Hey dividend income investors!

Not long ago, I shared a post about how JEPG and JEPI — two of JP Morgan’s most popular income ETFs — were delivering some of the highest yields I’d seen in a long time. At one point, both were giving me over 15% annualised yields based on their monthly payouts! Naturally, that got many of us excited. But I also included a note of caution — that these high yields were driven by temporary market volatility, and might not last if things calmed down.

Well, that’s exactly what we’re starting to see. Since then, the yield on JEPG has come down quite a bit to about 8% annualised yield. Since then, I received quite a few messages from viewers and friends, all pointing me to another ETF — JEPQ, the Nasdaq-100 focused ETF. And they were all asking the same thing: the yield for JEPQ hasn’t dropped much. In fact, the latest number is still over 12% per annum, and its yield has outpaced JEPG every single month in 2025.

So today, let’s talk about it. Is JEPQ the better choice now for income? Why is its yield holding up? I’ll also explain whether I still prefer JEPG for my own portfolio, even though its yield has pulled back.

But before we dive in, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the ETFs discussed, but what works for me might not work for you.

Alright, let’s get started!

What Are JEPG and JEPQ?

If you’re new to these ETFs, let me quickly explain what JEPG and JEPQ are.

JEPG stands for JP Morgan Global Equity Premium Income UCITS ETF, and JEPQ is the JP Morgan Nasdaq Equity Premium Income UCITS ETF. Both are exchange-traded funds managed by JP Morgan, and they share a common strategy — to provide investors with monthly income through enhanced dividend yields.

Covered Call Strategy To Enhance Yield

They do this using a covered call strategy. That means they buy a portfolio of stocks — JEPG holds a globally diversified set of defensive stocks, while JEPQ focuses on US tech-heavy Nasdaq-100 stocks — and then they sell call options on stock indices to generate extra income. The premiums collected from these options are then distributed monthly to investors, which is how both ETFs offer yields that are often much higher than traditional dividend funds.

London-Listing Provides Tax Efficiency

Now, here’s something especially important for Singapore-based investors like us — both ETFs are listed on the London Stock Exchange (or LSE), which means we can invest in them without incurring any dividend withholding tax. That’s a huge plus compared to US-listed versions like JEPI or JEPQ, where the 15% withholding tax eats into the yield.

So in short, JEPG and JEPQ let us access J.P. Morgan’s popular income strategy, enjoy high monthly payouts, and do so in a tax-efficient way.

The Yield Comparison: JEPQ Still Holding Strong

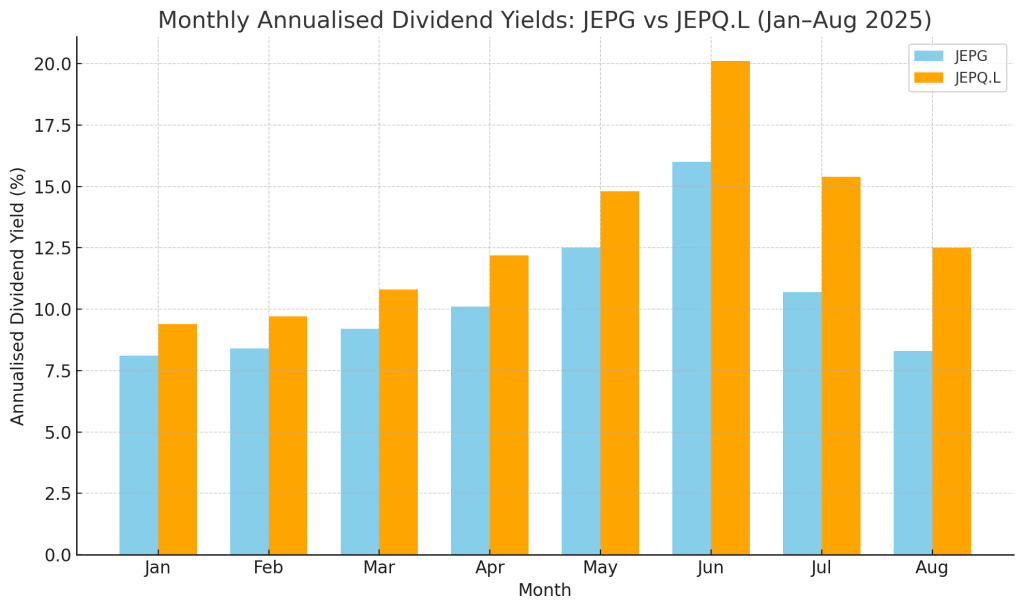

Let’s take a step back and look at the full picture — from January to August 2025. If we plot the monthly dividend yields of both JEPG and JEPQ side by side, as we’ve done in the chart, a clear pattern emerges.

Both JEPG and JEPQ’s Yield Trends Follows Market Volatility

For JEPG, the dividend yield started the year at around 7.2% in January, climbed steadily with the rise in market volatility, and peaked at over 16.0% in June. Since then, as markets calmed, the yield has eased slightly and now sits at about 8.3% in August.

JEPQ, on the other hand, began even higher — with a 9.0% yield in January, reaching its peak at around 20.1% in June, and currently offering an attractive 12.5% as of August. So while both ETFs followed a similar trajectory — rising as volatility surged and pulling back slightly afterward — JEPQ’s yield has been consistently higher across the board.

And that’s the first key point.

Both JEPG and JEPQ have risen from the start of the year, peaked when volatility was at its highest in mid-2025, and have since moderated slightly. This shows the close link between market volatility and the income these ETFs generate through their option strategies.

JEPQ’s Dividend Yield Consistently Higher

But the second point is even more important for us dividend-seeking investors.

From the chart, it’s obvious that JEPQ’s yield has not just been higher now — it’s been higher all year long. In every single month from January to August, JEPQ outperformed JEPG in dividend yield. This isn’t just noise. It suggests a structural reason — something built into the ETF’s strategy or underlying that gives it an edge in generating income.

So before anyone rushes to conclude that JEPQ is the “better version” of JEPG, we have to ask: What’s causing this consistent difference?

And more importantly, there is a strategy difference underlying the two ETFs that might affect whether one is better suited for you, based on your own risk tolerance and desire in earning reliable dividends. Let’s walk through the key differences between JEPG and JEPQ that really matter, starting with where that yield is coming from in the first place.

Nasdaq’s Higher Volatility Boosts Income — But Increases Price Swings

To understand why JEPQ consistently delivers higher dividend yields than JEPG, we need to look beyond just the ETFs’ holdings. The real driver lies in the index each ETF writes covered call options on.

JEPQ is built on writing options based on the Nasdaq-100, and that index is, by design, far more volatile than the broader, globally diversified markets that JEPG writes options from. The Nasdaq-100 includes stocks like Tesla, Meta, Nvidia, and Amazon — companies that tend to swing more aggressively with earnings, macro news, or changes in sentiment. Even when overall market volatility cools down, the Nasdaq still carries a higher level of implied volatility.

Why does that matter?

Because both JEPQ and JEPG generate income by selling options — and the value of those options is directly linked to implied volatility of the underlying indices written on.

Higher Volatility Results In Higher Price Swings

So when volatility is high, the premiums collected from selling those options go up — and that’s what funds the higher monthly dividends. Because the Nasdaq remains structurally more volatile, JEPQ continues to earn more premium income. On the other hand, JEPG writes its options on broader indices like the MSCI World, which have become much calmer in recent months. As a result, the option premiums — and therefore the dividends — have come down.

But of course, that higher volatility cuts both ways. While it helps JEPQ generate stronger option income, it also makes the ETF more sensitive to market downturns. We saw this clearly during the market pullback in April 2025, when rising global tariffs sent tech stocks tumbling. JEPQ, which writes options on the Nasdaq-100, experienced a noticeably sharper decline in price compared to JEPG, which held up better thanks to its broader diversification.

So while JEPQ may win on yield, investors shouldn’t overlook the other side of the coin — price volatility.

Global Diversification and Strategy Design Keep JEPG More Stable

That steeper drop in JEPQ during the April tariff-driven selloff wasn’t just bad luck — it highlights a key structural difference.

JEPQ is tightly linked to the Nasdaq-100, both in the stocks it holds and the options it writes. JEPG, on the other hand, spreads its equity exposure across developed markets globally and, crucially, uses a decoupled strategy — holding lower volatility stocks, while writing options on broader, more volatile indices.

This combination gives JEPG two important layers of stability. First, its global portfolio cushions it against country- or sector-specific shocks, especially when compared to JEPQ’s US tech-heavy exposure.

Second, its decoupled structure reduces sensitivity to equity drawdowns. Even when market volatility spikes, JEPG can earn higher option income without experiencing the same magnitude of capital loss. So while its yields may be lower than JEPQ’s, the trade-off is better capital stability — which may appeal to investors who prefer a smoother ride.

What’s This Decoupled Strategy?

Let’s take a closer look at the mechanics behind this.

JEPQ follows what’s called a coupled strategy. It holds Nasdaq-100 stocks and writes call options on that same index. This creates tight alignment between its holdings and its income source. So when the Nasdaq falls — as it did in April — the fund’s share price falls too. At the same time, while volatility boosts option premiums, the increase is often not enough to fully offset the capital loss. The result is what investors saw during the tariff-driven downturn: a steeper price correction for JEPQ, not due to a failed strategy, but because its structure offers limited flexibility in downturns.

JEPG, by contrast, uses a decoupled strategy anchored in a globally diversified, low-volatility portfolio. It holds 200–300 high-quality, defensive stocks across developed markets, deliberately tilting away from tech and cyclicals. Its selection process focuses on companies with stable cash flows, strong balance sheets, and lower beta — relative to benchmarks like the MSCI World. At the same time, the options overlay is written on indices like the MSCI World or S&P 500, not on JEPG’s own specific holdings. This gives the ETF a valuable advantage: when volatility spikes, JEPG earns more from options, while its stock portfolio experiences smaller drawdowns — thanks to both diversification and strategic decoupling.

In simple terms, here’s what all that means.

JEPQ moves in sync with the Nasdaq — when the index drops, the ETF drops too, because it owns those stocks and sells options on the same thing. JEPG takes a different approach: it holds a steadier mix of global stocks, and earns income by selling options on bigger, more volatile indices. That gives it two advantages — more stability when markets get shaky, and the ability to still earn from volatility without suffering as big a drop in price.

Before we move on, if you’ve found this post helpful so far, do consider giving it a like — it really helps more people discover the channel. And a big welcome to our new members on my YouTube channel, Ben Lai and Steven Lim — thank you for supporting The Dividend Uncle! If you’d like to join them to support the channel, you can hit the Join button at my YouTube channel. But of course, I’ll be just as happy with your thumbs-up!

The Dividend Uncle’s Take

So here’s my honest take.

Yes, I’ve seen JEPQ’s dividend stay high this year. The Nasdaq’s structural volatility and the coupled strategy have helped it maintain payouts even as others dropped.

But if you’re wondering, “Uncle, how come you didn’t talk about it earlier?” — I’ll be straight with you.

I prefer what JEPG is doing. I’m looking for consistent monthly income with lower volatility. I want something that holds up when markets are choppy, but still gives me exposure to a broad mix of regions and sectors. JEPG’s decoupled structure and global diversification fit that purpose.

Yes, JEPQ has given more yield recently. But for me, the trade-offs are too steep: capped upside if the Nasdaq rallies, higher correlation to tech stocks, and more vulnerability if growth stocks sell off.

That said, I’m not saying JEPQ is a bad ETF. In fact, if you’re an investor who wants maximum income, and you’re okay with higher volatility and tech sector concentration, JEPQ could be a very compelling option. Especially if you believe the Nasdaq will stay range-bound or volatile for a while — this strategy will continue to extract income effectively.

But it all comes back to knowing what role each ETF plays in your portfolio. JEPQ gives you a stronger income engine — but with more noise. JEPG gives you more balance — with a smoother ride. For me, that balance matters more.

Alright, that’s all for today folks. Let me know what you think in the comments. Are you holding JEPQ? Or do you prefer the more balanced setup of JEPG like me?

And if you found this breakdown helpful, I’d really appreciate a thumbs up — and consider subscribing to the channel if you haven’t already. It helps support the work I do, and helps more income-focused investors like you make smarter decisions.

Until next time, happy investing — and stay steady.

Leave a reply to 2 Dividend Stocks I Bought, 2 Sold And 1 Eyeing In November 2025 – The Dividend Uncle’s Take Cancel reply