Executive Summary

Mapletree Pan Asia Commercial Trust (MPACT) (SGX: N2IU) has undergone a period of operational stress and portfolio recalibration over the past two years, driven by uneven recovery across its key assets in Singapore and Hong Kong. This article examines eight consecutive reporting periods to assess whether the trust’s risk profile and earnings stability have materially changed.

By analysing performance trends at VivoCity, Festival Walk, and Mapletree Business City, alongside recent management and capital actions, the article evaluates where stability has improved, where challenges remain, and which factors will determine whether MPACT can move beyond stabilisation toward a more durable recovery.

Context: From Deterioration to Reassessment

MPACT entered FY24 under mounting pressure. Festival Walk’s retail performance in Hong Kong remained volatile, Singapore business parks came under scrutiny amid hybrid work trends, and the trust appeared increasingly dependent on VivoCity for earnings resilience. At that point, the portfolio’s diversification benefits were diminishing, with downside risks becoming more concentrated.

Since then, changes have been incremental rather than headline-driven. Renovations concluded, footfall trends normalised, rental negotiations evolved, and capital management actions were implemented. Reviewing these developments across eight reporting periods allows for a more objective reassessment of whether MPACT’s operating and risk profile has stabilised meaningfully.

VivoCity: Consistent Anchor and Earnings Stabiliser

VivoCity remains MPACT’s most important asset, both strategically and financially. Its contribution to net property income is substantial, and its performance continues to shape overall confidence in the trust.

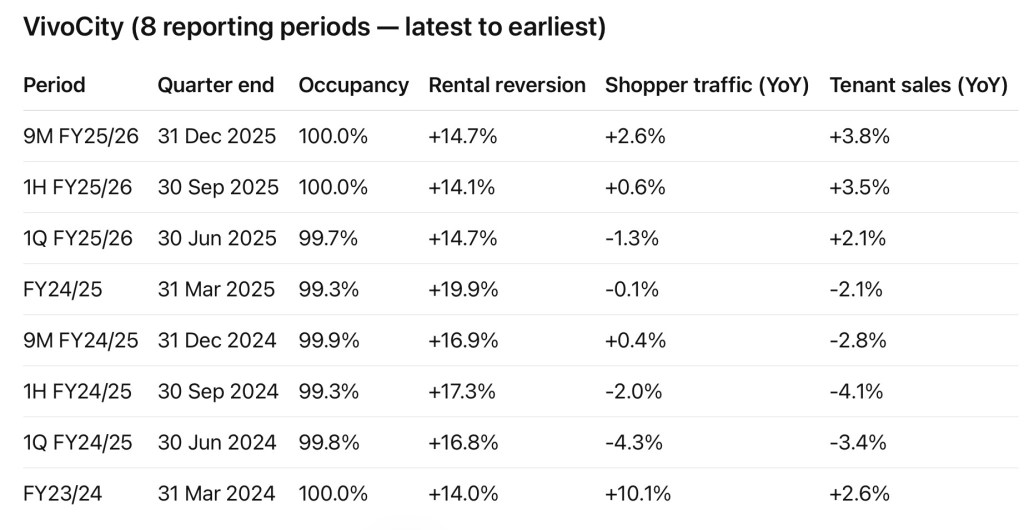

Across the eight reporting periods, VivoCity maintained exceptionally high committed occupancy, consistently around 99–100%. This stability indicates that challenges faced during the period were operational rather than structural. Tenant demand remained intact, and leasing risk was minimal throughout.

The impact of basement renovations became visible in shopper traffic and tenant sales during FY24/25, when both metrics turned negative. These declines coincided with temporary disruptions to access and footfall. Importantly, the data shows a clear sequence of recovery: traffic stabilised first, followed by improving tenant sales in FY25/26, culminating in positive growth on a cumulative basis by the nine-month mark.

Rental reversion trends provide the strongest signal of asset quality. VivoCity delivered consistently strong positive rental reversions across all eight periods, frequently in the mid-teens and occasionally approaching 20%. This occurred even during quarters when sales and traffic were temporarily weaker, highlighting sustained tenant demand and management’s pricing power.

With renovations completed, VivoCity exited the period with improved tenant mix, resilient leasing dynamics, and recovering shopper behaviour. Its role as MPACT’s earnings stabiliser and upside engine remains intact, and its performance continues to offset weaker contributions elsewhere in the portfolio.

Festival Walk: Recovery Remains Incomplete

Festival Walk represents the more challenging side of MPACT’s retail exposure. While it remains a high-quality asset, its performance over the review period has been uneven and materially weaker than VivoCity’s.

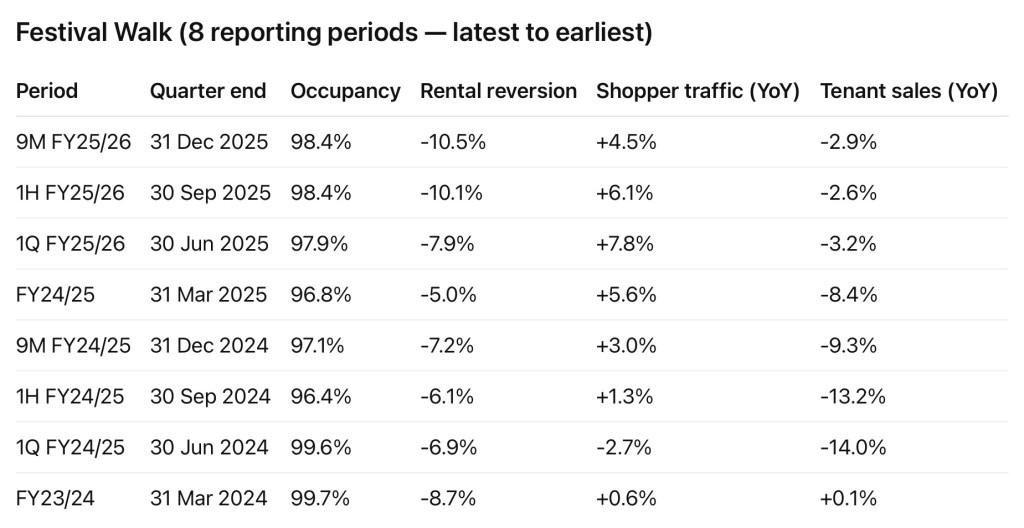

Occupancy at Festival Walk declined from near-full levels to the mid- to high-90% range during FY24/25 and has yet to fully recover to prior peaks. While these levels remain respectable, the downward shift reflects weaker leasing leverage and a more cautious tenant environment.

Shopper traffic trends have been more encouraging. Multiple periods recorded mid- to high-single-digit growth, indicating that footfall has returned. However, tenant sales did not follow the same trajectory. Sales remained negative through most of FY24/25 and into FY25/26, despite improved traffic. This divergence suggests lower spending per shopper, weaker conversion, or a tenant mix still adjusting to changing consumer behaviour.

Rental reversions underscore the challenge. Festival Walk recorded negative rental reversions across all eight periods, ranging from mid-single-digit declines to double-digit drops in FY25/26. Management appears to have prioritised occupancy and long-term relevance over near-term rental growth, accepting lower rents to maintain tenant stability.

While traffic recovery is a necessary condition for improvement, it has not yet translated into earnings recovery. Until tenant sales stabilise and rental reversions flatten, Festival Walk is likely to remain a drag on portfolio-level growth.

Management Actions and Capital Discipline

Recognising uneven asset-level recovery, management has taken targeted steps to reduce portfolio risk and defend the balance sheet.

Divestment of Festival Walk Tower

MPACT announced the divestment of Festival Walk Tower, the office component of the Hong Kong development, for HKD 1.96 billion (approximately S$328 million), in line with its latest independent valuation. The sale was executed at fair value, with high committed occupancy at the time, indicating a deliberate portfolio optimisation rather than a distressed exit.

The transaction reduces exposure to a segment facing different demand dynamics and lower recovery visibility, while allowing management to focus on the retail component where recovery is more plausible. Proceeds are expected to be used primarily for debt reduction, with aggregate leverage projected to improve by approximately one percentage point upon completion.

This divestment follows earlier office disposals in Japan and reflects a consistent approach of pruning assets with weaker recovery prospects.

Improving Interest Cost Dynamics

Capital management has shown gradual improvement. Gearing has edged down into the high-30% range, and the weighted average all-in cost of debt has declined from above 3.5% previously to around 3.2% most recently.

This has translated into lower finance expenses, which declined 10.2% year-on-year for the quarter and 14.5% year-to-date. For a diversified commercial REIT with uneven asset-level growth, easing interest costs provide meaningful relief to distributable income and enhance resilience during recovery phases.

Mapletree Business City: The Swing Factor

Mapletree Business City (MBC) is one of MPACT’s most significant Singapore assets, contributing net property income comparable to VivoCity. As such, its performance has an outsized influence on perceptions of the trust’s Singapore office and business park exposure.

Occupancy Versus Pricing Pressure

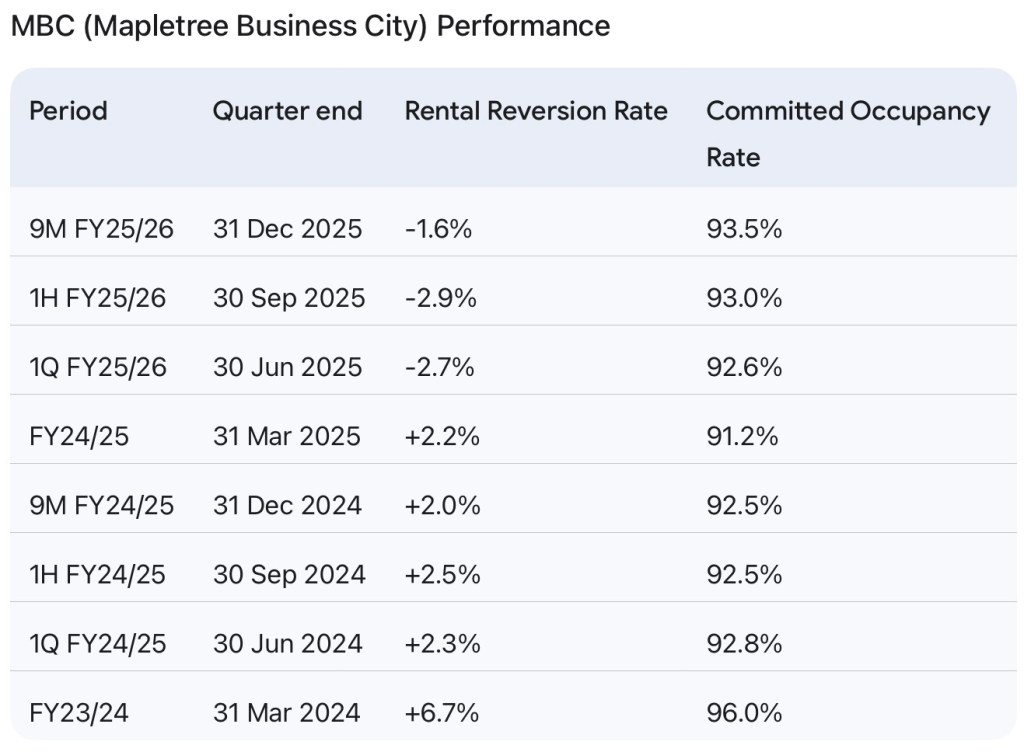

Concerns around Singapore business parks have intensified amid hybrid work adoption, tenant consolidation, and corporate cost discipline. For MBC, these pressures did not manifest as a sharp collapse in occupancy. After bottoming at approximately 91% in FY24/25, occupancy stabilised and gradually improved to about 93.5% by the December quarter of FY25/26.

The stress point instead emerged in rental reversions. While MBC delivered positive rental growth through FY23/24 and much of FY24/25, pricing power deteriorated in FY25/26. Rental reversions turned negative, ranging from approximately -2% to -3%, even as occupancy improved. This indicates that landlords were conceding on rents to retain and attract tenants in a softer demand environment.

Early Signs of Stabilisation

More recently, the magnitude of negative rental reversions has narrowed. On a nine-month basis, reversions improved to approximately -1.6%, compared with closer to -3% earlier in the fiscal year. While still negative, this suggests that pricing pressure may be easing as the market approaches a new equilibrium.

At this stage, MBC appears to be stabilising rather than recovering. Sustained improvement in rental reversions will be critical to confirming whether the business park segment has moved past its adjustment phase.

Overall Assessment: Stabilisation Without Confirmation

Across eight reporting periods, MPACT’s operating profile appears more stable than during its earlier phase of deterioration. VivoCity continues to perform strongly and anchor earnings. Festival Walk shows improving footfall but remains constrained by weak tenant sales and negative rental reversions. Mapletree Business City has stabilised in occupancy, with early signs that rental pressure may be moderating.

Management’s portfolio optimisation and improving interest cost dynamics have reduced downside risks at the margin, providing time for asset-level recoveries to mature. However, recovery remains uneven and heavily reliant on VivoCity.

At present, the data supports a view that MPACT has found a footing, but not yet a clear path to broad-based recovery. Confirmation will depend on whether tenant sales at Festival Walk improve meaningfully and whether rental reversions at Mapletree Business City stabilise decisively. Until then, MPACT remains in a middle ground—no longer deteriorating, but still awaiting stronger evidence of durable improvement across its key assets.

How This Analysis Fits Within a Broader Research Framework

This article forms part of an ongoing research series examining Singapore-listed REITs and income-oriented investments through the lens of asset quality, income sustainability, capital discipline, and portfolio role. The objective is to provide structured, long-term analysis rather than commentary on short-term price movements.

Related Research

• Singapore REITs 2026 Guide

• Core–Satellite REIT Portfolio Framework

• Dividend Investing & Income ETFs — Structural Overview

Publication note: This article is intended for educational and informational purposes and reflects publicly available information as at the date of publication.

Leave a comment