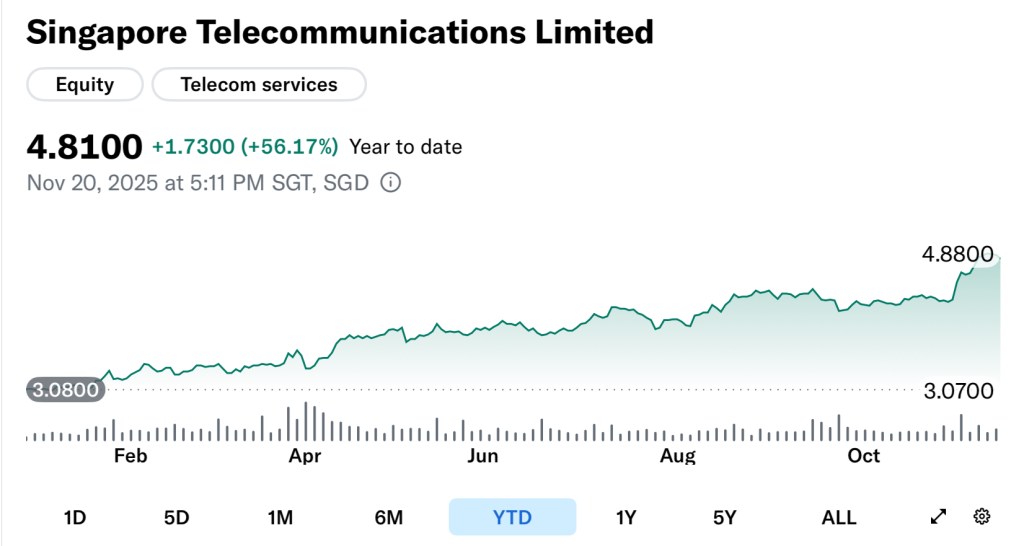

Over the past year, Singtel’s share price has climbed around 60%, and over the last two years, it has surged almost 100%. That’s an incredible run for any blue-chip dividend stock. So the key question I asked myself was this: Is this rally still justified?

The latest 1HFY2026 results confirm that the underlying business is not just stable — it’s building on positive momentum and it’s strengthening.

Earnings surged to $3.4 billion, up 176% year-on-year. Yes, there were one-off gains from selling a 0.8% stake in Bharti Airtel… but even if you strip out all exceptional items, underlying net profit jumped 14% to $1.35 billion.

And if you adjust for currency effects, that underlying gain would have been 22%.

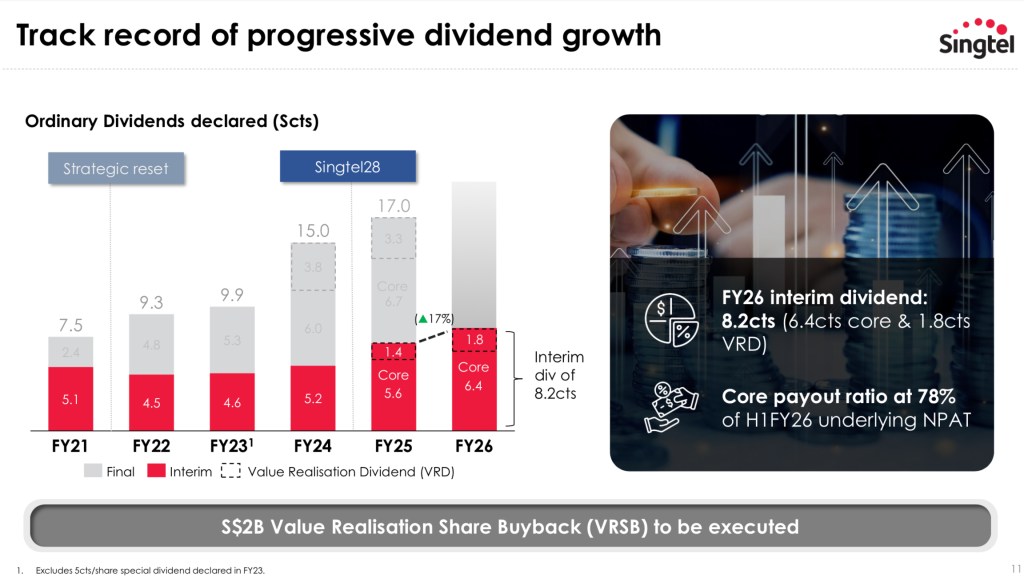

Dividends were another highlight. Singtel raised its interim payout from 7 cents to 8.2 cents, made up of a core dividend of 6.4 cents and a 1.8-cent value realisation dividend funded by asset monetisation. Yields are expected to be about 4.6% in FY2026, which is pretty decent.

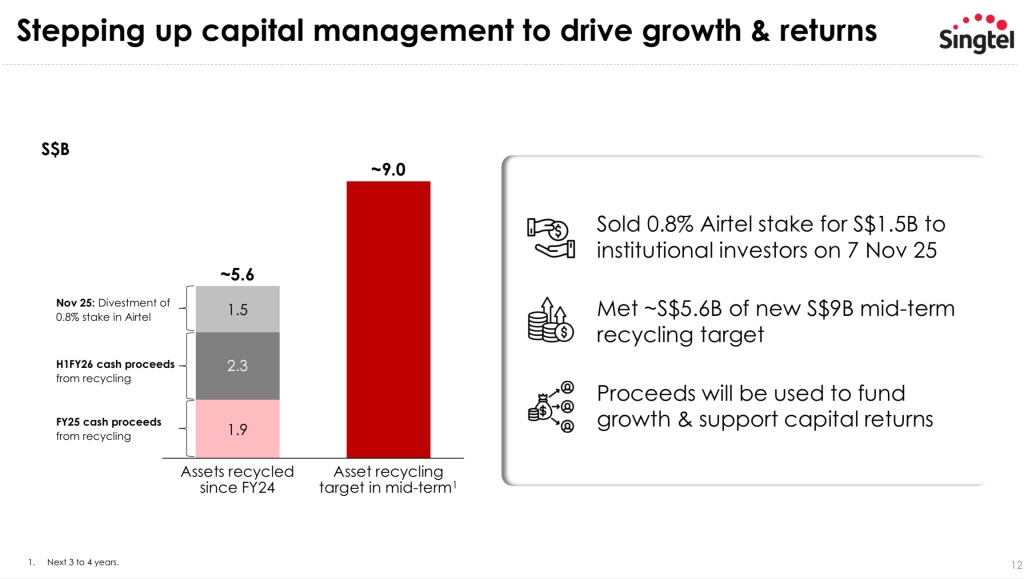

And this is where the story gets increasingly interesting — because Singtel has now divested $5.6 billion of assets, out of its $9 billion mid-term target. This gives Singtel a very rare advantage: the ability to keep a generous dividend and reinvest aggressively in high-growth areas.

One of those areas is data centres, riding the A.I. wave. Their Nxera venture expects EBITDA to grow above 20% CAGR over the next four years, supported by expansions in Singapore, Thailand and Japan. And if the rumoured deal with KKR to acquire more than 80% of ST Telemedia Global Data Centres or ST G.D.C. happens — potentially over $5 billion in value — Singtel could become one of Asia’s most important data-centre operators overnight.

Meanwhile, the enterprise arm NCS continues to grow with solid bookings, and Singtel expects EBIT for the full year to increase from “high single-digit” to “high single-digit to low double-digit”. This is a sign of confidence from management that the earnings momentum is not slowing anytime soon.

If you zoom out, what’s happening to SingTel seems to have powerful momentum: Singtel is multi-year transforming from a telco into a digital infrastructure powerhouse. Faster data centres, asset recycling, stronger associates, and rising dividends — all supported by operating improvements across the region.

And the market has rewarded this story with Singtel shares reaching around $4.70 recently. While valuations are no longer cheap, with the forward price-to-earnings ratio at about 24 times, and share price at almost 2 standard deviations from its trading range over the past 20 year, with SingTel riding the AI wave, perhaps its best days are yet to come.

SIA Engineering: Quiet Compounder In A Strong Uptrend Momentum

Now let’s turn to another Singapore blue chip — one that doesn’t make headlines the way Singtel or the banks do, but has quietly been building real operational momentum: SIA Engineering.

Over the past year, the stock has risen strongly — about 60% over the past 12 months and after being flat for almost 3 years. Investors are asking the same question: does the business performance justify the rally? Based on the latest numbers, the answer appears to be yes.

SIA Engineering isn’t a glamorous business. It doesn’t own aircraft; it doesn’t run an airline. What it does is the heavy, essential, and incredibly sticky work of maintenance, repair and overhaul (or MRO) across Asia-Pacific — line maintenance, base checks, engine and component repairs, and joint-venture partnerships with some of the world’s top OEM.

And in the latest half-year results, the company showed the clearest sign yet that aviation is not just recovering — but normalising at a level that strongly benefits the MRO ecosystem.

The Results: A Real Inflection in Operational Strength

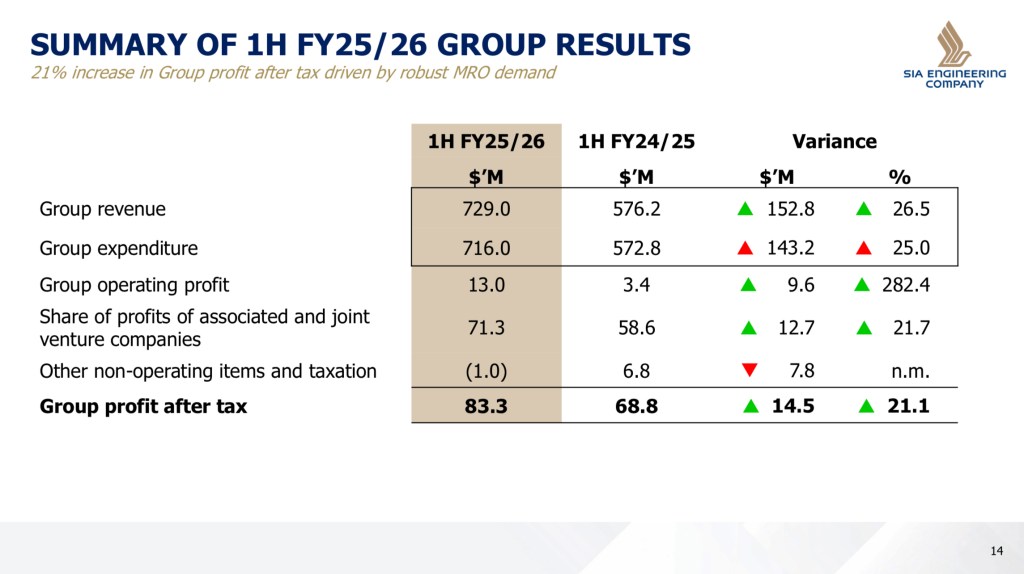

For the first half of FY2025/26, SIA Engineering reported net profit of $83.3 million, up more than 21% from a year ago, while second-quarter profit rose to $40.4 million, showing another quarter of consistent progress. Revenue for the half-year grew strongly to $729 million, a 26.5% jump, driven by robust demand for MRO services as airlines increase flight activity.

Operating profit remained modest at $13 million, but that was still a $9.6 million improvement from last year. Importantly, the group’s joint ventures and associates — which are a major part of its long-term earning power — delivered profit contributions of $71.3 million, up nearly 22% from the prior year.

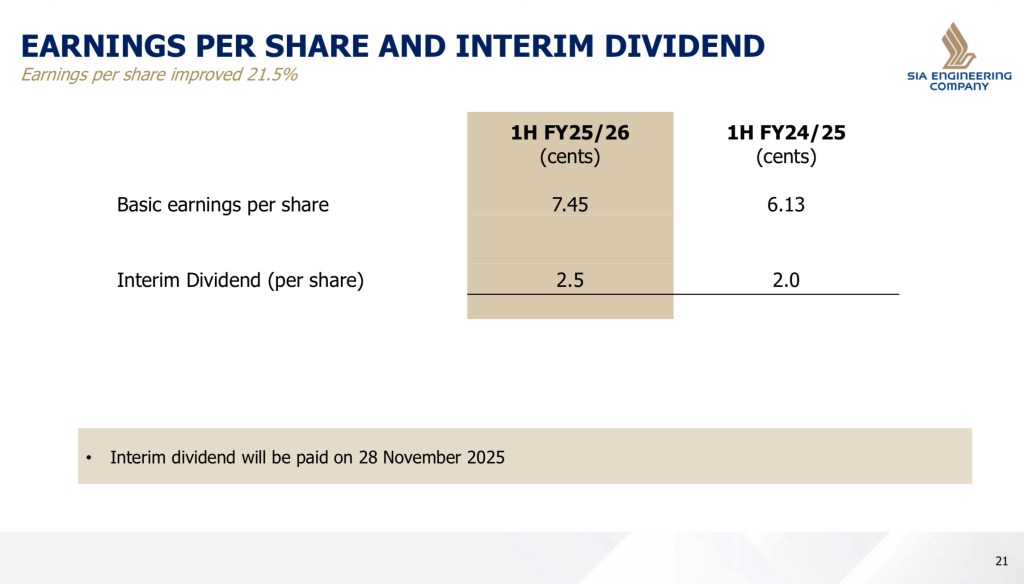

These results translate into basic E.P.S. of 7.45 cents, up 21.5% y-o-y.

The company also declared an interim dividend of 2.5 cents per share.

Positive Momentum Exhibiting – Can It Hold?

Where the story becomes encouraging is in understanding where the operational momentum is coming from. Demand for MRO work continues to rise as global travel climbs. SIA Group traffic, Scoot growth, and increasing regional airline activity all translate into more work.

And SIA Engineering is not simply relying on cyclical recovery — it is actively expanding capacity for next-generation aircraft, strengthening capabilities through joint ventures, upgrading core systems, and positioning itself as an Asia-Pacific maintenance hub.

For a business built on long-term contracts and technical expertise, these capabilities matter more than quarterly headlines.

Bottom Line: Solid Tailwinds

SIA Engineering may not be the loudest stock in the room, but it is one of the most consistent in delivering steady earnings tied to the long-term growth of aviation in Asia.

Revenue is rising. Profits are rising. J.Vs are delivering.

And its balance sheet remains rock-solid.

In a market where many blue chips are facing structural challenges or valuation concerns, SIA Engineering stands out as a steady performer with durable fundamentals.

Bonus Stock With Positive Momentum Stock: ST Engineering

Before we move on, I want to briefly touch on ST Engineering. I wasn’t planning to include it in this post since I’ve discussed it a few times recently. But with the kind of sustained positive momentum it’s showing, it really deserves a quick mention here.

Over the past year, ST Engineering’s share price has climbed about 80%, and more than 120% over the last two years — a rare run-up for a Singapore industrial stock. And despite announcing a massive $667 million impairment at its iDirect satcom business, the momentum for the rest of the company is moving in the opposite direction — stronger demand, stronger growth, and stronger visibility.

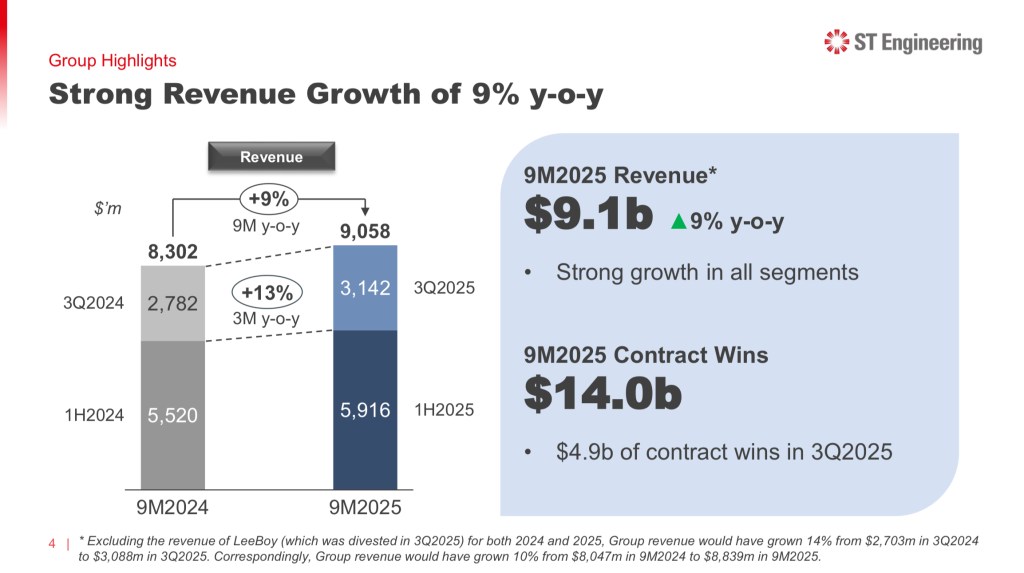

In its latest 9M FY2025 update, revenue for the third quarter alone grew 13% y-o-y to $3.14 billion, while contract wins hit a record $4.9 billion in that same quarter. Across the first nine months, total wins reached $14.1 billion, already surpassing the whole of FY2024. This pushed its order book to $32.6 billion, with around $5 billion scheduled for delivery in the remaining months of the year.

The growth is broad-based. Commercial aerospace is seeing strong MRO demand and multi-year contracts. Urban Solutions continues to secure rail electronics, tolling and I.C.T. systems work. And Defence & Public Security remains the standout, with new orders surging and diversified contracts across cyber, land systems and marine.

Dividend payouts remain steady at 4 cents per quarter, with an extra 6 cents coming in Q4 and a 5-cent special dividend, bringing total FY2025 payouts to 23 cents per share.

I’ve mentioned before that from a dividend investor’s point of view, the challenge now is valuation — yields have compressed sharply as the stock climbed. But with the kind of operating momentum ST Engineering is showing, it’s not surprising that investors have continued to bid the stock up.

Singapore Airlines: A Strong Brand, But Weakening Numbers

Now let’s talk about a company that’s not doing so well, a blue-chip stock with a negative momentum — Singapore Airlines. Despite a strong tourism backdrop globally, the stock has been essentially flat over the past year and the past two years, showing no sustained momentum. So the obvious question was: Could this be the moment where SIA finally turns the corner?

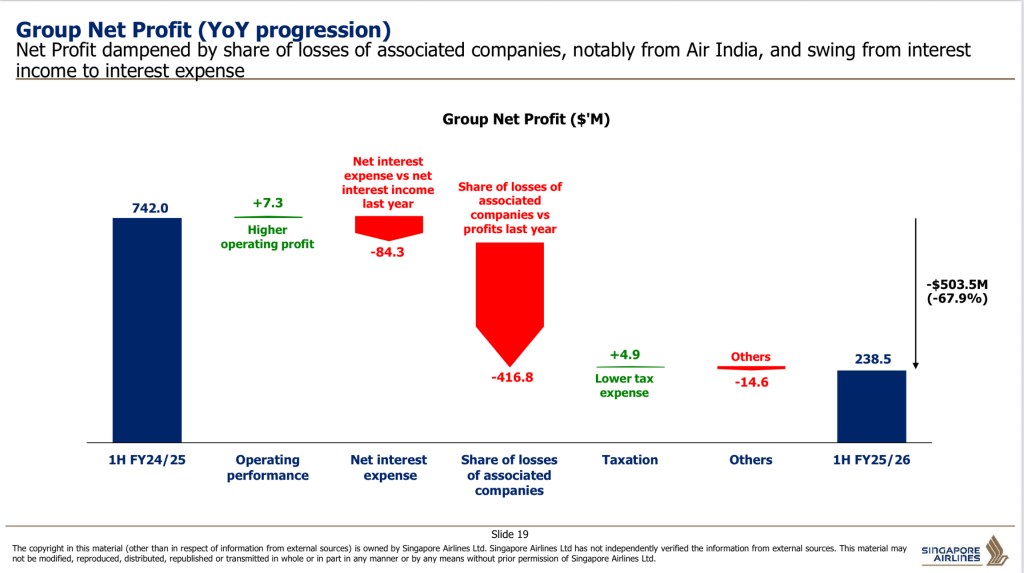

Well, it seems like the answer, for now, is no. In the second quarter ended September 2025, SIA’s earnings fell 82% year-on-year to $52 million. For the first half of the financial year, net profit dropped 67.8% to $239 million.

The biggest drag? Air India.

SIA now owns 25.1% of the Air India Group after the Vistara integration, and the losses from the Indian carrier flowed straight into SIA’s results. The share of losses from associates was $417 million lower year-on-year. For a company as efficient as SIA, that number is massive.

Revenue did rise slightly — up 2.2% in the second quarter and 1.9% in the first half — but rising non-fuel expenses and lower interest income offset the gains.

Analysts expect any growth in profit would be offset by the continued concerns from Air India and declines in interest income, with additional risks arising from a weaker macroeconomic environment reducing demand for air travel and air cargo demand.

This is a classic “weak gets weaker” scenario. Strong brand, strong operations… but weakening profitability due to structural headwinds and idiosyncratic events. So I’ll be careful about picking the bottom for my portfolio for SIA.

Quick pause before we continue — if you enjoy deep dives like this, you’ll probably like what I’m doing over on Telegram.

I’ve taken over the telegram channel from my buddy from REIT-tirement, and it’s now curated under The Dividend Uncle. There are more than 2,500 members there, and I use it to share not just my own posts and YouTube updates, but also interesting analyses and articles from other REIT investors and finance creators.

And yes, it’s completely free — the link is right here, or just search “S-REITs Posts & Analyses – Curated by The Dividend Uncle” on Telegram and join in. It’s a nice, no-spam space to stay informed and connected.

Okay, let’s continue with the post.

Genting Singapore: A Potential Turn… Finally?

And for the moment you have been waiting for… the company that looks like it may finally be at the start of an upturn, with positive rolling momentum gathering strength is none other than Genting Singapore.

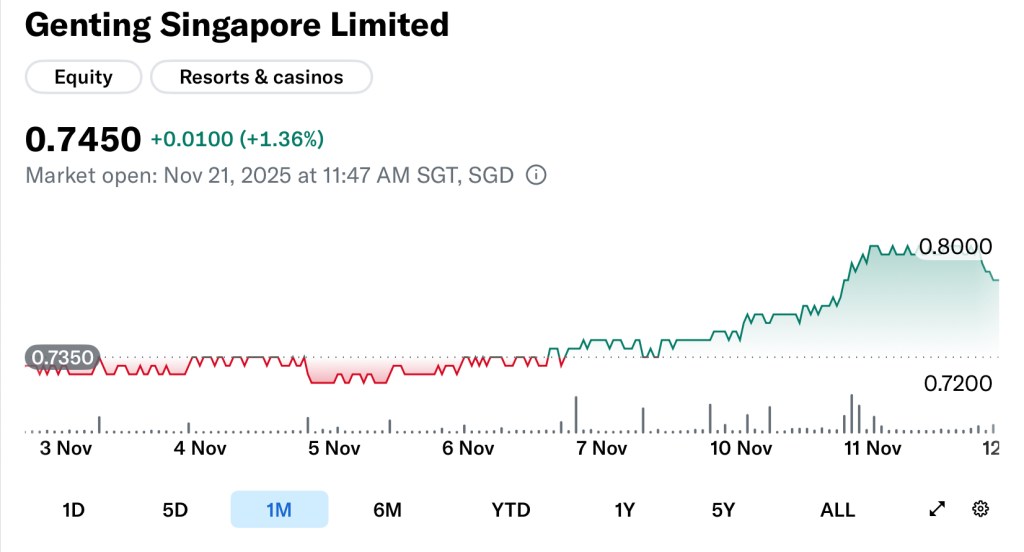

For years, Genting Singapore has tested investor patience. Revenue grew slowly, competition from Marina Bay Sands intensified, and its expansion plans dragged on with limited progress. The share price has gone nowhere for the past 2 years.

But recently, something has changed, and its stock price jumped almost 10% in one week.

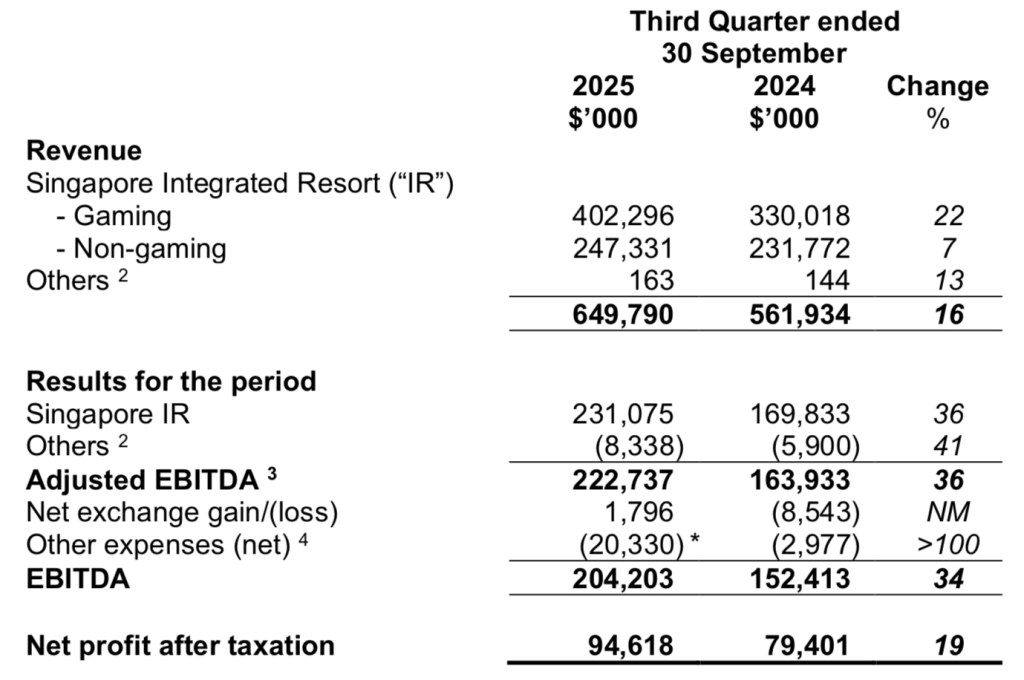

Genting reported 3QFY2025 net profit of $94.6 million, up 19% year-on-year and 5% quarter-on-quarter. Revenue grew 16% year-on-year to $649.8 million, and adjusted earnings jumped 36% to $222.7 million.

Even on a quarter-on-quarter basis, revenue grew 10% and earnings rose 19%.

This kind of sequential improvement is rare for Genting, and it was driven by two key areas:

1. VIP gaming improvement

VIP rolling volume rose 14%, and win rates improved from 2.45% to 3.1% — lifting VIP gross gaming revenue by 45% year-on-year.

2. Non-gaming strength

This is the big story. The Singapore Oceanarium and the Weave lifestyle precinct were completed earlier this year, boosting foot traffic. Non-gaming revenue surged 33% quarter-on-quarter and 7% year-on-year.

Hotel occupancy also improved from 73% to 92%, though average room rates softened slightly.

Analysts across the board raised their optimism — either maintained buy or add ratings. And the market reacted. Genting’s share price jumped nearly 10% in a week after the results.

But there’s more.

There are ongoing developments at the parent-company level. Genting Berhad is trying to privatise Genting Malaysia to gain funding flexibility for a New York casino license bid. If the deal goes through, Genting Berhad will likely need higher cash flows to service new debt — and the easiest source is Genting Singapore.

Because Genting Singapore has a strong net cash position and robust free cash flow, analysts believe dividends may be raised above the expected 4 cents for FY2025. Any signal of higher dividends could spark a re-rating.

Now the risks – issues that may stop the positive momentum in its tracks.

Competition from MBS remains intense. Their VIP win rates have jumped to 4.84%, driving a 272% increase in VIP gaming revenue — far above Genting’s improvement. Labour costs are rising. And even though RWS 1.5 is rolling out, full benefits may only come later.

But the truth is: after years of stagnation, Genting is finally showing early signs of a real turnaround. New attractions are pulling foot traffic, gaming metrics are improving, dividends may be raised, and the stock is finally reacting.

The Dividend Uncle’s Take — What Do These Four Companies Tell Us?

Looking at these four companies together, I see a clear pattern.

Some businesses are gaining strength with every quarter. Singtel is broadening its earnings base and expanding into data centres at scale. SIA Engineering continues delivering contract wins, increasing visibility and dividend stability.

Others are struggling with issues that take years — not months — to resolve. SIA’s underlying business remains strong, but the Air India consolidation, lower yields, and higher cost pressures are structural. These issues don’t go away quickly.

And then there are companies that may finally be turning a corner. Genting Singapore is strengthening across both gaming and non-gaming, and new attractions plus potential dividend uplifts could provide the spark for the next multi-year cycle.

Momentum doesn’t mean chasing what’s hot. It means recognising which companies are improving at the operational level, which ones are deteriorating, and which ones are beginning to show meaningful upward shifts.

On balance, I’m personally positive on Genting Singapore, and have been accumulating over time. I’m fully aware that its risks haven’t disappeared, especially competition from M.B.S. and labour cost pressures… but the direction of change seem to be finally upward. And in investing, the change in direction is often more important than the level itself.

If you found this deep dive useful, do give the post a like, leave your thoughts in the comments, and subscribe to follow along on my dividend investing journey.

Until next time, stay patient, stay disciplined, and keep collecting those dividends.

Leave a comment