[Listen on Spotify!]

Hey there, fellow dividend investors! Welcome back to the channel.

I’ve been investing in Singapore shares for a long time, and most of the time, the stocks either rise gradually or fall slowly. But every now and then, there are stocks like Sembcorp Industries — where one results announcement can send the share price tumbling almost 14% in a single day, wiping out nearly $2 billion in market cap and triggering one of the sharpest sentiment shifts we’ve seen this year.

Since its August peak near $7.90, Sembcorp has fallen about 25% to $5.90, and yet, if you zoom out, the stock is still up around 7% year-to-date. And for the last 5 years, the stock is actually up 250%, riding the wave of Sembcorp’s impressive restructuring of its massive businesses.

This is where things get interesting. The key question I am asking myself is of course whether the 25% decline is an opportunity to accumulate for a longer term structural upturn.

So today, I want to dive deep into whether this decline was justified, developments since then, and whether Sembcorp could actually represent value at these levels. Importantly, I’ll also talk about my own positioning and how Sembcorp fits into my personal portfolio, especially given its unique mix of utilities, renewables, and long-term contracts.

This article builds on the broader framework outlined in Dividend Investing & Income ETFs, which explains how income strategies work across dividend stocks and exchange-traded funds.

As always, a reminder that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed adviser before making any investment decisions. I own some of the shares discussed, but remember what works for me might not work for you.

Alright, let’s dive in.

What Sembcorp Is Today: A Transformed Business with Five Core Engines

To make sense of Sembcorp’s share price movements, it’s important to first understand what the company actually is today — because the Sembcorp of 2025 is very different from the one many investors remember a decade ago. After divesting its marine arm and reshaping its legacy operations, Sembcorp has evolved into a focused utilities and sustainable energy platform built on five core business segments, each playing a distinct strategic role.

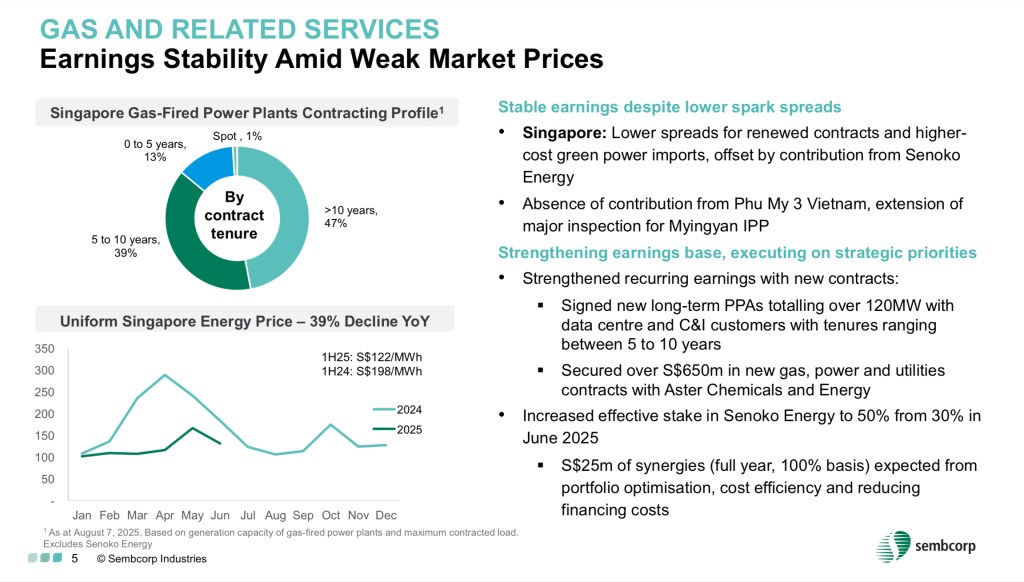

The largest engine is Gas & Related Services, the financial anchor of the group. This includes Sembcorp’s power generation assets in Singapore, embedded generation in the UK, and long-term utilities contracts with industrial customers. In the first half of FY2025, this segment contributed around 60% of group net profit. Margins dipped slightly, but more than 80% of Singapore’s generation portfolio is backed by long-term PPAs, giving Sembcorp predictable cash flows and a stable platform from which it can fund its renewables expansion.

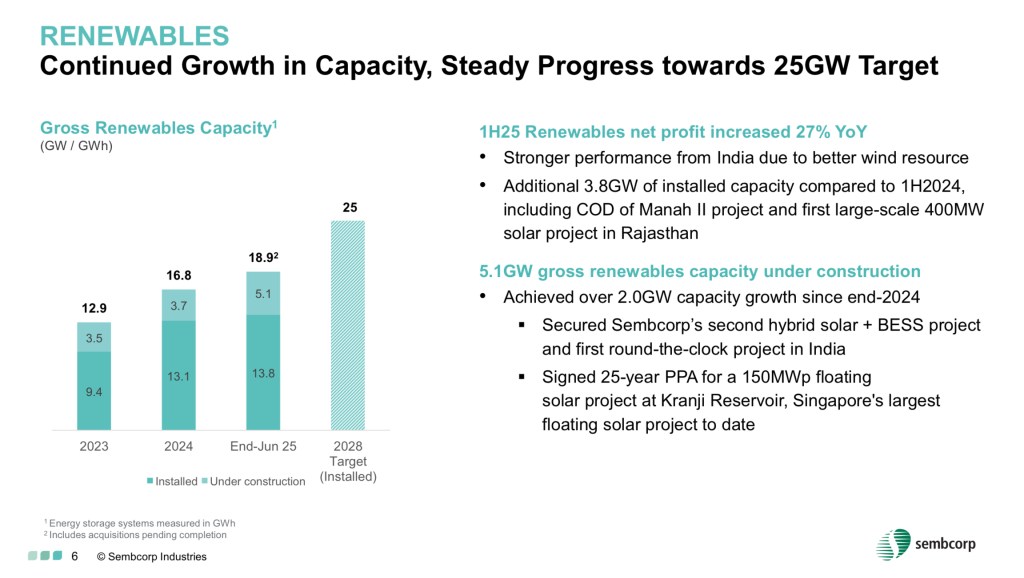

The second engine, Renewables, has become the group’s primary growth driver, contributing roughly 25–30% of net profit. This portfolio spans solar, wind, and battery storage across India, China, Southeast Asia, and the UK. Gross installed capacity now sits at nearly 19GW, much of it under 20–25-year power purchase agreements. What stands out here is momentum: Sembcorp continues to win tenders, complete acquisitions, and expand its presence in higher-margin markets like India.

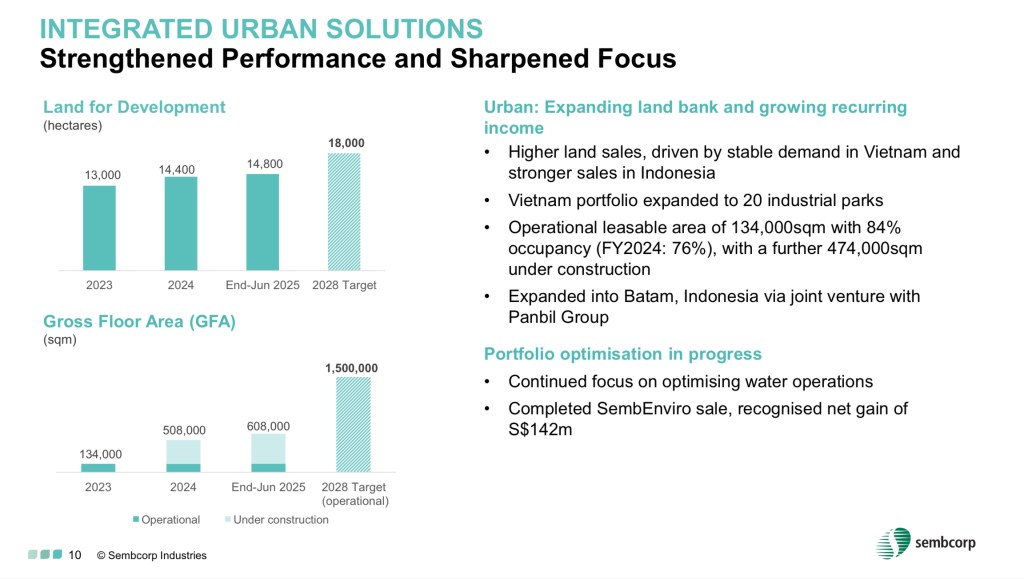

The third segment, Integrated Urban Solutions (IUS), contributes about 10–12% of net profit. Its role goes beyond earnings — it integrates energy infrastructure with industrial development across Vietnam, Indonesia, and other growth regions. This gives Sembcorp a foothold in emerging manufacturing hubs and helps seed long-term customers for its energy solutions.

The fourth engine, Decarbonisation Solutions, remains a smaller contributor today but is strategically important. This includes clean hydrogen-ready infrastructure, energy efficiency projects, cross-border renewable imports, and carbon management initiatives. The upcoming 600MW hydrogen-ready power plant in Singapore — a major part of this segment — is expected to begin contributing meaningfully from FY2026 onwards.

The final segment, Other Businesses & Corporate, captures ancillary activities such as specialised construction, minting, captive insurance, and corporate-level earnings. While not a growth driver, it provides operational support across the group.

When you step back, Sembcorp today is a blend of utilities stability and renewables expansion. Gas & Related Services provide earnings resilience and cash flow visibility, while Renewables anchors long-term growth. IUS offers diversification and customer pipelines, Decarbonisation positions the company for the future regulatory landscape, and the corporate segment ties everything together.

What Triggered the 25% Drop

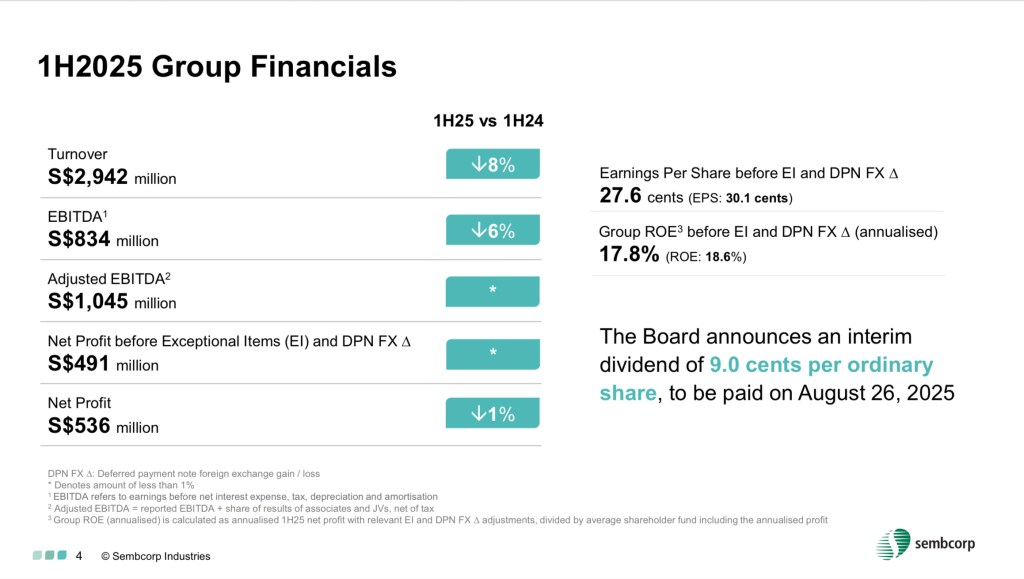

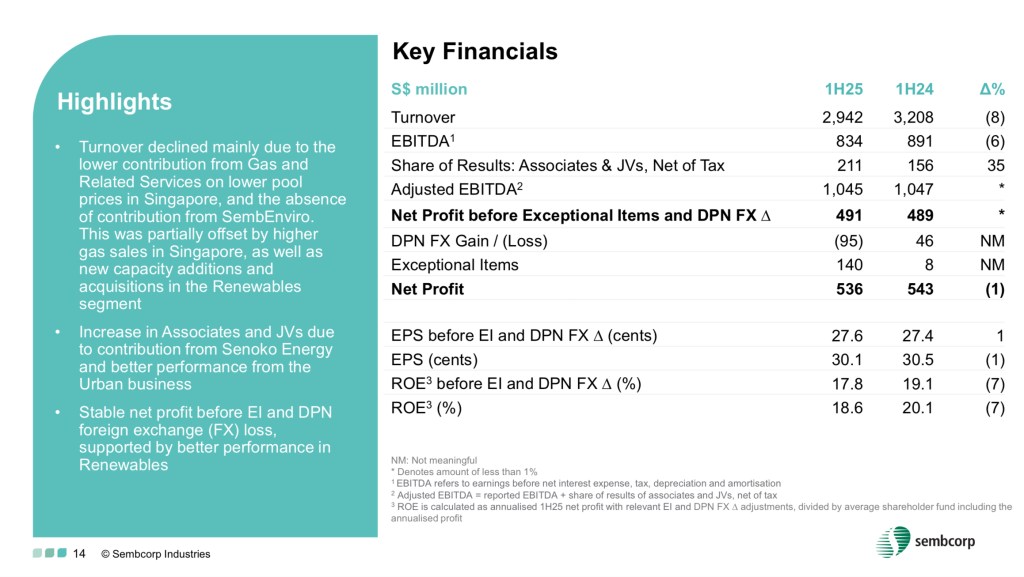

On 8 August, Sembcorp released its 1H2025 results — and what followed was one of the steepest single-day declines seen among Singapore large caps in recent years. The share price fell almost 14% in one day, marking the start of a 25% slide from its August peak near $7.90. And this happened despite results that, on paper, looked stable. Net profit came in at $491 million, essentially flat year-on-year, and the 8% revenue decline was consistent with the group’s ongoing shift toward higher-margin, lower-revenue renewable assets.

So why did the sell-off happen? It comes down to expectations.

In the five months leading up to the results, Sembcorp’s share price had rallied roughly 35%, driven by bullish sentiment around renewables, project wins in India, and growing anticipation of a potential India monetisation event. Investors weren’t just expecting solid results — they were expecting another round of outperformance, the kind Sembcorp had delivered multiple times in the past. When the results didn’t show a clear “beat,” sentiment flipped quickly.

And the headline number that overshadowed everything else was the forex impact. Sembcorp recorded around $23 million in non-cash forex losses due to the sharp strengthening of the Singapore dollar after the US holiday period. More significantly, a further $95 million forex effect hit the deferred payment note for its India assets because of the SGD–INR movement. Taken together, these currency effects wiped out what would have been about a 5% increase in underlying profit — turning growth into a slight year-on-year decline. That was enough to trigger disappointment for a stock priced for perfection.

Once the forex impact grabbed attention, investors also began examining operating segments more critically. In Gas & Related Services, margins narrowed and segment profit slipped from $339 million to about $330 million. The China renewables portfolio, which contributes roughly 10% of renewables earnings, faced higher curtailment and tariff adjustments. The gas and utilities business saw lower near-term profit despite new contract wins. Individually, all these were small variances — but taken together, they added to the perception that earnings momentum had softened.

In short, the sell-off was less about a collapse in fundamentals and more about a sudden reset of expectations. A stock that had climbed sharply into the results faced a headline earnings drag from forex movements — and sentiment unwound quickly.

What Has Happened Since Then: Momentum Has Accelerated, Not Slowed

Since the August sell-off, the flow of news surrounding Sembcorp has told a very different story from what the share price implies. Instead of slowing down, the company has continued to move with speed and conviction — winning renewable energy projects, expanding across markets, strengthening long-term contracts, and even announcing one of the largest overseas acquisitions in recent years. Week after week, new developments have reinforced one key point: operational momentum has remained strong, even as sentiment weakened.

Theme 1: Renewables Momentum Has Accelerated Across Multiple Markets

India continues to be the centre of Sembcorp’s renewables expansion — and activity there has actually picked up since August. The $246 million acquisition of ReNew Sun Bright gives Sembcorp full ownership of a 300MW operational solar asset backed by a 25-year PPA. On top of that, the company secured a 150MW firm and dispatchable renewable energy (FDRE) project from SJVN, which will require roughly 750MW of new solar and battery capacity. This single project pushes Sembcorp’s India portfolio above 7.6GW, and importantly, moves the company deeper into higher-value 24/7 renewable solutions.

Momentum in Singapore has also been strong. Sembcorp won the tender for an 86MW floating solar project at Pandan Reservoir, added the 118MWp ground-mounted solar farm on Jurong Island, and implemented a battery-stacking enhancement that lifted energy storage capacity from 285MWh to 326MWh without additional land. These developments reinforce Sembcorp’s growing strengths in solar deployment, energy storage, and grid-supporting systems — all increasingly crucial to Singapore’s energy transition.

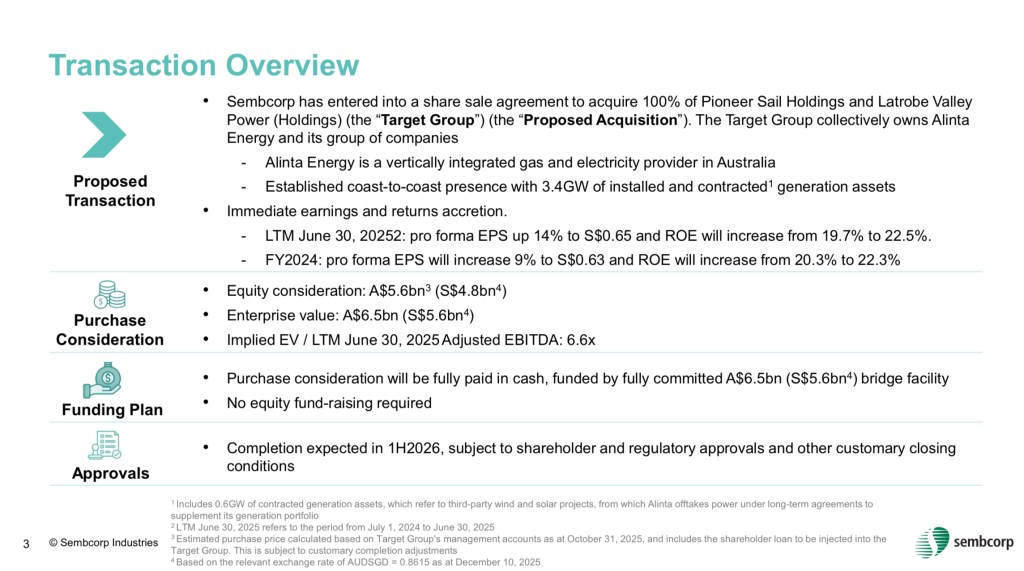

Theme 2: Expansion into Developed Markets — The A$6.5 Billion Alinta Energy Acquisition

The biggest development since August is Sembcorp’s planned A$6.5 billion acquisition of Alinta Energy in Australia. This is transformational. Australia is one of the region’s most mature and forward-looking energy markets, and Alinta brings a portfolio with 93% dispatchable availability and a massive 10.4GW development pipeline across solar, wind, and battery systems.

By retaining Alinta’s existing management team, Sembcorp reduces integration risk and gains immediate scale in a developed market — a strategic counterweight to its heavy exposure in emerging markets. Once completed in 1H2026, this acquisition will give Sembcorp a balanced footprint across Singapore, India, and Australia, and a platform for long-term growth in one of Asia-Pacific’s most important renewable markets.

Theme 3: Singapore’s Rising Power Demand and Long-Term Contracts Add Stability

Even as renewables expand, Sembcorp continues to benefit from rising structural power demand in Singapore, driven by data centres, semiconductor expansion, and AI-related infrastructure. Its 18-year renewable energy agreement with Micron is one major example — and analysts expect additional demand as Micron builds out new facilities in the coming years.

Sembcorp is also well-positioned for Singapore’s second data centre “call for action,” which requires around 300MW of new energy capacity. With its integrated renewable and gas-fired portfolio — including the upcoming 600MW hydrogen-ready plant coming online in 1Q2026 — Sembcorp is seen as a frontrunner.

Meanwhile, the integration of Senoko Energy, where Sembcorp increased its stake to 50%, strengthens earnings visibility. Senoko is expected to generate more than $200 million in earnings (100% basis) in 2026, and the majority of its contracts will be locked into medium- and long-term PPAs.

Theme 4: Capital Recycling and a Potential India Monetisation Event Ahead

Finally, capital recycling remains an important catalyst. UBS estimates that monetising Sembcorp’s India renewable portfolio could unlock $3.5 billion to $5.5 billion in proceeds, depending on the stake retained. Such a move — possibly through a stake sale or IPO — could materially deleverage the balance sheet and fund new growth initiatives in Australia, Singapore, and India. While timing is not confirmed, management has indicated that the second half of 2026 is a reasonable timeframe.

Summary of This Section

If you look at the months following the August sell-off, the operational story has only strengthened. Sembcorp has expanded its India and Singapore renewables pipeline, entered Australia through a landmark acquisition, reinforced long-term contracted earnings in Singapore, and kept potential capital recycling on the table. The business momentum is running ahead of the share price, not behind it.

With all these developments reshaping Sembcorp’s outlook, the next question is — what does the current share price actually tell us?

Before we move on, I know today’s post is a much deeper and longer dive than usual — there’s just so much happening with Sembcorp right now. If you’ve found the breakdown useful so far, the best way to help the website is to subscribe and give the post a quick “like.” It really helps tell Google that more investors might appreciate such detailed analysis.

Alright, let’s continue.

Is Sembcorp Attractive at Today’s Price?

With Sembcorp now trading roughly 25% below its August peak, the natural question is whether the stock offers value at current levels. The answer depends on how you view the company’s medium-term trajectory — but purely on numbers, the valuation reset has brought Sembcorp back to a far more reasonable zone.

Comparison With Peers

On a forward price-to-earnings basis, Sembcorp now trades at around 10 times forward earnings, compared to the 12–14 times commanded by many utilities and renewable developers across the Asia-Pacific region. The discount widens meaningfully when you look at EV/EBITDA, where Sembcorp trades at more than a 45% discount to regional peers despite having stronger or comparable growth prospects.

Profitability also tells a compelling story. Sembcorp’s return on equity sits close to 19%, which is unusually high for a company operating large-scale renewables and gas-fired assets. To put this into context, Indian renewable giant Adani Green Energy — one of the clearest regional peers in pure-play solar and wind — typically operates with an ROE in the low- to mid-teens.

Diversified utilities such as YTL Power in Malaysia generally come in even lower, often within the mid-single-digit to low-teen range depending on annual fluctuations. Against this backdrop, Sembcorp stands at the upper end of the profitability spectrum. The fact that it still trades at a valuation discount suggests the market’s recent derating may have over-corrected.

Dividend Outlook

Income investors may also appreciate the clearer dividend outlook. Management has indicated confidence in maintaining at least 23 cents per share in annual dividends for the next several years, which translates into a yield of around 3.6% at current prices. It is not a REIT-level yield, but for a utilities and renewables growth story with improving free cash flow, the payout is both sustainable and backed by contracted earnings.

Share Buybacks

Even the company’s own actions reinforce that management sees value. Since late August, Sembcorp has conducted share buybacks totalling approximately $12.5 million, at an average price of around $6.11. While not enormous in scale, buybacks at this point of the price cycle are a strong signal that internally, valuations are seen as attractive.

Taken together, the valuation, profitability, and forward earnings profile all point toward a company that has been punished largely on sentiment rather than fundamentals. At these levels, Sembcorp is no longer “priced for perfection” — it is priced more in line with, or even below, regional peers while delivering stronger operating metrics.

So from a valuation perspective, Sembcorp today is cheaper, stronger, and more diversified than it was just a few months ago.

But even with these strengths, any balanced assessment needs to consider the risks as well.

The Risks: Important, Tangible, and Not to Be Sugar-Coated

Despite the attractive valuation, Sembcorp is not without meaningful risks, and these need to be recognised clearly.

First, currency risk remains real. Exposure to emerging markets — especially India — makes earnings vulnerable to SGD strength. The $118 million total forex drag in 1H2025 is a reminder that even when the underlying business performs well, reported profits can fluctuate.

Second, Sembcorp faces regulatory and pricing risks in markets like China and Vietnam, where tariff adjustments, curtailment, and grid bottlenecks can compress margins. These issues don’t derail the long-term strategy but can create volatility quarter to quarter.

Third, the push toward 25GW of renewables by 2028 requires substantial capital. While free cash flow has been strong, acquisitions — including the A$6.5 billion Alinta deal — can increase leverage if not matched with capital recycling or organic cash generation.

Finally, Sembcorp is still navigating the transition from gas-heavy earnings to renewable-heavy growth. The upcoming hydrogen-ready plant will help future-proof its Singapore portfolio, but the transition period may involve margin shifts and operational adjustments.

These risks explain why Sembcorp still trades at a discount. They don’t invalidate the investment case, but they require investors to have realistic expectations — this is a multi-year transition story with natural volatility.

The Dividend Uncle’s Take: Am I Buying Sembcorp Now?

A 25% decline changes the conversation. It doesn’t automatically make Sembcorp a buy, but it does justify a fresh, honest review of the investment thesis. So I went back to the numbers, the segment performance, and everything that’s happened since August.

What stood out to me is that the business hasn’t slowed. If anything, Sembcorp has accelerated — from solar and battery wins, to India expansion, to its hydrogen-ready plant, and now the landmark Alinta acquisition in Australia. The long-term direction remains clear.

There are risks, especially with currency swings and the usual volatility that comes with fast-growing renewables. But after such a sharp pullback, the balance between risk and potential return looks more reasonable than it has in a long time.

So here’s where I stand: I’m willing to dip into the decline. Not trying to catch the bottom, not rushing in, but accumulating slowly and deliberately. Because to me, the long-term story still looks intact — and Sembcorp feels like it has many good years ahead.

Alright, that’s all from me today. Now I would like to hear from you – do you see Sembcorp as being of value at this point in time? Do you see a continued structural upturn in the next few years? Let me know in the comments! I’ll continue tracking Sembcorp closely and will share updates whenever meaningful developments emerge.

If you found this deep-dive helpful, please like thepost and subscribe — it helps the channel reach more dividend investors.

Until next time, happy investing!

Leave a comment