[Listen to this post on Spotify or YouTube]

Hey savvy investors! Today, we’re diving deep into one of the most beloved picks among long-term dividend investors among the Singapore REITs. With a well-diversified property portfolio and a reputation for steady distributions, it’s no wonder that this REIT has been one of the go-to investments for those of us who value stability. In fact, it has been a cornerstone in my own REIT portfolio, delivering reliable income through the ups and downs of the market.

But now, significant challenges are brewing, and I believe these challenges could potentially shake its steady track record. From vacancies piling up in key properties to rising expenses and declining distribution per unit, the cracks are becoming harder to ignore. In fact, these challenges have led the REIT to significantly underperform the overall S-REITs index: over the past 3 months, the share price has plunged 23% while the CSOP iEdge S-REIT Leaders ETF declined by a milder 8%.

So, which REIT am I talking about? This is none other than Frasers Logistics & Commercial Trust, or FLCT, a long-time favorite among dividend investors for its steady income and diversified portfolio. But could these challenges spell trouble for one of the most dependable REITs in Singapore?

In this post, I’ll take you through the headwinds FLCT is currently facing: from its revenue pressures to rising expenses, and how all of this could impact its all-important distribution per unit, or DPU. Stick around because, as always, I’ll wrap up with my thoughts on what this means for us dividend investors.

And just a quick note: This post is for informational purposes only. Always consult a licensed financial adviser for advice tailored to your financial situation. Yes, I hold REITs in my portfolio, but remember, what works for me may not work for you.

Alright, let’s dive into FLCT and see what’s changing for this REIT giant.

Pressures Are Building Up for FLCT

I’ve been monitoring FLCT closely, and it’s clear that pressures are building up for this once-steady performer. One major indicator is the decline in its DPU for FY2024, ending September 2024. DPU dropped by 3.4% year-on-year, reflecting growing challenges for the REIT.

What’s behind this decline? Despite FLCT’s net property income increasing by 2.7% in FY2024, its finance costs shot up by a staggering 40.4%! Rising interest rates have significantly affected its cost of borrowing, increasing from a 12-month average of 2.1% to 2.8%, alongside more borrowings, with leverage increasing from 30% to 33%. These have weighed heavily on its ability to maintain DPU levels.

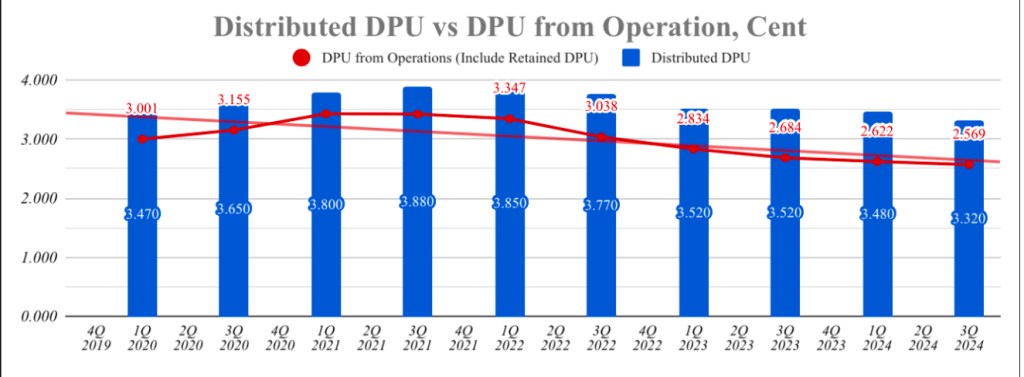

But it’s not just a one-off issue. If you look at the longer-term trend, DPU has been declining for the past two years since 2020, as seen by the wonderful chart from REIT-tirement.com. One reason for the reduction in DPU in 2022 is the divestment of Cross Street Exchange in Singapore and 2 office buildings in Melbourne. But FLCT’s distributions have been under constant pressure since then, and this trend isn’t encouraging for dividend investors like us.

What’s even more concerning is the growing reliance on capital distributions to support DPU amidst the declining trend. For FY2024, 16.3% of the DPU came from capital distributions derived from divestment gains. While management has guided such distribution to stabilize payouts in the short term, it’s not a sustainable strategy for long-term growth. Once this is exhausted, unless there is substantial growth in revenues, the DPU may drop off the cliff.

This tells us that FLCT is feeling the heat, and the pressures we’re seeing now could potentially extend into the next financial year if these challenges aren’t addressed effectively.

Revenue Pressures for FLCT

For our deep dive, let’s run through each critical element making up the DPU. Starting with revenue, one of the lifelines of any REIT: unfortunately, FLCT is facing significant headwinds in this area.

Firstly, threats of lower occupancies exerting downward pressure on revenues. Take Alexandra Technopark, for instance, which accounts for about 10% of FLCT’s portfolio. Google, one of its major tenants, is vacating space, which will cause occupancy rates to drop from 85.9% in 4QFY2024 to just 74% in 1QFY2025. Backfilling this space has been slow, with only 25% of the first tranche and 15% of subsequent space pre-committed.

For its other overseas commercial properties, we can observe that the occupancy rates have also been consistently low for its commercial properties, at 87.5%. While FLCT has been proactive in leasing, and has indicated that it intends to lower the contribution from commercial properties within FLCT from 28% currently to around 15% in the future, continued vacancies are bound to weigh on revenue in the near term.

Next, rental reversions are another challenge. At Alexandra Technopark, reversions were negative 2.9%, while the renewal of the Commonwealth of Australia lease at the Caroline Chisholm Centre saw reversions below negative 10%. Again the weakness is coming from its commercial properties.

However, there is a silver lining. FLCT achieved overall portfolio rental reversions of 23.6% for FY2024, driven by the logistics properties, due to several of these properties being under-rented particularly in Australia. These reversions helped mitigate some of the pressures.

Finally, on a positive development but with a twist, FLCT acquired 2 Tuas South Link 1 in Singapore, which comes with a net property income yield of 6.6% and a pro-forma DPU accretion of 1.7% for 1HFY2024 which is attractive. However, while this will contribute to revenues in the right direction, the acquisition will also further increase the REIT’s interest expense going forward, which we will discuss later on.

Now before we move on, if you’ve enjoyed the post so far, please give me a “like” and subscribe to the website, so you don’t miss any such in-depth discussions.

Expense Pressures for FLCT

But it’s not just revenues under pressure; FLCT is also grappling with rising costs, pushing up its expenses.

Firstly, the jump in taxes for FLCT was in the limelight some time ago. In Victoria, Australia, the so-called Absentee Owner Surcharge doubled to 4% in 2024, raising property taxes by $9 million and lowering net property income by 2% for FY2024. This policy affects 16% of FLCT’s portfolio and directly raises tax expenses.

Such non-recoverable land taxes in Australia will continue to add on to the REIT’s operating expenses going forward.

The bigger challenge lies in refinancing. FLCT has approximately $550 million in loans maturing in the coming year. These loans were likely issued during periods of lower interest rates, below the REIT’s 12-month average interest rate of 2.8%. With refinancing costs now expected to exceed 3.8%, this will significantly increase interest expenses this year.

We have already seen finance costs risen by 46% year-on-year to $36.4 million in 2H FY2024 due to rising interest rates and additional borrowings. And with gearing expected to rise by another 1.4 percentage points due to the acquisition of 2 Tuas South Link 1, FLCT’s financial flexibility is becoming increasingly constrained.

Finally, to add to the pressure, FLCT’s management is likely to opt to take more of their fees in cash rather than units going forward, increasing operating costs and adding pressure to the REIT’s financial performance. This decision was likely made due to an accounting issue as a result of the share swap involving Thai Bev and TCC Assets previously. Given that such fees account for 7% of FLCT’s DPU, the impact on DPU will not be insignificant.

Impact on DPU

So, what does this all mean for FLCT’s distributions? With revenues facing headwinds and expenses on the rise, the outlook for DPU isn’t promising. Adding to the challenges, FLCT’s managers may sell some of the units previously received as management fees, potentially exerting further downward pressure on its share price.

As a result, analysts are projecting further declines, some of which are quite significant. For instance, JP Morgan estimates DPU in FY2025 ranging between 5.21 cents and 5.76 cents, representing up to 25% below FY2024’s DPU of 6.8 cents.

While the acquisition of 2 Tuas South Link 1 is promising, and the backfilling of logistics vacancies offer some hope, the concern is that these may likely not be enough to fully offset the broader challenges.

The Dividend Uncle’s Take

So, is there any good news for FLCT investors?

The next few quarters will be critical for FLCT. With rising vacancies, higher refinancing costs, and pressure on DPU, the REIT is facing significant headwinds. However, its diversified portfolio and proactive management provide some reasons for cautious optimism.

For me, the coming quarters will be all about watching how FLCT navigates these challenges. Are they able to backfill the vacancies at Alexandra Technopark? Can rental reversions in logistics properties continue to offset weaknesses in other areas? These are the key questions I’ll need answers to before deciding whether FLCT can remain a core holding for dividend-focused portfolios.

I would also like to use this post to remind all viewers of The Dividend Uncle to stay vigilant and keep a close watch on FLCT. It’s also a timely nudge for all of us to review our holdings and make sure they still fit well with our investment goals and risk comfort.

In summary, FLCT has long been a favorite among dividend investors for its steady distributions and diversified portfolio. But with mounting challenges, it’s clear this REIT is at a critical juncture. For now, I’m keeping an eye on how FLCT tackles its vacancies and manages refinancing in the quarters ahead.

What about you? Are you holding on to FLCT, trimming your exposure, or scouting for other opportunities? Let me know in the comments below. And if you found today’s deep dive helpful, don’t forget to like this post and subscribe for more updates.

Until next time, stay diversified and happy investing!

Leave a reply to Something’s Changing for REITs… But Market Is Ignoring It (For Now) – The Dividend Uncle’s Take Cancel reply