Hey there, fellow REIT investors, welcome back to the channel.

As dividend investors, we’re often told to tune out short-term noise — that markets overreact and good, blue-chip REITs will eventually bounce back. But what happens when the negativity isn’t just noise… but a long, dark cloud that stays around and never quite clears?

Both Mapletree Industrial Trust and Mapletree Logistics Trust have been stuck under this kind of gloom for quite a while. For MIT, its concerns about the quality of its US data centres. For MLT, it’s the ongoing drag from its exposure to China’s logistics sector. These risks haven’t just popped up recently — they’ve been weighing on sentiment for more than a year.

But here’s the tricky part: sometimes the market gets it wrong, and the sell-off becomes a buying opportunity in plain sight. Other times, the market’s caution turns out to be right, and what looked like overreaction could actually be justified.

In this post, I want to explore the very different risks facing these two REITs – not just to unpack the risks, but to ask the key question: Is the fear overdone, or still not enough? Because even though I continue to hold both, the reasons I do so are very different.

But before we dive in, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the REITs discussed, but what works for me might not work for you.

Alright, let’s get started.

Mapletree Industrial Trust – Small Data Centres, Big Concerns?

Mapletree Industrial Trust, or MIT, is one of the most well-known Singapore REITs with exposure to both local industrial assets and data centres across the U.S. Over the years, it has evolved into a high-quality REIT, backed by a strong sponsor.

But one narrative that’s been dragging down investor sentiment is the concern over its U.S. data centre portfolio, particularly the smaller or more at-risk assets that may struggle to attract tenants in a hyperscale-dominated world.

So how real is this risk?

The market seems to think it’s significant — MIT’s share price has fallen about 16% over the past year, with much of that pressure coming from investors questioning the long-term value of these smaller U.S. assets. But the actual breakdown paints a more nuanced picture.

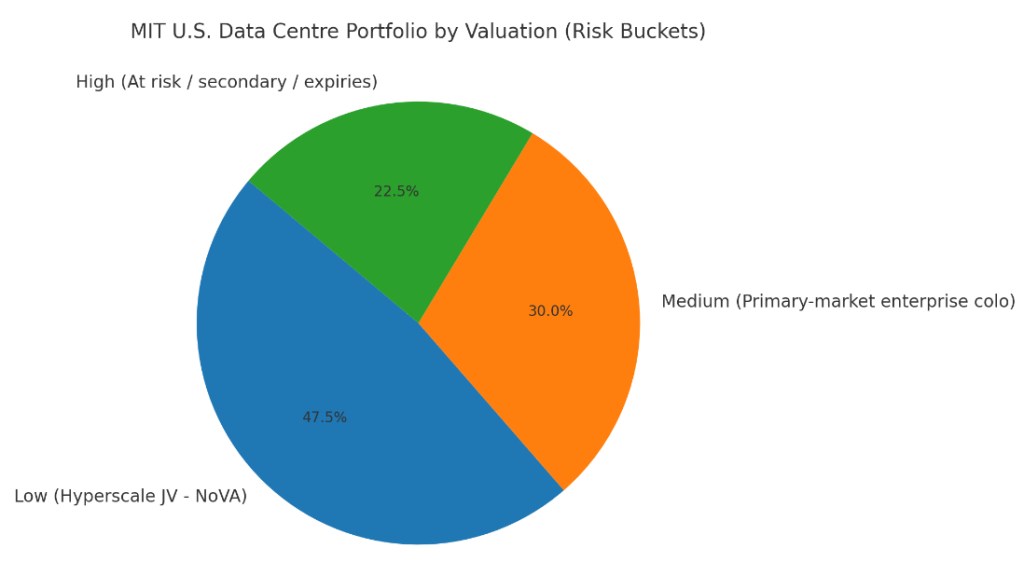

Let’s look at the valuation-weighted risk breakdown of its U.S. data centre portfolio. I’ve gone deep into assessing the potential riskiness of each of their properties and classified them into 3 categories. I might be wrong, but these are my personal views.

Firstly, ‘Lower Risk’, which accounts for about 47.5% of their U.S. data centre portfolio valuation. These sit in the hyperscale J.V. in Northern Virginia, which some analysts say is one of the most resilient data centre markets in the world.

Second, the ‘Medium Risk’ category, which accounts for about 30%. These are smaller than hyperscale, but located in core metros, like Dallas, Silicon Valley, and Phoenix, where the demand is higher and hence occupancies are more stable. They’re usually multi-tenanted and not facing near-term expiries.

And finally, the ‘Higher Risk’ category. These account for about 22.5%, and are in smaller, secondary-market or lease-cliff assets. These are where the market concerns are focused.

Let’s go even deeper.

Among the ‘Higher Risk’ assets, 7337 Trade Street in San Diego is the most concerning. AT&T, the tenant, has only extended on short-term leases, with the next expiry in May 2026. Management has said they’re keeping their options open — backfill with a new DC tenant, reposition the site for lab or cleanroom use, or sell it altogether. If they go the repositioning route, expect downtime and some capex.

Then there’s 250 Williams in Atlanta, a mixed-use office-data centre asset. The office lease has a confirmed non-renewal, and management is considering converting some office space into additional DC capacity — though that depends on whether more power can be brought in. Worst-case, they may just re-let it as an office.

On the flip side, there’s good news too. 402 Franklin in Brentwood, once vacant, has been fully backfilled with a long-term lease by Vanderbilt University Medical Center. That’s a major win. And 2775 Northwoods in Norcross, Georgia — another smallish, non-core asset — has been sold off above valuation, freeing up capital and removing rollover risk.

So MIT isn’t sitting still. There’s clear evidence that management is tackling the weaker assets one by one — either by re-leasing, repurposing, or selling. Some analyst report that even in worst-case scenarios, the drag to DPU is modest — around 1–4% if these high-risk assets go vacant and stay vacant.

Yet the market sell-off continues.

My take on all this? Honestly, the share price fall feels harsher than the reality.

Yes, there’s risk. And yes, the smallish data centres are harder to lease than the big hyperscale ones. But we’re talking about 22.5% of the U.S. data centre portfolio, which translates to about 10% of MIT’s total portfolio value. And even within that segment, MIT has already backfilled (Brentwood) or divested (Norcross) some of the weaker assets.

What’s more important is that the bulk of MIT’s U.S. data centre value — about half — sits in strong or resilient markets, including its crown jewel: the hyperscale J.V. in Northern Virginia. The middle bucket is steady but not bulletproof and continues to show good occupancies and healthy demand.

Combine that with MIT’s Singapore industrial assets, which still provide a stable base of earnings, and you get a REIT that’s facing some headwinds—but not in crisis mode.

I think the market may be pricing in a bit too much fear here. That’s why I continue to hold MIT in my portfolio — not just hoping for a turnaround, but because I believe management has shown enough adaptability to weather this period.

The key will be what happens with San Diego in the next 12 months. If they manage to either re-let or divest it meaningfully, that’ll remove a big overhang.

So yes — there are small cracks. But they’re not structural collapse in my personal opinion.

Mapletree Logistics Trust – More Than Just a China Problem?

Now, let’s move on to Mapletree Logistics Trust or MLT. It is one of the stalwarts of the Singapore REIT space. It owns over 180 logistics properties across 9 Asia-Pacific markets. And yet, its share price has lagged behind some of its peers lately. The reason? Most people will cite just three words: “China logistics weakness.”

But is that the whole story?

Let’s start with the numbers. In the latest quarter, MLT’s China portfolio continued to drag. Rental reversions in China were –7.5%, while occupancy dipped to 93.0%. That sounds painful—and it is. And as a result, their share price has fallen about 45% over the past 5 years.

But here’s the important part that sometimes gets missed: China makes up only 20% of MLT’s portfolio by valuation. And outside of China, things are actually quite stable.

Take Singapore—MLT’s home base—which saw +5.2% rental reversion, with full occupancy. Japan posted +7.2% rental reversion, Hong Kong and South Korea at +1.1%.

And remember, in one of my earlier posts, I flagged Hong Kong as a possible weak spot to watch. But so far, Hong Kong has surprised on the upside—with stable demand and relatively steady performance. This reinforces a point I’ve made several times: the risks in MLT’s China exposure are very real—but they are contained.

Management isn’t sitting still either.

They’ve continued to recycle capital actively, disposing of underperforming or non-core assets and reinvesting into stronger markets. For example, divestments in Singapore and Malaysia at premiums above valuations of up to 40%, and the redevelopment of 5A Joo Koon Circle in Singapore, indicate these aren’t just token moves—they signal that management is trying to future-proof the portfolio. But before we get ahead of ourselves, the elephant in the room is the macro environment.

I’ve previously said that even though I’m cautiously confident in MLT’s strategy, regional trade uncertainty remains a risk. That’s still true. Recent macro data has looked okay, but there’s some concern it could be due to front-loading of exports in anticipation of further tariffs or restrictions. If that’s the case, we may see a slowdown in the coming quarters as things normalise.

My take on this? Well, I think the obvious risk here—China—is actually well-contained given its portfolio size. The bigger risk now might be regional trade flows in general. If cross-border trade continues to slow, especially between major Asia-Pacific economies, then even the strong markets in MLT’s portfolio could start to feel the strain.

So while I remain cautious, I’m not bearish. MLT is a good example of a REIT that’s navigating short-term challenges with a clear long-term plan. If they can maintain the momentum in portfolio rebalancing, there’s a decent chance investor sentiment will turn… eventually.

Before we move on to the final section where I’ll break down why I’m holding both MIT and MLT despite their major differences, if you’ve found the post useful so far, please do this uncle a favor and give it a ‘like’, and subscribe to the channel if you haven’t. Appreciate all your little gestures of support!

Alright, let’s get to the most exciting part.

The Dividend Uncle’s Take

Looking at both REITs side by side, the contrast is actually quite striking. In my view, only one of these REITs is being unfairly punished — and that’s MIT.

Yes, it does have some smaller-sized data centres in the US portfolio that may underperform. But those make up just 10% of its overall portfolio. In the bigger picture, its Singapore base is rock solid, the balance sheet is strong, and management seems ready for what’s ahead. That’s why I’ve not just held on — I bought a substantial amount recently, as shared in my earlier post.

MLT, on the other hand, is facing something trickier. The China risk, which I’ve long said is limited and contained, is still present — but now we’re seeing broader trade-related fears creep in. The slight optimism in recent export numbers may well be due to front-loading — the real test is yet to come.

Despite that, I’m continuing to hold MLT. The REIT continues to show resilience in other markets, and management has been actively recycling assets to drive value — which reflects the quality of their assets and adaptability. So while I expect weakness to persist for a while, I’m looking to average down when the price is right, because I still believe that trade is the lifeblood of Asia, and MLT is a key player in that space.

So yes — both REITs have risks. But only one feels overblown. And that’s where I’m personally leaning in. But remember this is what I’m doing for my portfolio, which may not be suitable for you.

Alright, that’s all for today’s post. Thanks for watching, and I hope this helped you make sense of the risks — both real and perceived — around MIT and MLT. If you found this useful, do give it a like, and better still, join as a member to support more of such thoughtful investing content. Until the next post, stay steady and keep investing wisely!

Leave a comment