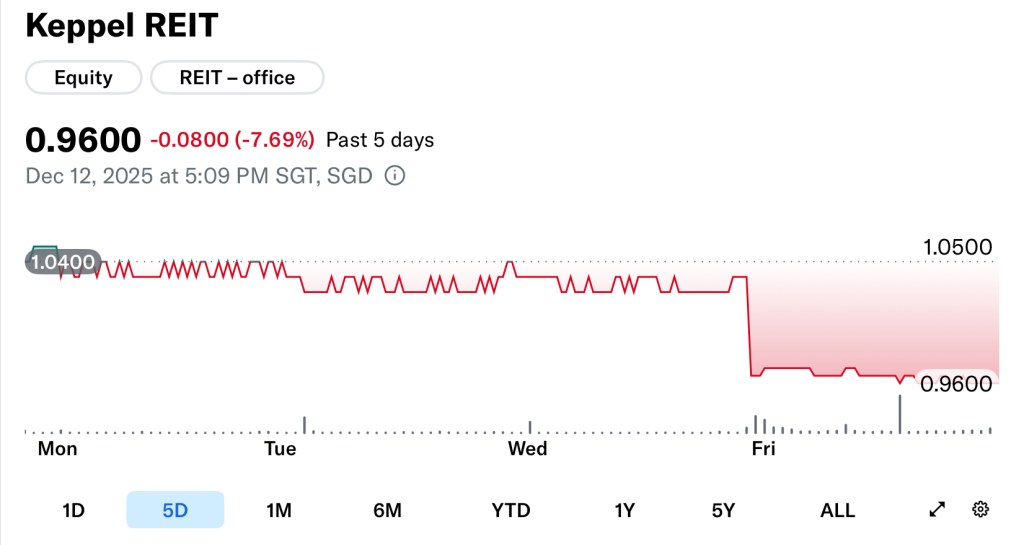

Keppel REIT (K71U.SI) just dropped one of its biggest announcements in years — a move that instantly sent its unit price sliding all the way down to the preferential offering level of $0.96. It’s acquiring an additional one-third stake in MBFC Tower 3, one of the most prestigious Grade A office assets in Singapore’s Marina Bay area, and the deal is being funded through a sizable non-renounceable preferential offering.

And because this is the kind of asset that rarely becomes available on the market, and because the preferential offering or preferential offering price now sits exactly where the unit price has fallen to, investors have been buzzing with questions: Is this good? Is this bad? Is it dilutive? Is it the right move at the wrong time? Or is this one of those moments where long-term quality and short-term pain collide?

Now, I don’t usually publish a full deep-dive early in the week. My usual rhythm is Saturday morning, or Friday afternoon for members if I manage to get everything ready ahead of time. But this announcement is genuinely time-sensitive. Many of you messaged me right after the news broke, and because preferential offerings have deadlines and the market is moving, this is something I wanted to break down quickly, clearly, and accurately. So today’s post comes a little earlier than usual — and I hope it helps you make an informed decision.

In this article, we’ll break down the mechanics of the acquisition and the preferential offering, look at the financial impact, unpack the bigger issue of why REITs sometimes buy high-quality assets even when the immediate math is dilutive, go through the concerns analysts are raising, and end with my personal take — both from the point of view of existing unitholders and investors who don’t own Keppel REIT today but are watching the price action very closely.

This analysis forms part of the broader Singapore REITs 2026 Guide, which provides REIT-by-REIT research on asset quality, balance-sheet strength, and long-term income sustainability.

Before we dive in, let me remind you that this article is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the REITs discussed, but what works for me might not work for you.

Alright, let’s jump right in.

The Acquisition and the Preferential Offering

Let’s start with the facts. Keppel REIT is acquiring the additional one-third interest in MBFC Tower 3 from Hongkong Land at an agreed property value of $1.453 billion. This is just about 1% below the independent valuation, which for a prime, fully stabilised Grade A office building in Marina Bay, is quite typical. These assets rarely trade at distressed valuations because they are essentially irreplaceable.

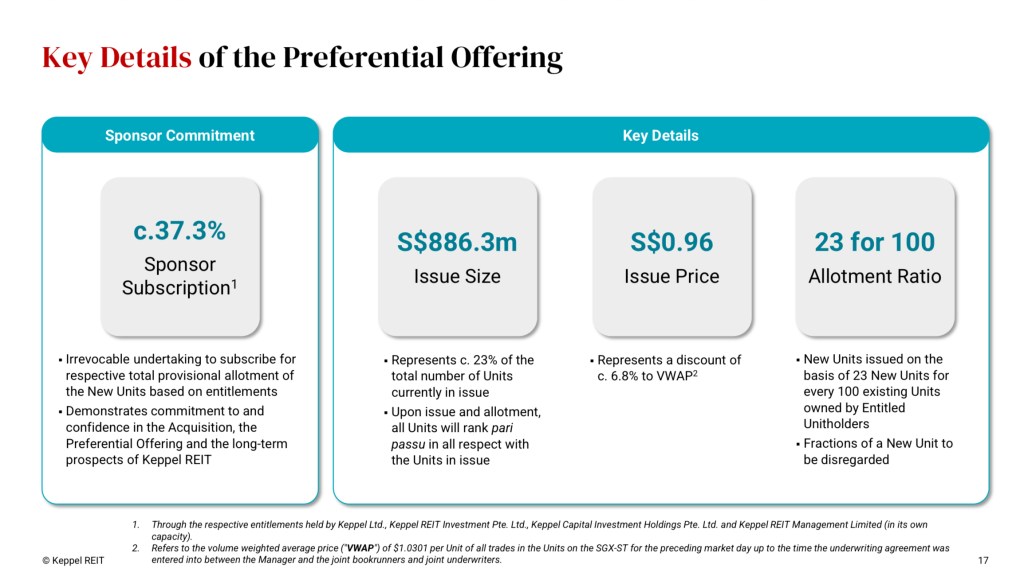

Including transaction costs and fees, the total outlay is around $937.5 million. To fund this, the REIT is launching a fully underwritten, non-renounceable preferential offering of $886.3 million, priced at $0.96 per unit. The ratio is 23-for-100, meaning for every hundred units you own, you are entitled to subscribe for twenty-three new ones at the issue price.

This is one of the larger preferential offerings we’ve seen in Singapore’s office REIT sector in recent years, and it will enlarge the unit base significantly. Keppel REIT currently has about 3.84 billion units in issue, and after the preferential offering, that number will rise to roughly 4.76 billion units.

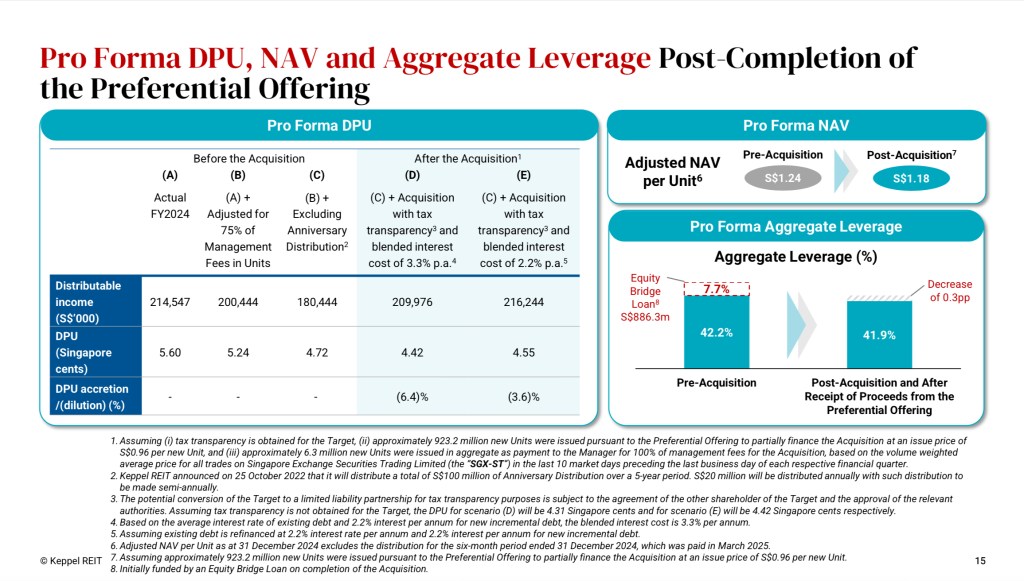

The next big question is always this: is the deal accretive or dilutive? And Keppel REIT answers that directly. Their FY2024 reported DPU is 5.6 cents, but this includes the special anniversary distribution of twenty million dollars a year.

Once you strip out that one-off item and look only at recurring operating income, the baseline DPU is 4.72 cents. This is the correct number to use when assessing dilution, because recurring DPU reflects the REIT’s true ability to generate income without temporary boosts.

The pro-forma DPU after the acquisition and preferential offering ranges from 4.42 cents to 4.55 cents depending on funding assumptions. In other words, the dilution is about 3.6% to 6.4% compared to recurring DPU

Net asset value or NAV per unit also drops from $1.24 to $1.18 — again, not surprising when new equity is issued at below NAV.

Gearing improves slightly from 42.2 percent to 41.9 percent once the preferential offering proceeds are used to repay the equity bridge loan.

On paper, the acquisition is mildly dilutive in the short term on both NAV and DPU, but strengthens the balance sheet marginally through additional equity.

Understanding the Quality-Asset Dilemma in REITs

Now let’s step back a bit, because this deal reflects a deeper trend I’ve been seeing across the REIT landscape in the past two years. There has been a series of acquisitions that feel like REITs being “forced” to buy assets when they become available — even if the timing isn’t fantastic and even if the math is somewhat dilutive.

High-quality assets don’t trade frequently. And when they do, the REIT holding the right of first refusal is under pressure to decide quickly. If they don’t buy, someone else will — and sometimes that “someone else” might be a direct competitor who ends up strengthening their portfolio relative to yours.

Keppel REIT is in this exact situation. Hongkong Land wants to sell, Keppel REIT has the first right, and this is a trophy asset. Passing rents at MBFC Tower 3 are estimated to be below current Grade A market rents, meaning there is rent reversion potential.

DBS is the anchor tenant, which means extremely stable occupancy. And Marina Bay remains one of the most supply-constrained office districts in Singapore for several years to come.

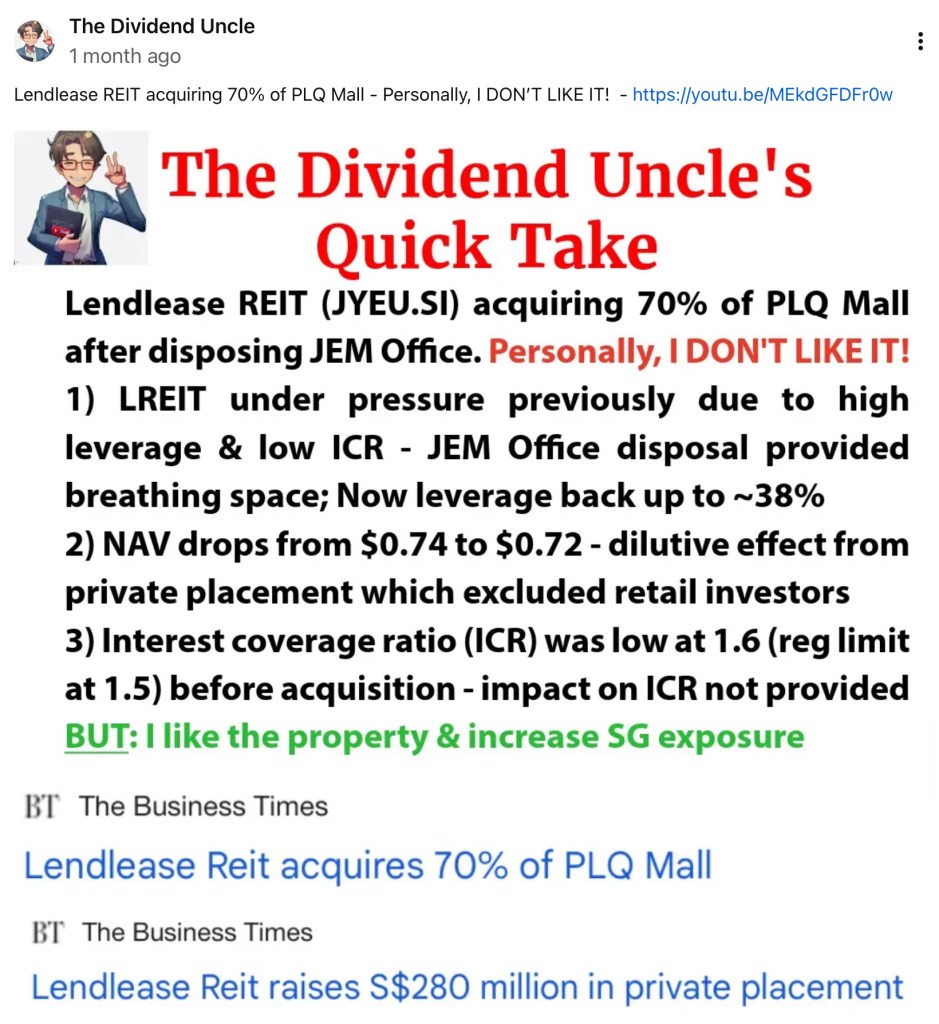

Nobody wants to walk away from an asset like this, because opportunities like these don’t come often. It’s very similar to Lendlease REIT’s recent acquisition of the 70% stake in PLQ Mall. Ideally, Lendlease REIT should be deleveraging as I mentioned in the previous post where I expressed disappointment with the acquisition.

But PLQ is such a strategically important asset within Paya Lebar that letting it go was not an option. That deal was also dilutive in the short term — because quality almost always comes with low yields — but strategically necessary in the long term.

This is the underlying dilemma for REIT investors: the highest-quality real estate tends to have the lowest yields, and owners of these assets tend to hold them tightly. So when one finally comes to market, REITs often prioritise long-term strategic quality over short-term DPU accretion. Whether that’s the right move depends on your investment philosophy.

The Yield Problem With Trophy Assets

Over my years of investing in REITs, I’ve seen this repeatedly: the very best assets, especially those in the super-prime office space or certain malls along Orchard Road, almost always come with extremely low property yields.

A prime office building or Orchard mall might have rental uplift potential, but the going-in yield is often barely enough to deliver meaningful DPU accretion unless the REIT levers up significantly or buys below valuation.

MBFC Tower 3 sits in that category. You’re paying for location, prestige, stability, and long-term scarcity value. But because yields are low, the immediate DPU impact is rarely positive — and often slightly negative.

That doesn’t mean the acquisition is bad. It just means the return profile is more long-term in nature, and investors need to calibrate expectations accordingly.

Concerns and Managerial Incentives

This leads to a related point that has surfaced in certain analyst commentary. Some analysts have suggested that dilutive acquisitions can sometimes be aligned with the REIT manager’s incentive structure rather than unitholder interest. Because management fees are typically calculated based on assets under management, growing the portfolio — even with deals that are not immediately accretive — increases fee income.

I’m not implying Keppel REIT is making decisions that are misaligned with unitholders. But it’s true that the manager recently expanded its investment mandate to include new asset classes beyond office, and it bought a retail mall in Sydney just a few months ago.

This expands the opportunity set, but also increases the execution risk and raises the possibility of further acquisitions that may not be straightforwardly accretive. And if you’ve been following this channel, you would’ve seen my typical Singaporean “complaints” about the mandate expansion, and why I didn’t like it.

But back to the issue, investors should be aware of this dynamic. When a mandate expands and when fee structures are tied to AUM, it becomes especially important for investors to monitor the quality and rationale of future deals.

The Market Reaction and TERP

Let’s talk about the market reaction, because this is perhaps the clearest indicator of sentiment. Using the pre-announcement price of $1.03, the theoretical ex-rights price (or TERP) after issuing twenty-three units at ninety-six cents for every hundred units is approximately $1.017. In other words, the theoretical fair price after dilution should be around $1.02.

But the unit price quickly fell all the way to $0.96 — the preferential offering price itself.

This tells us two things. First, investors are not enthusiastic about the preferential offering. Second, there is a reasonable chance that the preferential offering may be under-subscribed, particularly among retail holders who may not wish to commit additional capital.

If that happens, underwriters will have to take up the unsubscribed units. They don’t intend to hold these units long term. They will sell them gradually once the price moves above $0.96. This is why $0.96 may become a ceiling for a while. If the price rises above it, underwriters may start reducing their inventory. Until that’s absorbed by the market, there may be an overhang.

This phenomenon is not unique to Keppel REIT. We have seen similar price behaviour in previous non-renounceable offerings across other REITs.

Before we continue, just a quick note of thanks for everything who have been supporting thedividenduncle.com website. If you find these time-sensitive analyses useful, the best way to help the website is to give it a ‘like’.

Alright, let’s get back to the breakdown.

The Dividend Uncle’s Take

Now let’s bring all this together. Using the recurring pre-acquisition DPU of 4.72 cents and the pre-announcement price of 1.03 dollars, the yield was about 4.6%. Using the pro-forma DPU range of 4.42 cents to 4.55 cents and the current price of ninety-six cents, the yield is also around 4.6%. On a yield basis, almost nothing changes.

But investors don’t experience this in percentage terms. They experience it in nominal DPU. And nominal DPU is lower. So existing unitholders feel the dilution more viscerally.

Let me break it down into two investor groups.

For non-existing investors, the REIT is arguably more attractive today than before the acquisition. It has increased its exposure to Singapore, strengthened its portfolio with a super-prime asset, and the unit price has adjusted downward. The combination of higher asset quality and lower entry price should be a favourable setup.

But the recently expanded mandate introduces new uncertainties. If the REIT continues to diversify into other geographies or asset classes, future acquisitions could bring more dilution. And with the risk of a sizeable underwriter overhang, I personally wouldn’t rush in as a new investor. Since I don’t own Keppel REIT today, waiting for price stabilisation — or even a dip below $0.96 — may be the more prudent move.

For existing investors, the feeling is understandably mixed. In the short term, you are being diluted. Your DPU per unit will fall. But in the long term, you will own a larger piece of one of Singapore’s most prized office assets. Your portfolio exposure becomes higher quality.

So, should you subscribe to the preferential offering? If I were an existing investor, that means I’m already optimistic about Keppel REIT’s long-term prospects. So I would consider subscribing — but I will wait till the last minute. I would monitor the unit price closely. If the price drops below $0.96, I may choose to buy from the market instead of subscribing. If it stays at or above the preferential offering price, then subscribing makes sense to avoid further dilution.

That’s my take: monitor first, subscribe only if the market price does not offer a better deal.

That’s all for today, folks. Keppel REIT’s acquisition of a one-third stake in MBFC Tower 3 is a classic REIT case study in long-term quality versus short-term dilution. It strengthens the portfolio and increases Singapore exposure, but weakens per-unit metrics in the near future.

Let me know what you think in the comments. And if you found today’s early-week deep dive helpful, do give the article a like so more investors can see it, and I’ll see you in the next one.

Leave a comment