Hey there fellow investors, welcome back to the channel. I’m finally back from my overseas trip and am ready to position my investment portfolios for the next year.

About 6 months ago, I published a post that many of you still reference today — the one where I shared exactly how I’m building my diversified China exposure using just 3 ETFs. That post came at a time when sentiment toward China was still in the gutter. Headlines were bleak, confidence was shaky, and even long-term China investors were questioning whether it was time to be in completely.

Yet at the same time, there were early signs of stabilisation: a pick-up in market activity, state-linked buying, stimulus hints, and a gradual shift in Chinese retail confidence. And it was in that backdrop that I decided to take a measured, diversified approach, instead of making concentrated bets. I wanted exposure to China’s internal economy, its technology engine, and its dividend opportunities — without being overly dependent on any single story or individual stock.

In that earlier post, I walked you through the 3 ETFs that made up my allocation. And since that post was published, many of you have asked for an update: How have these ETFs performed? How has China’s market evolved since then? And among the 3 ETFs I highlighted, which one am I personally focusing on for the months ahead?

So today’s post is exactly that follow-up. I’ll walk you through how the China market has progressed over these 6 months, the updated performance numbers of the ETFs, and of course, the one ETF I’m leaning toward in the near term — and why.

As usual, before we dive in, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the ETFs and REITs discussed, but what works for me might not work for you.

Alright, let’s get started.

How the China Market Has Changed Over the Last Six Months

To understand the performance of the ETFs in my portfolio, we first have to understand what’s changed in China’s markets more broadly. When I did the earlier post 6 months ago, the tone was still one of caution. Chinese equities had been deeply oversold for years. Foreign money was leaving, and domestic sentiment was subdued especially due to the bursting of the residential property market.

Fast forward to today, and the picture has become more balanced. We’re finally seeing signs of life.

Onshore equities, represented by the CSI indices, have stabilised as monetary policy loosened and more targeted stimulus made its way into the economy. Industrial output has picked up, certain consumption categories have shown signs of recovery, and for me, the government has continued sending signals that they want to support investor confidence — including improving market functioning, strengthening capital market regulations, and providing liquidity support, is especially important.

The tariff environment has also shifted somewhat. The US–China discussions earlier this year led to temporary tariff reductions under a 90-day arrangement. That doesn’t solve long-term issues, but it does create a window where businesses can operate with a little less uncertainty. And as we’ve seen historically, even small improvements in US–China relations can have outsized impact on China-related sentiment, especially for exporters and technology names.

At the same time, however, risks haven’t gone away completely. Property developers are still fragile, foreign positioning remains light, and long-term structural challenges remain — from demographics to real estate to consumption patterns. And because Chinese markets are extremely sensitive to policy announcements, volatility is still high.

So the 6-month picture is mixed: not dramatically bullish, but meaningfully better than earlier this year — and enough for certain ETFs to show real recovery.

This is why I said in the previous post that if I were to participate in China at all, I needed a diversified ETF approach. And looking back now, I’m glad I went down that path.

A Quick Recap of the 3 ETFs I Used

Before I dive into performance numbers, let me revisit the three ETFs I introduced in the earlier post — and the allocation I aimed for.

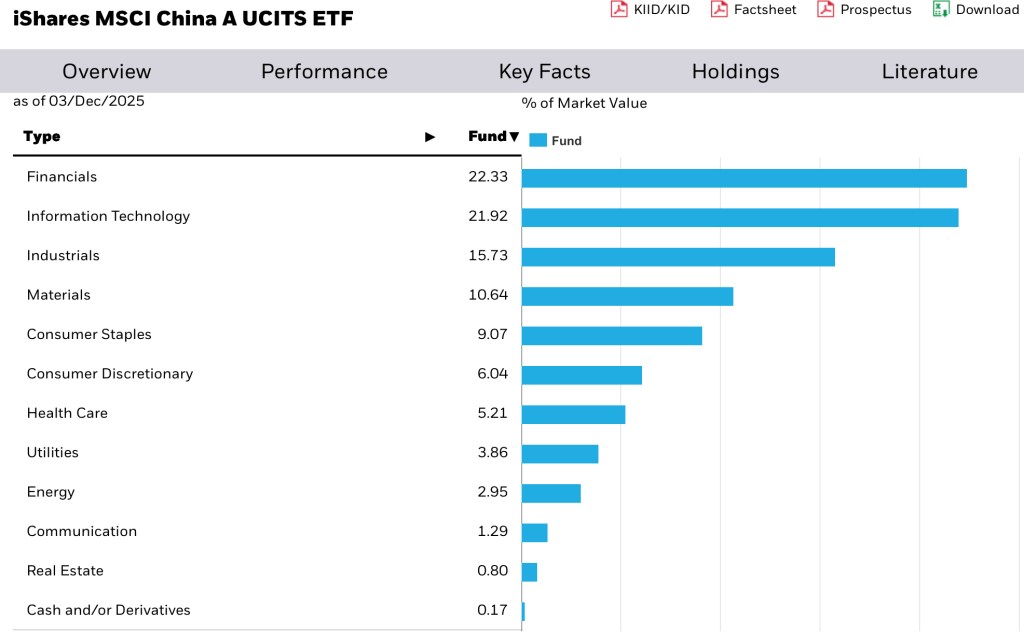

The first is CNYA, the iShares MSCI China A ETF listed in London. This ETF gives you exposure to the domestic A-share market — essentially companies that drive internal consumption, infrastructure, financial services, healthcare, and industrial growth. I positioned CNYA as the core of my China strategy, roughly 50% of my allocation, because if China’s stimulus and internal stabilisation were going to work, this is the segment that would benefit first.

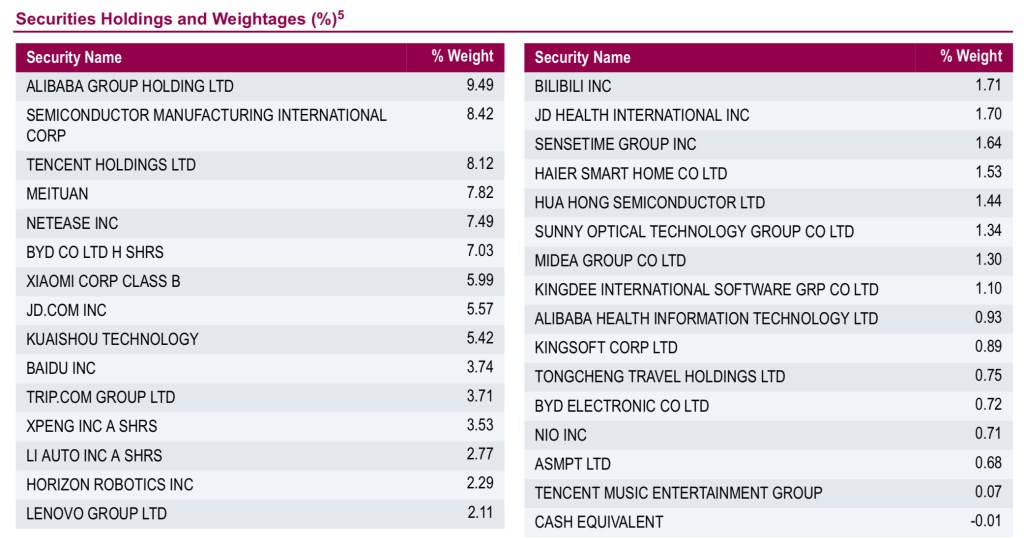

The second ETF is HST, the Lion-OCBC Securities Hang Seng Tech ETF listed in Singapore. This ETF tracks the Hang Seng Tech Index — China’s largest technology names: Tencent, Alibaba, Meituan, JD.com, Xiaomi, and so on. I allocated around 30% to HST because it represents China’s long-term innovation engine — though with more volatility. It’s where the growth potential is, but also where headlines can hit the hardest.

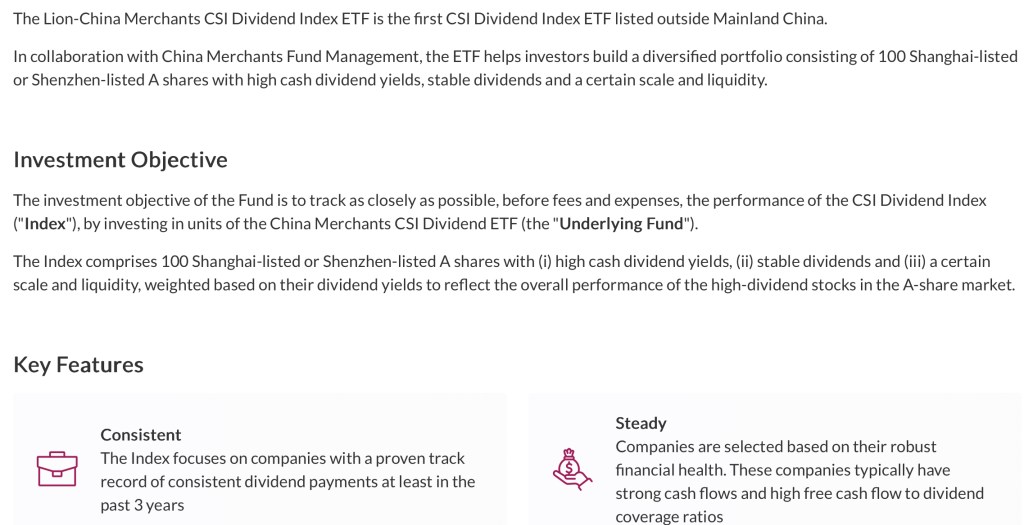

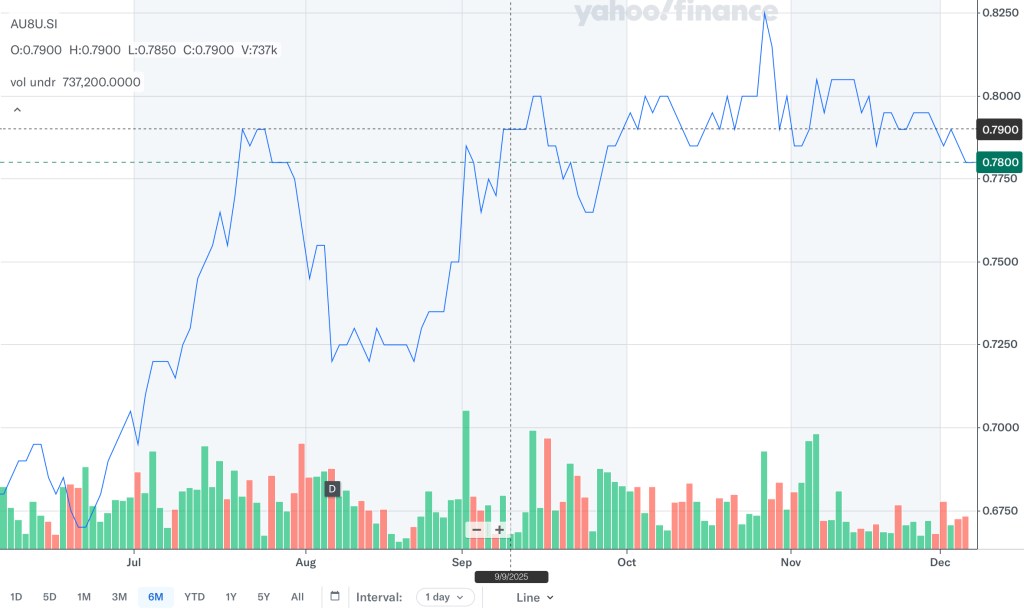

Finally, the third ETF is INC, the Lion-China Merchants CSI Dividend ETF, again listed in Singapore. This ETF targets the highest-dividend A-share companies — stable, cash-generating businesses with a track record of consistent payouts. I took around 20% exposure through INC because I wanted a stabilising layer in my China allocation — something less sensitive to tech cycles and policy noise, and offering an attractive dividend yield of around 6% based on its underlying index.

Those were the three building blocks of my China allocation.

Now let’s talk about how they actually performed.

CNYA — Surprise! Up About 23%

CNYA has been the standout best performer, rising roughly 23% since my earlier post. At first glance, it is somewhat surprising, because CNYA is the most diversified ETF among the 3 – usually the broadest index captures both the ups and downs of different sectors, and reflect an average return.

However, diving deeper and rationalising, I think the China A-shares has responded first along with improvements in the local sentiments, since domestic investors dominate this segment. And because these companies are the direct beneficiaries of any stimulus — fiscal support, infrastructure spending, consumption subsidies, liquidity injections — they tend to reflect recovery faster than offshore tech stocks.

I also mentioned previously that CNYA was my “engine room” ETF, the one meant to carry steady weight in my China allocation. And honestly, this performance so far is in line with that expectation. It’s not explosive, but it’s a solid representation of how the broader domestic confidence has come so far.

HST — Up About 10%, But 13% Off Its Recent Peak

Now onto HST, which has had a more interesting journey.

The ETF is up about 10% over the 6-month period. But it’s also still down roughly 13% from its intermediate peak earlier this year. This is very consistent with the nature of China tech — bursts of strong rallies followed by sharp pullbacks when headlines change. Regulatory adjustments, macro data, corporate earnings cycles — these all move the tech index very quickly.

That said, if you zoom out, the sector today is still in far better shape than it was during the worst period of the regulatory crackdown. Companies have adapted, compliance has improved, and Beijing has become much more vocal about supporting innovation, AI development, and digitalisation. The volatility hasn’t gone away, but the underlying environment is more constructive.

I’ll talk more about why HST is my near-term focus later in this post.

INC — Up About 8% Since Launch

INC is the newest among the three ETFs, and as expected, its performance has been more stable. Since my initial investment, the ETF is up roughly 8%. For an ETF built around dividends, that’s a decent outcome in a relatively short period.

What I like about INC is that its underlying index — the CSI Dividend Index — has historically been resilient during volatile markets. The companies inside it tend to have predictable cash flow, less dependence on speculative growth, and more disciplined capital management. For me, INC is the ballast of my China allocation. It’s the one that lets me sleep at night even when the tech sector is moving all over the place.

Before we move on, if you’re finding this helpful, I’d really appreciate it if you subscribe to the channel and to give this post a “like”. And if you want more of these follow-up updates as the China story unfolds, let me know in the comments below. Okay, let’s move on.

CapitaLand China Trust — A Quiet 14% Climb, With a New Onshore Tailwind

CapitaLand China Trust, or CLCT, deserves a quick spotlight here—when I posted my 3-ETF allocation in the previous post, many viewers asked me about CLCT. Well, to be very clear, it remains one of my core China holdings. Over the past 6 months, CLCT climbed about 14%, which has beaten the tech focused ETF, and in my view, that strength has come from two forces working together.

First, there’s the macro lift. China’s growth picture in 2025 has looked more stable than many expected, with policymakers leaning into support for the real economy and signalling continuity around structural priorities. That macro stabilisation has helped domestic sentiments, which similarly propelled the CNYA ETF into top spot.

Second—and this is the idiosyncratic part—CapitaLand Investment, CLCT’s sponsor, alongside CLCT, successfully listed an onshore retail C-REIT in Shanghai: CapitaLand Commercial C-REIT (or CLCR). It is China’s first international-sponsored retail C-REIT, and launching an IPO that was heavily oversubscribed, then listing with a strong first-day pop.

This matters because it validates the sponsor’s onshore capital-markets access, opens a domestic REIT channel to recycle Chinese assets, and complements CLCT (which is listed in Singapore) by creating two lanes of liquidity—onshore for Chinese investors, offshore for international investors. Over time, that can support valuation discovery and give the sponsor more options to unlock value and recycle capital between platforms.

Put simply: CLCT’s +14% doesn’t look like a speculative spike. It looks earned—helped by steadier China data on the ground and the sponsor’s new onshore listing milestone that could make future portfolio reconstitution and fee-income growth more predictable. That’s why CLCT remains a meaningful, steady anchor for my China exposure outside my 3-ETF portfolio.

Why My Near-Term Focus Is on HS Tech

Let me be clear: I am not turning into a China tech cheerleader. I’m not expecting a repeat of the 2015 boom, and I’m not ignoring the risks that remain.

But among the three ETFs in my China allocation, HST is the one that I think deserves closer attention right now, mainly because of three reasons.

First — Policy tone has shifted toward supporting innovation

If you look at speeches from Beijing this year, whether from the State Council or the regulators, you’ll notice a clear and consistent theme: the government wants to rebuild confidence in the technology sector.

The tone is very different from 2021–2022. Today, policymakers are emphasising AI development, cloud infrastructure, robotics, manufacturing upgrades, semiconductors, and digital transformation. Partly due to increased competition with the U.S. tech sector, this is something that will continue for quite some time for national security reasons.

This doesn’t mean the sector is risk-free. But compared to two or three years ago, the environment is far more stable and supportive. When policy tone improves, tech tends to respond — and we’re already seeing early signs of that.

Second — Valuations remain historically attractive

Despite its rebound earlier this year, the Hang Seng Tech Index is still trading at a significant discount compared to global tech peers. Many large-cap names are valued at levels that assume very low growth or even stagnation — yet these companies continue to grow revenue, expand into AI, cloud services, and enterprise solutions.

The valuation gap between China tech and US tech is unusually wide. Historically, when gaps like this widen too much, they eventually converge. That doesn’t mean a sudden rally. It simply means the risk-reward today is more favourable than it has been in years.

Third — Investor positioning is still very light

Foreign ownership of China equities remains near multi-year lows. Even Hong Kong-listed tech names have seen very slow re-entry from Western institutional investors.

This creates an interesting setup: any incremental improvement in sentiment — even small inflows — can have an outsize impact. This is exactly what we saw earlier in the year during mini-rallies. And if tech earnings continue stabilising while policy tone stays supportive, a more sustained re-rating may happen.

The Dividend Uncle’s Take

So after six months, how do I feel about my China ETF allocation? And am I changing anything in 2026?

The short answer is — not really. Even though I’m giving Hang Seng Tech ETF more attention in the near term, I’m not shifting my overall target allocation. And the reason is simple: investing in China still comes with meaningful risks.

The recovery is uneven. The property sector remains fragile. External demand is uncertain. Policy direction can shift quickly. And sentiment — both domestic and foreign — is still sensitive.

That’s why I’m keeping the same diversified structure I shared 6 months ago:

CNYA as my core exposure to China’s internal economy.

HST as my growth engine — selective, volatile, but meaningful for long-term innovation.

INC as my stabiliser — providing cash flow and lower volatility.

If China continues to stabilise, I want all three ETFs to participate in different ways. If China surprises on the downside, the diversification helps cushion some of the impact.

And that’s also why I’m not making dramatically larger investments. I’m simply adjusting my focus based on where I see near-term asymmetry — and right now, I think HST offers that.

Before I wrap up, let me emphasise again: this is not a recommendation to buy China tech or any of these ETFs. Everyone’s risk tolerance and conviction level toward China is different. If you’re uncomfortable with volatility or find China too unpredictable, there is absolutely no need to force this exposure into your portfolio.

But for those who, like me, still believe a measured approach to China can make sense as part of a global portfolio, I hope today’s update helps you see how the three ETFs have evolved — and why I think the allocation still works as a whole.

Alright, that’s all for today folks. Thanks for tuning in, and until next time, happy investing!

Leave a comment