Hey savvy investors! Today, I want to start by expressing my heartfelt thanks to each and every one of you for supporting The Dividend Uncle channel. We’ve recently hit an incredible milestone of 5,000 subscribers on YouTube! This is a huge achievement, especially for a ‘faceless’ channel like mine, and it’s all thanks to you, my amazing supporters!

But now, let’s get to why we’re here today. On the surface, Mapletree Logistics Trust or MLT’s latest results might seem like a bit of a disappointment, especially for us long-term dividend investors. A headline DPU drop of 11% year-on-year is exactly the kind of news we fear. In fact, I’ve heard from several of my friends who are just about to give up on MLT. But, as always, I believe in looking beyond the surface, and trust me, there’s more to this story than meets the eye!

So, were you also thinking of giving up on MLT? Before making any decisions, listen to what I have to say first. Let’s dive in and unpack the details, looking at the latest results, the surprising findings, the challenges, and what this all means for us as long-term dividend investors.

But first, let me remind you that this post is for informational purposes only and not financial advice. Always consult a licensed financial adviser to ensure your decisions align with your goals. And yes, I hold MLT in my portfolio, but remember, what works for me might not work for you.

Alright, let’s get started!

11% DPU Drop is Terrible! Or is it?

Let’s address the elephant in the room. The 11% drop in DPU for 2Q of financial year 2024/25 compared to a year ago, that’s splashed across the news reports. This sounds bad, and it is: imagine getting a pay cut of 11%, that’s substantial! This reflects the major challenges MLT is facing.

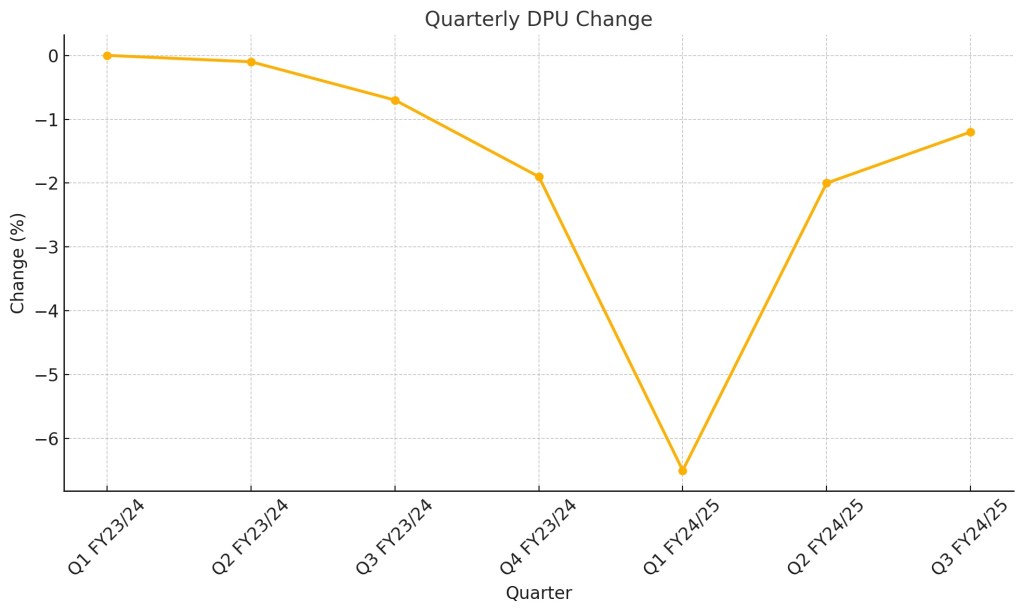

But now, let’s take a look at my preferred DPU comparison: the quarter-on-quarter or q-o-q trend. Why do I prefer q-o-q rather than year-on-year? Well, unlike sectors like retail or hospitality, logistics REITs like MLT don’t really have a strong seasonal impact on their revenue. So looking at DPU q-o-q, over a longer term, can give us a better sense of direction. And here’s the good news.

The quarter-on-quarter decline seemed to have peaked at -6.5% in 1Q FY 2024/25, which is when MLT’s share price took a significant hit. In Q2, the decline slowed to -2.0%, and this latest quarter, it’s just -1.2%.

With this showing that the DPU decline is slowing, could we be nearing a bottom? That’s the key question I’m watching closely. If you ask me, my answer is not so soon, but the slowing decline is definitely encouraging.

Market Underpricing the Value of MLT’s Assets?

Now let’s talk about what really caught my attention: MLT’s divestments.

In the past month or so, MLT completed the sale of 2 properties in Singapore and 1 in Malaysia, fetching prices that were almost 40% above their valuations. For instance, 1 Genting Lane and 8 Tuas View Square in Singapore were divested at 35.2% and 39.8% above their respective valuations. And as REITs, MLT is mandated to revalue their properties on an annual basis, hence the premiums were not due to outdated valuations on their books.

Think about that for a moment. I think it is not unreasonable to assume that the management is astute enough and to be selling off properties that are not as attractive or have less growth potential. If these properties are being sold at such a substantial premium, what does that say about the rest of MLT’s portfolio?

To me, this is a strong signal that the logistics sector remains a choice sector to be invested in, and that MLT’s net asset value or NAV might be understated. If so, the current market price could be underestimating its true potential. With the current Price to NAV of 0.96, if the valuations are 20% above the valuations, the Price to NAV of MLT would become 0.8.

While divestments like these are great for raising cash and boosting NAV, they also reaffirm the quality of MLT’s assets, particularly in Singapore.

My Fears On Hong Kong Properties Seem Mitigated

In my previous post on MLT, I mentioned my deep concerns about the performance of MLT’s Hong Kong properties. I pointed out that with China properties already facing significant challenges, making up 18.5% of MLT’s portfolio, any similar deterioration in Hong Kong properties, which form an even larger 23.2% of the portfolio, would spell serious trouble for MLT.

The reason for my concerns is the apparent weakening of the overall logistics market in Hong Kong, with vacancies in the market reaching more than 8%. Hence, I’ve been monitoring the metrics for this key market. This quarter brought me some relief. From an occupancy rate of 95.6% at the start of the year, the occupancy rate actually improved to 97.7% this quarter. What is more positive is the stable and improving rental reversion for Hong Kong. From a stable 2.2% at the start of the year, the rental reversion has reached 2.5% in this quarter.

So, while MLT’s China properties continue to struggle, its Hong Kong properties continue to perform well so far, with strong rental reversions supporting revenue growth.

Now, this is something I want to clarify. Last time round, when I talked about China versus Hong Kong properties for MLT, some viewers asked whether I knew Hong Kong is part of China! Yes, I know lah, but MLT segregates its exposure this way in its reporting, and their performances are, fortunately, not the same. So let’s hope that it will continue that way.

Before we move on, do give your favourite dividend Uncle some CNY luck by tapping the ‘like’ button if you found this post useful. Other than that, please enjoy the rest of the content.

The Risks: Probably Not Out of the Woods Yet

As optimistic as I am about the slowing DPU decline and the strong divestment gains, let’s not ignore the challenges ahead.

1. China Remains a Key Risk

MLT’s China properties are still under significant pressure, with oversupply in the logistics market weighing on rental growth. While rental reversions in China were slightly less negative this quarter, at -10.2% compared to -12.2% last quarter, the risk isn’t over yet.

In the coming year, 15% of MLT’s total leases are expiring in China. That’s a big chunk, and given the ongoing oversupply and geopolitical risks like US tariffs, it’s something to watch closely. Even MLT’s management has guided that China will likely remain weak for at least another year.

2. Rising Interest Rates

Interest rates have been stable for MLT at 2.7% recently, but management has already warned that they expect this to increase to 3% in the next financial year. This is after taking into account their high proportion of fixed rate loans, which at 82% is among the highest among the S-REITs.

With leverage at around 40%, and is even higher when you include the perpetuals that they have, MLT’s financial flexibility is somewhat limited. Rising rates will continue to eat into distributions, adding to the pressure.

The Dividend Uncle’s Take

Now let’s talk about what this all means for us as dividend investors.

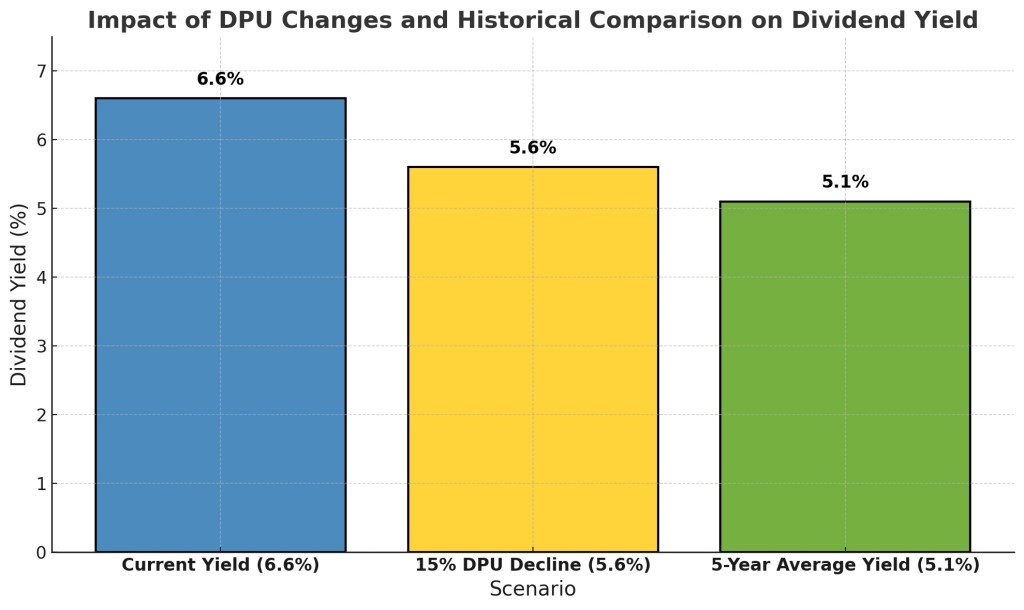

Historically, MLT has traded at lower dividend yields because investors saw it as a growth REIT. But with growth now under pressure, the current dividend yield has risen to about 6.6%, reflecting the market’s concerns.

Let’s say we factor in another 15% decline in DPU over the next year due to the risks we discussed. Even with that drop, the yield could still be around 5.6%, which isn’t bad at all for a logistics REIT. Other than China, logistics is still a growing business.

And personally, I don’t think the decline will be that severe. With DPU trends showing signs of bottoming out, and strong divestment gains pointing to undervalued assets, I’m cautiously optimistic about MLT’s future. But of course, nothing is guaranteed and depends on how market conditions evolve.

That said, the risks, particularly in China, cannot be ignored. For now, I’m monitoring their performance and looking for more attractive entry points.

Okay folks, what do you think about MLT’s latest results? Are you seeing opportunities, or do you think the risks are still too significant? Let me know in the comments below! And if you found this post helpful, please give it a like and subscribe to the channel for more insights.

Until next time, happy investing and happy CNY!

Leave a reply to My Top 5 Satellite REITs for Potentially Bigger Dividends & Growth (Risky But Rewarding?) – The Dividend Uncle’s Take Cancel reply