Hey fellow REIT investors, today’s post is a pivotal one – in fact, it might turn out to be one of the most important episodes I’ve ever produced about a single REIT. Manulife US REIT — or MUST — is at a crossroads.

Its upcoming Extraordinary General Meeting or EGM in mid-December is not just another procedural vote. It is a decision that could determine the future of the REIT for years to come.

I know some of you have been following MUST closely with me over the past few years, and yet many more have given up on it. I’ve seen the comments, the frustrations, and the genuine worries. Some investors feel trapped. Some feel disappointed, and vows never to touch anything “Manulife”.

To add on, this EGM feels like this vote is coming too late, leaving unitholders with no real choice. And honestly, I understand every one of those sentiments.

But this EGM is also the first moment in a long time where I feel that MUST actually has a chance to move forward. Not a guaranteed recovery, not an overnight turnaround, but a genuine, realistic path to move beyond the difficulties of the last two to three years. And because of that, I think it is crucial for all unitholders to understand what has happened, what this new plan means, and why the vote matters so much.

So here’s the plan for today. First, I’ll walk through how MUST ended up in this position. Then I’ll explain what has happened over the past few years to bring us to the M.R.A. After that, we will go through the new Growth & Value Up Plan to be voted on in the upcoming EGM, in a simple, practical way. I’ll also share my personal concerns — and what MUST’s management has replied in response. And finally, I will give you my own take on how I’ll be voting, and why.

Before we dive in, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the REITs discussed, but what works for me might not work for you.

Alright, let’s jump right in.

The Unexpected Journey Of MUST Investors In The Past Few Years

Manulife US REIT was once one of the most well-loved REITs among Singapore income investors. It was the first pure-play US office REIT listed here, and for years it delivered strong yields, stable distributions, and attractive properties in major American office markets. Back then, US office assets were seen as defensive. Leasing demand was healthy, tenants were expanding, and interest rates were low. Everything worked… until it didn’t.

The first blow came from rising interest rates. The speed and magnitude of US rate hikes from 2022 to 2023 were unlike anything in recent decades. MUST’s debt costs rose sharply and refinancing became more costly and challenging.

Second, came the even bigger shock: the US office sector collapse. Remote work changed tenant behaviour almost overnight. Demand fell, incentives rose, and vacancies took longer to backfill. Valuations came down across the country.

And while this wasn’t a MUST-specific issue — it affected almost every US office owner — MUST was uniquely vulnerable because it was so concentrated in properties and locations which were most affected by the work from home trend. For instance, it has very little exposure to the tech sector which continued to churn along despite the COVID issues.

Finally, poor timing. MUST had increased its leverage to almost the limits to expand its property portfolio just before the depth of the COVID crisis hit.

Hence, by late 2023, the REIT reached a breaking point. Leverage was rising towards the regulatory limit, bank covenants were in danger, and refinancing windows were closing. MUST was at risk of breaching its loan agreements.

That was when the Master Restructuring Agreement, or MRA, was established. The Sponsor stepped in with an interest-reserve loan. The banks agreed to relax certain covenants temporarily. In return, MUST had to commit to a series of property disposals — a Minimum Sale Target — to bring down leverage.

And to give credit where it’s due, MUST’s management executed a significant portion of this plan. They successfully sold assets at prices that were competitive given the market environment. They repaid more than US$300 million of debt. They eliminated all their 2025 maturities and cleared most of their 2026 maturities.

Leasing momentum also improved, even if slowly. And for the first time in years, the US office sector shows very early signs of stabilising.

But even with all this progress, leverage remains too high, the Minimum Sale Target has not been fully met, and MUST cannot exit the MRA without lender approval. That brings us to the new plan you and I are voting on.

What Exactly Is This New Plan?

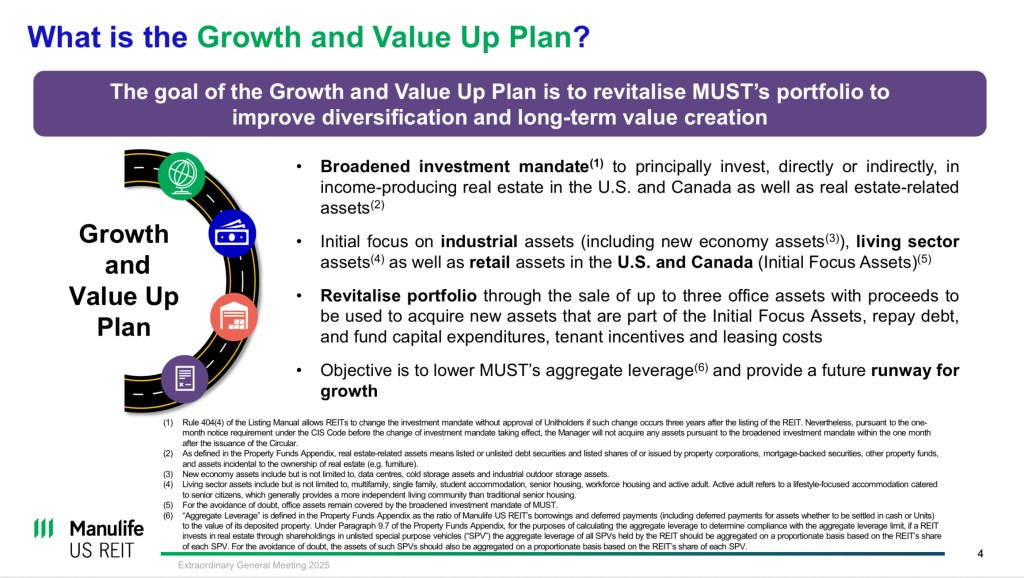

The Growth & Value Up Plan, as specified in the circular, is actually made up of several parts, but the easiest way to think about it is this: the plan is trying to buy MUST the time, flexibility, and strategic breathing room to finish its restructuring and reposition its portfolio beyond the US office sector.

The first component is a renewed Disposition Mandate. This allows MUST to sell up to three properties, with a minimum sale price of 90% of valuation, and a total net proceeds cap of US$350 million.

The mandate will run until the earlier of April 2027, or until three assets have been sold, or until the cap is reached, or until MUST’s leverage drops below 40%. Because the plan gives management pre-approval, they do not need to call repeat EGMs for each sale — which improves negotiating speed and reduces transaction friction.

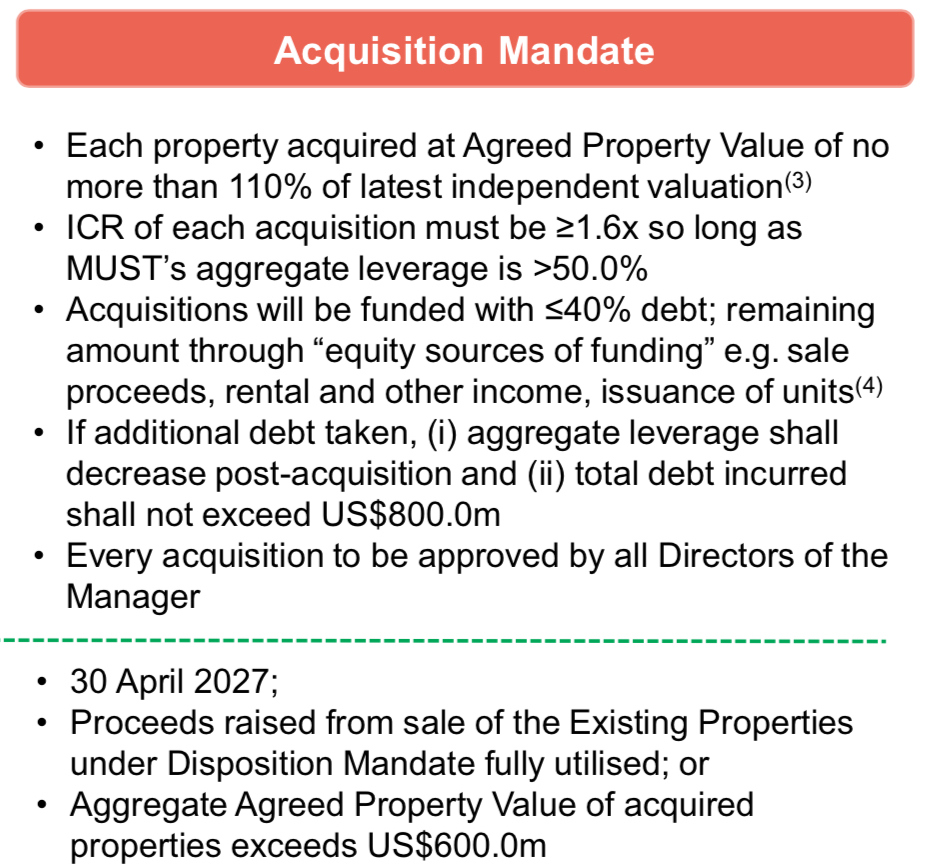

The second component is the Acquisition Mandate. This allows the REIT to acquire new assets up to a total value of US$600 million, but with very tight guardrails. Any acquisition must be priced within 110% of valuation, must be funded with at least 60% equity (mostly sale proceeds), and must use at most 40% debt.

For acquisitions executed while leverage remains above 50%, the deal must have an interest coverage ratio of at least 1.6 times. These guardrails are meant to instil discipline and prevent MUST from “buying growth” with too much leverage.

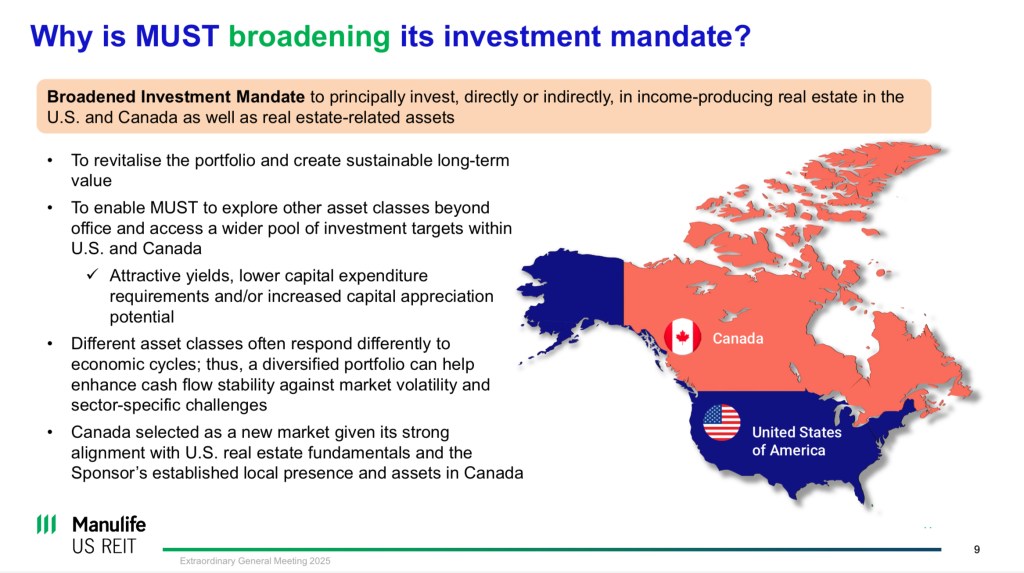

The third component is a broader investment mandate. Instead of being restricted to US office, MUST can now invest across a wider range of sectors — industrial, logistics, data centres, cold storage, multifamily, single-family rentals, student housing, retail — and across both the United States and Canada. The goal is to reposition the REIT into sectors that have better fundamentals than office today.

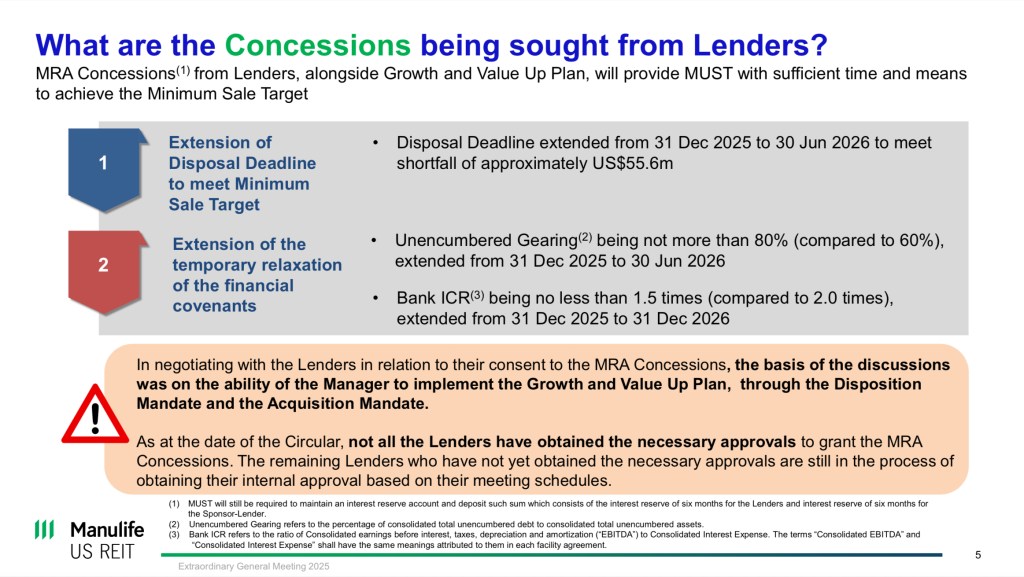

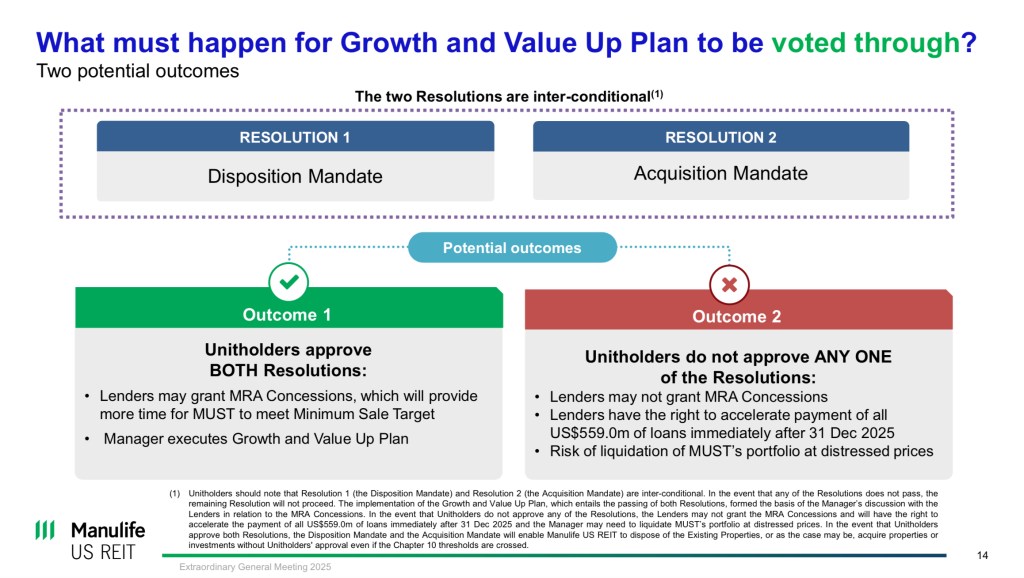

Finally, and most importantly, lender concessions under the MRA will only be granted if unitholders approve this Plan. These concessions include extended covenant relaxations and an extended disposal deadline from 31 December 2025 to June 2026.

Without this extension, MUST risks breaching its covenants and facing loan acceleration in a couple of weeks. With the extension, MUST gets additional time to sell assets in an orderly fashion and stabilise its financial profile.

Put simply: this vote keeps MUST financially stable long enough to complete the restructuring.

My Concerns And The REIT’s Responses

Even though I see the logic behind the plan, I also have real concerns — concerns I believe many unitholders share. Before arriving at my final take, I raised several concerns with MUST’s management, and a MUST spokesperson responded to each of them. I want to summarise their answers here so unitholders can understand the thinking behind the Growth & Value Up Plan.

My first question was about the timing of the EGM. Calling the meeting just before the 31 December MRA deadline felt extremely tight for unitholders. According to a MUST spokesperson, the sequence of lender discussions made an earlier meeting impossible.

Management had been engaging lenders since May 2025, but lenders only indicated willingness to extend the disposal deadline in early November, after it became clear that achieving the Minimum Sale Target by year-end was unlikely. Once lenders were aligned, MUST still needed time to prepare the circular and regulatory filings. This, they said, is why the EGM landed in mid-December.

I also asked what happens if the resolutions do not pass. The spokesperson confirmed that without unitholder approval, lenders are not obliged to grant any concessions, and MUST may effectively face repayment of around US$559 million immediately after 31 December. They noted that lenders have little incentive to force liquidation given the REIT’s progress, but the contractual right exists — and this is why the vote is so critical.

Another concern was leverage. I wanted clarity on how leverage would actually come down if sale proceeds might be used for acquisitions. MUST clarified that because the Minimum Sale Target has not yet been fully met, the next disposal must go toward debt repayment. Only after meeting the target will MUST evaluate whether proceeds should be used for more debt reduction, leasing needs, or acquisitions. They added that new acquisitions must be structured with at least 60% equity and no more than 40% debt, which should help lower overall leverage over time.

As for returning to the MAS gearing limit of 50%, they said the timeline depends on transaction execution, and that is why the Plan runs until April 2027.

I also raised the concern many of you have asked me about — whether MUST might end up selling some of its best assets, especially with the “90% of valuation” reference in the circular. The spokesperson explained that the 90% figure is simply the regulatory minimum under MAS rules. They stressed that MUST’s preference is to sell the remaining Tranche 1 asset, since it is required under the MRA, and to preserve the strongest Tranche 3 assets unless lenders approve otherwise. They said the intention is always to maximise value, not to sell quality assets unnecessarily.

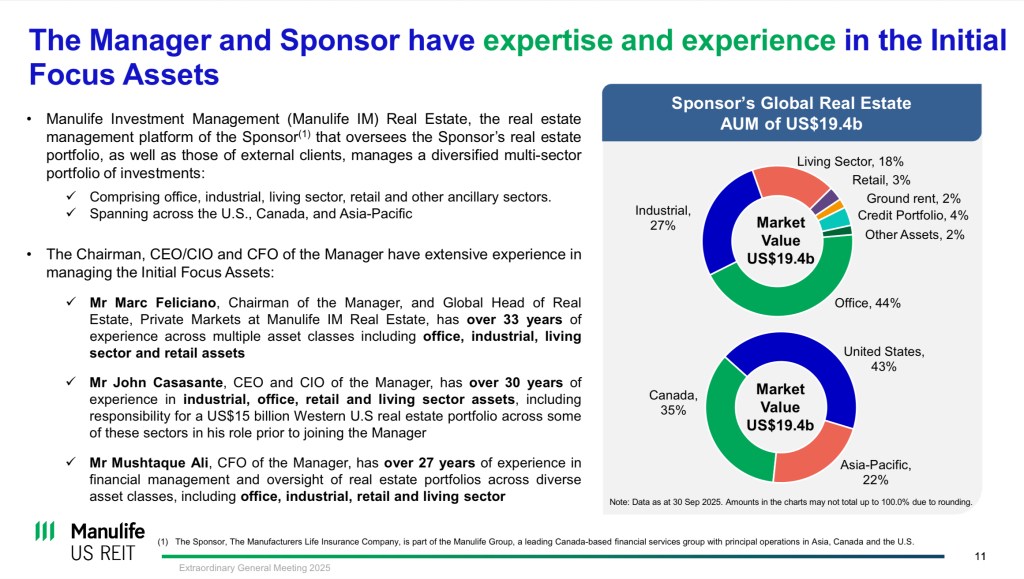

Finally, I asked why Canada was added to the mandate, and whether MUST has the capability to operate there. The spokesperson said Canada’s fundamentals are similar to the U.S., and crucially, the Sponsor already has a full real estate platform and deal-sourcing network there. Both MUST’s CEO and CFO have broad multi-sector experience, and MUST receives deal flow through the Sponsor’s North American investment team, including off-market opportunities.

These responses don’t remove all uncertainty — nothing in a turnaround situation ever does — but they do clarify the rationale behind the Plan and how management intends to execute it. With that context, let’s move into The Dividend Uncle’s take.

The Dividend Uncle’s Take

Let me now share my own position. I will be voting yes on all the resolutions. And I want to explain why clearly and calmly.

The first reason is simple: the alternative is far worse. If this plan fails, MUST may lose the lender extensions. Without the extensions, MUST risks breaching covenants, triggering potential loan acceleration, and possibly facing forced asset sales under distress. None of us — unitholders who have held through this tough period — want to see the REIT pushed into an even more painful situation. Voting yes avoids this cliff edge.

The second reason is that this plan finally provides a way for MUST to break out of the freeze it has been stuck in. For the past two years, MUST has been unable to buy, unable to plan long-term, and barely able to operate normally due to lender constraints. This plan, while not perfect, gives MUST the flexibility to recycle capital out of weak office assets and into stronger, more resilient property types. It is a pivot the REIT should have made years ago — and finally has a chance to execute now.

The third reason is the discipline built into the framework. I like that the plan forces valuation discipline on both disposals and acquisitions. I like the 40% debt limit for new assets. I like the requirement for a 1.6 times interest coverage ratio for any acquisition while leverage remains high. These guardrails do not eliminate risk, but they make reckless decisions far less likely.

And the fourth reason is that this vote is truly pivotal. MUST has been stuck in the doldrums for too long, held back by sector challenges, high leverage, and covenant constraints. With this plan, it finally has a roadmap — not a guaranteed success, but a real opportunity to rebuild its balance sheet, diversify its income streams, and gradually restore stability.

To be clear, voting yes is not a vote of blind optimism. It is a vote of realism. It is a vote for the option that keeps MUST alive long enough to execute a recovery. And honestly, it is a vote that avoids a freak result, because the last thing we want is for apathetic voting to cause resolutions to fail despite majority support.

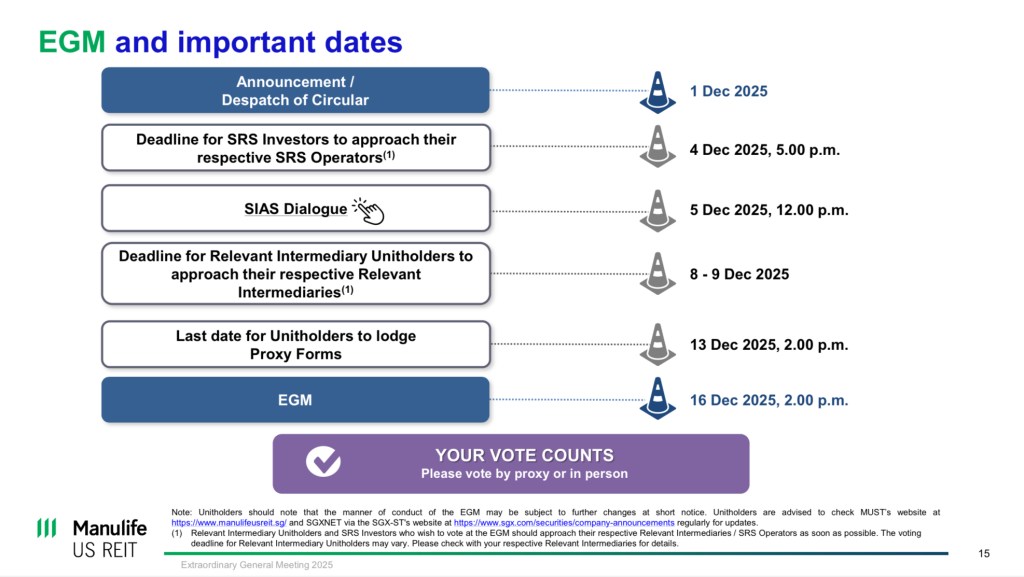

For those planning to vote, there are a few important dates to note. MUST dispatched the circular on 1 December, The SIAS dialogue happened on 5 December which I have shared the link on my Telegram, and will drop the link right here. For direct CDP holders, the final deadline to lodge proxy forms is 13 December at 2pm. And finally, the EGM itself will be held on 16 December at 2pm. So if you intend to vote — don’t wait till the last minute. Mark down these dates and make sure your vote is counted!

To close, MUST’s upcoming EGM is more than just another corporate formality. It is a defining moment for the REIT, for its financial future, and for every investor who has held through these turbulent years. The past few years have been painful for everyone involved. But this plan offers a way forward — not an easy way, and certainly not a guaranteed one, but a necessary one.

If you are a unitholder, I strongly encourage you to cast your vote. Don’t leave it to chance, and don’t assume others will do it for you. Every vote counts, and the consequences of a failed vote are simply too great to ignore.

Until next time, happy investing!

Leave a comment