[Watch on YouTube as well]

Hey there fellow REIT investors, welcome back to the ‘The Dividend Uncle’s Take’.

It’s the end of the month again, which means it’s time for my usual update on what I bought, and what I’m eyeing for the month ahead. But unlike most months, this one has been a little bit unusual — partly because I’m overseas on holiday with my family while working on this, and partly because the market did something I honestly didn’t expect to see!

Over the past month or so, two of the most stable, most reliable blue-chip REITs in Singapore suddenly corrected — and not by a little bit.

Frasers Centrepoint Trust, or FCT — the REIT that’s practically the “default setting” for investors focusing on stability — dropped almost 10% in a single month, and actually became the worst-performing S-REIT over the past 30 days.

And Parkway Life REIT, or PLife — arguably Singapore’s safest REIT by asset quality — also declined almost 10% as well, over the past two months. This is rare, because this is a counter that normally doesn’t move down much at all.

In my personal opinion, I think what we’re seeing right now is not a normal pullback, and it’s not something long-term investors get to witness often. So in today’s episode, other than sharing the REIT that I bought, my focus is really on walking you through what’s happening to FCT and PLife, why these declines caught my attention, and why I personally think this rare pullback has opened up an opportunity worth considering.

Now, because I’m working on this while on the go in Japan, I just wanted to let you know that today’s episode may not include as many charts or illustrations as my usual deep dives – hoping for your understanding.

As usual, before we dive in, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the REITs discussed, but what works for me might not work for you.

Alright, let’s jump right in.

What I Bought This Month: Of Course, It’s Stoneweg Europe Stapled Trust

So let me start with the REIT I actually bought this month: Stoneweg Europe Stapled Trust, or SERT.

I won’t repeat the entire deep dive here — if you haven’t watched the previous post where I broke down SERT’s portfolio, capital structure, and valuation drivers in detail, do check that out after this. What I want to emphasise today is simply this: I put my money where my research is.

In that previous deep dive post, I mentioned that SERT was quietly improving its fundamentals. The recent Fitch upgrade, the execution progress in its property repositioning, and the valuation uplift from its UK addition to its data centre fund had all given me confidence that the worst was behind the REIT.

I saw the transformation, and after spending hours going through the numbers and speaking to people close to the deal, I felt the risk-reward made sense for a small-but-meaningful position in my satellite portfolio.

So this month, I added to SERT. And I’m mentioning it upfront here because I think it’s important for you to see that when I do a deep dive on a REIT and the data convinces me, I don’t just talk about it — I act on it.

That’s the REIT I bought this month – now let’s talk about the two blue-chip REITs I’m eyeing for December.

Why FCT and PLife Are The Most Stable REITs In Singapore

Singapore has many REITs — but only a handful have proven themselves across multiple cycles, crises, interest rate shocks, and everything in between.

FCT and PLife belong to that elite group.

FCT dominates suburban retail — the most resilient retail segment in Singapore because it captures daily essentials, heartland spending, services, and F&B demand. Even during COVID-19, FCT’s suburban malls bounced back faster than Orchard Road.

PLife, on the other hand, owns hospitals. And not just any hospitals — but highly strategic healthcare assets in Singapore and Japan, including Mount Elizabeth Hospital, which anchors Singapore’s premium private healthcare sector. Healthcare demand doesn’t fall in recessions; in fact, it often rises.

These are the “defenders” in my portfolio — not meant to be high-yield goal scorers, but rock-solid protectors of stable, predictable income. Which is why their recent price declines feel so deeply out of character.

The FCT Correction: A 10% Decline With No Fundamental Weakness

Let’s begin with FCT, because its sudden drop is the most surprising. A near 10% fall in just one month is almost unheard of for a REIT that has historically moved slowly and steadily. But once again, price movements tell only half the story. When I went into the latest financials, the numbers showed something very different from what the market seems to be pricing in.

Financial Performance Remains Strong

For the second half of FY2024/25, FCT reported double-digit growth in gross revenue, NPI, and distributable income. These numbers were boosted by the acquisition of Northpoint City South Wing and the completion of AEI works at Tampines 1.

For the full year, the same trend continued — revenue up nearly 11%, NPI up nearly 10%, and distributable income up almost 9%. This is extremely solid performance for a suburban retail REIT. Nothing in the results suggests a REIT in distress.

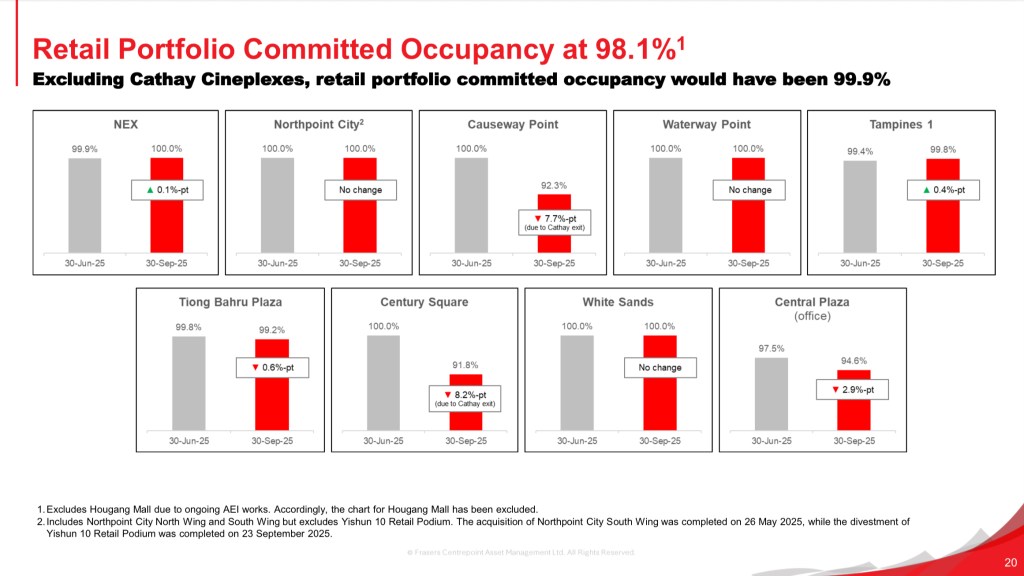

Understanding the Occupancy Dip

The only negative headline was the drop in occupancy from 99.9% to 98.1%. But once you break it down, the situation becomes far less dramatic. The decline came almost entirely from the exit of Cathay Cineplexes at Causeway Point and Century Square — two large spaces, each enough to cause a visible drop when they go vacant. But if you remove these two units, FCT’s portfolio occupancy would still have been 99.9%.

This is why context matters. A vacancy caused by a cinema exiting is not the same as weak tenant demand or falling retail spending. And based on the strong leasing pipeline and healthy demand for suburban retail, analysts agree the financial impact should be manageable.

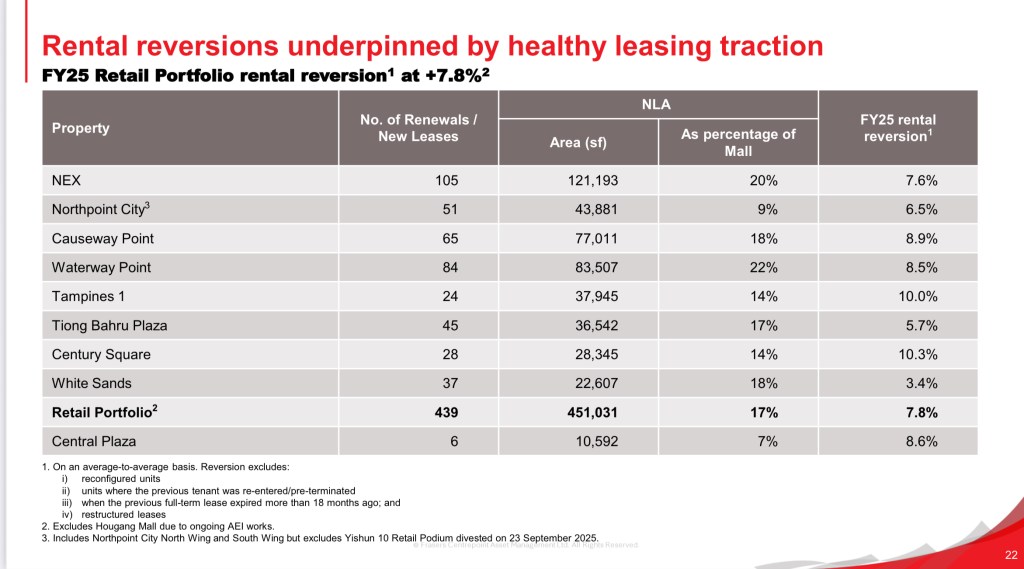

Rental Reversions and Tenant Sales Continue to Improve

Meanwhile, rental reversions across the portfolio remain robust. FCT secured a very healthy +7.8% rental reversion for the year, with several malls achieving double-digit increases. Shopper traffic and tenant sales also showed positive year-on-year growth. Everything points toward a resilient suburban retail environment.

Capital Management: Strong, Though Perpetuals Need Nuance

FCT’s aggregate leverage fell to 39.6%, one of the lowest levels in recent years. This is partly due to the issuance of $200 million in perpetual securities. And as I’ve said before, perpetuals may not count toward the official gearing limit, but as investors, we must still factor them into our overall picture of leverage – hence, I’m not particularly impressed here.

But even with this adjusted view, FCT’s debt profile remains safe. More than 83% of debt is fixed. The average cost of debt remained at 3.8%, and the interest coverage ratio improved to 3.5x this quarter. Refinancing needs are spread comfortably over the next few years. There is no refinancing crunch, no sudden spike in borrowing costs, and no liquidity concerns.

So Why Did FCT Fall So Much?

From what I can see, this drop was driven more by sentiment than fundamentals. The Cathay vacancies caused temporary uncertainty. Institutional investors likely rebalanced and trimmed positions in larger, more liquid REITs like FCT. None of this reflects weakening performance. When fundamentals strengthen and prices fall, that is usually where opportunity begins to form.

Parkway Life REIT: A Rare 10% Pullback In An Ultra-safe REIT

Now let’s move to Parkway Life REIT. If FCT’s fall was surprising, PLife’s 10% decline over 2 months is just as noteworthy — because PLife almost never moves this much, even in volatile markets.

PLife’s Track Record of Stability

For 17 consecutive years, PLife has grown its DPU. It survived the Global Financial Crisis, Japan’s natural disasters, the pandemic, and one of the fastest interest-rate hikes in history — all while maintaining steady income growth. Even the depreciation of the Japanese yen, which has fallen more than forty percent over the years, did not stop PLife from increasing DPU.

PLife is one of the few REITs where you buy not for yield, but for incredibly reliable compounding. This is why a sudden 10% correction feels so out of character.

Fundamentals Remain Intact

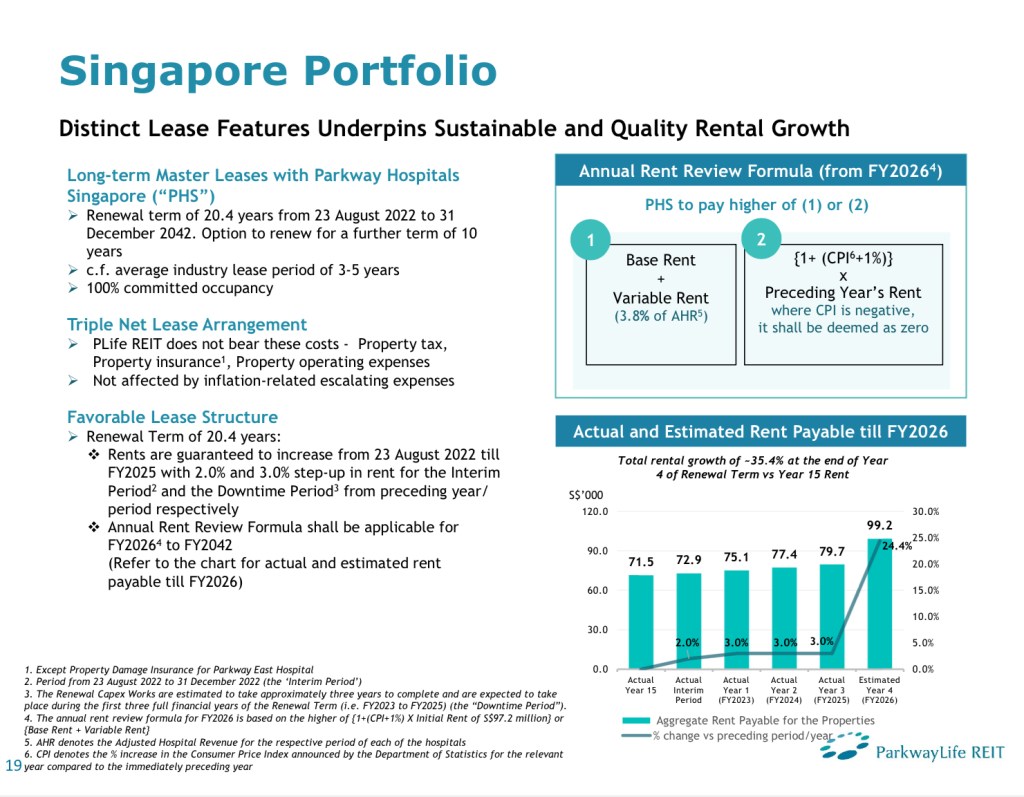

The latest results show no weakening in the business. The Singapore hospitals are under long-term master leases. The Japan assets continue to receive inflation-linked rent escalations. Debt levels are conservative. Currency risks are hedged. And operationally, everything remains stable and predictable.

A Major Catalyst: Project Renaissance

What makes the correction even more compelling is the timing. PLife is just months away from completing its S$350 million renewal project for Mount Elizabeth Hospital. Once the renewed lease terms kick in, the uplift to PLife’s DPU could be significant.

The pro forma projections point toward DPU rising to around 18.26 cents by FY2026 — roughly about 20% higher rental income for its Singapore portfolio. Some analysts estimate that this could push PLife’s yield from the current 3.8% to more than 4.3% once the uplift is fully reflected.

For a REIT of PLife’s risk level, that is meaningful upside.

Why Did PLife Fall?

The likely explanation is a temporary rotation into higher-yielding REITs during market volatility. PLife’s yield is low compared to others, and in uncertain periods, investors often rebalance away from low-yield counters. But again, this doesn’t reflect weakening business conditions — and that’s exactly why this correction stands out.

Quick pause here — if you’re enjoying the quick analysis, smash the like button for me. I’m literally squeezing in analytical time during my holiday, so it would be quite cool (and very encouraging indeed) to come back from my trip, open YouTube, and see a flood of “likes”. That would be the best souvenir from you all!

Alright, back to the post.

What Are The Real Risks, And Do They Justify The Sell-off?

No REIT is risk-free, and both FCT and PLife have their own challenges. But just as a preview, none of these risks justify such steep corrections.

FCT’s Risks in Context

FCT’s short-term downside comes mainly from cinema vacancies and ongoing A.E.I. These will temporarily depress NPI at specific assets. But they do not affect the long-term desirability of suburban malls. A.E.I., in particular, historically lead to better tenant mix and higher rents.

The expected completion of the R.T.S. Link with Johor Bahru is a oft quoted risk for FCT, especially for its malls in the North, such as Causeway Point and North Point. But this is old story by now, and most analysts, including myself, are relatively confident of FCT’s abilities to continue providing good returns.

PLife’s Risks

PLife continues to face currency exposure, although this is well-managed. Its yield will always be lower than peers, and it often trades at a premium.

But none of these have worsened recently, and none justify such a sharp decline — especially with the Mount Elizabeth uplift just ahead.

The Dividend Uncle’s Take

This month feels a little different from the usual “What I Bought, What I’m Eyeing” updates. On one hand, I added to SERT — a smaller, riskier REIT where execution and momentum matter. With a general recovery for Singapore REITs in 2025, the opportunities are no longer that clear-cut. On the other hand, two of Singapore’s most stable blue-chip REITs suddenly corrected at the same time.

And to me, that contrast highlights an important point about portfolio management.

For the satellite part of my portfolio, I’m comfortable taking calculated risks — and that’s where SERT fits in. The reason I bought it immediately after my deep dive is simple: the numbers made sense, the risks were clear, and the upside looked achievable.

But for the core part of my portfolio, it’s very rare to get these kinds of opportunities. FCT and PLife falling 10% — both with fundamentals still intact — doesn’t happen often. These are the REITs people hold for stability, not volatility. So when they do fall sharply, I pay attention.

That’s why, for the month ahead, FCT and PLife are on my watchlist in December. I’m not saying prices can’t fall further — nobody knows. But based on fundamentals versus current sentiment, I don’t get many chances like this to accumulate high-quality names. And when the strongest REITs correct without fundamental deterioration, that’s almost always where long-term opportunity begins.

I’m going to get back to my holiday now, but I’ll be checking my trading app periodically. Let me know in the comments—are you buying the dip on FCT or PLife, or are you looking at high-yielders like SERT?

If you found this post helpful, do give it a like and share your thoughts in the comments. Are you buying the dip like me? Or waiting for further weakness?

As always, stay safe, stay invested, and I’ll see you in the next one.

Leave a comment