Hey savvy investors! Today, I’m thrilled to share some exciting news that could be particularly interesting for fellow dividend hunters who, like The Dividend Uncle, are always on the lookout for consistent income streams.

The JP Morgan Equity Premium Income ETF, or JEPI, has recently listed on the London Stock Exchange or LSE. For income-focused investors in Singapore, this listing presents a fresh opportunity to explore this globally popular income-generating ETF. Why is this a big deal? Because now investors can receive JEPI’s monthly payouts, without the hefty 30% U.S. withholding tax that used to apply when it was only listed in the U.S. market.

In this post, I’ll share factual information about how JEPI works, discuss its performance history, and consider the potential opportunities and risks it offers. By the end, you’ll have a clearer understanding of JEPI’s structure and whether this type of investment aligns with your financial goals.

But before we dive in, let me be clear: This post is for educational and informational purposes only. It is not financial advice. Always consult a licensed financial adviser for advice tailored to your financial situation. I may hold positions in the investments mentioned, but my decisions may not be suitable for everyone.

Alright, let’s dive into the world of JEPI and see what makes this ETF so popular in the U.S., and the role it could play in your dividends portfolio!

What Makes JEPI Unique: The Covered Call Strategy

So, what makes JEPI stand out from other dividend-focused investments? It’s all about the covered call strategy it employs. Let me break it down.

JEPI invests most of its assets, around 80%, in a portfolio of large-cap U.S. stocks. These are companies with lower volatility and strong fundamentals, providing a stable base for the ETF. But here’s where it gets interesting: JEPI uses the remaining 20% to implement a covered call strategy through Equity-Linked Notes or ELNs.

Now, what’s a covered call strategy? Think of it this way: Imagine you own a car, but you don’t use it every day. Instead of letting it sit idle, you rent it out to earn some extra income while still owning the car. That’s essentially what JEPI does. It “rents out” the right to buy its underlying stocks at a predetermined price by selling call options. In return, JEPI collects premiums from these options, which contribute to the ETF’s monthly payouts.

The beauty of this strategy is that it generates consistent income, even in volatile or stagnant markets. Its dividend yields of the U.S.-listed version range from 6% to 12%, making it a popular option for income-focused investors who want exposure to U.S. markets.

However, it does come with a trade-off: The upside potential of the underlying stocks is capped because JEPI has already sold the rights to profit beyond a certain price level. This means JEPI prioritizes income stability over high capital growth.

Historical Performance Insights: How JEPI Stacks Up

Now let’s talk about performance, because what’s an investment without looking at the numbers? But as always, please note that past performance does not guarantee future results.

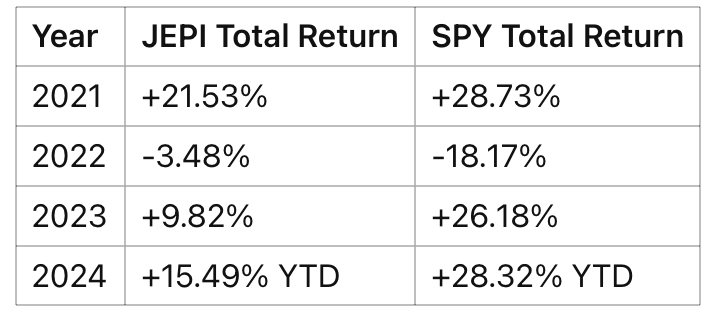

Year-by-Year Comparison: Here’s how JEPI has performed compared to its benchmark, the S&P 500 Index represented by SPY ETF, over the past few years of its existence. Note the returns cited include dividends.

In 2021, JEPI delivered a total return of +21.53%, which is impressive, though slightly below the S&P 500’s +28.73%. This reflects how JEPI’s covered call strategy limits gains in strong bull markets.

2022 is where JEPI shone. While the S&P 500 plunged -18.17%, JEPI only declined by -3.48%, thanks to its income generation and lower volatility. For defensive investors, this resilience was a major win.

In 2023: JEPI returned +9.82%, again lagging behind the S&P 500’s +26.18%, as the market experienced a tech-led rally. This underperformance is painful, but keep in mind that the objective of investing in JEPI is more on long-term, stable performance.

For the year-to-date 2024, JEPI has gained +15.49%, compared to the S&P 500’s +28.32%, highlighting how it performs steadily but may underperform in euphoric bull markets.

In terms of dividend yields, the yields of the U.S.-listed JEPI range from 6% to 12%, over the past 4 years after it has been listed. The dividend yield of the LSE-listed JEPI is 7.53% for its inaugural distribution in December, showing its dividend potential.

Performance in Different Market Conditions

Let’s break it down further into how JEPI could perform in different market conditions going forward.

1) Bull Markets: JEPI tends to underperform during strong bull markets. The covered call strategy limits upside potential because the premiums collected offset some gains, and the upside is capped.

2) Bear Markets: During downturns, JEPI’s strategy provides a cushion. The premiums from covered calls and dividends can help offset losses, resulting in smaller declines compared to the broader market. This makes JEPI appealing for defensive investors.

3) Flat or Sideways Markets: This is where JEPI truly shines. In stagnant markets, where prices don’t move much, JEPI’s income generation through option premiums and dividends can deliver steady returns, outperforming traditional index funds.

Another key advantage of JEPI is its lower volatility compared to the broader market. For example, in 2022’s bear market, when tech stocks saw wild swings, JEPI’s focus on low-volatility stocks and its income strategy helped smooth out the ride for investors. I’m repeating myself but while the S&P 500 dropped -18.17%, JEPI did much better at -3.48%. This makes it an excellent choice for those who value stability alongside consistent income.

Why the LSE Listing is Significant for Investors?

If you’ve been following my posts, you’ll remember that in my recent post, I discussed how valuations in the U.S. market are hovering near historical highs based on the Shiller’s PE ratio. Take a look at that post if you’d like a deeper dive into what the Shiller’s PE ratio is. Some analysts believe that this indicator suggests that U.S. stocks might be quite overvalued, increasing the chances of a bear market or a flattish market in 2025.

If such scenarios come true, JEPI’s income-focused strategy could make it a good alternative for dividend investors. While the broader market might struggle to deliver returns during stagnant or declining periods, JEPI’s covered call strategy is meant to generate steady payouts even when stock prices aren’t soaring. Investors looking for stability and income, especially when market conditions are less favorable, may wish to consider JEPI.

Now, here’s another reason why JEPI’s listing on the London Stock Exchange or LSE is a game-changer. Previously, when JEPI was only listed in the U.S., Singapore investors faced a 30% withholding tax on its dividends. That significantly reduced its appeal. However, the LSE listing is domiciled in Ireland, meaning there’s zero withholding tax for Singapore investors. This opens the door for us to fully enjoy JEPI’s high dividend payouts without losing a chunk to taxes.

That said, based on the December 2024 distribution, the dividend yield for the LSE-listed JEPI appears to be about 10% lower than its U.S.-listed counterpart. This could be due to differences in fund structure or timing of distributions. While this is something to monitor, the elimination of withholding tax still makes the LSE-listed JEPI an option worth exploring for income-focused investors.

In short, with zero withholding tax and JEPI’s income-focused strategy, some investors might find that JEPI’s approach aligns with their financial goals and consider exploring it as part of a diversified portfolio.

Considerations and Risks

While JEPI offers several advantages, it’s important to keep potential risks in mind:

1. Capped Upside Potential: As mentioned, JEPI’s covered call strategy limits capital appreciation during strong market rallies. Hence, some analysts cautions that over the long term, covered-call funds may not be the best buy-and-hold investments for investors with a longer time horizon.

2. ELN Counterparty Risk: JEPI uses ELNs to implement its covered call strategy, which introduces a level of counterparty risk. This means that if the issuer of the ELNs fails to meet its obligations, it could impact the ETF’s performance.

3. Currency Risk: JEPI is denominated in USD, so investors need to consider the potential impact of currency fluctuations on their returns. For Singapore-based investors, JEPI’s USD denomination means that your returns could be affected by movements in the exchange rate between the USD and SGD.

4. False sense of security: Some analysts describe JEPI as having lower volatility and can outperform the market during a bear market. However, during the recent market volatility in August 2024, the S&P 500 Buywrite index, a benchmark for covered call strategies, dropped 2.8%, which is only marginally better than the S&P 500’s 3 per cent fall. This does not offer much additional protection. However, this has not taken into account the dividends that investors can receive from JEPI, which can help to mitigate the price drops.

The Dividend Uncle’s Take

Now, let’s talk about how I personally intend to use JEPI in my portfolio. But before I continue, it’s important to remember that everyone’s financial situation is different. What works for me may not work for you.

Now, for me, holding a diversified portfolio is key. JEPI plays a role in my dividend stocks portfolio, alongside REITs and growth stocks.

I consider JEPI’s diversified base of large-cap, value-focused U.S. stocks, could provide mitigation to concentration and valuation risk. Plus, its monthly payouts helps provide a consistent cash flow, whether it’s for reinvestment or to cover expenses. Most other dividend stocks and REITs pay dividends on a quarter or semi-annual basis.

In summary, JEPI’s listing on the London Stock Exchange is fantastic news for Singapore dividend investors. With its high yields, steady payouts, and now no withholding tax, it’s an option to consider for generating income. While it’s not perfect for every investor, JEPI offers a combination blend of stability and income, making it worth considering as part of a diversified portfolio.

What do you think about JEPI? Will it find a place in your portfolio, or are you sticking to traditional dividend stocks and REITs? Let me know in the comments below. And if you found this post helpful, give it a like and subscribe to the channel for more insights. Until next time, happy investing!

Leave a reply to Shanice W Cancel reply