Hey fellow REIT investors! If you follow CapitaLand China Trust or CLCT like I do, you’ve probably seen all the excitement around their latest announcement — the launch of CapitaLand Commercial C-REIT, or CLCR in China. During their AGM, 70% of the questions were about this, although when it was first launched, CLCT’s holding in the China REIT will be less than 1% of their total assets.

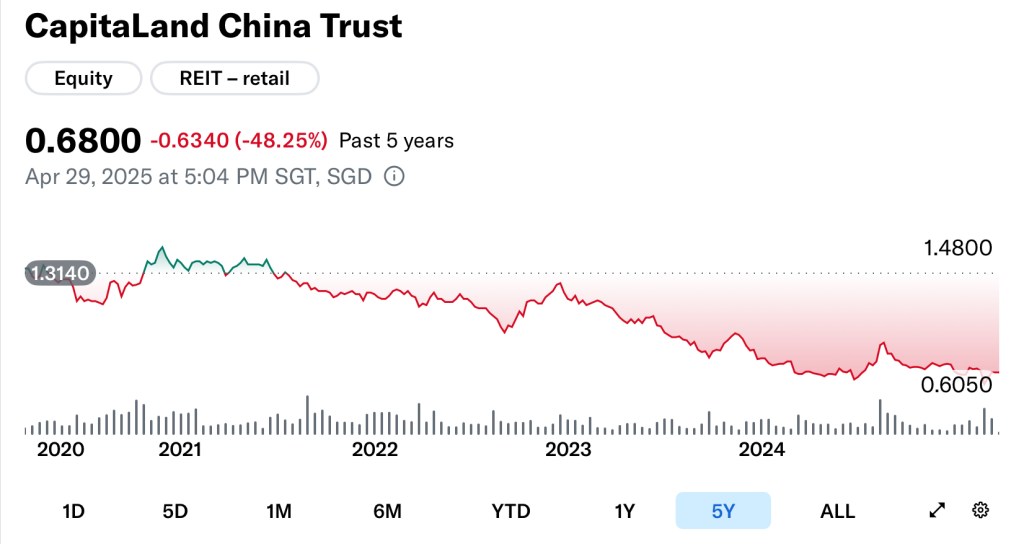

Why? This is because many investors are hoping this is the game-changer that CLCT needs. Over the past 1 year, CLCT’s share price has gone nowhere. Over a longer period of 5 years, CLCT has plunged nearly 50% – that’s roughly a 10% average annualised decline – a tough stretch for long-term investors. Contrast this with the past week or so after the announcement of the C-REIT – price jumped more than 8%!

Now, the thinking behind the potential of the China REIT or C-REIT is simple: listing a C-REIT in China taps into a new pool of domestic investors who are much more familiar with retail malls there — just like how we Singaporeans know and love our local malls like Plaza Singapura and Junction 8. They will appreciate the value of such malls better.

On paper, it sounds fantastic. But is CLCR really the panacea for CLCT? Or are there risks lurking behind the scenes that we need to be careful about?

Today, we’re going to unpack what the C-REIT concept is about, what CLCT is doing with CLCR, and the real concerns and opportunities that come with it. I must apologise ahead of time that I found today’s post to be quite long and dry despite efforts to simplify and shorten it. So guys, please grab your favourite kopi gao first before diving in!

As usual, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the REITs discussed, but what works for me might not work for you.

Alright, let’s get started!

The C-REIT Revolution: China’s “New” Opportunity for Investors

Before we dive deeper into CLCT’s move, it’s important to understand what C-REITs are — and why their emergence in China is such a big deal.

C-REITs, or China Real Estate Investment Trusts, were officially launched only a few years ago. Initially, they were strictly limited to infrastructure and affordable rental housing projects — things like highways, sewage treatment facilities, and government-backed housing. But in 2023, Chinese regulators made a pivotal change. They expanded the eligible assets to include “consumer infrastructure” — retail malls, department stores, and even farmers’ markets. That opened the door for commercial real estate players to tap domestic capital markets directly, something that was not possible before.

Today, the commercial C-REIT sector is still relatively small — only around US$1.95 billion — but the potential is massive. S&P Global estimates that over US$5 trillion worth of commercial assets could eventually be packaged into C-REITs over time. Importantly, it seems that the investor appetite is strong: many Chinese domestic investors are actively seeking yield, especially with alternatives like government bonds offering below 2% returns. Some of the early C-REITs, such as GLP C-REIT and ESR C-REIT, have even managed to trade above book value — a sharp contrast to many S-REITs and offshore-listed Chinese real estate vehicles still struggling with big discounts. Think CLCT, trading at only 0.64 of its NAV.

There are still strict rules. Sponsors must retain at least a 20% stake with a five-year lockup. C-REITs can only invest in fully stabilised, income-producing assets — no major A.E.I.s, no redevelopment plays. Proceeds raised from IPOs are heavily restricted too.

Still, despite these limitations, the expansion of the C-REIT framework is a game-changing development. It gives asset owners like CapitaLand a new way to recycle capital, while giving Chinese investors more options to access stable, income-yielding assets. And for players like CLCT, it introduces a fresh avenue to unlock value — if managed carefully.

How CLCT Is Betting on China’s Domestic Investors As A Trigger For Its Re-rating

So what exactly is CLCT doing with CLCR — and how does it fit into the bigger picture for CapitaLand?

CapitaLand Investment (or CLI), together with CLCT and CapitaLand Development (or CLD), are establishing CLCR, a retail-focused C-REIT to be listed on the Shanghai Stock Exchange. The initial portfolio includes CapitaMall SKY+ (owned by CLI and CLD) and CapitaMall Yuhuating (which is currently owned by CLCT), with CLI, CLD, and CLCT collectively subscribing for at least 20% of the IPO. That’s a mouthful of Cs, but I hope it helps clarify the transaction in a nutshell.

For the CapitaLand group, CLCR is part of their broader “China-for-China” strategy — creating an onshore platform to unlock value from their China retail assets, tap domestic investor demand, and build a new recycling channel without relying solely on foreign markets. CLI will also manage the CLCR assets post-listing, ensuring alignment and operational continuity.

For CLCT, this move is more strategic than it looks. By divesting CapitaMall Yuhuating — a mature, fully stabilised mall — CLCT unlocks capital that can be redeployed to strengthen its balance sheet by repaying debt. At the same time, by holding a stake in CLCR, CLCT maintains exposure to China’s growing C-REIT market, which could benefit from stronger domestic liquidity and valuations. More importantly, CLCT keeps its right of first refusal (or ROFR) over CLI’s retail pipeline, ensuring continued access to new growth opportunities.

In short, in my personal view, CLCT’s participation in CLCR gives it a dual advantage: a new avenue for recycling mature assets, and a foothold into China’s domestic REIT ecosystem — positioning it uniquely among S-REITs with China exposure.

It’s a strategic move — but is it without risks?

The Big Fear: Will CLCR Hollow Out CLCT’s Best Assets & Acquisitions?

Some investors and analysts are worried – and I don’t blame them. I think there are 2 key risks that we should consider.

Firstly, CLCT might end up selling off more of its best-performing malls into CLCR, especially if C-REIT pricing turns out to be more attractive than what offshore investors are willing to pay. This is especially pertinent given that F.Y. 2024 and the just announced Q1 2025 results have made it extremely clear that retail malls are what is supporting CLCT’s performance and distributions.

If too many good retail assets are divested to CLCR, CLCT could find itself increasingly reliant on its business parks and logistics parks — sectors that have struggled in recent quarters. The numbers don’t paint a pretty picture. Business park occupancy fell to 83.7%, while logistics parks, although showing improved occupancy at 95.7%, continue to face oversupply challenges. If CLCT relies more heavily on these sectors, wouldn’t the quality of the REIT’s earnings go downhill?

Secondly, from the parent group’s perspective, selling into CLCR also makes sense: domestic Chinese investors are hungry for yield, and C-REITs can trade at premiums to book value — something offshore investors, including Singapore, have been reluctant to offer lately. It would then make more financial sense to sell its stabilised assets to CLCR, instead of to CLCT – if so, wouldn’t acquisition growth by CLCT be impaired?

So the fear isn’t unfounded: over time, if management isn’t careful, CLCT risks hollowing out its core strengths while holding onto assets that are harder to grow.

Before moving on, just a quick behind-the-scenes moment — I’m working on this post while stuck in a traffic jam due to one of those unwelcomed thunderstorms in Singapore. But don’t worry, I’m not driving! But if even a thunderstorm can’t stop this Uncle from thinking about REITs, maybe that’s worth a quick like? Tap that ‘like’ button — and let’s get back to the post.

[The Dividend Uncle: Btw, I’m not that old hor!]

The Strategic Upside for CLCT

That said, I believe the concern, while valid, is a little overblown — at least for now. In fact, I think there’s probably more strategic upside for CLCT.

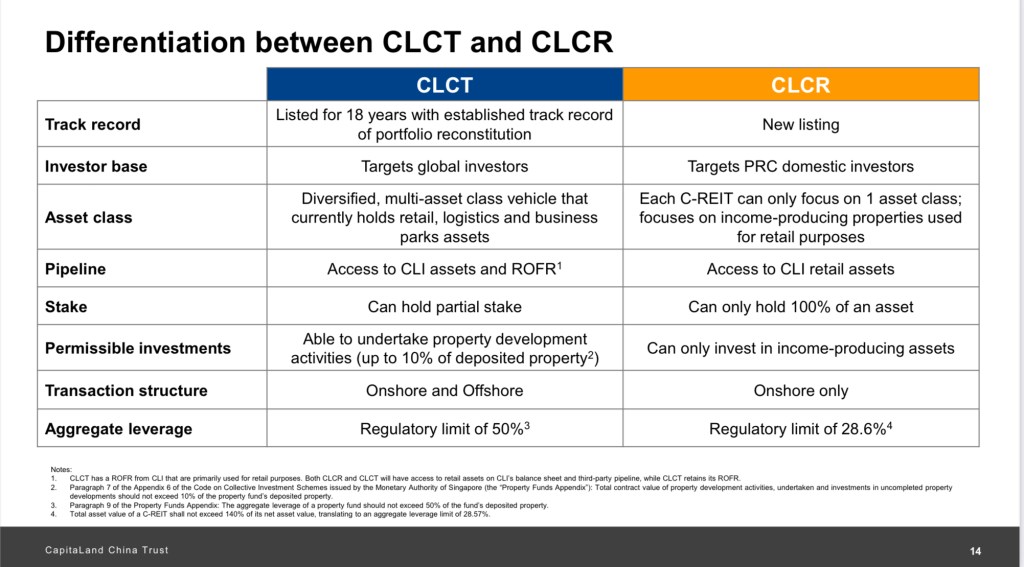

1) CLCT and CLCR have fundamentally different mandates. CLCR can only hold fully stabilised, income-producing assets with no major asset enhancements allowed. CLCT, in contrast, has the flexibility to undertake redevelopment projects and reposition properties, with up to 10% of its portfolio allowed for development activities.

This means that the parent would have a relatively good idea of which properties are more suited for CLCT, and which for CLCR – the competition is probably lesser than feared.

2) The size gap is huge. CLCR will hold about RMB2.8 billion worth of assets when launched. In comparison, CLCT currently holds RMB17.1 billion worth of assets. CapitaMall Yuhuating, which CLCT is selling to CLCR, represents less than 1% of CLCT’s total assets. So you can imagine that it will take a very long time for CLCR to reach even a quarter of CLCT’s size. Even if more assets are recycled over time to CLCR, it would likely be gradual, not disruptive. Why? There is a need to balance investors’ appetite for such assets as well, with appropriately sized equity fund raising exercises.

3) Shine a spotlight on how undervalued CLCT remains. This was one of the key benefits as pointed out by management – if C-REITs continue trading at healthier valuations, it could potentially narrow the persistent discount to book value for CLCT as investors recognise the arbitrage.

4) CLCR actually provides CLCT with a new, strategic recycling channel. It can be an avenue to offload the REIT’s mature, low-growth assets without having to depend on third-party buyers or volatile offshore markets. Instead of hollowing out the portfolio, it gives CLCT a tool to refresh and rebalance its holdings more efficiently.

The Dividend Uncle’s Take – Focusing on the Bigger Challenges

Overall, I view the C-REIT initiative as a positive milestone for CLCT — a move that’s been two years in the making. It gives CLCT greater access to China’s growing domestic capital markets and provides more options to manage its portfolio dynamically.

But let’s stay realistic. As long term investors looking at the bigger picture, let’s not be too distracted by CLCR even though it is persistently in the news headlines. To me, there are bigger challenges for CLCT that both the management and investors should focus on.

The business parks and logistics parks are still weak spots. Management used to talk ambitiously about building up these “new economy” sectors — but lately, that narrative has softened, reflecting the reality that demand for these asset types remains patchy.

At the same time, CLCT has signalled interest in expanding into new sectors like rental housing, data centres and even integrated developments, similar to the Raffles City model. Given CapitaLand’s presence in China, this could eventually help CLCT diversify away from weaker segments like logistics parks. However, with gearing already high at around 42%, and CLCT trading at a steep discount to NAV, raising fresh equity to fund this diversification would be tough. Management may have to rely more on asset recycling.

Lastly, while it’s encouraging that CLCT is refinancing more of its debt into lower-cost RMB loans, interest savings have been limited so far and could be modest for the rest of the year due to higher interest rates for the off-shore debt. So while refinancing helps, and interest expenses are likely to stabilize, it’s not a game-changer in turning around DPU to investors.

So for now, I view CLCR as an opportunity, not a panacea. Some investors see it as a silver bullet, but I prefer to look at the full picture. I’m staying invested, but my eyes are firmly on how the portfolio evolves, how cash is deployed, and whether operational performance, particularly in the non-retail assets, can stabilise over time. As always, in REIT investing, it’s not just about new headlines — it’s about execution on the ground.

What do you think?

Is CLCR the game-changer CLCT needs? Or are you keeping a cautious eye like I am?

Let me know in the comments below — and if you found this post helpful, do this Uncle a small favour: tap that like button, and consider subscribing for more insights on REITs, ETFs, and dividend investing.

Until next time, stay steady, stay informed and happy investing.

Leave a reply to 40% Price Surge! 5 REITs To Chase Or Stay Cautious? – The Dividend Uncle’s Take Cancel reply