Hey fellow dividend investors, welcome back to the channel.

Today’s post is a little different — because the REIT I’m deep-diving into is not one of the big names like CapitaLand Integrated Commercial Trust or Mapletree Industrial Trust. In fact, it’s a much smaller REIT that honestly… probably won’t get this post a lot of views for the channel. But that’s perfectly fine, because I know some of you appreciate these deep dives where I roll up my sleeves, spend hours researching, and try to simplify something that most investors don’t have time to analyse.

And I think this one is worth taking a closer look at.

Because the REIT I’m talking about — Stoneweg Europe Stapled Trust, or SERT — was actually one of the top-performing REITs in 2024. It surprised a lot of investors with how well it held up. But fast-forward to today… it has suddenly become the highest-yielding REIT in the entire Singapore market. And when a REIT tops the yield table, you know what happens — investors get nervous. High yields usually trigger high fears.

So why did a REIT that performed so well just a year ago trade at with the highest yield?

Is something fundamentally broken, such that other REITs have surpassed it in the recent recovery?

Or is the market simply misunderstanding this REIT?

In true The Dividend Uncle fashion, I’m going to take you through a full deep dive — not to hype this REIT, but to create a resource you can come back to whenever you want to review SERT. Whether it’s today, next month, or a year from now, you’ll have a detailed breakdown of the portfolio, the numbers, the trends, and my personal take as an investor.

And a small apology upfront — this post is going to run a bit longer than usual, because I really wanted to make sure everything is properly researched and clearly explained. So thanks in advance for staying with me — I promise the depth will be worth it.

But before we dive in, let me remind you that this post is for informational purposes only and not financial advice. Always do your own research and consult a licensed financial adviser before making any investment decisions. I own some of the REITs discussed, but what works for me might not work for you.

Alright, let’s jump right in.

Deep Dive Into SERT’s 100 Properties

To make sense of this massive portfolio, I’m breaking it into four economic clusters. Once you see these four clusters, the whole REIT becomes surprisingly straightforward.

Cluster 1: The Core Light-Industrial & Logistics Engine

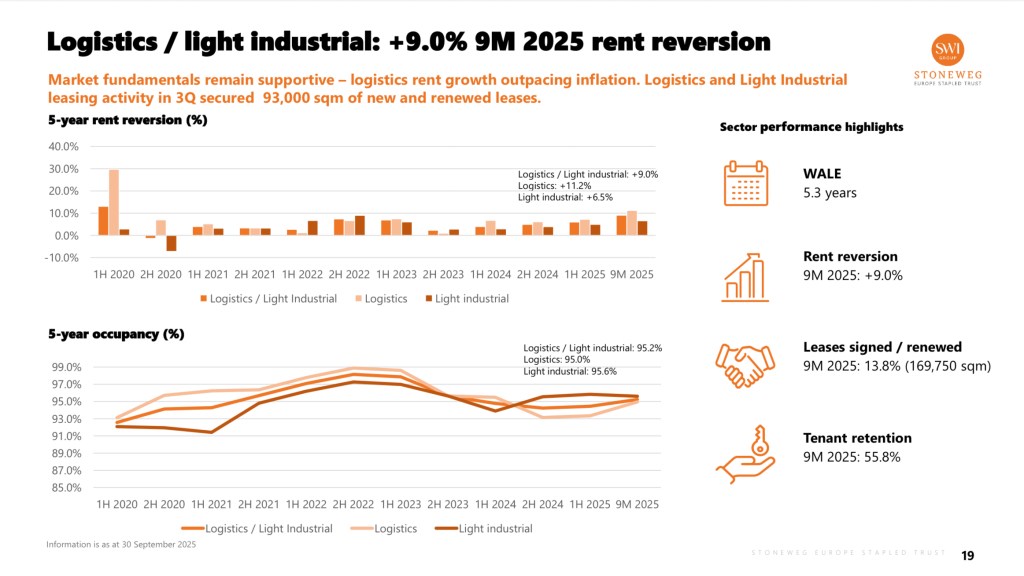

This cluster is the heartbeat of SERT. It makes up about 59% of the property value. These are the assets delivering 95.2% occupancy, +9.0% rent reversion year-to-date, and consistently strong leasing activity.

In the first nine months of 2025 alone, SERT signed ~93,000 sqm of new and renewed industrial leases, including standout German renewals of +28.1% and +11.0%. Logistics specifically delivered +11.2% rent reversion, and light-industrial came in at +6.5%.

This is the “steady income machine” of the trust — multi-tenant estates in France, Germany, Denmark, Italy, and the Netherlands that keep occupancy in the mid-90s and pricing power firmly positive.

Now to showcase some properties inside this cluster.

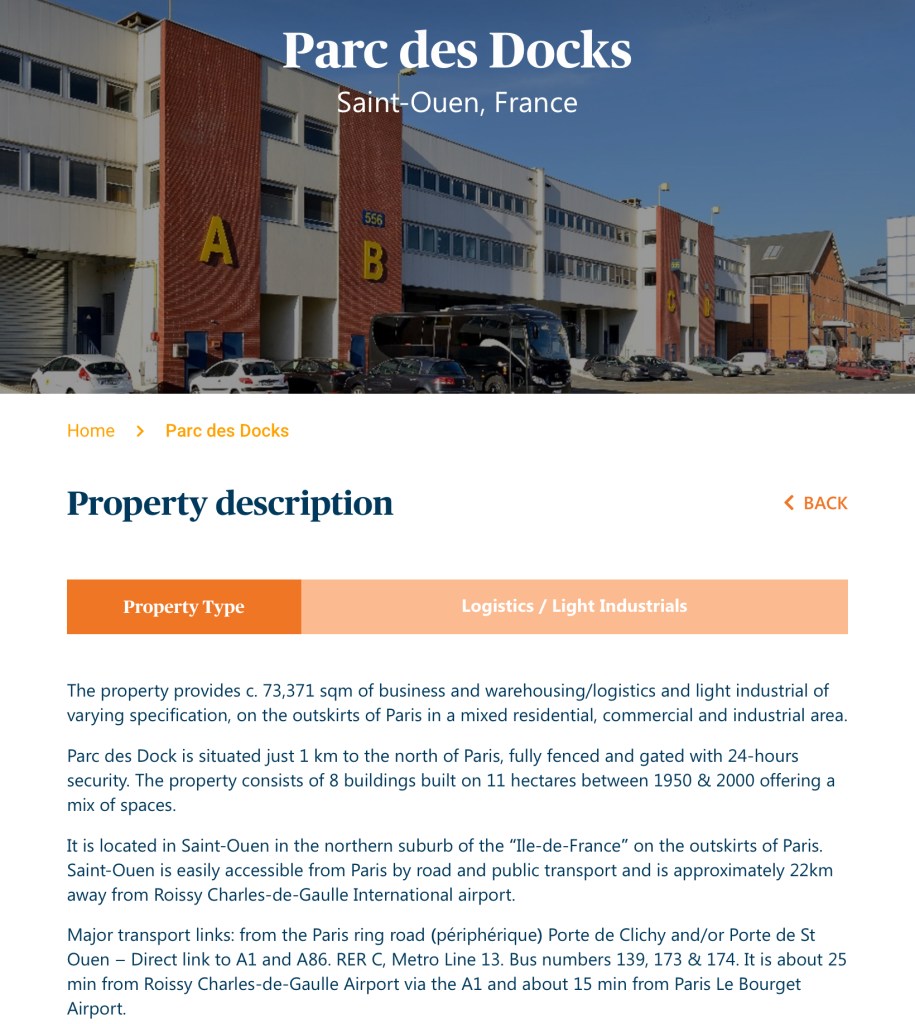

First, Parc des Docks, Greater Paris.

A 73,000 sqm light-industrial estate just outside central Paris. Demand is so tight that renewals consistently come through with uplifts. This one property helps explain why SERT’s French industrial exposure is such a strong contributor.

Second, the German Industrial Estates cluster.

You don’t need all the names. All you need to know is that Germany delivered the highest rent reversions in the entire REIT — as high as +28%. That’s real operating leverage.

Finally, the Copenhagen Logistics Estate.

This Scandinavian asset sits above 95% occupancy, reflecting an industrial market with disciplined supply and sticky tenants.

When management says the “vast majority” of SERT should eventually be industrial and logistics, these three properties tell you why.

Cluster 2: Prime Office Turnarounds

Office is where most investors get nervous, but this is not your average European office portfolio. After multiple disposals, SERT’s remaining offices are high-quality, long-WALE assets under active enhancement.

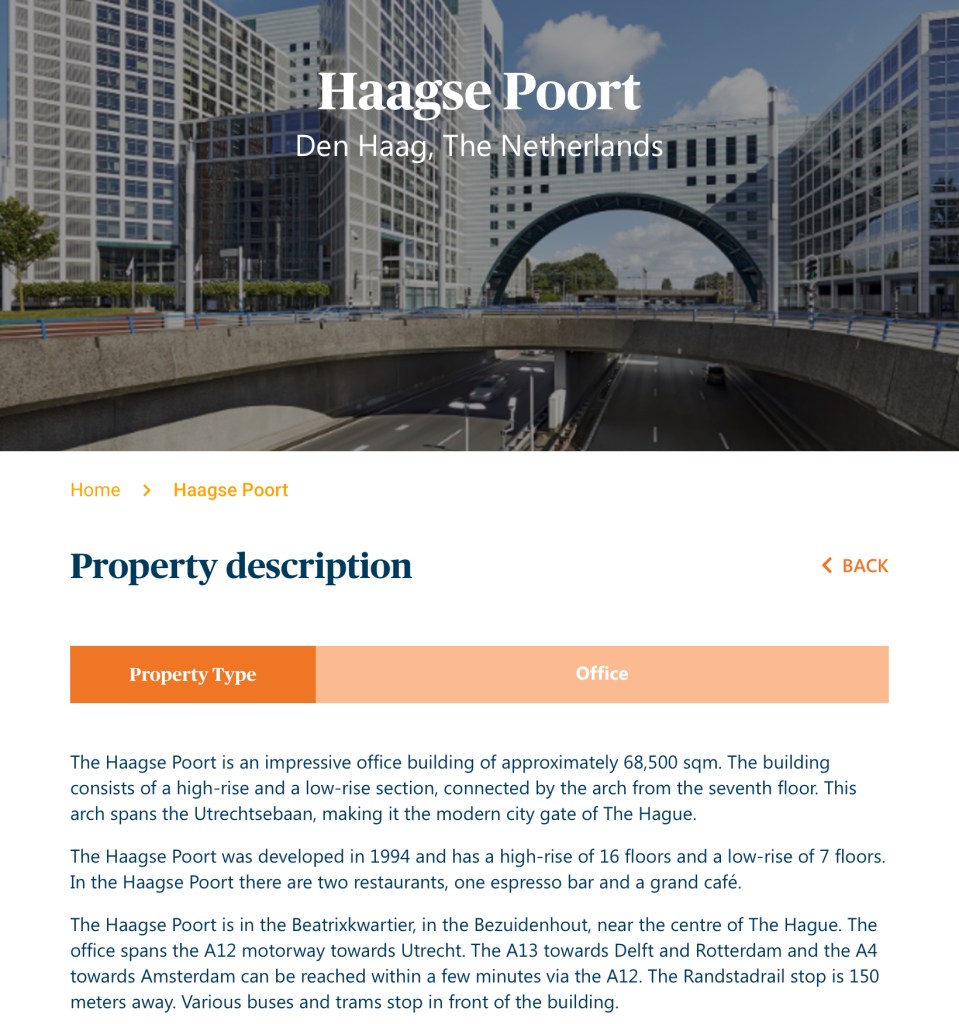

This flagship example is Haagse Poort in the Netherlands. This is an office asset secured a rare 20-year lease renewal from NN Group, one of Europe’s largest insurers. In today’s office market, a 20-year renewal is almost unheard of. And it lifted SERT’s office WALE to 4.9 years.

SERT is also investing roughly €60 million over several years to upgrade the building to modern ESG and efficiency standards — with the anchor tenant already locked in. That de-risks the capex significantly.

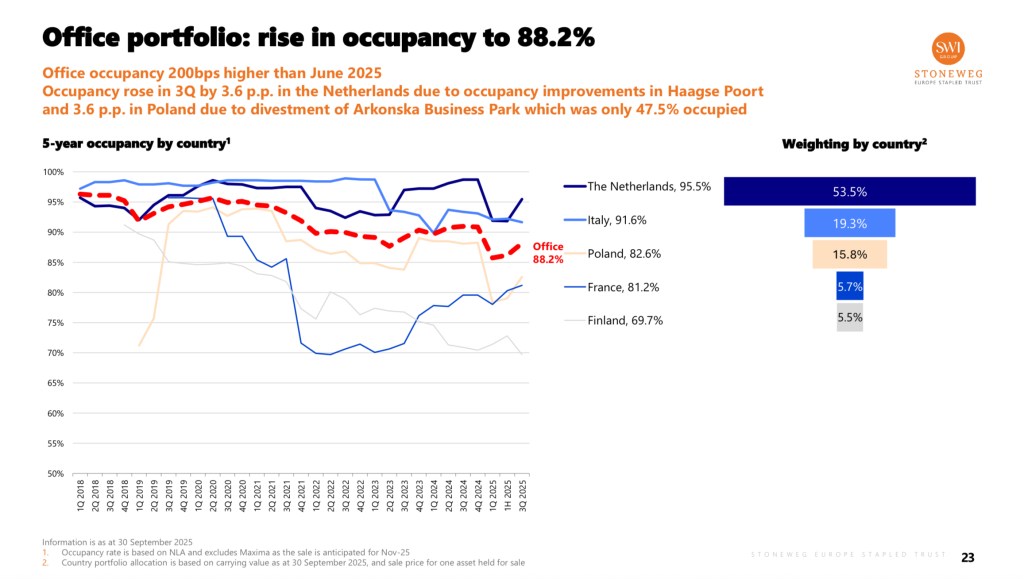

Office occupancy overall stands at 88.2%, up 200 bps from June, helped by disposals of weaker Polish assets and strong Milan performance.

Today, this cluster represents about 30% of SERT’s value — focused on quality, not quantity.

Cluster 3: Legacy / Non-Core Recycling

Every REIT has assets it quietly works to exit. For SERT, this cluster — roughly 9% of its portfolio — consists of older, less strategic properties, including the Polish office that was only 47% occupied.

Management has been steadily disposing of these underperformers, redeploying capital into stronger industrial assets and keeping gearing under control. These sales may not grab headlines, but they’ve quietly lifted portfolio occupancy and reduced risk.

Cluster 4: Strategic Growth — The AiOnX Data Centre Platform

This is where SERT surprised me — in a good way.

On 24 June 2025, SERT invested €50 million into the sponsor’s European data-centre platform, now branded AiOnX. The fund controls approximately 225 hectares of land across Europe with 1.116 gigawatts of secured power, plus visibility on another 563 megawatts — adding up to ~1.68 gigawatts of potential capacity.

After a UK site was added to the portfolio, SERT’s early entry led to an unrealised €24.8 million valuation uplift, equivalent to roughly a +49.6% gain on its stake.

This is not about DPU today. This is about long-duration digital infrastructure optionality that complements the industrial shift.

The AiOnX portfolio as a whole — Ireland, Spain, Italy, Denmark, UK — representing hyperscale development in markets constrained by limited power availability.

Quick pause before we continue — if you enjoy deep dives like this, you’ll probably like what I’m doing over on Telegram.

I’ve taken over the telegram channel from my buddy from REIT-tirement, and it’s now curated under The Dividend Uncle. There are 2,500 members there, and I use it to share not just my own posts and YouTube updates, but also interesting analyses and articles from other REIT investors and finance creators.

The idea is simple — a one-stop feed for anyone who follows the Singapore REIT scene, with a bit of my personal commentary sprinkled in so you get some context and perspective.

And yes, it’s completely free — the link is right here, or just search “S-REITs Posts & Analyses – Curated by The Dividend Uncle” on Telegram and join in. It’s a nice, no-spam space to stay informed and connected.

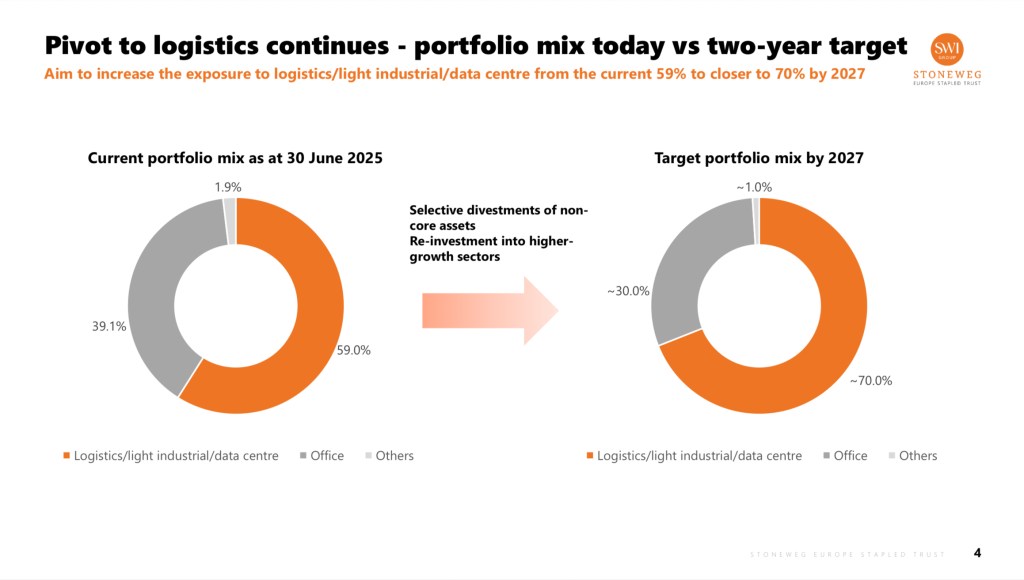

Why SERT Is Shifting from Office to Industrial — The Real Story

One thing investors have noticed is how deliberately SERT has been shifting from office into light-industrial and logistics. And this isn’t a small tweak — it’s a strategic repositioning that management has been very open about.

The logic is simple: industrial gives SERT stability; office requires reinvention.

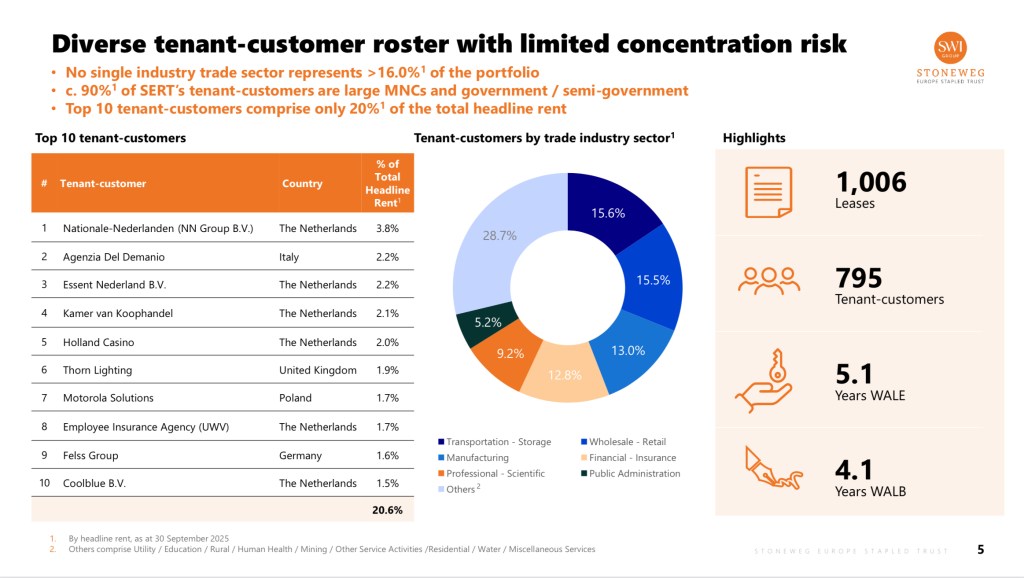

Occupancy across the industrial portfolio remains above 95%, rent reversions are running in the high single digits, and tenant concentration is extremely low — the largest tenant accounts for only 3.8% of income.

Meanwhile, office has become a bifurcated market: Grade-A assets thrive, but secondary ones struggle under hybrid work and rising retrofit costs. Management has been clear — they’ll only invest where returns are proven, and recycle what no longer fits.

The recent Slovakia divestment perfectly illustrates this strategy. It marked the near-completion of a €400 million capital-recycling programme, with €411 million of non-strategic assets sold since 2022 — at an 11% premium to valuation. The CEO explained this move as “exiting smaller, less liquid Central European assets” to focus on core Western Europe, where liquidity and tenant demand are stronger.

In short, SERT isn’t just talking about change — it’s executing it.

Selling the tail, upgrading the core, and concentrating on markets with real structural demand.

This isn’t a tactical shuffle. It’s a business model evolution.

And this is why I think SERT looks less like a troubled high-yield REIT… and more like a transformation story that the market hasn’t fully priced in.

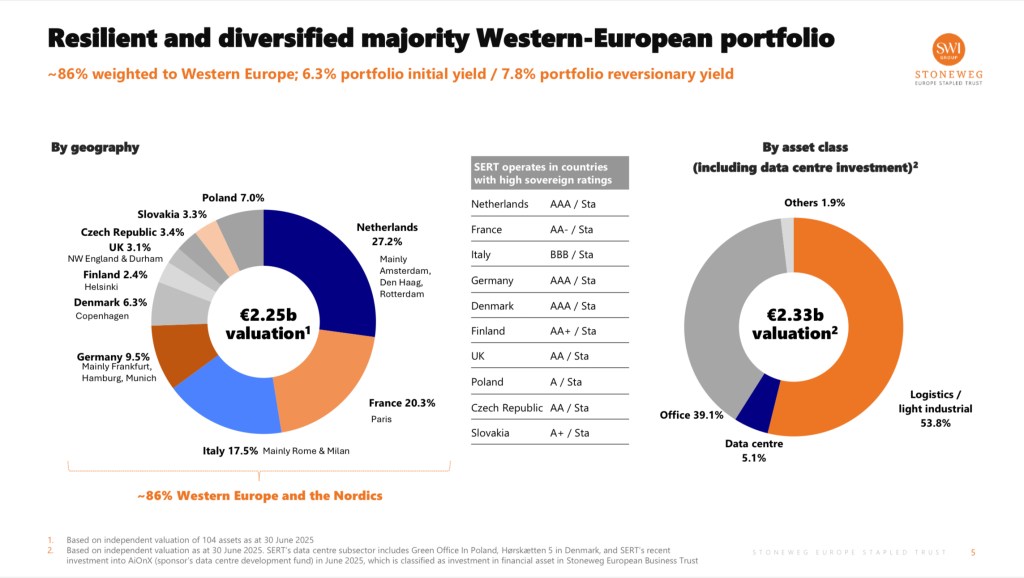

Consequential Diversification — Geography and Tenants

Once you split SERT’s assets into these four clusters, something else becomes very clear:

The REIT is far more diversified than investors realise.

Geographic diversification

Western Europe now represents ~86% of portfolio value, spread across France, Germany, Italy, Denmark, the Netherlands, Spain, and now the UK through AiOnX. This spread provides a built-in macro hedge — when one market softens, another often offsets it.

Tenant diversification

SERT hosts over 800 tenants. The top ten account for just 20% of income, and the largest tenant contributes 3.8%. This granularity is rare for a high-yield REIT and reduces earnings risk significantly.

Together, SERT’s geographic and tenant mix acts as a natural stabiliser — one reason the portfolio continues to deliver steady operating metrics despite market volatility.

Financial Performance — The Real Trend Story

Over the past year, SERT’s operating numbers have quietly improved even as headline distributions softened.

From 1Q to 3Q 2025, revenue rose from €53.6 million to €56.1 million, and N.P.I. from €33.5 million to €36 million — slow but steady progress.

For 1H 2025, revenue grew 1.1% year-on-year to €107.4 million, and N.P.I. rose 2.2% to €66.9 million. Like-for-like N.P.I. was up 4.9%, driven by +7.4% growth in industrial and +1.0% in office.

Occupancy improved to 93.5%, and rent reversion averaged +11%, led by Germany and Italy.

DPU came in at 6.55 euro-cents, down 7% year-on-year — a decline driven not by weaker assets, but by higher interest expenses and temporary income loss from sold properties.

So while DPU looks soft, the underlying portfolio is strengthening. With cost of debt already easing from 3.97% to 3.88%, and 85% of borrowings hedged to 2027, there’s room for operating gains to start showing through as rates normalise.

The recently completed Slovakia divestment further strengthened the REIT, cutting gearing below 40%. It also contributed to SERT’s remarkable debt profile — no maturities until 2030 and a weighted average debt expiry of almost six years following a €70 million extension.

In short: operations rising, occupancy rising, rent reversion rising — distributions temporarily held back by financing costs.

The Dividend Uncle’s Take — How I Personally See SERT in My Portfolio

For me, SERT sits firmly in my satellite portfolio.

It’s not a core holding like CICT or Parkway Life REIT, but it plays a very clear role.

1. It gives me credible exposure to Europe

My REIT portfolio is heavily weighted to Singapore, Australia, and some US positions.

Europe has been a missing piece — not because I didn’t want exposure, but because very few SGX REITs provide it in a compelling way.

SERT fills that gap.

2. It is well diversified within Europe itself

I get exposure across France, Germany, Italy, Denmark, the Netherlands, and now the UK — each with slightly different economic cycles.

This lowers my portfolio’s reliance on any single region.

3. It gives me diversification across asset classes

SERT’s mix of light-industrial, logistics, selective office, and early-stage data centres means I’m not tied to one single property type. This is rare and valuable.

4. The yield compensates me for the complexity

Yes, SERT is more complex than a pure Singapore mall REIT.

But the very high DPU yield and the visibility of industrial income more than compensate me for taking that on.

5. It is a REIT in transition — and I want exposure to that story

I like that industrial is rising, office is being cleaned up and upgraded, and data centres give me long-term optionality.

Because sometimes, the best time to invest is during the transition… not after the market finally wakes up.

This is why, in my personal portfolio, SERT sits firmly in my satellite bucket — a higher-yield, higher-reward position that diversifies me geographically and by asset class, while offering a credible transformation story backed by numbers.

Alright, that’s all for today folks. When I look at SERT, I don’t see a risky high-yield REIT. I see a platform in transformation — streamlining its portfolio, recycling capital wisely, and positioning itself in Europe’s most resilient property segments.

It’s complex, yes. But it’s credible.

If you found this deep dive useful, do me a favour — give it a thumbs-up so YouTube knows it’s worth sharing. And subscribe if you’d like more insights like this on REITs, dividend stocks, and portfolio building.

Thanks for dropping by, and until next time, happy investing.

Leave a reply to 1 REIT I Bought – And Why I’m Eyeing FCT & PLife In December 2025 – The Dividend Uncle’s Take Cancel reply