Hey fellow REIT investors, today’s episode is something a little different — and I think you’ll want to stick around for this.

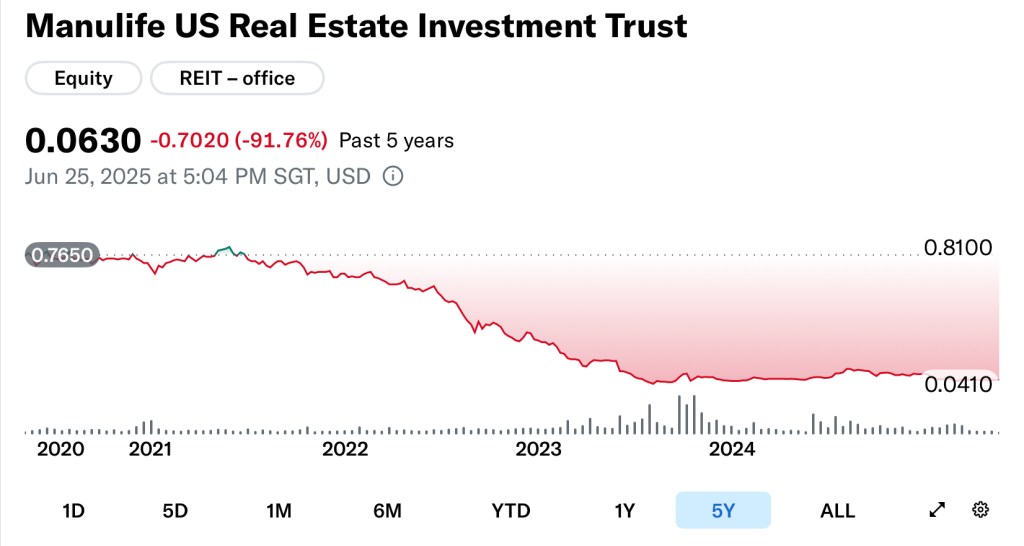

Now if you’ve been following the REIT space, especially the US office segment, you’ll know that Manulife US REIT, or MUST, has been through one of the most painful downturns we’ve seen in recent years. From being a retail investor favourite in its early days, to a 90% share price plunge… it’s no exaggeration to say that many investors have completely given up on it. Some don’t even want to look at the name anymore.

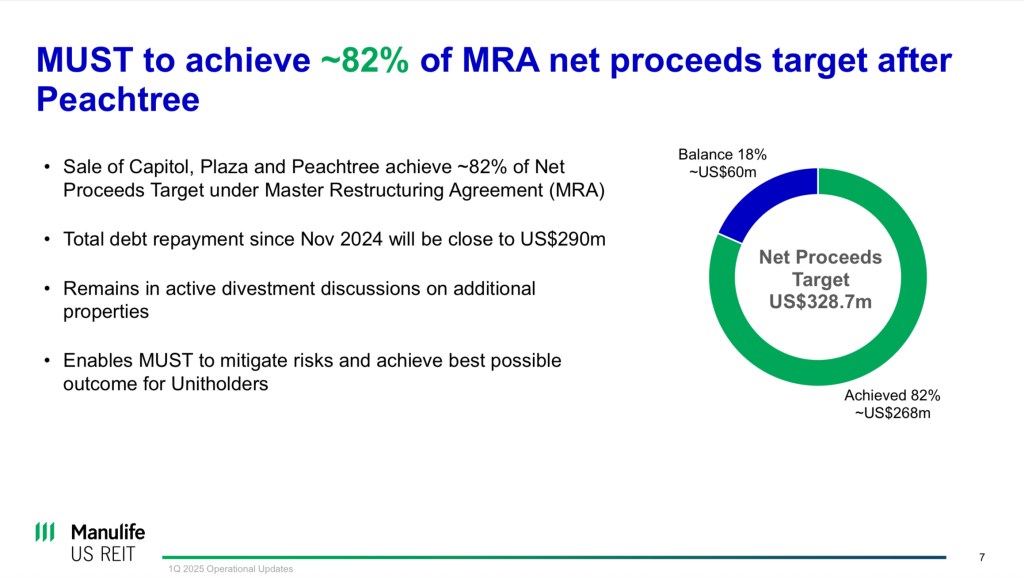

But here’s the thing — something has been changing quietly behind the scenes. Over the past year, MUST has been working hard to deliver on its debt reduction plan. And with the latest announced sale of the Peachtree property, the trust has now achieved over 80% of its net proceeds target. That’s no small feat.

Now I’m not saying the issues are over — there’s still a long road ahead. But if you’re the kind of investor who’s looking for a potential turnaround story, this might not be the time to keep looking away.

To help us understand the latest developments, I’ve arranged something special: a written interview with MUST’s CEO, Mr John Casasante. I’ve submitted a set of tough but fair questions — the kind I know many of you would want answered. And in this post, I’ll walk through those questions, and share John’s responses, along with some of my own thoughts on what it all means.

Before we dive in, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own the REIT discussed, but what works for me might not work for you.

Alright, let’s dive right in.

Navigating Challenges and Progress So Far

Manulife US REIT was the first pure-play U.S. office REIT listed on the Singapore Exchange. As at 31 March 2025, its portfolio comprised eight freehold, mostly Trophy and Class A office properties located in key U.S. markets, including Atlanta, Los Angeles, New Jersey, Washington D.C., Virginia, and Orange County.

Over the past few years, MUST has encountered significant headwinds. The U.S. office sector has been under pressure due to evolving work-from-home trends, rising vacancies, and higher interest rates. These factors have led to significant declines in property valuations and rental incomes, impacting the REIT’s financial performance and leading to a suspension of distributions to unitholders in 2023.

In response, MUST initiated a strategic plan to deleverage its balance sheet and stabilize its financial position. A key component of this plan involves asset divestments aimed at raising net proceeds of US$328.7 million by June 2025, as stipulated in its Master Restructuring Agreement (or M.R.A.) with its lenders.

As of May 2025, MUST has made notable progress:

● Peachtree Sale: The REIT agreed to sell the Peachtree office building in Atlanta for US$133.8 million. This transaction is expected to generate net proceeds of at least US$121 million, contributing significantly towards the debt repayment goal.

● Debt Reduction: Including the Peachtree sale and previous divestments, MUST has achieved about 82% of its targeted net proceeds, bringing it closer to meeting its obligations under the M.R.A..

● Leverage Improvement: Pro forma aggregate leverage is projected to improve to 56.3% from 59.4%, and the weighted average interest cost is expected to decrease to 3.94% from 4.37%.

● More importantly, it allowed Manulife US REIT to push back the asset disposal timeline to 31 Dec 2025 from 30 Jun 2025, which in my own views, will provide the REITmore flexibility to achieve a better sale price for the final asset.

These steps indicate a concerted effort by MUST to address its challenges and position itself for recovery. While uncertainties remain in the U.S. office market, the REIT’s proactive measures demonstrate its commitment to financial stability and long-term value creation for unitholders.

Written Interview with the CEO of Manulife US REIT

Let’s move on to my written interview with the CEO of MUST, John Casasante.

Alright, let’s go.

“Hi John, thanks for taking the time to do this special “written” interview with The Dividend Uncle. As many of my viewers already know, I’m a unitholder of Manulife US REIT — so I hope you won’t mind if some of my questions go straight to the heart of the tough issues. The aim is transparency, accountability, and hopefully a better understanding for both current and prospective investors.

First, credit where it’s due — there’s been real progress by you and your team since unitholders overwhelmingly approved the Master Restructuring Agreement (M.R.A.). We saw MUST’s unit price double at one point late last year, reflecting a burst of optimism. But since then, the momentum has faded, alongside much of the broader REIT sector. This pullback comes even as MUST has executed key parts of its debt repayment plan under the M.R.A. — a development I think deserves closer attention.

With that, let’s dive into the issues investors care most about.

Part 1: US Office Market — Still Doomed… or Turning a Corner?

The US office sector has been under intense scrutiny, but there’s been increasing talk of green shoots — stronger leasing activity, improved return-to-office momentum, and some signs of investor interest.

1. From where you sit, are there clear signs that the worst is over for the US office market? Are you seeing a meaningful pickup in leasing activity or tenant interest, particularly in your portfolio cities?

While still early, there are initial signs of green shoots. According to a 1Q 2025 J.L.L. U.S. Outlook Report, leasing volume across the U.S. grew more than 15% compared to 1Q2024, with the average length of lease terms on first generation new leases continuing to extend approximately 8% year-on-year to 9.1 years. Leasing volume over the past 12 months now reflects about 89% of typical pre-pandemic activity, with direct asking rents remaining largely stable, driven in part by stabilising concessions on lease renewals. An increasing number of companies, including Amazon, AT&T, The Washington Post and Dell Technologies, have also reinstated five-day in-office attendance requirements. Some of MUST’s submarkets see a similar trend.

2. How does MUST’s on-the-ground experience compare? Are there cities or sectors performing better than others, and are tenants gradually returning to the office in a more permanent way?

We have shared that there is a bifurcation in our submarket performance, with some submarkets showing signs of stabilisation while others continue to face leasing challenges. The categorisation of our assets by tranches provides a general sense of how different submarkets are performing. In terms of leasing, at Phipps and Michelson, both Tranche 3 assets in Buckhead, Atlanta and Orange County, California respectively, there is a significant amount of leasing pipeline, both new and renewals, under the proposal and touring stages, whereas in Tranche 1 assets Penn and Diablo in Washington, D.C. and Tempe Arizona respectively, leasing has been slow.

Our FY 2024 financial performance also reflects the differences in performance of the tranches. At the end of 2024, the valuation of Tranche 1 properties declined by 15.3% year-on-year while Tranche 2 and 3 properties recorded smaller declines, respectively. In terms of NPI performance in FY2024, the NPI decline in Tranche 1 and 2 assets was also steeper compared to Tranche 3 assets which experienced a 5% dip in NPI.

As for return-to-office, we have seen a noticeable improvement across our portfolio since the U.S. administration mandated a return to office for federal workers. We are encouraged to see people returning to the office later in the week on Thursdays and Fridays, on top of the usual Monday to Wednesday attendance. We also witness increased CBD traffic and higher card swipe activity at our properties, as well as expansion requests from existing tenants looking to accommodate returning employees.

Part 2: Fire Sale or Smart Move? Breaking Down MUST’s Latest Transactions

You recently announced another asset sale, pushing debt reduction past 80% of your M.R.A. target. That’s a major milestone. But the Peachtree gross sale price came at a 19% discount to book value — at a time when many investors hoped office valuations were starting to recover.

1. Can you walk us through the decision to sell Peachtree at that price? Was there pressure from the M.R.A. timeline? And how should investors interpret this discount — especially in light of hopes that US office valuations were stabilising?

There was initially robust interest in the property, but the bid submission timeline coincided with the tariffs announcement by the U.S. administration in early April. This was unfortunate timing which led to increased market uncertainty and an over-cautious reaction by the market, resulting in buyers pulling out of the process. This reversed the competitive advantage that we had, which resulted in us going with a buyer that we knew could close and complete the transaction.

The lenders’ approval for the M.R.A. extension was also conditional on the sale of Peachtree, so there was an urgency to secure the deal leading up to the original 30 June 2025 deadline.

2. Where do things stand now in terms of your debt repayment plan? What’s left to be done, and what’s the target leverage you’re aiming for over the next 12–18 months?

Assuming that repayment of US$146 million of outstanding loans, coming from net proceeds of Peachtree’s sale as well as cash, was made on 31 March 2025, our pro forma leverage is 56.3%. This repayment also leaves us with just approximately US$36 million of debts outstanding in 2026.

We pursued an extension of the disposal deadline to give ourselves more time to maximise opportunities to sell Tranche 1 assets. An extension allows us to continue engaging with stakeholders and potential buyers amidst the current challenging market conditions. Having achieved around 82% of our Net Proceeds Target, we are now focused on trying to sell a Tranche 1 asset in order to meet our M.R.A. obligations and repay debt before the 31 December 2025 deadline.

We will continue to lower our gearing through further asset dispositions and debt repayments. We also believe that a recovery in asset values will help improve our leverage and have already observed stabilisation/improvement in the value of some assets in our latest valuation exercise.

3. Are you seeing stronger interest or pricing for the remaining assets? Is there a realistic path to achieving fair valuations on future sales?

Current market and liquidity conditions, exacerbated byvolatility from the evolving U.S. tariff situation, have made it more challenging to sell assets at book value. The current buyer pool for office assets is focused on stronger market leasing fundamentals and assets with higher occupancies. Most buyers are seeking significant discounts for properties similar to our Tranche 1 assets due to weak leasing demand in our Tranche 1 submarkets such as Washington D.C., downtown Los Angeles and Tempe. The exception is owner-users, who would be willing to make a better offer for an asset for strategic reasons. That said, we continue to have disposition conversations for Tranche 1 assets and are evaluating liquidity in the market for such assetsto strike the best balance between liquidity and price.

We also see improving credit conditions in the U.S. The last two purchasers of our assets, Plaza and Peachtree, were able to secure debt for their purchases compared to what we observed 12 months ago. This signals improvement in capital markets for U.S. office transactions. Furthermore, with our M.R.A. deadline pushed back later to 31 December 2025, we believe this will give us more time to find the best offer for our Tranche 1 asset.

Part 3: What’s Left in the Tank? Operational Outlook for Remaining Assets

Despite macro optimism, MUST’s latest Q1 2025 results showed further deterioration: occupancy dropped from 73.9% to 69.9%, and rental reversion worsened from -5.1% to -8.9%. Understandably, this has raised concerns.

1. Can you help investors understand what’s driving the declines — is it specific to certain tenants or properties, or is it a broader market lag?

At the same time, some US office REITs are reporting stabilisation in occupancy. Why is MUST still seeing declines? Are the assets simply less competitive — or are you deliberately holding out for better tenants?

Occupancy declined in 1Q 2025 largely due to lease expiries at Diablo on 31 December 2024, but this was offset by new leases signed at Phipps and Centerpointe. We have been adopting strategic leasing to optimise our capital. Instead of purely chasing higher occupancies, we have been focusing on strategic deals where we either hold a competitive advantage or can applysome creativity in structuring the lease, so as to maximise liquidity. This, in turn, also affects the number of leases we sign.

As for rent reversions, they vary significantly depending on leases signed during each reporting period. Each lease is unique, taking into consideration market rents, tenant improvement and free rent packages, lease terms, etc. We continue to focus on accretive net effective rents and low capital deals that create liquidity. Generally, as we negotiate deals with lower tenant improvement. Tenants offset this by securing lower rental rates and longer free rent periods, thus lowering their effective rental rate. Furthermore, in some cases, current market rents have yet to catch up with the gross rents from leases signed 10 years ago, which included 2% to 3% annual escalations. This has resulted in negative rent reversions. We have reported that although rent reversion in 1Q 2025 was negative, 6 out of 7 office leases signed were above market rents.

2. Among your remaining assets, which are performing well? Are there any that are particularly difficult to lease, and why?

We have identified our Tranche 3 assets, Phipps and Michelson, as having low occupancy risks and low to medium capex requirements. These assets will not be prioritised for disposition. Currently, as we focus on strategic leasing and prudent capital management, we are pursuing deals where we have a competitive advantage to allow us to negotiate strategic and accretive leases rather than simply pursuing commodity leases based solely on the lowest rental and highest tenant improvement allowances.

At the moment, we have not seen any new leasing interest for Penn, although we are expecting to sign a short-term renewal with the US Treasury. However, there is still leasing interest in other assets located in challenging markets. For instance, at Figueroa, tenant demand currently exceeds available vacancy, reflecting strong leasing interest. However, tenant concessions in downtown Los Angeles remain very high, and most leases are not accretive. Meanwhile, Diablo is a back-office asset that flourished pre-COVID but has experienced decreased demand since the pandemic as tenants downsize and allow employees to work from home. That said, we remain in leasing discussions with various potential tenants for both buildings. For instance, at Diablo, we are seeing a slight pickup in leasing from a new user group – trade schools, while Figueroa has some new leasing interest from financial and government tenants.

Part 4: What’s Next for MUST? Distribution Plans, Recovery, and Strategy

Let’s shift to the road ahead.

1. Once the M.R.A. obligations are met, what’s your vision for MUST over the next 1–2 years? Will the REIT return to growth mode, or is it more about stabilisation and recovery?

We target to meet our M.R.A. obligations by 31 December 2025. For us, the recovery and growth phases go hand in hand. Diversification is necessary for the REIT to support long-term sustainable risk-adjusted cash flows, returns and distributions.

Under the recovery phase, we are continuing to pay down outstanding debts, improving our financial metrics and liquidity as well as looking to resume distributions to unitholders. Under the growth phase, we plan to pivot by recycling capital into other asset types that offer attractive and accretive cash yield and are less capital intensive than office.

2. What is the sponsor’s long-term commitment to MUST? Beyond supporting the restructuring, are there plans to provide further backing — financial or otherwise — to reposition the REIT for long-term viability?

In our latest agreement with lenders to extend the M.R.A., we also agreed to use an additional US$25 million from our balance sheet to partially pay down debts due in 2026, 2027 and 2028. As a show of support, the Sponsor Manulife did not receive any repayment at this stage, demonstrating its commitment to support MUST through its restructuring. Its US$137.0 million loan is the last stack among lenders to come due, signaling its commitment to support MUST through its restructuring until all its other lenders have been paid off.

In our pivot to growth, MUST will leverage on the Sponsor’sglobal real estate platform, including its on-the-ground transaction expertise and broker relationships, market research, weekly discussions on a robust investment pipeline for potential acquisition, to capitalise on value investment opportunities including alternative asset classes.

3. A frank question — and I understand if you can’t comment. Now that MUST is a smaller trust, has privatisation ever been discussed at the sponsor level? With fewer assets, some investors wonder if it might now be more feasible.

This question would be better directed to our Sponsor. In any case, it is not currently part of our conversation with the Sponsor.

4. Finally, many retail investors have written off MUST completely. What’s your message to them? Why should someone who exited — or is sitting on the fence — consider giving MUST another look?

At MUST’s current price of around 0.27x to book as at 3 June 2025, and having made steady progress toward recovery, including achieving around 82% of our Net Proceeds Target under the M.R.A. and being just another asset sale away from meeting our M.R.A. obligations, we believe there is strong upside potential for the REIT. We are also working towards pivoting to growth by recycling capital into other asset types that are less capital intensive and enjoy better capital appreciation compared tooffice to diversify our income and generate sustainable cashflows for unitholders. Resuming distributions to unitholders remains a priority for us, and we are working on creating sustainable cash flows which will allow us to resume distributions.

Thanks again, John, for taking the time to address these questions candidly. The challenges are real, but so is the progress — and I believe interviews like this help rebuild trust, one step at a time.”

The Dividend Uncle’s Take – Is MUST Finally Moving On?

Now that you’ve heard directly from the CEO… here’s my take.

Let’s not sugarcoat it — Manulife US REIT’s share price has been through absolute carnage. I know many retail investors who sold out in frustration, and honestly, I don’t blame them. The 90% drop wasn’t just a number. It represented real losses, broken trust, and the sense that this REIT had become untouchable.

But when I look at what’s happened over the past 12 months… it’s not business as usual anymore.

They’ve sold off Peachtree — yes, at a discount — but they also cleared over 80% of their net proceeds target. And here’s what many might have missed: that single move bought them six more months of runway. That means more time to sell the next asset right, not desperately. That’s a huge difference.

Occupancy? Still weak. Rent reversions? Still negative. But the CEO was surprisingly frank: they’re not chasing vanity metrics. They’re selectively leasing to maximise liquidity. That’s not a growth mindset — it’s a survival mindset. But at least it’s an intelligent one.

And the sponsor? They’ve stayed last in line for repayments. That’s not just lip service — that’s skin in the game.

So what does all this mean?

To me, MUST today is no longer in free fall. It’s stabilising. Slowly. Unevenly. But stabilising.

Am I buying more? Not yet. Part of the reason is that I already hold a position and have been averaging down over the past year — so I’m not in a rush to add further until there’s clearer progress. I want to see that final asset sale done. I want to see distributions come back. But I’m also not selling. Because if this really is the bottom… then the upside from here could be meaningful.

And honestly, it feels like the market hasn’t caught on. Or maybe it has — and just doesn’t care yet. And to be fair, there are still significant risks. A lot still depends on whether MUST can successfully sell that last asset, keep occupancy from sliding further, and eventually resume distributions. If any of those stumble, this recovery could easily stall.

But you know what I always say — there is always a value stock somewhere. And value isn’t where everyone’s cheering. It’s where everyone’s yawning. The key is knowing whether it’s neglected… or fundamentally broken. For now, I’m cautiously leaning toward the former — but watching closely.

So maybe… just maybe… this could be a REIT worth watching again.

Alright, that’s all for today folks. Let me know in the comments your thoughts on MUST and your general strategies on out-of-favor REITs. And if you’ve enjoyed the post, please give me a ‘like’ and subscribe to the website to avoid missing any of my personal analyses I do for my own investment portfolio.

Until next time, happy investing!

Leave a comment