Hey fellow REIT investors! Over the past few months, I’ve progressively shared with you my thoughts on Core REITs, which are those stable, long-term holdings that form the foundation of my portfolio. I’ve also talked about Satellite REITs, which are more tactical investments with higher risks but potentially higher rewards. Do take a read for those of you who want to know a bit more about the concepts.

Now, many of you have asked, “So Uncle, how do these two work together in a coherent portfolio? What does your full REIT portfolio look like?”

Well, today, I’m going to show you exactly that. It has always been my intention to combine the top Core and Satellite REITs I’ve discussed earlier into a single dividend-focused REIT portfolio, which should complement each other in their risk and returns characteristics. Now, I’m not just doing this for fun or for the sake of making a post or a YouTube video – This is my personal REIT allocation plan, which aligns with my own investment goals and preferences. I will personally move towards in the months ahead.

But before we dive in, I need to make one thing very clear: this is NOT a recommendation for you to follow. This post is for informational purposes only and should not be taken as financial advice. The REITs mentioned reflect my personal investment approach and risk tolerance, which may not be suitable for everyone. Always conduct your own research or consult a licensed financial adviser before making any investment decisions.

Alright, let’s get started!

How I Structured This Portfolio

As you know, my approach to REIT investing revolves around both stability and growth. You can call me a greedy uncle, as these two concepts may sometimes be mutually exclusive. But I think with the core-satellite approach, it is possible to achieve a good balance between the two.

My Core REITs provide that stability. These are well-established names with stable, long term business fundamentals, have strong sponsors and a history of delivering consistent dividends. Meanwhile, my Satellite REITs add a bit more potential upside but come with more risks. These REITs could be facing some idiosyncratic risks, which may require some faith in investing in them for longer-term gains or higher than average dividend yields.

Now, let’s break down the weightage of each group in my portfolio at the high level. I have mentioned that Core REITs should be around 70% of my portfolio. Satellite REITs, with their more opportunistic nature, should be around 30% of my portfolio.

Why this mix? Because I want a portfolio that delivers consistent dividends while still having some upside potential.

I conducted a backtest using historical data to understand how this portfolio mix reacted to past market conditions. This is not a guarantee of future performance, as market dynamics constantly evolve. The purpose is to assess trends, not to suggest that similar returns will happen again.

My Target REIT Portfolio – Final Allocation

After much thought, feedback from viewers, and some kopi fueled portfolio planning, here’s how I’ve decided to structure my target REIT portfolio. This is the mix I’m personally moving towards, balancing stability, income, and a bit of upside potential.

Core REITs (70%) – The Foundation of Stability & Growth

These are my anchor holdings, the REITs I consider solid, resilient, and reliable dividend payers.

Firstly, CapitaLand Integrated Commercial Trust or CICT, which will form 20% of the portfolio. CICT remains my top REIT choice because of its diversified portfolio of high-quality retail and commercial properties. From Plaza Singapura to Raffles City, this REIT holds some of Singapore’s best-located properties, with strong tenant demand. Its stable distributions make it a cornerstone in my portfolio.

The second REIT on my list is Mapletree Industrial Trust or MIT, which has been in the limelight for some of the wrong reasons recently. Despite that, MIT has my vote of confidence and I intend to hold 20% of my portfolio in it.

MIT gives me two-in-one exposure: Singapore industrial properties for stability and data centers for long-term growth. While there are concerns about U.S. data center vacancies, I believe the long-term structural demand for digital infrastructure remains strong. This is one of my Core REITs, and I’ve talked about its recent struggles in my last post, so if you haven’t watched that yet, go check it out.

Third, Parkway Life REIT or PLife REIT, at 15%. This is one of Singapore’s most defensive REIT, backed by hospitals like Mount Elizabeth and Gleneagles, and a growing portfolio of nursing homes in Japan. If you want recession-proof, crisis-proof dividends, PLife REIT has historically maintained a stable distribution profile, supported by built-in rent escalations. However, as with all investments, there are risks, and investors should evaluate whether this aligns with their own risk profile.

The final REIT in my Core portfolio is CapitaLand Ascott Trust or CLAS, at 15%. This is Singapore’s biggest hospitality REIT, but with a twist: it’s not just about hotels, but also serviced residences. The unique mix of income stability (from master leases) and growth (from revenue-linked properties) makes this a well-balanced REIT. CLAS has been expanding globally, and I see it as a long-term play on the recovery of business and leisure travel.

Satellite REITs (30%) – Higher Yield & Tactical Growth

These REITs are riskier but offer higher yields and potential for capital appreciation. They are mostly smaller, more volatile, and face challenges, but they also have long-term upside potential. I have 5 REITs in this portfolio despite the smaller overall allocation of 30% to provide for better diversification of the underlying risks.

The first REIT in my Satellite portfolio is CapitaLand China Trust or CLCT, at 8%. It’s a China play, which means higher risks, but also potentially higher rewards. Chinese retail and business parks are still recovering, and while sentiment has been weak, valuations have become very attractive. This is my contrarian pick, where patience is key.

The second name is a bit of a misfit in the Satellite portfolio. Mapletree Logistics Trust or MLT is a strong choice, and under other circumstances would definitely be in the Core portfolio. However, there are certain key risks facing it currently. Top in the minds of investors is the slowdown in the logistics sector in China, and the potential for risks to spread to other regional countries. Although it missed out in the Core portfolio, I believe in this turnaround potential and hence placed it here, accounting for 8% of my portfolio.

Third, it’s none other than Stoneweg European REIT or SERT, which has been a top performer last year. It also accounts for 5% of my target portfolio. This REIT focuses on light industrial/ logistics and office properties, in Western Europe, and has been benefiting from a stabilising portfolio performance and the lowering of interest rates in Europe.

Daiwa House Logistics Trust or DHLT, at 5%, is my next Satellite REIT. This is a pure-play logistics REIT focused on Japan, offering exposure to a high-demand sector with long lease stability. Industrial and logistics properties remain one of the most resilient sectors, and this REIT provides a strong yield without the risks of office REITs.

The final name in my Satellite REIT is Keppel Pacific Oak US REIT or KORE. Yes, U.S. office REITs are out of favor, but this one offers a potential turnaround story with stronger leasing performance in recent quarters. Most of its assets cater to tech and healthcare tenants. If U.S. interest rates stabilize, this REIT could see a meaningful recovery in just months ahead. Definitely higher risk, but that’s why accounts for the lowest allocation at 4%.

What About CLAR, FCT and CLINT?

After I published my posts on Core and Satellite REITs, many of you left great comments and feedback. And one of the most common questions was:

“Why not include CapitaLand Ascendas REIT or CLAR in the Core REITs?”

Great question! CLAR is a fantastic REIT with exposure to industrial and business parks. But here’s my reasoning: since I’ve already chosen MIT, I wanted a REIT that covers both Singapore industrial and U.S. data centers for growth. That’s why I stuck with MIT.

“What about Frasers Centrepoint Trust or FCT? It’s another strong suburban mall REIT!”

Absolutely! I have no issues with FCT, it’s one of the most stable retail REITs out there. However, since CICT is my top REIT choice and already includes high-quality malls, I didn’t want too much overlap.

“How about CapitaLand India Trust or CLINT?”

A friend referred me to CLINT as a potential Satellite REIT, but I see higher risk with this one. Given the macroeconomic concerns over India, I believe it could take longer to recover. But definitely in my monitoring list.

Putting My Money on the Table – Personal Target of $200,000 in the Portfolio

Now, it’s one thing to talk about portfolio allocation in theory. But as always, I believe in putting real money on the table. This isn’t just a hypothetical exercise, this is my actual target REIT portfolio that I’m personally working towards.

For my own investment planning, I have structured this portfolio based on my available capital and risk considerations. The actual amount will differ for every investor, based on their financial situation. For me, I’ve set a target portfolio size of $200,000, based on what I believe is an appropriate allocation for my investment goals for this portfolio.

Translating this into dollar amounts, here’s how it breaks down into.

Needless to say, I’m still in the process of adjusting my allocations to this. Some positions are already close to target, such as CICT, while others will require me to gradually add more over time. For example, I may need to increase my holdings in MIT, which I think recent weaknesses might provide a good opportunity.

There are also other REITs that are not in this target list that I will slowly dispose of. These include Mapletree Pan Asia Commercial Trust.

At the same time, I’m not going all-in or all-out immediately. Given how the REIT market is still volatile, I plan to dollar-cost average into these positions over time. This way, I can take advantage of potential price fluctuations rather than trying to time the absolute bottom.

It is also important to stress that this portfolio isn’t static: it’s a living, evolving investment strategy that I’ll be tracking and adjusting as needed. And I plan to publish regular updates on its performance, so we can see how it holds up over time.

Backtesting the Portfolio – How Would This Have Performed from 2020?

To get a sense of how this target REIT portfolio would have performed over time, I ran a backtest using historical data from 2020 to 2025 (year-to-date). Of course, past performance is not a guarantee of future returns, but looking at historical trends helps us understand how this mix of REITs would have behaved in different market conditions.

The average total returns (including share price appreciation and dividends) for the portfolio range from 2% to 7% over the past few years. What was positive is that there are no years with negative returns. I want to assure you that this uncle did not go and do portfolio optimisation, whereby I adjust the portfolio allocation up and down for each REIT until I get a good result to show you. Generally, I find such exercises futile as future returns will be different. Instead, my process is to select the top REITs, followed by an intuitive sense of the portfolio allocation, then I did the backtesting. I know this is hardly scientific or mathematical, but at least the portfolio makes sense to me.

Now, let’s breakdown how the constituents of the portfolio did over the years.

For 2020, the portfolio returned 5%. If you recall, this was a volatile year for REITs due to the COVID-19 market crash. While the portfolio saw significant declines early in the year, the strong recovery in the second half helped it end with a modest gain. Core REITs like Parkway Life REIT and MIT, and Satellite REITs like MLT provided resilience, cushioning the hit from weaker sectors like hospitality and retail REITs like CICT and CLAS.

In 2021, the portfolio returned 6%. PLife and MLT continued to do well, while the post-pandemic recovery boosted certain REITs, particularly those with exposure to logistics and office properties.

For the year 2022, the portfolio would have provided me with a 6% return. With COVID reopening benefiting hospitality and retail REITs like CLAS and CICT. Despite rising interest rates, the portfolio managed to perform well, largely supported by strong dividend yields. However, PLife had a poor showing, as investors shifted money out of defensive REITs, showing the importance of having diversified REITs in the portfolio.

In 2023, which is a tough year for REITs as high interest rates continued to weigh on valuations, the portfolio still managed to return 2%. While dividend payouts helped cushion the downside, price declines in key holdings like KORE and CLCT dragged the portfolio’s performance close to flat.

For 2024, the portfolio provided 7% returns. This year has been more stable, as REITs have started seeing signs of stabilization, although 2 false starts in REIT recoveries affected investor sentiments. PLife and SERT outperformed the rest.

And finally in 2025 so far, while it is still too early to tell how the year will be, the sudden upturn in March for REITs mean that the portfolio would have returned 7% so far.

Key Takeaways from the Backtest:

1) Dividends provided stability – Even in weak years like 2023, dividend payouts helped offset price declines, reinforcing the importance of steady cash flow in REIT investing.

2) Sector diversification helped – While some REITs struggled in certain years, others provided balance. For instance, Parkway Life REIT and MIT remained stable when retail and hospitality REITs faced headwinds.

3) Interest rates remain a wildcard – Years with rising rates in 2022-2023 saw weaker performance, while stabilization years in 2024 allowed some recovery. The portfolio’s future performance will heavily depend on the interest rate environment.

This backtest is based on historical data and simplified assumptions. It does not account for transaction costs, tax implications, or real-world market liquidity constraints. As always, past performance does not indicate future returns.

The Dividend Uncle’s Take – Is This the Right Portfolio for Me?

After putting everything together, what do I think about this target portfolio?

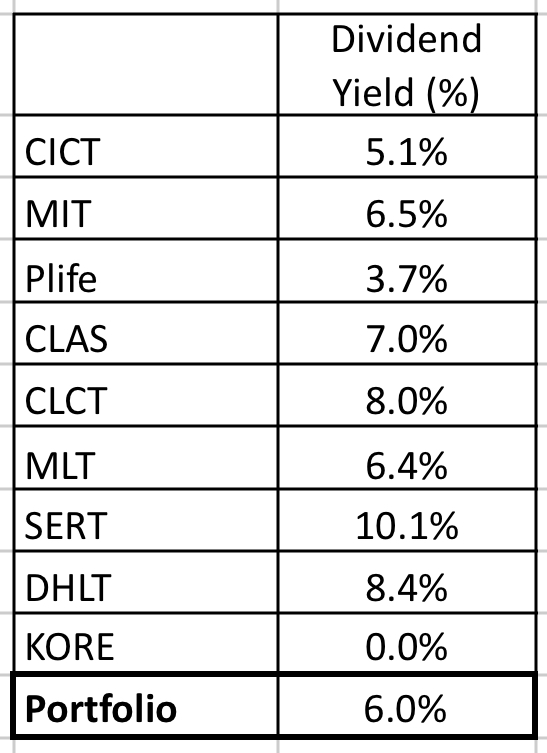

First, the average dividend yield of 6.0% is quite credible given the stability of total returns over the years. It strikes a balance between generating income and preserving capital, without taking excessive risks. The Core REITs provide steady cash flow, while the Satellite REITs offer potential upside, even if they come with more volatility. This means that, even in difficult years like 2023, dividends helped cushion the impact, keeping overall returns stable.

Second, this portfolio isn’t designed to be the highest-yielding REIT portfolio. If I only cared about high yield, I could have stuffed this portfolio with more Satellite REITs, pushing the yield closer to 8% or more. But that would come with much higher risks. Instead, this allocation is something I believe is sustainable, meaning I don’t have to keep making big changes every year just to chase short-term performance, although I would expect more changes to the Satellite REITs over time.

Third, of course, there are risks. The biggest wildcard is still interest rates. If rates remain elevated or even rise further, REIT valuations could stay suppressed. Another risk is sector-specific headwinds. We’ve seen how data centers such as MIT or MLT are under pressure from AI-driven shifts, while retail REITs face questions over long-term shopper behavior. While I’m comfortable with these risks for now, I’ll be watching closely in case adjustments are needed.

Alright, that’s all for today. I’m planning regular updates on the portfolio’s performance. That way, we can track how it evolves over time, whether it continues to meet my investment objectives, and whether adjustments are needed.

So, what do you think? Do you agree with my allocation, or would you do things differently? Let me know in the comments! And if you found this post useful, tap the like button and subscribe, your support keeps this uncle going!

Until next time, happy investing!

Leave a reply to The ONE Singapore REIT Morningstar Loves… But I’m NOT Buying – The Dividend Uncle’s Take Cancel reply